Do Cryptocurrency Speculators Fear Utility?

The state of being useful, profitable, or beneficial.

Currently, the "marketcap" for all cryptocurrency projects is over $130 billion. I'm using air-quotes there because we don't really know how much of that value is real. What percentage of token holders could drive down that number if they decide to liquidate for some other form of value like fiat currency, gold, or silver? How much of that value is real and exchangeable for other goods and services?

If you've been following my blog for any amount of time, you know I'm a huge fan of cryptocurrency and somewhat of a hopeful optimist. I'm also attempting to be a realist in terms of using reason, logic, and evidence to directly impact my understanding of reality. When I see ICO projects raising tens of millions of dollars in "value" in moments, I have to wonder, is this for real?

I get how much value is escaping the fiat currency system and how almost any blockchain-based value token is a better form of money (i.e. a better ledger which, at its core, is what money actually is). But I can't help but notice what happens when the hype around a cryptocurrency project dies away, and we're left to evaluate its actual utility at accomplishing stated goals.

When this happens, speculators turn into investors. They turn off the wishful thinking and start making more rational comparisons to other players in the space both inside and, importantly, outside the cryptocurrency scene. Once a project starts actually doing the thing it claims to disrupt within a market vertical, we can no longer pretend it will be world-changing unless it actually is changing the world.

I'll give two examples to illustrate my point. Right now, from my perspective, two cryptocurrencies are clearly delivering on their stated promises with a proven track record of success: BitShares and STEEM.

BitShares is a fully-functional, decentralized exchange with self-funded, ongoing development, multiple levels of security, and great flexibility for creating all kinds of secure tokens either as pegged or free floating value assets. Many of the promises made by other up-and-coming decentralized exchange projects can be seen right here which forces us to ask the question: how valuable is this as a real market service? Who's wiling to pay for it and how much will they pay?

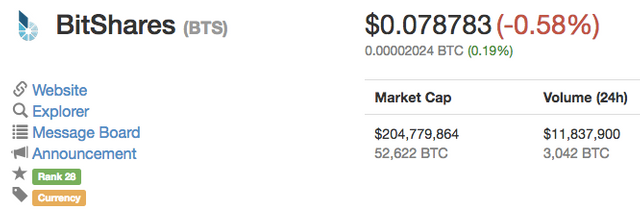

BitShares is currently trading for less than $0.08 and is 28th on coinmarketcap.com.

Speculators will have a much more difficult time telling new stories about how BitShares will disrupt the world because the reality is already up and running. Now it's just a matter of deciding what we're going to do with it and whether or not those actions provide enough value to justify a high token valuation.

STEEM is also delivering on its promise with ~40k accounts active in the last 30 days. This system is functional right now. It's no longer a promise of some idea at some point in the future. We can now evaluate it against existing competitors in the space such as Facebook, Twitter, Medium, Reddit, and the like. We can ask questions like, "How well does it hold up? How much utility is it providing?"

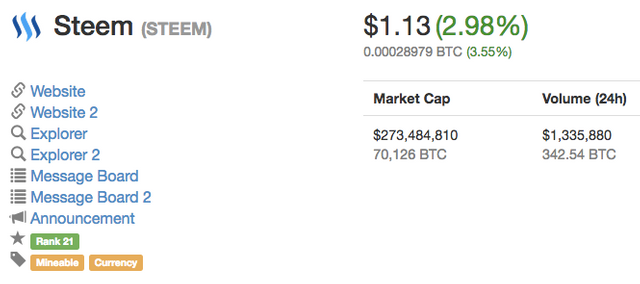

STEEM is currently trading at $1.13 and is ranked 21st on coinmarketcap.com.

Like BitShares, it can process thousands of transactions a second and has super quick blocktimes (only 3 seconds!). STEEM also has completely free transactions! Compared to many other cryptocurrency projects, it is technically far superior. So why the low price? Why are there so many other projects with higher valuations that haven't really done much yet but promise great things in the future?

Could it be we love the promise of future disruption and avoid the reality of current utility?

