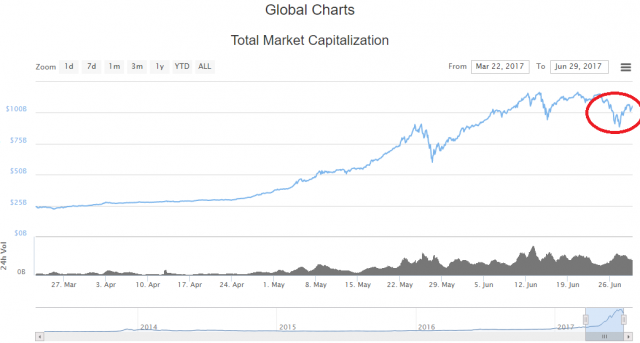

Up or Down? Is this a dead-cat bounce?

Global market cap of all cryptos is in a subtle down-trend from the high on June 14th of 2017. However, most people have not viewed this downtrend with great trepidation or as a bear market. One reason for this is likely because the market had gone up so far prior to the downtrend. Also, even today, it is only slightly off the highs of two weeks ago, sitting at 105 bil market cap. compared to the 116 market cap which was reached previously. This latest dip down to 91 billion is roughly a 21% decline from the tip top of the market. This is not so bad even in traditional markets like the stock market.

In some ways, without a more sizeable crash, it may not be appropriate to call this a dead cat bounce. While it certainly may be one from a technical analysis standpoint, it appears to me to be a more of a sideways, leaning down correction, rather than a crash.

These types of market corrections are difficult to gauge when they happen because the bulls are wrong, and the bears are also wrong. The bears, fearing a crash generally cause the end of this type of consolidation, where they have one last selling hurrah, after which point "We are clearly in a bear market, get ready for a crash" meaning negativity has fully penetrated the market mentality of anyone willing to be negative, thus causing a bottom well before any serious crash occurs. Real crashes happen in a panic when the market "can't crash any further".

On this latest blip up, I have perceived people being positive about the cryptocurrency market. Even observing myself, it feels good to have crypto just off of the highs. Emotion is an important observation for gauging near-term market events such as tops and bottoms. Near-term it is hard for me to gauge if our last dip was the bottom of this consolidation, or just a dead-cat bounce to new lows. What I can say is my viewpoint is that for bitcoin specifically, if it touches back to $2,000, I believe it will garner considerable outside investment supporting the price and also helping support the market.

Long-term what I know is this: Cryptocurrency is in its infancy.

Even for the "Cryptocurrency Bubble", we have not seen this bubble yet. It has only just begun. I say this for multiple reasons:

Cryptocurrencies are scrambling to implement 'standard ideas' based on blockchain. Steemit, for example, is just a traditional blog linked with blockchain, but implemented very well. All the standard ideas have not been built yet, meaning there just has not been enough time to develop the things that the free market wants to develop, meaning the technology available for blockchain 3 years from now, will be much greater with a larger audience than exists today.

New ideas are launching cryptocurrencies to the next level of implementation. EOS is the best example, but other examples include BAT (even if it doesn't succeed). These projects are the bleeding edge of innovation in cryptocurrency, meaning it is still relatively easy to innovate within this market place. This also means, we should expect innovation to continue for more than 5 years. The internet which began in the late 80's only began to exhaust its innovation in the last 10 years, with the dominance of Google and Facebook. Everyone wanted to invent the next Facebook, but the new place to innovate has to be different in some way, not a rehash of traditional technology with the same features or less. Cryptocurrency makes that new world of innovation, and like game-changers that have come before it, the big guys are too slow to adopt, making it a prime landscape for entrepreneurs.

Bubbles happen over years, not 3 months. If a bubble forms over a 3 month period, then that means it can fully crash in 3 months, and be back into a bull market into new highs within 12 months... so true bubbles can't form in 3 months for a revolutionary technology. Legend has it people were calling for the dot-com bubble to pop in 1995, after which the NASDAQ went up 500% in the years that followed.

The Cryptocurrency Bubble will make the dot-com bubble look small. The reason for this is, the-dot com bubble existed under traditional capital restrictions, which was limited to sophisticated, first world investors, favoring those in the USA. Cryptocurrencies do not exist under these limitations. ICO's garner worldwide investment. On one of my livestreams, I was chatting with a working class person in India who was investing in crypto.

1 Trillion Market Cap, HERE WE COME!

In one of my first videos, I outlined how I believe cryptocurrency would trade in the trillions in market capitalization. I made this call when crypto was still under 30 billion market capitalization. Some people think I am nuts when I say things like, "Ripple could hit a trillion market cap."

