The US Government Clamps Down on Ability of Americans To Purchase Bitcoin

You have to feel sorry for Americans. They are some of the most financially enslaved people in the world.

The bankrupt US government has been instituting capital controls for years now and have ensured that Americans can’t open a bank account nor even a bitcoin exchange account outside of the US through things like the Foreign Account Tax Compliance Act (FATCA) and just outright threatening to attack any bank or bitcoin exchange in the world who accepts Americans as clients.

This leaves Americans in the “land of the free” with very few options for bitcoin exchanges.

No exchange outside of the US will accept Americans as clients. They’ll accept North Koreans. Iranians. Russians. Chinese. Anyone… except for Americans.

And due to all the regulations in the fascist/socialist mixed US economy, it is incredibly hard to even operate a bitcoin exchange in the US.

While there are now a few other options, which we’ll discuss further below, until recently, there was only one option. Coinbase.

To be fair to Coinbase a lot of the issues with the exchange aren’t its fault directly. They are due to the myriad of rules and regulations that are strictly enforced in the US police state.

This has led to countless complaints about how difficult it is to open an account at Coinbase. Many have said that it is just as difficult to open an account at Coinbase as it is to open a bank account in the US… which usually requires a phone book stack of documents and needing to report in each morning with what you ate for breakfast.

And there have been countless reports of people saying that Coinbase closed their account without reason or notice. And many others have reported that their bank accounts have been closed once the bank noticed they were doing business with Coinbase.

Matters were made worse when late last year the IRS requested a John Doe summons as part of a bitcoin extortion-evasion probe, seeking to identify all Coinbase users in the US who “conducted transactions in a convertible virtual currency.”

After all, the thieves at the IRS expect to get their cut.

To add to that, the US federal government is pushing a bill called “Combating Money Laundering, Terrorist Financing, and Counterfeiting Act of 2017” - which we talked about a few days ago.

This bill takes a further step to target bitcoin and wants to put any business which “issues” cryptocurrency under this umbrella of anti-money laundering regulations. Also, it will include bitcoin on the list of monetary instruments that must be reported when entering or leaving the US.

As you can see, trying to do anything related to bitcoin in the “land of the free” anymore is becoming more and more difficult. This combined with the SEC turning down a bitcoin ETF months ago has all but ensured that many Americans missed out on massive gains in the rise of bitcoin and other altcoins in the last year.

All in the name of protecting Americans, of course!

Lately, the site has also been plagued by technical issues as it is unable to handle the demand from customers.

There have been numerous website inefficiency and maintenance issues which rendered buy and sell orders useless for extending periods of time.

Plus there were extended periods of time when the site couldn’t be accessed at all, which left users unable to move their funds into other wallets. It’s worth noting as well that the majority of these instances occurred during periods of massive price movement which probably costs users millions in potential profits and losses.

As if all that weren’t enough to make its users furious, it just came out that Coinbase disabled the fundraising account being used to pay the incarcerated founder of the Silk Road, Ross Ulbricht’s defense attorneys.

Ross Ulbricht, for those who don’t know, was given numerous life sentences for having a website in the, need I say again… “land of the free.” Here was my recent interview with his mother on the massive injustice done to him.

This happened not long after Coinbase hired the former Silk Road’s federal prosecutor, Kathryn Haun.

Wait a sec… why in the world is Coinbase hiring US government criminals?

Many libertarians were going to give the boot to Coinbase after hearing this… but it turns out this prosecutor was the one who put the corrupt FBI agents who stole Ross’s bitcoin in jail.

So, she may not be totally evil. We aren’t passing judgement just yet.

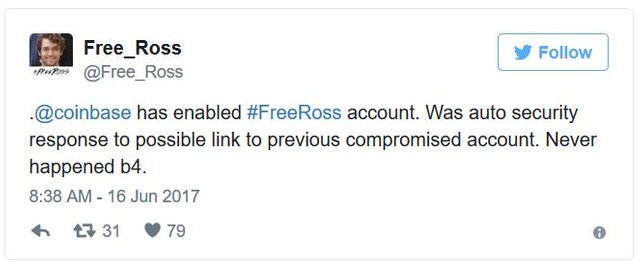

And, yesterday, Ross’s account was enabled again:

So, Coinbase saved some face this time.

But, if they can’t somehow lessen their adherence to the millions of US government regulations and fix their site technically they will lose customers to competitors.

At this time we are only aware of two other bitcoin exchanges operating in the US that will allow users with American bank accounts to exchange fiat for bitcoin.

