How Do YOU Compare To The Average American, Financially?

I am often spending time reading about finances, as financial independence is my goal. The best information is found on personal blogs, but I sometimes stray to the MSM personal finance sites to see what is going on.

I often regret it as it is full of low level, basic stuff. Or whining. Or some combination of the two.

But sometimes I find an interesting thing or two. The other day I found a few interesting bits of information about the 'average' or 'median' American in regards to their finances.

I found myself mentally checking where I was in relation to the responses. Here is where I stand. Read along and think about where you are, financially.

Are you above or below the mean?

The Median U.S. Home Value Is $205,100

According to Zillow, my home is worth $177,000. So I live below the median, which is fine by me. I also think my house was a great investment, unlike what you will repeatedly hear on some personal finance sites. Purchased during the summer of 2014 for just over $98K, I spent a few weeks and around $10K to update it.

This is a return of 64% from the purchase and renovation costs.

The Average Indebted Graduate Owes More Than $30,000

Me? $0

I have never had a student loan in my life. Feels good man.

The Median Household Income Is $59,039

My family is single income and I earn a touch over $66K per year, slightly over the median.

The Median American Salary Is $30,533

However, the median is much lower than the average U.S. wage that brings in just shy of $46,641 a year.

My salary of $66K is 43% above the average.

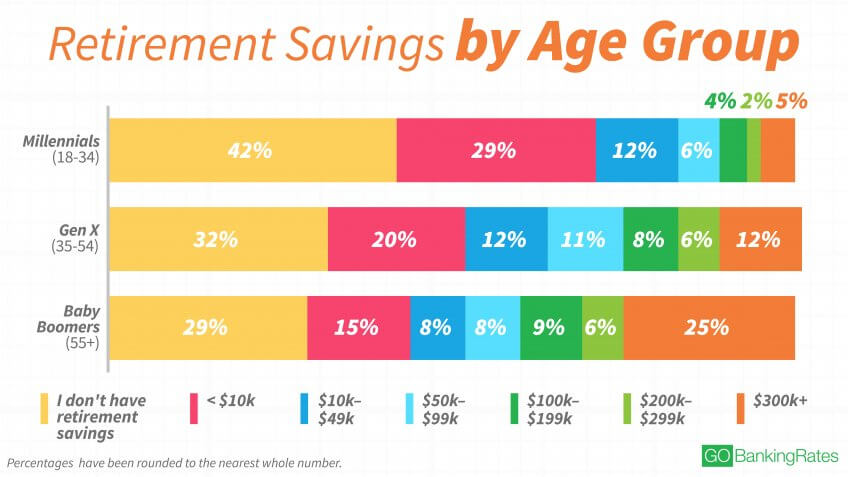

Most Americans Will Retire Broke

Good news! I am well on the way towards a healthy retirement. I might have started later, but I just surpassed the $100K milestone of investments! This puts me in the top 26% of my age group.

Most Americans Don’t Think They’ll Retire in Their 60s

Neither do I.

No, I plan to be able to FIRE in just over a year, at age 37. That seems to put me in the 11% of Americans who expect to retire before 50.

A Plurality of Americans Don’t Know How They’ll Finance Their Retirements

The article states that 39% of Americans have no idea where they will get the money to retire on.

I plan on a pension plus dividend income. Throwing in whatever Social Security will have for me as an extra.

29 Percent of Americans Believe They’ll Become Millionaires

Count me in that percentage!

The Root of Financial Stress Varies by State

Apparently, the main cause of financial stress in my state is debt. The only debt we have is a mortgage of under $60K. I am as stress-free as can be.

Retirement Is the Biggest Financial Fear

The survey found that 22% of Americans fear they will never retire. Another 20% fear they will always live paycheck-to-paycheck.

I am not found in either of these groups.

Most Americans Have More Savings Than Credit Card Debt

64% said so, to be exact. However, it was cautioned that respondents tend to include retirement savings in this calculation.

As I check my credit card balances, I see that it totals to a few hundred dollars. Credit cards are just free rewards to me as they get paid off every month with no interest. So yeah, I easily have more savings than credit card debt.

In America, Debt Is the Norm

Household debt is now at $13 TRILLION in the U.S. Wow, that is a big number. Sadly, I add to that number.

The average indebted respondent owes $140,113.

I am below the average at $60K in debt. It’s just the mortgage though. I plan on being completely debt free.

Most Americans Save Their Tax Refund or Use It to Pay Debt

This was surprising given the poor overall financial picture that Americans seem to be in. Mine gets invested.

Beware: The season of “Spend Your Tax Refund Here!” is coming.

The Average American Spends $688 on Rent

My mortgage payment is $715, so about $1/day higher. But since my salary is 43% higher than the average, the percentage of my income that goes towards housing is much lower.

I like to have no worries about paying the bills.