The reason I see the market this way is because cryptocurrencies are currencies, not stocks. Stocks are limited by corporate management, corporate capital, revenues, and so on. Currencies are limited only by the people using them to transact. They have no profitability model. If more people use and hold the currency, the value of that currency on the market increases. It is a simple and predictable dynamic. It has less failure points than the average company exchanging on Wall Street. Due to it having less failure points, you could even call crypto a "safer investment" once we understand that the price swings are more substantial because the marketplace is young.

Stocks are worth 69 trillion worldwide, total (last I checked). Cryptocurrency exchanging up into the trillions is not far-fetched, but inevitable.

Excellent analytics!

The dotocom bubble was 6 trillion dollars. I think crypto can goto 10 trillion dollars for the reasons stated above. You are right there is a lot of projects coming out that will help fuel a real bubble.

Nice write up. A trillion dollar market cap...that would be pretty wild. In order for that we need about 10 fold increase in the market. I believe it will happen one day...the big question is when? Count me in for the ride.

Cryptos are but a wee in a swimming pool when you compare them it to the $US65 billion that the European Central banks are printing each month, or the $US45 billion per month trade deficit you guys are running - or the $US20 Trillion in Government debt you have, or the $550 trillion in world wide derivatives - these are the real bubbles Ted - SK.

Someone who knows about worldwide derivatives!

Is this your real life field Ted?

No, hobby interest of mine. I'm an accountant real life. At least that is what I did for the last several years and I have a degree in. Nowdays, I am chilling in the mountains of Colrado waiting for Bible college to start, and crypto is starting to pay decent.

You scared of what you are seeing in derivatives?

I have an accounting background too - still working in the field more or less. Will be a long time before Crypto pays me enough to give up my day job though. SK.

Well, it's a failed system, I guess. Not so much scared of it. Just you mention that the world derivatives exposure is so high, and people have no clue.

Cool that you're in accounting. In the end the job bothered me because I want to succeed, and average large company just wants you to number crunch. Doing some projects besides YouTube. Right now I am programming a game along with my college friend who is a professional web developer, so I got enough side projects going that can pay that I'm pretty blessed. Youtube is going to issue me my first check next month, pretty excited about it.

'Failed system' - understood. Have you read any of James Rickards books Ted? He believes it is a failed system and outlines the reasons for this well.

Buffett has stated that derivatives are 'financial weapons of mass destruction' - I am sure you know this too.

Great that that you will be getting paid by YouTube.

Can you imagine what Steemit will be like once advertisers are let in - it will be worth tens, no hundreds of billions! I assume this is the long term plan - can't see Steemit working if people have to actually pay to read the posts themselves.

Once the advertisers do come in - reputation will be everything.

SK.

Advertising would be great, no idea if that is a goal of theirs. Would be neat, though. If you ever wanted to earn revenues that way, just find a decent program to sell. JerryBanfield sells his courses, and uses his social media to promote it, works well for him.

I was doing great promoting Genesis Mining and making decent money, but I stopped because I decided it was not the best for my viewers to be getting into... better to just own crypto. Steemit in the end will pay better than Genesis Mining. That said, when my game project launches, I might do some cross promotion with it.

Mistaking volatility for a bubble is what causes people to sell short..These dips and rises are just indication of a volatile market..Bubble would be when it reaches 1 trillion mkt cap in a year...More smart money is flowing into crypto than any other investment options..when the investors understand what they are investing in,there is less chance of entering a bubble..

Well said.

first upvote and first comments :)

You're the numbers guy so you help make concrete what we are seeing, feeling and sensing. Billions are now coming and going by the hour, which wasn't so even a couple of months ago. Edgy but exciting.

Good post. Yeah, we are still in the early days alright. Most people I speak to have never even heard of Bitcoin, nevermind Ethereum, IOTA or all these crazy ICOs. And this volatility is normal for any crypto veteran, 21% down is a walk in the park.

My best guess is that there is some big money waiting on the sidelines for the scaling problem to be solved. Lets see what happens in August, I'm cautiously optimistic there won't be a chain split, and we'll have Segwit. I've read about a lot of hedge fund guys ready to pounce once we're through these growing pains. Watch out below once the City of London and Wall Street enters the fray, then we'll see some real bubbles.

Chain split is almost impossible unless they get a clean 50/50 divide, or they do multiple hard forks to achieve a chain split. The minority hash can't operate a bitcoin blockchain without difficulties resetting. To reset difficulties, you have to hard fork again. Furthermore, the minority chain is likely to be very unprofitable without a difficulty reset, so all the hashing power would switch back to the main chain anyway. I could see a movement springing out of the fork, like someone uses that opportunity to 'make a better bitcoin' but it would likely just be an altcoin. Bitcoin Unlimited people have never had any intention of being an altcoin, complete dominance is their only goal, but now that they got the other side to cave on 2MB, I think they are going to be more open to middle ground.

https://hardfork.cafe/

I've bet all my money in Neo (antshares) If market cap gets bellow 90 billion or if antshares gets back to $8 that's my exit signs.