Even Bitcoin, the cryptocurrency flagship, has to deal with the gap between perception and reality. As a tool for the unbanked or a cheaper/faster remittence system or a consumer banking and payment platform alternative, it's currently coming up short. The fees are too high, the transfer time is too long, the global adoption by merchants is too low, and the conflict with governments seems to be increasing daily.

And yet, I still agree with Rick Falkvinge's 2013 post: The Target Value For Bitcoin Is Not Some $50 Or $100. It Is $100,000 To $1,000,000.

Bitcoin certainly has hurdles to overcome – scalability and usability being two of them – but it has done remarkably well in maturing in the two years since I started looking at it. My prediction of a mainstream breakthrough around the year 2019 remains, and it still depends on getting mainstream usability; a target market cap may be reached about a decade after that happens, as a technology typically takes ten years from mainstream breakthrough to maturity.

We're still dealing with scalability and usability issues more than 4 years later. And yet, the price is no longer $41, as it was in 2013 when that was published. Today it's $3,800+.

How much of that is again pricing in future value? How much of that is based on actual utilty today?

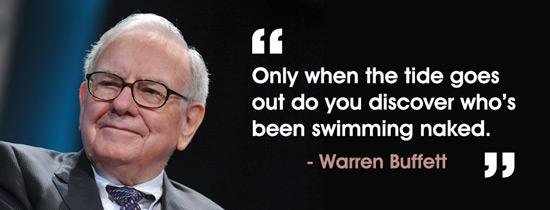

These are some tough questions we should be asking ourselves. In many ways, the markets are not rational and neither are we humans. Things will be all over the place as we play our games of hopeful optimism and irrational exuberance. At the same time, when the dust settles and fiat continues to noticably decline in purchasing power, we'll have to ask ourselves, where do we want to be?

While there's great speculative money to be made as ICO projects rise and fall, I also think there's wisdom in storing your long-term value in demonstrated real-world utility. Eventually, the speculators will have to find shelter somewhere. The comparison between the cryptocurrency markets today and the Internet dot-com bubble of 2000 is a good one. Do you want to be wrapped up in a pets.com speculative investment or backing the next Google or Amazon?

When making your investing/speculation decisions, keep utility in mind. Find projects you're excited about because they meet real needs. Eventually, I think you'll be glad you did.

What do you think about the cryptocurrency space when it comes to utility and value?

I'm adding the #discussion tag based on a recent post by @timcliff because great discussion here really does separate this platform from many others.

Luke Stokes is a father, husband, business owner, programmer, and voluntaryist who wants to help create a world we all want to live in. Visit UnderstandingBlockchainFreedom.com

Bitshares building an SEC compliant, regulated decentralized exchange and listing and trading compliant tokens is the biggest news in crypto. If people think China cracking down on ICOs and exchanges is bad, they have seen nothing yet. When, not if, the SEC steps in crypto is going to feel a thousand pound gorilla breathing down their necks.

Bitshares can currently handle all crypto trading on the planet - on every exchange in every token - with a few zeros in capacity to spare. Bitshares will still provide decentralized trading of un-regulated tokens/securities, but will soon provide whitelisted, safe, clean tokens to trade as well.

Every single crypto investor should be hedging regulatory crackdowns (China, SEC etc.) by taking a position in Bitshares and buying BTS right now. My God, every time I read the the Bitshares State of the Network post I can't understand why BTS isn't in the top 5 on CMC based on current status/adoption/development/utility/transactions etc.

🎩

😍

👕👍Great!

👖

This!

I feel the same way. So much amazing stuff going on, and it seems like most of the rest of the crypto space is just ignoring it. It's really... odd.

You make a great point about if (when?) the SEC really brings the hammer. I resteemed a post early today that's a good discussion about that. We may have some time still, but anything could change quickly when it comes to government decree.