There is New York-based Winklevoss twin’s Gemini exchange and the San Francisco-based Kraken exchange.

We recommend Americans at least consider them as alternatives to Coinbase.

That’s just being prudent.

As always, though, ignore Mike the Health Ranger Adams on anything to do with bitcoin.

He recently put out an article entitled, “Bitcoin wallet COINBASE now seizing accounts of Americans… users rage against ‘total ripoff’ as their Coinbase accounts VANISH,” saying that Coinbase stole everyone's money.

This, as usual from Mike, is completely untrue. Please stick to vitamins Mike… we got the cryptocurrency space covered over here.

You can tell Mike doesn’t understand what he’s talking about in his article because he refers to Coinbase as a “popular bitcoin wallet”. Of course, it provides users with different wallets for different currencies, but only an inexperienced user would refer to an exchange as a “wallet.”

Mike goes on to quote an issue Coinbase is having with Wyoming users saying Coinbase is stealing their money;

“Although we strive to provide continuous access to Coinbase services, Coinbase has indefinitely suspended its business in Wyoming and we regret that we cannot currently support services in Wyoming. You can find a further explanation of our account suspension policy here. We hope to restore service in Wyoming soon, so please check back again.”

While it is true that many users in the state of Wyoming experienced this issue, Coinbase hasn’t yet stolen the funds Mike, let's not jump to conclusions. And, as I said earlier, this issue is caused yet again by the egregious labyrinth of laws in the “land of the free”, not by Coinbase.

It seems like lately Mike seems to be jumping at any opportunity to incite more bitcoin-based fear propaganda, maybe he’s upset he sold his bitcoin at such a low price level?

In any case, one thing is clear through all of this. As an American, it is becoming harder and harder to get access to bitcoin.

This should be a wake-up call to many. The US government is bankrupt. The US government is installing capital controls to ensure Americans cannot leave the country with their money.

And, they are making it harder and harder for Americans to convert their US dollars into bitcoin.

The writing on the wall is clear. And if you haven’t begun to get at least some of your assets outside of the US you should be running not walking to do so.

This is what every country on Earth does just before their currency hyperinflates into worthlessness or the government defaults. Just ask people in Greece. The government there has just decided they will begin taking people’s homes and the contents of their safety deposit boxes in order to keep the country from bankruptcy.

People like Peter Schiff have been warning people to stay out of bitcoin since it was $20. And now the Health Ranger is warning you to stay out of it too.

You have to wonder what is the motivation of these people who should be smart enough to know that we are on the verge of a collapse of the US dollar to warn people away from alternatives that could save them.

Cryptocurrencies have a lot of risks and we wouldn’t recommend anyone put all their assets into them. But we do recommend you begin to use them, put a small percentage of your assets into them and learn more about them.

For that I have created a free four-video webinar on the importance of cryptocurrencies which you can view HERE. And we’ll even send you your first $50 in bitcoin if you accept our offer to get more information in the videos.

To summarize, Coinbase has a lot of issues, but most of the issues are just because it operates in the US. It still, however, is the largest exchange in the US and does offer an excellent bitcoin ATM/debit card. And you can get $10 in free bitcoin if you signup using this link.

Americans can expect to have more and more problems as the US government bankruptcy and Federal Reserve hyperinflation of the dollar nears closer.

My advice is just to get out of the US for much freer places across the world where you can trade easily in bitcoin.

But, if you can’t, or won’t, you should be at least ensuring your assets are kept out of the easy reach of the world’s largest terrorist organization, the US government and the world’s largest extortion racket, the IRS.

Bitcoin is just one easy way to do that. You can find out more in my free four-video webinar here.

Nice post man i am 14 years old and i am trying to get young people like myself to use time on steemit to benefit from there skills :) you are a real inspiration and if you could support my post by upvoting that would mean a lot ;) i upvote all your content

How awesome that the younger generation is using steemit! tell all your friends how wonderful it is!

My kids are doing steemit as well. My daughter will be posting soon about her trip to New York City. I'll be watching for your posts.

Thank you for the support :)

No problem. :)

Thank you for keeping us updated! I heard of the bill that would put more restrictions on Bitcoin, but I didn't know it was forcing blockchain assets out of the US... that's crazy! I think a good way to restore the American dream - at least when it comes to Bitcoin/Altcoin investments, is to allow more power to the people. I think one of the bigger problems revolves around the ignorance and fear of cryptocurrencies that the public has, simply because they don't understand it. followed @ottostephens @storcogato (that's crazy ur only 14) and @dollarvigilante. Keep it up!

