Bitcoin Has Not Yet Fundamentally Recovered At This Time – A Mathematical Case

I wrote about a week ago that Bitcoin does not seem to have recovered yet (here and here), following the Bitcoin correction to about $6K and after it seemed to be recovering and had risen again to about $11K. At the time, many Bitcoin watchers were already predicting recovery and new highs. The problem is that trading analysis, as useful as they are in certain scenarios, simply lack the information to see fundamentals that underlie the value of some assets. Meanwhile, that fundamental value is what gives rise to sentiment, which is what chart analysis can then attempt to measure; sometimes with some success.

That said, fundamentally, based on an analysis spanning the 9 years of information available to us, the current metrices are pointing to issues persisting with Bitcoin adoption rate as well as several other metrices. Some of these are described below. But first, a brief, not too technical description on the math behind this review.

Mathematical Modeling of Bitcoin Sentiment Value

(This section may be skipped by any not disposed to math without affecting the enjoyment of the rest of the article.) Since Bitcoins are not exactly pegged to any value (just like pretty much every modern currency right now anyway), the value essentially is a market value driven by demand and its deflationary supply scheme. This sounds simple, and the supply side is, given that it is a constant rate of 12.5 BTC roughly every 6 minutes. The demand side on the other hand is where the action is, as it is dependent on several valuables, and that is where the action is. Mathematically, this can be represented as:

Which simply states that D is a function of n variables, represented by X1, to Xn. The challenge then is to determine what those variables are firstly. Next is to determine the how D reacts in response to changes in those variables. This part is much easier and there are tools in multivariable calculus that allows this to be done. This step also gets much easier if an analysis of the effect of those variables can prune them down to one or two that are more dominant in influencing D, or if it can be determined that a few of the variables seldom change much allowing the model to consider them to be fairly constant without much loss in accuracy.

(Sometimes, it could also be that the effect of some of the other variables are transient on a smaller scale, for instance in days, such that if we are only interested in modeling D on a longer time scale, such as in months, then the effect of those variables can be dropped since they would average out over a monthly time scale.)

In leading up to the paper: “Digital blockchain networks appear to be following Metcalfe’s Law”, the author reviewed several of the metrices available on the blockchain, and showed that the value historically could be fairly well modeled by the daily unique adoption rate. The rationale behind why this variable is probably a strongly characteristic one is explained below.

Daily Adoption Rate

The daily new unique addresses (DUA) on the blockchain points to the adoption rate of Bitcoins more than any other metric on the blockchain. (And the blockchain is a mathematical modeler’s dream because it provides more information on a real time basis than almost any other financial system hitherto available; most of which are quite opaque.)

The popular elasticity curve and equations used by economist to model demand and supply is developed for a system in equilibrium, and is not suited to rapidly growing systems that have not yet reached an equilibrium state, such as the bitcoin network. So other approaches were explored in the referenced paper.

In a growing network with constant supply rate, the demand can be shown to be driven mostly by the rate at which new users are being added to the network. If a user acquires bitcoins, for instance at say $1, and a new user attempts to join the network, with the limited supply they would need to get an existing user to part with some of their holdings. The existing user is then able to demand a premium over how much they obtained it to sell to the new user. If the value demanded by the existing user is too high, then the new user either looks for another user willing to part with theirs for less, or waits, or just does not join the network.

The faster new users wish to join the network, the faster the value will slowly rise. And the more people join the network, the more they share and introduce the network to their social circles, which then leads to new adoption. And the more people join the network, the more other people they have to use and exchange the network’s resources with, making the network more useful and valuable. This is referred to as the network effect. It turns out in that paper that using approaches based on network effect theory on the daily unique addresses was found to model the price of bitcoins fairly well over the prior 8 years of data available at the time.