I follow the entire crypto market and am fairly well versed on the top 20-30 tokens - by that I mean I have pretty decent understanding of what they are for and where they are at development-wise. There is literally nothing that comes close to the Graphene based chains, nothing. Bitshares and Steem are easily the most mature, most scalable, most used, fastest and most secure chains in the world. What is really odd is that, by any metric you could choose, BTS and STEEM should be the highest valued tokens on the market. Yes, right up there with ETH and BTC. Honestly, would $10-$20 BTS look odd to anyone? Anyone?

And yet, the Graphene chains are largely ignored by the small group of big money speculators that seem to pump useless half-baked shitcoins to billion dollar caps every week or two.

I'm starting to thing 90% of the crypto market is a scam created by a small group of people. They run the exchanges, create USDT out of thin air, they release shit coins, pump them and sell to suckers.

There is a great Reddit post about USDT on r/bitcoin right now asking if anyone knows anyone that participated in the $120 million of USDT created last week. No takers and a lot of downvotes.

I never, ever, thought I'd say this... but the SEC can't drop the hammer soon enough. I'll bet there's not a dozen tokens on CMC with any intrinsic value in a post-SEC crack down market. BTC, BTS, STEEM, EOS, XMR, STORJ, LTC, XMR, MAID, GNT... I run out pretty quick.

We could have some very, very interesting times in front of us. Thank you for sharing your analysis and thoughts.

Good isight (!) and wow I own at least a little bit of six of those. Note to self, buy the others....

"Could it be we love the promise of future disruption and avoid the reality of current utility?"

That is a really good question. For me I think the answer is no, because I am with you in supporting STEEM and BitShares for their utility despite them being neglected by the speculative boom of others. I think for the majority of "hot money" the answer is yes. Far too many people are investing in this space hoping to make a quick buck in the next get-rich-quick scheme. The prospect of a modest 20% return per annum does not interest them. They want everything to "moon" so they can buy their "Lambos".

Lambos all around!

Heheh. Yeah, it's difficult sometimes to stick with rational investing when there's so much irrational money all around to be made. I remember when I invested in OMG, NEO, and SAN and they blew up. I could have made a nice return then, but I guess I'm more of a buy and hold investor. Still though, they did much better than STEEM/BitShares (so far anyway).

Hype and novelty attract those who want to be rich "right now". Steem and Bitshares haven't mooned yet, long after they were released. So they're probably seen as not going anywhere by most of these speculators.

I understand not wanting to wait. Nobody is against getting rich quick. But my bet is on the long term. Valuable things aren't built overnight. And the value of Steem will come from masses of non-crypto people joining.

I really like the sound of that. I hope you're right.

I don't know how old you are, but I remember when I had no idea what an internet was or why it could be useful. I think it's the same with crypto. We are at the point now where most people either have no idea or just a vague idea of what it is. The only people I know into crypto are either on Steemit or they started getting into it because I talk about it so much. And those are few.

I'm 38 so I too remember when the Internet was just coming around. I agree and I think Bitcoin is more disruptive than the Internet. It'll just take some time for everyone else to realize that.

I totally agree, people who are into gold, silver, stocks, and traditional investments are generally already invested and already have their minds made up. Like the cell phone, big and clunky with not many users 20 years ago, that market needed time to develope and improve...same will be the case with crypto currency. My only concern is manipulation by the central banks. This kind of goes against the crypto is out side of their forces logic. But when they can print and invest a seemingly infinite amount of dollars they can drive prices up and down for just about anything. If they see crypto as the enemy, wouldn't surprise me to see them start a scare campaign coincided with a mysterious entity selling a ton of bitcoin all at once, driving the price significantly lower.

I'm 60 years old from the Austrian economics way of thinking. Since many decades, I have been a "real" assets man - gold, property and equities. I have never been a fan of new fads. I missed a few profits because of that, but generally did alright. I managed to get through 1999 with a 73% profit despite not owning a single dot-com.

I don't think bitcoin is a fad. Since June this year I have been acquiring bitcoin. I am aiming for 5% to 10%, although I realise many would say 20% in bitcoin is a good number at this moment. I don't disagree. For me 10% gold and 10% bitcoin seems like the right number, gold for insurance - it has stood the test of 20'000 years, and bitcoin for rapid profit.

