Option Greeks: Unlocking the Secrets of Options Trading 🌟

Hey there, finance enthusiasts and investors! 📈 Let's dive into the world of options trading and explore the concept of option Greeks, a powerful tool for understanding and managing options positions. 🌠

Unlocking Option Greeks 🗝️

Option Greeks are essential metrics used in options trading to analyze and manage risk and reward. Let's uncover their secrets and power! 🌟

Source: Medium

Option Greeks: A Trader's Guide 🌟

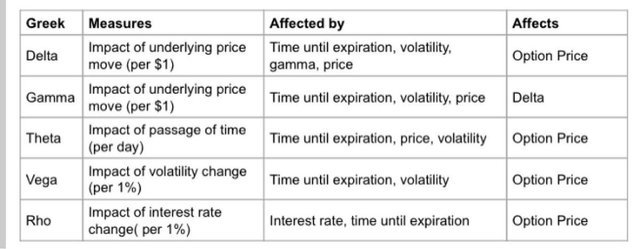

- Delta: Delta measures the sensitivity of an option's price to changes in the underlying asset's price. It indicates the expected price movement of the option for a $1 change in the underlying asset's price.

- Gamma: Gamma represents the rate of change of Delta with respect to the underlying asset's price. It measures the curvature of the option's price-movement curve, providing insights into the option's sensitivity to price changes.

- Vega: Vega measures the sensitivity of an option's price to changes in the underlying asset's volatility. It indicates how the option's price is affected by changes in volatility, helping traders understand the impact of market volatility on their positions.

Why Option Greeks Matter 🌟

- Risk Management: Option Greeks are powerful tools for risk management in options trading. By understanding and analyzing Delta, Gamma, and Vega, traders can assess and manage the risk associated with their positions, making informed decisions to protect their investments.

- Position Analysis: Option Greeks provide valuable insights into the behavior of options positions. Traders can use these metrics to analyze the potential profitability, risk exposure, and sensitivity of their positions, helping them make strategic decisions and adjust their strategies accordingly.

- Market Dynamics: Option Greeks help traders understand the impact of market dynamics, such as price movements and volatility, on their options positions. By monitoring and interpreting these metrics, traders can adapt their strategies to changing market conditions and make more informed trading decisions.

Embrace Option Greeks 🌟

Option Greeks are a powerful tool for options traders, offering insights into risk management, position analysis, and market dynamics. By understanding and utilizing Delta, Gamma, and Vega, traders can make more informed and strategic decisions, enhancing their trading strategies and managing risk effectively.

Stay tuned for more finance and investment insights, and let's continue to explore the fascinating world of options trading and its complexities! 📈

Source: Option Greeks