Modeling the Value as a Function of the DUA

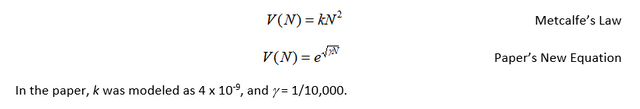

The DUA was modeled using several network models in the referenced paper. The Metcalfe law was found to be a fairly good approximation. A new model was also proposed by the author, which showed potential to model cryptographically-enforced digital currencies about as well. The two most successful models in that study have the form as follows:

It should be noted that the accuracy of the models as presented in the paper was about 9% over the 8 years of data. This indicates that significant deviation from the model should not be expected over spans of longer than about 6-9 months. And indeed we saw significant departure around 2014 essentially forming a bubble, with a snap back to the model within months. We also see a departure during the run up of values to over 19,000 by the end of 2017 with a snap back closer to the model’s value of about 5,000 by early February 2018.

So it seems fundamentals will never go away for long – they can only take temporary vacations.

Where Are We Now?

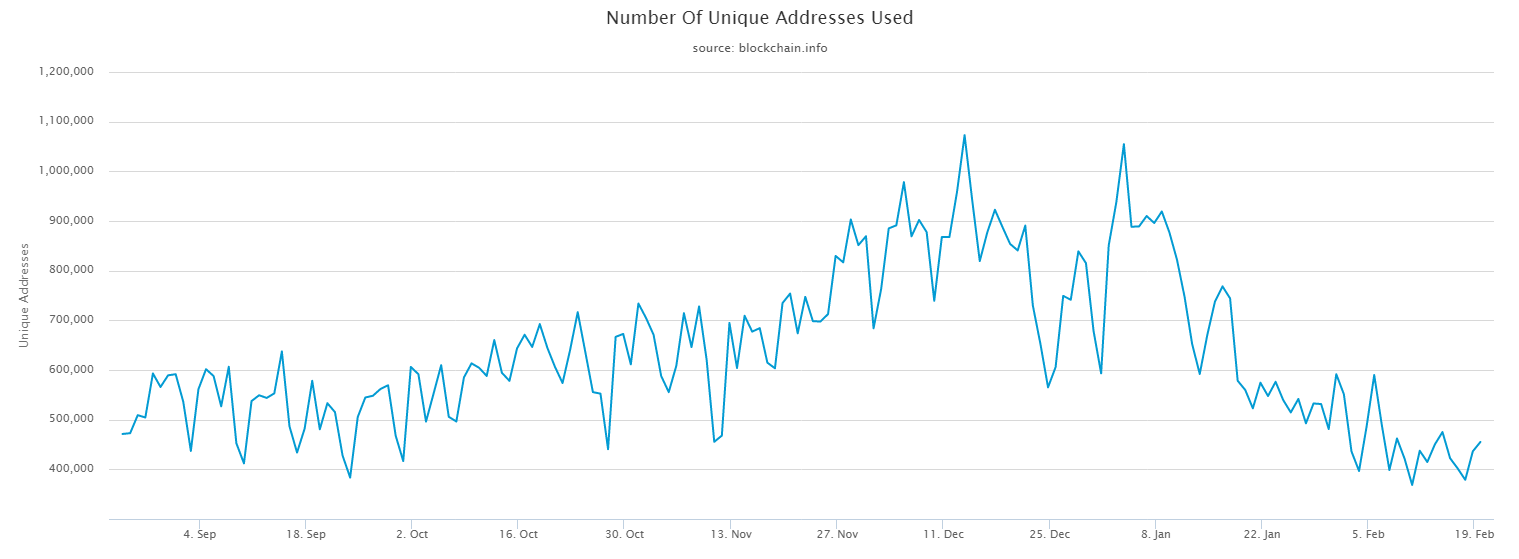

The current values of the DUA shows that the metric has not yet recovered. The DUA is shown below over the past 6 months. The rate is currently back to levels last seen in August 2017. The Metcalfe model at such low DUA places the value closer to $4,800 than where it has currently “recovered” back up to. (Note that the DUA is uncharacteristically and could well recover before dragging the price down to this level.)

Source: Blockchain.info on Feb 21 2018.

