SBD, What’s going on …

Let's have a discussion on the economic effects of the current SBD bonnanza. In my view the economic value of Steem is being drained on an unprecedented scale. The daily reward pool for some days in recent weeks equated to as high as $850k. This is far above a sustainable level.

Is there anything we can do to stop the drain?

Steem is not Bitcoin

Many aspects of Steem contribute to it being different than other Cryptocurrencies. The idea that any user can earn it as they add value to the system contribute to the token Steem having a sustainable economic model. It has in fact created a self-sufficient online economic model that is global in scale.

50%:50% or 100%

The main selling point for Steem is that you “get paid” to post. You do “get paid” with a digital token that has a perceived economic value. This is not cash but a digital token which represents a share of the Steem ecosystem. This is not a share of a company but a share of a digital decentralised economy.

Aligning Interests

One of @dan's principles from the start has been to set up a system where economic and social interests incentivise behaviour. An aspect of Steem that is different from other cryptocurrencies is that it is not all liquid. When you “get paid” you can opt to get paid half in liquid rewards and half in Steem Power which is not liquid. This is a cornerstone of the system and it leads to all participants having a stake in the system. It creates an incentive to make the system work.

People are less inclined to cash out because people have a long term stake in the platform.

Democratic Evolution

Late last year the power down rules changed from 2 years (which was seen as excessive) to 13 weeks.

Powering down is the length of time it takes before you can withdraw your Steem Power.

Governance

This drastic change was seen as necessary at the time and implemented via a hardfork of the Blockchain (HF16).

Another fairly unique aspect of Steemit is its governance structure. Delegated Witnesses Implement Hardforks. For HF16 there were proposals, discussion and a democratic decision to implement the change to the rules for powering down.

In recent weeks something altogether less democratic has happened. The rules for extracting value from the system have suddenly changed without any such due process. Only time will tell if this loophole is shut down or if people continue to drain value from the system.

Lets celebrate the bonanza but lets not be complacent.

Value

Have you ever asked yourself why is cryptocurrency worth anything?

Consider Facebook for a moment...

Facebook has value because it has a unique asset, a network of users which it has created. This network can generate revenue streams from advertising and via selling valuable information about the digital footprint of its users. These revenue streams contribute to the value of that company and are reflected in the share price.

Steem has value because it also has a unique asset. It has created a network of users that add value to the system each day by writing and interacting with it.

The network is the asset in Steem’s case and as the network grows and more people wish to join to utilise the technology and connections that this network has created, the value of the system will increase.

This is the theory at least and this is why people speculate on the market price of Steem. The perceived potential that is building in the network will increase the market price of Steem as more people join and the network grows and evolves.

Nothing is Infinite

Any system has inputs and ouputs. Lets look at Steems inputs and outputs.

Inputs

Anything that grows or adds value to the network. e.g.

- Posts

- Comments

- Votes

- Applications

- Communities

Outputs

Anything that extracts or reduces the value of the network. e.g.

- Power Downs and Sale of Stake for Fiat

- Sale of Liquid Currency for Fiat

Value Extraction

It's probably a law of thermodynamics or something but as value or energy is extracted from any system the value of the system will drop.

The main method of extracting value from the Steem, until recently, was powerdowns and selling Steem for Fiat.

In November this balance suddenly shifted dramatically.

Before HF16 there was not much extraction from the system. Liquid rewards were not a major component and people were generally building the network without cashing out. Since the beginning of 2017 we have seen several large powerdowns from people and sale of stake, but worryingly in recent weeks the balance has changed and people now have found a new way to extract value from the system in the form of Liquid rewards.

SBD

A crucial feature of the Steem system is SBD, a counterparty free asset pegged to the US dollar. In theory it’s quite simple how this works

- If the price of Steem is < 1 dollar you get paid interest for holding SBD instead of Steem.

People have an incentive to hold SBD and will buy it driving up the price. - If the price of Steem > 1 dollar your post payouts become more valuable if you get paid in part with SBD.

You have an incentive to sell your dollars on the market which will drive down the price.

Why is this important

Built into the Steem system is an asset that is automatically pegged to the Dollar. If your risk averse or wish to hedge your currency risk you can, and the market should automatically handle keeping this asset in line. This allows commerce to thrive with certainty for people wishing to plan for the future or set a price that will not fluctuate wildly.

So who pays 16 dollar’s for 1 SBD?

On November 1st the Volume of SBD traded was 25m dollars according to coinmarketcap. This level was very much out of line with the daily trading volumes for the last year. Since then the price of SBD has been very high.

Was it all the people paying for Ubers with SBD at Steemfest???