As for the alt-coins, and tokens, I have been terribly dissappointed by the ones I looked at. Ripple is an example. I think 99.9% of Ripple investors have got the wrong end of the stick. They think it will become valuable when the Ripple global payments system replaces the Swift system.

The same kind of misconception exists with many alt-coins where there is some kind of belief that a successful business will lead to a more valuable alt-coin. I haven't had time to look at many alt-coins, but the ones I studied properly (i.e. read and comprehended the white paper), are all going to be rubbish investments.

For that reason I will stick with bitcoin which has accepted monetary value that will increase as the 99.5% of the population who don't own any, start to look more closely.

When I find an alt-coin that has monetary value, I will add it to my portfolio. So far I am not convinced, although there are three or four or five which merit further study.

Investors are always looking for new asset classes, particularly ones that are not correlated to the existing asset classes.

I agree. But after socializing with many older traditional investors, many are set in their ways are a even scared to touch crypto. But I see that too is starting to change.

What I like about Steem is that authors get paid for content, unlike other social media platforms. I have told my son about Steem, and I hope he joins. He has a big following on Snapchat and Instagram - he needs Steemit :-) He, and people like him, will take Steem to the next level. The word will get out, just takes time.

@lukestokes - Hats off to your practical viewpoint. Following sequence I have often observed in real world:

As you have said - if an existing utility or service exists in the same space/ parameters, then we should use it to keep ourselves sane. Bitshares and Steem are great examples.

I do not have too much experience of crypto yet but I think the basic principle I have stated above applies.

Thanks. Upvoted full.

Regards,

You make a great point that in that we should judge the value of projects in the crypto sphere based on their utility. Looks like whatever Dan Larimer is involved like EOS is also a good bet. Of course this can change over time, but those with proven uses and applications will succeed in the long run.

You wonder how bitcoin has gotten so expensive with such high fees and slow transaction times. Perhaps Bitcoin Cash at a much cheaper valuation takes over eventually?

I've been wondering about Bitcoin Cash as well. Overall, the cryptocurrency market is still quite small in the world of global finance. It will be interesting to see where things go from here. I'm a big fan of EOS as well.

Bitcoin cash is on my list of valid investments, although I don't own many. I collected some in the fork, but have not bought any. As for EOS, see my other comment in this thread.

I briefly studied EOS. I was very excited by the token at first because of Dan Larimer. He is quite a Satoshi! However after study, I didn't see the value link between the EOS token and the EOS operating system. As an investment it is on the back-burner until I re-read the white-paper. If you have thoughts as to what would make the EOS token attractive to investors, please share.

This is exactly the point I've often tried to express, but you put it so well:

And as you say, there are just a few blockchains that are at that stage.

I have lost so many opportunities by focusing on the fundamentals and not understanding how the majority simply bandwagons based on hype. I have learned my lesson, but I still find it hard to understand how the hype-investor thinks and acts. It looks like the phenomenon will continue. I sold my ETH at $10, but looking at the popular news it seems like people are just starting to get interested in bitcoin, and Ethereum is the next big thing. It's a pain to be too much ahead of one's time.

I also sold a lot of ETH at $7 after buying at $6 and watching it go to $11 only to come back down to $7. At the time, the chart for ETH looked like along term downtrend and with no cap on the coin, it seemed it would just keep going down. The crypto market... is weird. Maybe some day coins like BitShares and STEEM will take off and people will tell stories about how they sold STEEM at $1 or $2 or how they sold BitShares at $0.25 or $0.40.

Me too. Fundamentals have been the reason I missed so many investments. I never bought Amazon because their p/e ratio was too high. I missed Tesla because they have no profits and negative cash flow. I never touched Twitter because I don't understand how their business model would make a profit, if they had to pay their staff with money instead of diluting paper. So many others went to the moon based on hype not fundamentals.