What this essentially means is that new users are not be joining the network at the exponential growing rate that was observed the prior 8 years. This might be temporary but just lasting unusually long right now. It might also point to an enduring shift in the cryptographic-enforced digital currency space. If it is temporary then growth is expected to return, and only then will the current correction be over. If the price continues to rise now without that adoption rate picking up, it will almost surely snap back eventually. Where would the value growth be coming from? The adoption rate might pick back up on its own although this is the longest stretch we have seen where it has departed from the netoid function that was used to model it in the paper. The growing adoption rate could also return with the introduction of the Lightning network that will address the scalability issue and increasing fees that might have contributed to the retreating adoption growth rate.

However, if this new lower adoption rate is enduring then the current correction should persist because the major driver for increases in value was previously indicated in the growing adoption rate. That manifested the overall sentiment to the asset. Could different new sources of value boost bridge the gap in that lost adoption growth rate? It is possible. For instance, institutional resources pouring in through newly established futures market may add new demand for some time, but it is unlikely to sustain the previous price growth rate long term if not accompanied by close to the same old growth rate from actual users. The adoption rate drop off from the bitcoin network could then simply transfer to other alternatives. If this is the case, the shift will likely take several months to unfold.

References

https://www.sciencedirect.com/science/article/pii/S1567422317300480”.

Legal Disclaimer: I am not a financial advisor and this is not financial advice. The information provided in this post and any other posts that I make and any accompanying material is for informational and educational purposes only.

It should not be considered financial or investment advice at all. You should consult with a financial or investment professional to determine what may be best for your individual needs.

This is only opinion. It is not advice nor recommendation to either buy or sell anything! It's only meant for use as informative, educational, or entertainment purposes.

Good post!! Interesting to see it from this perspective. Most posts on Bitcoin are just talking about how it’s going to explode to the moon without much backing it up. It’s much better to know and understand both sides of the argument!! Got to wait it out! Thanks for the post!!

Yes a lot of analysts are essentially predicting higher highs which looks correct when everything is going up. Its just like predicting the hands of a clock will pass the 12 hour mark - it eventually will. Sadly it is causing so many to lose their money following such baseless and something shifting predictions, and it is bad for the technology.

One of the best analysis out there @kenraphael. It's important to show the different scenarios and you explained both from a functional and technical perspective.

The market is volatile and there is no indication if Bitcoin will go up or down. The only thing that personally I am sure banks and governments are against.Regulations can kill the future.

It's true that regulations can several impact the growth of the technology. However, the last few comments by Chris Giancarlo of the CFTC shows that they might be approaching regulations a bit more cautiously than many anticipated. Just like the early days of the Internet when they shied away from applying regulations and even sales tax on Internet sales, refraining from impeding the technology can prove to be the best move the regulators have made so far; and that may be recognized in future.

@kenraphael - very interesting post about using mathematics to determine the value of some potential cryptocurrency or other asset. It is interesting to analyze something that has had recent price corrections & working to return to previous levels of value.

Is it possible that Bitcoin returns to it's previous highs of over 19K? It is possible, but it may take some more time to do that, in my opinion.

Great post- keep up the awesome work. Upvoted!

Yes it is possible. The fundamental metrices simply points to the fact that it is unlikely to be anytime soon. Much of the recent bitcoin recovery since the 2014 one has been within days and weeks. It does not look like this one will be. The DUA needs to pick up before you can see any sustained recovery. But again please note that this is not financial or investment advise.

god

Great article. Resteemed.

Really very very informative post. WOW! Please keep it up.

You have mentioned ==>"It should be noted that the accuracy of the models as presented in the paper was about 9% over the 8 years of data" - Does this mean that this accuracy rate is far below average and should be taken seriously...kindly explain this.

Also looking the way internet stocks and NASDAQ moved from 1995 till 99-2000 should we really be worried too much? Should we just ride this without questioning much? Specially when avenues of getting return is near zero for a common man. The only avenue which is stock market is now so much rigged that its a no brainier that it can crash anytime - non stop rally from nov2017.