Something about this doesn’t feel right and there are just two reasonable explanations for the volumes on that day

- Market Manipulation

- Other Crypto Traders who don’t know what Steem is and what SBD is trading charts.

The second possibility is unlikely as any chart for the past few months will show a stable SBD price so the likely conclusion is Market Manipulation. To put this into context if you were holding SBD and the price went up to 16 dollars you would have made 16x profit for dumping your SBD. It feels like a bubble that will burst at some stage.

So who profits from SBD being at all time highs?

We all get a bonanza for posts but there are two groups of people that are clearly profiting:

- Voting Bots

- Delegators

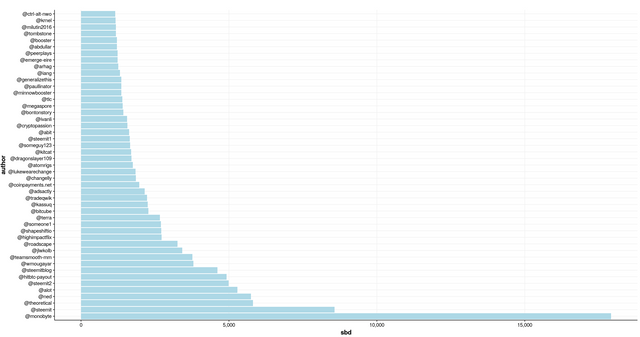

Where is the SBD sitting at the moment?

SBD Distribution by Account

This distribution ignores the top 3 holders. @bittrex is where most of the SBD is sitting and the only account that stands out here is @monobyte but this account isn't holding enough SBD to move the market, but I do wonder why any account has SBD. Who is buying it???

The questions this analysis leaves me with are

- Who are the top holders of SBD in bittrex.

- Why are they hodling on to it. Is it not time to sell before it reverts back to 1 dollar?

Draining the Long Term Value of the Reward Pool

I started this post with a headline figure of 850k. In the next section I will explain how I arrived at this figure but first lets take a look at the top trending post at the moment.

@haejin has written a post that is valued at 512.50 as per Steemit.com. The breakdown of the payout for this post will be 50:50 between liquid Steem and Steem Power.

- That is 256 US Dollars in Steem

- and 256 Steem Dollars worth about 7.75 Dollars or 1984 US Dollars.

@haejin has not done too badly for this post with an estimated payout of over $2000. This post consists of 3 graphs and limited text. Thanks @ranchorelaxo and @glitterfart

Implications

The reward pool is approx 46k steem a day which equates to around 100 - 140k dollars. Steem is set up to distribute this amount of value each day but half at least should be put into Steem Power. What is happening at the moment is much more in value is being paid out.

Payouts are currently 50% in Steem, 50% in SBD which may be worth up to 16 times its face value on the open market. That means the daily reward pool has jumped from 100k to 850k in value on some days.

This dramatic increase in value extraction is happening at the moment but it's not being instigated by witnesses and by the Steemit Governance Structure but by an unknown actor or group of actors. I have not seen it being discussed as a problem and if the price of Steem continues to rise it may not even be noticed but as an aspiring blogger I feel cheated by people extracting up to 8 times the daily rewards.

Combat the Pump

Is there anything we can do. The only way I can see to stop this value extraction exercise is by converting all the SBD you get to Steem and powering it up.

Have you any thought's about who is behind this pump and what it means for the economic value of Steem?

Thank you for reading this. I write on Steemit about Blockchain, Cryptocurrency, Travel and lots of random topics.

Images thanks to pixabay.com

Sorry, but your post is not an accurate assessment of the way the rewards pool works. I normally do not self-upvote, but I need to here for visibility. Your post is full of inaccurate information.

High SBD prices do not affect the amount of STEEM or SBD that is distributed from the rewards pool. They are completely unrelated. The rewards pool will pay out the same amount of tokens, regardless of whether SBD is trading at $1 or $10. The value of those tokens is what changes. SBD being valued at more than a dollar does not 'drain' the rewards pool.

This is the worst possible thing you can do. In this case you are only getting $1 worth of STEEM per SBD, when you could trade SBD for STEEM (then power it up) and get around $8 worth. Also, you are destorying SBD in the process, which is decreasing the supply - the last thing we want to do when there is surplus demand.

The post I have written is tagged economics as I am speaking from an economics point of view for the majority of this post. Maybe using the the term "Reward Pool" has other meanings but you can't refute the fact that each day the economic value of the Steem token is being drained as a direct consequence of the daily Rewards payouts. So in this context the "Rewards Pool" is being drained. Quite simply there is less value in the pot after people have extracted their SBD to fiat. I have changed the heading on one section of the post to more fully reflect this. I hope this is clearer now.