Definitely good for young users. I will be getting my daughter an account very soon so she can post daily and maybe make some money over the summer and during her Junior HS and HS years. She writes truly great poetry and makes great artwork as well as music via her Cello and loves to write stories and review books and she is a PC gamer like me (so proud 😢). Who knows maybe she can be able to buy her first car with STEEM in five years or so. Now...this may not apply to everyone but with US interference in cryptocurrency I think it is important that everyone in the know grab a little of each, like, yesterday. Also I know this doesnt apply to everyone as well but, if you have dual-citizenship, as many Americans with Immigrant grandparents are, you can use that along with a VPN to use your status as a citizen of say, Ireland, to do business. My Dad was born there so not only do I have dual-citizenship but so do my kids and my wife. Can come in handy for certain scenarios. The USA doesn't recognize dual-citizenship but other Countries do, so dont renounce (or denounce, I forget) your US Citizenship or anything because you don't have to. You can use something like TunnelBear to give you enough free VPN service to buy PIA (Private Internet Access) and for under $40 you have a year of picking an IP Address in many, many other countries including many in the US itself. Can help hide your location, access websites based in other countries like Australia, watch the BBC or other Hulu type websites etc. I have blogged twice about how to turn USD into crypto without a huge paper trail and received not much information. But this may be a way to do so especially if you have family overseas, that you trust, that can help you set something up. Or better yet maybe we here on STEEMIT can help others to do what they can't do in America, land of the free. But I do know one thing, whenever the government tries to take away a freedom it is because they fear it spreading and because they are protecting something. So I would diversify out of the USD now...and get ready to sell when that silver hits $200/oz and those 600,000 DOGE I have make me rich haha. Its too bad Cryptsy stole all my Dash or I wouldn't be a minnow right now I would be beaching myself on the shores of the Bahamas...like a 🐳

They got me for sooo much and its all my fault for keeping so much in an exchange. I lost about 200 Dash, 1.3M DOGE, 2 BTC and what I mined first, Litecoin (doh!) of which I had around 500, buying them when the price got chopped in a third. Sorry just had to spill my sorrows in crypto. If I was smart I could be sitting pretty right now but I wasn't, I made classic rookie mistakes and other than figuring out how to mine coins, did everything wrong except buying low. But I also sold low many, many times and wasted tons of time mining shitcoins. Stick with the big coins and the rising stars like STEEM and SD. Oh, did I mention if I still had my Monero how I would be able to buy a house on Long Island? I am so stupid!!! Don't tell my wife. Aye but I still haves me Silver, argh!

Dint realize that if they lock you out, you will end up losing all the coins in their wallet too. I just started tracking crypto currencies and hence it's too late for me to mine atleast with my exiting hardware so I am buying the coins. I have been buying stocks for a long time and I am really comfortable analyzing the support/resistance, EPS,

PE etc but with these coins i am flying blind. Not sure what price to enter ether, XRP, Litecoin. Etc

Same rules apply but a much more panic driven market and popular names of coins will keep value. You have to invest in something that people will want in the future. So diversify and ride the major five to big gains especially in 2018. Q2 & Q4, especially.

I noticed in the terms of service for Genesis Mining a statement about forfeiture of any credits, or payouts you have earned if the company happens to go out of business. Therefore, it would be prudent not to keep a large amount sitting on any website. Especially with hackers prowling around searching for a place to commit their shenanigans. Play it safe and get a hard wallet. When it comes to something as important as your finances there is no such thing as being too safe. Better safe than sorry.

Thanks :)

Steemit is an interesting platform with a lot of opportunity. I'm curious how/why you got involved with it at 14. I hope you are getting others to be able to see what true value is :) Thank you for your reply.

It's good you're getting into this stuff so young. While kids your age are goofing off you're investing your time into things that could greatly affect your future for the better, well done.

Yup, Coinbase has been good as long at BTC and ETH were moving along "slow and steady." But after this last week when I couldn't get orders executed when BTC and ETH bottomed it was extremely frustrating. Now I plan to be here for the long haul and have made several buys during this move up. It's just again frustrating when I wasn't able to take advantage of the volatility.

Because of that I opened up a Gemini account which is still pending verification. Another "exchange"/wallet I guess we can call it that I've used to buy BTC with my USD is Abra. Just word of caution with Abra is that you purchase of BTC can take a few days. So if there has been recent volatility in BTC, you might get a better/worse price then expected. To I guess hedge against this, I am going to try to load USD in my Abra wallet first then, then convert over to BTC, by changing the wallets currency when needed. This is something I have done with Coinbase to save a few dollars in fees when I use my debit card. Just again hopefully BTC or ETH hasn't been too volatility as you wait the 7 days for the money to clear.

