RE: (Alert). SIMULTANEOUS! Bonds Plunge, Stocks Selling Off, Dollar Falling. By Gregory Mannarino

The mainstream media is going to keep harping on about trade tariffs ignoring the much more important developments taking place. The 3 month Libor rate used in short term loans is rising faster than the Fed's rate hikes hitting companies and banks.

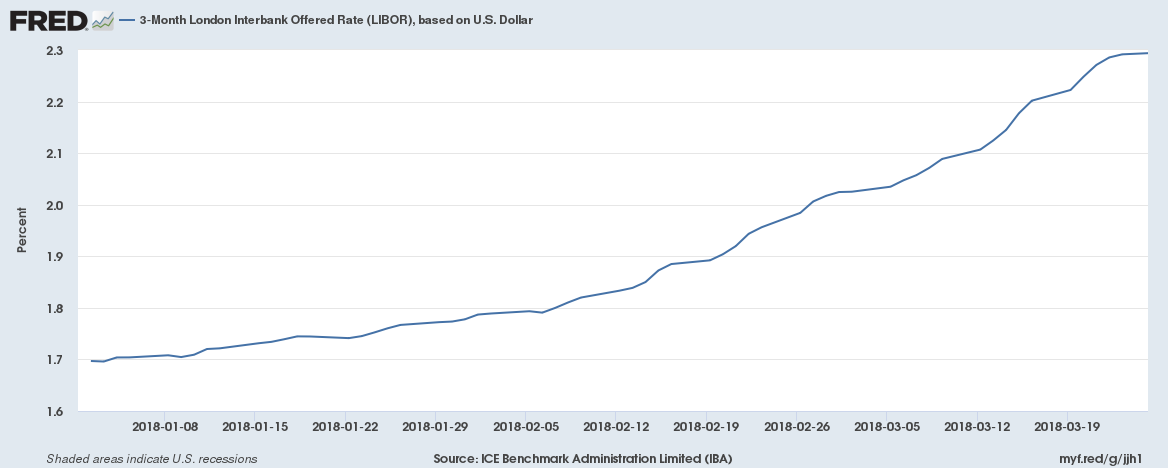

Look at how the 3 month Libor rate has spiked since the new year.

The current 3 month Libor rate at 2.29 is at its highest since 2009.

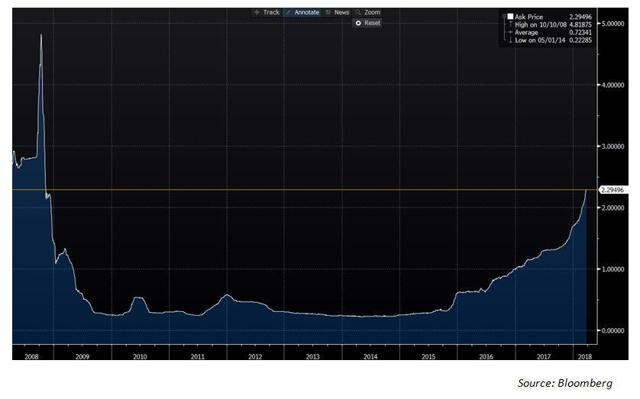

The chart below from Bloomberg shows the progress of the 3 month Libor rate since the economic crisis of 2008.

Spikes in the 3 month rate often indicators of financial stress as short term borrowing becomes more expensive.

Morgan Stanley has come out and stated that rising private borrowing costs are the real reason for the volatility in markets this year. If this trend continues be prepared for more market turmoil. It will be interesting to see how the Fed responds if this key benchmark rate continues to rise.