I have thought long and hard about why Steem has value, why its not a ponzi scheme and all the rest and the conclusion I get is because the users are creating value for the system. Steem is different than other coins because it is creating a circular economy which means it has value and will grow as long as value is not extracted from the system on an unsustainable scale. I have written about this elsewhere and I would urge you to read some of my posts on this.

On the second point thanks for the clarification. People should be converting Steem on the market which is what I do each time I convert my SBD to Steem. I have actually never converted Steem to SBD in the method you have described. Maybe this course of action makes more sense now in the context of the economics argument.

I have made my best attempt to explain a rather complex issue here for the purposes of the community and to promote discussion so I don't appreciate the downvote but thanks for your input.

There is no evidence of this, and I think your belief of this is based on a false understanding of how the rewards pool actually works.

Sorry, but this doesn’t make sense.

I can appreciate that, but there are a lot of posts where this is being discussed, and one that presents information that is not accurate is not adding value IMO. I didn’t ‘nuke’ it though (send the rewards to 0.00) because I don’t believe you had any malicious intent behind posting bad information.

There are a lot of posts where this is being discussed but it seems to me everyone (including me) are getting caught up in the euphoria of free money. Free money always comes at a cost to someone.

I have presented in this post a point of view on the economics of what is happening and the long term economic impacts which I don't believe has been discussed by anyone at all. The topic of the economics of blockchains is not a field that is well developed or discussed in a balanced way, but it is something that is key (in my opinion) to the long term survival of any blockchain project.

Economics is one of the things that make Steem different from other cryptos. Evidence of this is that we have already seen a circular economy develop which doesn't really exist yet in other cryptos.

There are a few corner stones to it, all of which contribute in a small way to give its competitive advantage:

The people that are going to lose on this are the crypto investors who are paying overly high prices for the SBD. It is bad for them, good for us (us being the Steem community).

Thanks for this thought-provoking piece of content! Shared for more attention since I'm pretty convinced that it's undervalued right now :-)

How much SBD would someone or a group of someone's need to buy to be able to have a serious influence on the prize? Currently the market cap is at $37.788.105 USD (bittrex.com). On the 1st of December 2017 (almost one month ago) it was below 5 million.

This means a raise of more than 700% in only one month.

This is definitely an unhealthy type of growth, and we can be pretty sure that the prize will drop down considerably sooner or later. It will then leave a huge gap in steemit's books, since - as you perfectly pointed out - people cash our SBD instead of holding SP.

It'd be interesting to know how much of the ones that cash out SBD simply turn it into BTC and then re-invest in Steem (contributing to the networks growth again), and how many exchange into other cryptos or even Fiat. I guess it'll be hard to find that out.

From my personal point of view this evolution is just a logical consequence of the changes that have happend during the past months. Since vote-trading became one of the most lucrative business on steemit (mostly for the vote-sellers and not the buyers), steemit has suffered a considerable decrease in value from a social point of view (your link to @dan's mission). The healthy development of the community and the conscientious distribution of rewards have become secondary. Rewards are given to those who know best how to drain the pool, not to the ones who know best how to support the common vision.

Posts like this one are great ways of reminding people that this is a long term project, and that everybody of us might have an interest in a healthy network that's going to prosper for many more years.

Again, thanks for the input!

Unfortunately it seems that way at times. Voting bots and delegation are cleaning up at the moment. If you upvote your own posts you get X times the value because of the price of SBD.

and @eroch - I'm new to all of this (well joined in August, but back at it due to being too busy elsewhere all Autumn but having just read the white paper, it seems pretty clear that 'community' is second and making money is the primary goal of the platform - I think the 'crab bucket analogy' sums up the authors' view of collectivism and there's also a base assumption that high levels of inequality are natural, and that this is good because it taps into people's desire to want more and keeps them posting.

My sneaky suspicion is that this platform is working just as its creators intended.

However, I'm also finding it quite conducive to meeting some nice people and hopefully community will out in the end!

That is an interesting perspective @revisesociology

Whatever the reasons and motivations there is a nice community here and it is something that is evolving on a daily basis. I am happy to be on the journey and looking forward to the road ahead. Nice to meet you by the way.

There are lot of well-meaning people on here and I'm trying to blinker myself to all of the economic injustice, the problem is the economics + the anonymity are a ticking time bomb - think of the damage one malicious billionaire could do!

While people with influence on here seem to be focusing on expansion and innovation before sorting the basics out (I believe there's a 'code first' mentality)

Then again that's the problem with economic justice I guess - Much like the man himself, Karl Marx, it ain't that sexy.

Nice to meet you too, happy new 2018!

But his beard is so magnificent! Oh, and I see yours is, too! Bearded, sexy socialists unite! (and we shall wrest Steem from the grip of the Steem millionaires somehow.)