Bitcoin is such an easy target for politicians to give the impression to the general public they are doing something about terrorism. It's very uneducated of them and I'm sure along with the banks they want to see the demise of Bitcoin but in the end they will lose.

The Blockchain technology is the future, but of course the rich people at the top of the banking institutions are afraid of it. They will for sure fight it as Bitcoin etc. would prevent them from earning as much money as they do right now.

Yeah man. America freedom to fascism.

i don't feel the govts/elites are going to be able to move fast enough to manipulate cryptos. their ship is sinking fast, and most of their "wealth" is based on debt when you drill down to it. they can try this kind of regulation, but all it is going to do is cause a larger loss of faith in their institutions by the people. likely spurring more global adoption of cryptos. the US seems to be moving in the opposite direction of other major economic world players such as Russia and Asia. if they continue to treat us americans more and more poorly, more division and uprising will result. i have a lot of faith that cryptos are here to stay and will play a major role in our liberation from these crooks.

Even if they do impose some regulations I suspect that they will eventually roll them back as corporations learn how to get their cut of the profits. I was just reading an article that's a year old about The Hyperledger Project, "an open-source cross-industry endeavor focused on blockchain technology and led by the Linux Foundation." The article goes on to reveal the big players involved. "Early reports revealed technology giant IBM to be among the proponents for the endeavor that also counts several prominent banks such as JP Morgan and Wells Fargo." Also, "Apache web server’s primary developer and former Mozilla Foundation member Brian Behlendorf was instated as the project’s executive director." With such big players involved I'm thinking that they will use regulation to try to funnel the resources of the blockchain environment until they can figure out how to pool them, but that they will stop short of trying to shut it down. At least that's what I'm hoping.

indeed some of the largest corps and banks in the world have been paying attention to cryptos since early on. especially huge list on the Enterprise Ethereum Alliance: https://entethalliance.org/members/

still i feel they've missed their chance. they either didn't have faith in cryptos or were far too confident in their plans to act in time. they have a host of other issues to deal with now, and don't have the resources to prevent the rise of cryptocurrency. liberation.

Hulk

Not to worry, the soda tax will save us all!!!

LOL - that dupe Bloomberg in NY is such a piece of work.

More like the recreational/medical cannabis taxes!

That's why we need second passport

Well put together and a great read.. It's funny how our government is trying to stop us from taking money out the country but will WILLING just give our money away to other countries.. Billions of Dollars to the 10K limit I have on myself for bank transactions.. I cant carry my own money around??? cause its too much?? But we give BILLIONS to countries just as an "that a boy"

exactly

Mostly Israel though... They are more worthy of our own money apparently.

These governments ey.

Centralized exchanges are going the way of the dinosaurs. Recent problems with Coinbase, Bitfinex, Poloniex affecting withdrawals & trading.

No coincidence that the decentralized exchanges like Bitshares have seen a boom in recent weeks!

Don´t really know the difference between centralized and not centralized exchanges. How is Bitshares different from Poloniex. Perhaps you can point me in the right direction where I can learn about this. Thanks.

Here's a great article on decentralized exchanges that appeared here on Steemit a while ago.

I don't think you can convert between fiat and cryptocurrencies on decentralized exchanges, though; only between pairs of cryptocurrencies. Exchanges that do fiat conversions are what the OP was focusing on.

great, tks, @nocturnal. I'll read it.

The problem any government has with crypto is the fact that they can't inflate it to control their debt. If any country found a cryptocurrency becoming its currency of choice they'd then have to carefully manage budgets to prevent bankruptcy. Currently the U.S. is the only country with existing enforceable laws but I feel that if Bitcoin or any other crypto starts to rival a fiat currency there will be trouble for us.

Gemini Exchange is better than coinbase tbh

I just got approved for Gemini. I'm looking forward to trying them out. Coinbase is trending in the wrong direction.

I've tried coinbase flawlessly so far, not big purchases but your right , here in the US there are not a lot to choices to buy.

The problem I had with Gemini, I did join, but one thing is asking me for my debit/ credit card but Gemini asked for my bank user name and password! That ain't happeneing! I believe in getting a few different alt coins, I don't recommend putting anything in a storage with coinbase or anyone, buy it and move it directly to your wallet!

Unfortunately the story is correct in that the places to buy are far and few between here in the US.