Maybe instead of reading books like "The intelligent investor" by Ben Graham, "What works on Wall Street" by O'Shaughnessy, and "Stocks for the long run", by Jeremy Siegel, I should be reading "Navigate the Noise - Investing in the new age of media and hype" by Richard Bernstein.

Where can I go to get stats on trade volume on BitShares? The only data I could find would suggest that BTS is lightly used, even less than EtherDelta. The problem I've encountered when actually trying to use these platforms is that they are hard to use: both from a UI/UX perspective and also because there just aren't many trades going on. I see big bid/ask spreads on most currency pairs, low trade volume, and very thin depth charts. The speed of graphene doesn't matter much if they can't get usage.

Perhaps that's why Dan decided to start EOS -- he can focus on developing the best platform, and others can struggle with the UI/UX and marketing challenges of building businesses on top of it.

You can combine these two for a feel of what's going on there (they both use the BitShares blockchain):

https://coinmarketcap.com/exchanges/bitshares-asset-exchange/

https://coinmarketcap.com/exchanges/openledger/

$10M isn't much, but it's kind of a chicken or the egg problem. There isn't enough volume, so people don't use it. But because people don't use it, there isn't enough volume. I agree the UI/UX needs work, but there are some recent worker proposals that are being worked on to improve things there, so that's cool.

For the most part, if you know the price you want, you can get it at that price. The downside is, the market may have moved on from that price in the meantime.

I have tried very hard to start using BitShares. It just seems way too difficult to figure out how to get there. Firstly I think you have to pass via some third party financial institution if you want to get fiat in. Secondly I can't understand the trading pairs available. I can't find bitcoin/dollars or bitcoin/tdollars. Thirdly, spreads seem high. Fourthly, the fee structure is incomprehensible.

I can't see how I would get dollars in and how I would get bitcoin - or whatever, out.

I am totally confused about the relationship between whatever token has to be used to buy bitcoin, and the USD. It does not seem to be a 1 to 1 relationship like t-dollars.

Dan is a genius, and I would like to follow and support him, but he needs a translator - from "genius tech" language to "end-user - I can't read instructions" language.

This came up in the Bitcoin altcoin debate the other day. I posted about what Tony vays had said. I personally think utility tokens are not bad, I think it's a good step forward. Where we can globally take part in owning something.. Tony basically thinks that every coin besides Bitcoin is useless.. looking at coin market cap, you see a lot of coins that offer no real benifits to bitcoin . Then you see coins like steem that is powering social media and now videos.. and nlc2 coin that already has a working in use fantasy sports platform.. bitshares that is the safest, decentralized exchange. All working and in use..

Yeah, Tone's maximalist perspective takes away from his rationality, IMO.

Hello again. ICO investing and longer-term investing are two different styles. I suspect crypto needs both.

In this space, I'm a longer-term investor. In the US options market, I'm in positions around a few days to a few weeks.

The key to getting good higher frequency trading is to be in very liquid markets.

If you want a real sense of scale, look at how much years in Forex currencies compared to all crypto combined. That will dwarf the scale of actual crypto to actual fiat.

I agree with whoever said the ICO crowd doesn't want 20%. However, that is about what I'm making on regular options trading.

I never made any money trading options. The market was bigger than me. The golden boys would always move the price at expiry to the best one for them, meaning worst one for me.

I understand that feeling about the market movers. I now trade with the statistics on my side.

I rarely stay in until expiration. I trade to a specific target profit and have a limit exit. Otherwise, within a week of expiration, I'll roll or occasionally take a loss.

If you want to learn you could follow my HIT (How I Trade) posts and/or learn from tastytrade.

Thanks for your link to options training posts. I note that you don't trade to expiry date (VERY WISE). I'm not sure I have the patience for something that can't be held for the long term. I try to make as few investment decisions as possible.

@lukestokes, not only have I resteemed, but I also just put a couple of reference links to this post in the root post I just made. I'm not sure how the proper etiquette is for that. Thanks for this root post. Maybe it'll drive more here too.