I Shorted Ethereum And Struck Gold

Finding An Opportunity

I did not know this trade was going to occur, but let me tell you...it happened really fast

Just after the epic Ethereum crash from 289 - 215, I glanced at the charts unknowing what had happened. I quickly began noticing that many coins were experiencing over sold conditions, ETH was no exception.

Looking at the 2 hour candlestick charts I immediately notice a reversal candle showing at the bottom of the downtrend. Although not closed as the permanent look, it grabbed my attention. Particularly so because this hammer candle was forming on a support line.

Time To Short It

It may seem odd to you that I am just looking at a candle on a clear support line and thinking short. Do not worry. What I am expecting to go up, must come down..If you ask me why not just take the long trade then that would be a great question..I am glad you asked and this is why...The trend is down overall, and that has been consistent most of the year. The trend is your friend. What that means is that I am much better off looking for a short position than just logging on to see a bottom, and going long. That is especially so since selling is what everyone is still doing after the massive selloff.

Lower Time Frame

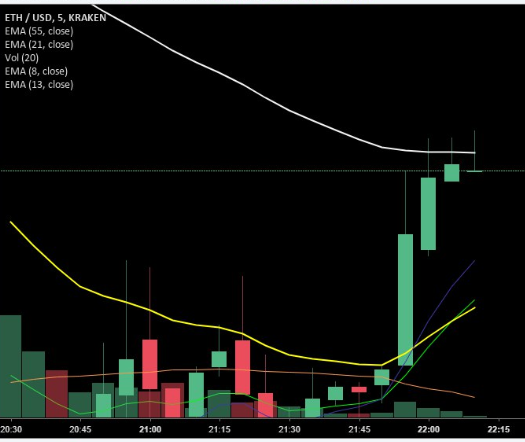

This is what the action currently looks like on a lower time frame. This clearly shows the upwards momentum that is contributing to the bullish hammer candle forming on the 2 hour charts. Look at the 4 long wicks being easily beaten back down in a row. A trouble sign for sure...When I notice the white EMA line being the clear resist point here I know its coming back down..

The trick to any margin account is to keep from getting liquidated, or in short (no pun there) , the exchange taking all your money to pay for the short you lost. So how do we keep from losing ? Be smart and do not use max leverage on your whole account, forget a stop loss, and forgetting to manage your overall risk and reward ratio wisely.. Tweak the numbers to your advantage. Play a low percentage of your overall margin account. I keep 60 - 80% free, often. My liquidation price is always very far away. I also will set a stop loss to where my risk and rewards ratio is at least at a 2:1. I wont get close to my liquidation price that way.

My final line of defense is actually taking profit at my target, once identified. This trade featured 3x leverage. I do love some leverage, but do not Bitmex yourself and get rekt. Ridiculously high amounts of margin is very risky and the house usually always has the upper hand. Statistically, they have it all worked out. Trust me.. If you get greedy, odds are you will get broke.

Foot On Accelerator

Notice how fast this is getting. I am flying through a few things now. Trend lines are up, shes holding within...good.

At a glance it looks like an inverted hammer candle is forming at this time. Even better... Ill keep it in mind

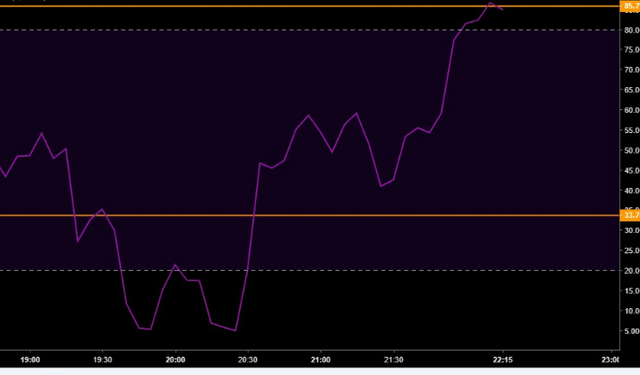

She has broken the white EMA, I remember how the bears fought it and am betting they will be back to finish it off soon. A quick peek at the RSI shows its oversold, past 80...awesome

Picking Our Target

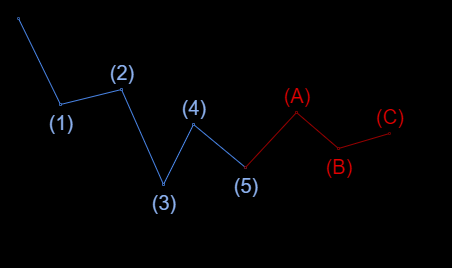

Failure is eminent as I use the Fibonacci Retracement tool to pick my target. It will be the 0.236 line. A red candle is forming, the bears have struck in force. A final Elliot wave count is done to ensure that I am right. Yes I know the Elliot count is goofy. It's ok, I have confirmed the drop so many other ways. I just wanted to see a structure in the waves, they were present.. The 5th wave is coming down, confirmed. Trade entered, leverage applied..

Finished The Trade

This trade may had lasted 30-45 minutes but from the time I entered the trade and it closed....15 minutes? Boom, done. A decent days wage in the bank. Good thing I looked at the charts before bed. I took one look back and this is what I saw...

Thanks for stopping by!!

I very much appreciate your support. The markets are dangerous. Please be careful. If you work hard and learn, you will be fine. I do not offer trade calls and please do not take anything I say to be meant to be advice on trading, investment or financial advice. I win and lose trades, just like you

So happy to see you doing great :D I'm not made for day trading, I would never sleep again :')

Thank you! Its painful at times, definitely not something I do all day long 🤗. This one I was just in the mood for and happened to see the setup for it immediately. These same principles apply on all timeframes though. Its just way slower. Alot of new traders want to day trade right away lol. Dont. Use high time frames, build skills and then its "safe" to get faster