I am very keen to know where can we get DAR (Daily Adoption Rate) data for BTC and all top coins. Is there any free site for getting such lovely analysis.

This DAR is based on addition of each new wallet address ? If yes should not VOLUME a bigger factor

Also I felt DAR is good for early stage but when INSTITUTIONs and hedge funds enter this game will not even one single wallet adress can impact BTC price significantly because of volume and value..

That accuracy rate over 8 years means it deviates by that much over that span. Which is good correlation and means that within a year one would not expect that model to continue to deviate by much from the actual measured. Which was why in December after it had departed for nearly 3 months the call for a serious return to form in this invited blog: https://cointelegraph.com/news/2018-blockchain-and-cryptocurrency-outlook-expert-blog.

No we should not be worried but we should be reasonable about our expectations. The model showed bitcoin market value doubling every 288 days. Which is impressive! But when it nearky doubles within a month from Nov 2017 to Dec 2017 (10K to 19K) we check our expectations, especially when user adoption or any other metric does not nearly match that rise. And maybe not be surprised when it corrects significantly after. And we should also be prepared to slowly let go of bitcoins as the flag bearer for the blockchain space if its fundamental issues are not resolved (and they are still working hard on this right now with solutions like Lightning and we are still watching if Segwit will have any real impact.) In the end, technology and utility always wins out and that would happen as well in this space.

The DUA published on the link above is one place to go to for a sort of measure of DAR. Other measures such as transaction volume includes a lot of nonsense such as dice games and other automated transactions that does not solely capture daily adoption. I wrote a rough program to distill the DUA in real time from the blockchain some years ago and I plan to maybe publish its daily value, maybe here at some point. But even the 2 day lagged DUA from bitcoin.info should be good for a value investor just maybe not for day trading.

One thing I want to share apart from adoption (which is the main thing discussed here), that bitcoin is NOT a cash replacement. It is hardly a digital gold, which it is trying to prove.

The reason why people invest in it, is the parabolic price movement. personally I fell, at this point investing in bitcoin is at a very low risk, compared to if someone had invested at 17k $.

This is coming from the fact that from 19k, the price has gone as low as 6k then currently at ~ 9.5k. This is the accumulation phase. Although it is very likely to hit a fresh all time low. But even so, BTC is known to bounce hard. So I am very comfortable to invest at this price point.

Overall I am bullish about BTC. Here are my reasons for it:

https://steemit.com/bitcoin/@cryptoaritra/btc-usdt-the-big-picture

Thanks for the comments. I tend to expect that bitcoins will eventually bounce back as well... although there is no basis to state it would bounce back hard, whatever hard means numerically. Maybe it means within weeks? You said BTC is "known" to bounce hard but if you went through its history you would see that it's also known to not bounce back hard, as it did in 2014, when it took over years to return to its prior high levels. Mathematically, it was shown in the referenced paper that the departure from its life long model currently is only second to the departure in 2014, so there's going by facts and data and going by feelings.

I'm not sure what not being a cash replacement implies here. Does it mean that if its user growth rate continues to decline its value can continue to rise opposite to that data? I followed your link and I saw a paragraph or so of analysis based on price data; which price is an expressed output data rather than inputs and so is unable to discern much farther than the pattern it is currently expressing. Price data and charts based solely on price, include Elliot wave methods, are not sufficient for true analysis that will ever be accurate beyond very short time frames.

This is really insightful. It's late so I'll wait to resteem until more people are online tomorrow, but really glad to find your blog.

Thanks. Knowledge is power and it is better to get out a balanced perspective that is based on real math than much of what passes today for analysis, which is trading analysts predicting new highs at every point and causing newbies to lose their funds and get disillusioned with this new technology.

Very intresting method, but if you apply fibonacci on btc chart, below $7787 is unlikely to happen (retracement level of 61.8%)

Fibo measures the emotional reaction of traders better than all other tech analysis, so i always combine it with other indexes for btc, since the btc traders are very excited in their positions!

This post is Powered by @superbot all the way from Planet Super Earth.