GREAT ARTICLE! Thank you so very much for sharing and the in depth analysis of this matter that has been puzzling for many of us...

Originally, the SBD was supposedly pegged to the USD, what happened with that all of a sudden??? As you quickly mention at the beginning of your article:

Now that we all know when this change happened, where did it take place, in other words, who instigated it??? Had the SBD been in deed pegged tot eh USD, this draining effect may very well have been averted. To boot, have the right to take the whole of one's investment from their Steem Power in 13 weeks alone makes the spin potentially much faster... Can the platform really survive this movement? ***Unless the instigators of this SBD drainage faucet is benevolent, it may very well the end of our powerful platform. If this is a move by individuals involved within the ecosystem, they may very well be allowing many to reinvest, including themselves, within the ecosystems relating to STEEM thus creating the pump to, later on, reinvest the increased value of the other cryptocurrencies that have now gained much more value because of the shift from SBD to that specific cryptocurrency. By buying back later on, you have flushed away a lot of people who are not into our platform for the long-term, in some ways skim away the people that aren't into our platform for the long-run! ;) I have a tendency to see the positive creative potential of situations and, as I am a realist, I am also aware that this is only one possibility for which all of us here on Steemit would gain...

Thanks again for an excellent quality post, it was thick and chunky and I LOVED it!

Namaste :)

Thank you so much for the words of praise. Your comments are very encouraging as always.

I have no answers to the situation but I am glad this post has spurred conversation.

This reminds me Pablo Escobar giving away free money. It never ends well. In the meantime as a Plankton I'm converting ETH into STEEM POWER, and if I have the change to get paid on my post I'll keep converting everything into POWER. I believe in the platform and I believe also that all these problems will be resolved by the team at Steem.

Great post and thanks for keeping us inspired to continue with our approach to POWER UP!

I am exactly your opinion. SBD price is only that high because it is a small market and easy to manipulate. But my own logic says me that 500% inflation will have its effect. And if the price will get even higher the inflation rate will get higher too. Better to sell SBD and buy Steem. SBD will go back to 1 Dollar in the mid to long term. Steem could profit from that because due to the high SBD price autors earning more money for their post and use the SBD to buy Steem and use it for powering up. Here is a link how the regulation mechanism works as it is for me: https://steemit.com/steem/@sevenseals/why-the-steem-dollar-sbd-will-fall-back-to-1-us-dollar-the-self-regulation-of-the-sbd

This is what is important for people to do to stop any drain in value on the system. It will even benefit Steem if the extra value is coming from naive traders trying to make a quick buck. :)

Great analysis and thanks for the deep insight. Lots to think about here @eroche!

Paying for Ubers, hahaha! Nice one.

Yeah, it's been really crazy! I'm wondering how it's gonna develop in the future. We'll see...

Thanks for this elaborate post. Glad to see you're still going strong.

Another possibility is what I call "crypto slosh", and I know for a fact it is happening, but I have no way to measure the degree.

A lot of fiat went into the high end crypto market (the top 20).

When the price of Bitcoin etc. got high, many people took profits, but not in fiat.

Some of that profit got shifted into other cryptos directly to avoid taxes on said profits.

I'm of the belief that the "sloshing" of cryptos in the bathtub of digital currencies has caused some spill-over (instability) in the smaller cryptos.

This may cause some volitility in the short term, but could be beneficial in the long term, as a rising tide lifts all boats.

I think the tide has come in a LOT quicker than expected, but will eventually settle out.

Thats my 2 steem worth!

"crypto slosh" sounds like a contributory factor indeed.

Looking through the daily volumes for SBD something happened noticeably on November 1st. This begun the tailspin. The rising tide leaves so much money to invest in ALTs , as you point out, and that is also contributing to the subsequent elevated levels. Who is continuing to buy this stuff though?

I suspect Bitcoin, Eth, Ripple and Dash profit takers, but all I have is anecdotal info.

A lot of the US tax bill stuff started in ernest in late Oct.

If so, we'll keep seeing shifts into minor cryptos and out of major cryptos until midnight Sunday by US holders of crypto.

As for the rest of the world, there's no telling without knowledge of their tax systems.

I wouldn't get too riled up about the prices yet, but definately watch what the other cryptos are doing.

Goldman Sachs has a crypto trading desk and Im sure other big banks also have them, so there's some possible major contributors.

Wouldn't be surprised to see central banks getting a slice of the pie too.

I think the big boys have seen the writing on the wall and are setting up viable escape routes from historical fiat systems.

But you never know...

I have been confused about what do with SBD and steem. i see price gow down everyday and what will happen I really don't know. but I am converting my SBD to steem all the time because I believe that steem price will go up more next monthes. thanks for sharing.