The Average Car Payment Is Now Greater Than $500

In 2016 the average car payment hit $503 with an average length of 68 months! Holybajeezus Batman!

That's a total of $34,204 for something that is probably worth $6,000 by the end of the loan. But that doesn't matter as I am sure you will be tired of driving that ratty ol' car around by then. Time for an upgrade! Treat yo self!

The dealer will be more than happy to roll whatever it is you have remaining into the new car loan. What could be better than that - you can pay for something you don't even own anymore!

You know what I do? I buy that "old" car of yours for $6K and drive it five more years before selling it for $3K.

My depreciation cost for 5 years? $3K

The average persons? $28K

It doesn't take long to build wealth when you aren't paying for it to literally drive away.

Americans Spend Twice As Much Time On Social Media Than On Their Finances

The average American spends 5.3 hours per week on social media and 2.6 working on their finances.

These numbers surprise me. Wherever I look, people are nose-deep in their phones. I would think that number should be twice as large.

As for the time spent on finances, it seems ok. Time spent doesn't really matter. If you have everything running smoothly it shouldn't take much time at all. Unless you are a finance nerd like me, that is!

I hardly spend any time on Facebook, maybe 15 minutes per week and most of that is replying to messages. I spend a bit more on Twitter as I have been promoting my articles on SeekingAlpha and my personal blog.

But if you count Steemit, then I am WAY over - and I bet you are too!

If I am not on Steemit, I am probably reading about finances. Investments. Personal development. Not really working on my finances, but learning how to be better at them. I don't think that counts towards what the survey was asking though. I maybe spend 30 minutes per week actually 'working' on my finances.

Great analysis @getontgetrain! The house in the photo is my dream house, lol.

I'd have to see inside first, :D

Here are my stats:

Frugality is a key path to wealth for the vast majority that make it there.

Have you read my latest charity post? We have a Steemit team on Kiva that I donate some of my steem earnings into. Would love to have you join up :D

https://steemit.com/community/@getonthetrain/team-steemit-on-kiva-help-people-across-the-world-with-the-power-of-steem

lol "treat yo self!" Love it.

Let's see here are my stats:

I love that bit about: "It doesn't take long to build wealth when you aren't paying for it to literally drive away."

Unfortunately my wife is not as disciplined, I folded and got her a pilot (happy wife, happy life), which was actually the inspiration for my double your money in 3 months article.

In my household, this is known as "the pilot trade"

House is a bit pricey, but the rest is looking good! Thanks for sharing @theroadtoriches

Agreed, especially against my income. I should note though that my wife pulls in 80k and my younger cousin rents a room from us for $400 a month, so it not so much a burden on the finances.

I think I rank pretty "OK" in the scheme of things. No mortage, credit card debt, or student loans. I have a good retirement, assuming it is still viable when I need it. About $260k now. Yearly salary for myself is $74k. I always buy 4 to 5 year old cars, finance half, so $200 payment avg. Hard to believe most Americans save or spend their tax refunds on debt? Everybody that I know just goes shopping! I buy silver, sometimes gold with my tax return...basically invest it. Hmmm...No real Facebook time, and my actual finance time is minimal, since I just check in on investments or read articles. Maybe 40 mins a week, actual finance time, but 3 hrs reading. I am a real economics nerd, so money and finances keeps my interest! Steemit, yes. Alot of time, probably 12 hrs/week total. Thanks @getonthetrain! Interesting median stats.

@jbcoin,

You're sitting really well from what I am seeing here. Do you own your home without mortgage or rent?

I know that type of 'shopping' - It's not what shoes do I want it's "Ohh which investment do I want to buy!" :D

You are on the road to millionaire status and beyond.

I rent a big farm house in the country, but I own another rental in town which pays my farm house rent, taxes, and about +$150 per month. I just store that away, in case of repairs. It's been working pretty well so far. I have a large family, so of course those expenses add up too. I don't think I'll ever be rich, just hope to be secure enough to take a break a little early. Kind of do the things I like instead. Metal Detecting, Steemit, coin shows, etc. Thanks, it's good to kind of step back and think about the plan sometimes though!

Eh, its not like I am never going to earn another dollar after I 'retire' - my goals will all lead towards income anyway.

Plus, having no job but a safety net of a pension will allow me to try new and exciting things!

It's just that I won't HAVE to work.

Yes, it would be nice to at least pursue the things that you want to do, instead of what you have to do. 😁 good plan!

I think it would be more apropos to say that

Americans spend no time on learning financial literacy.

which means they spend no real time on their finances. They may was well throw darts.

And the average The US home value is a meaningless statistic.

Your house is not an asset. It is your biggest liability. It costs you money to have a nice comfortable place to sleep.

What most retirees failed to do is pay off their mortgage. If you do that, then you can live off of SS. If not, you are doomed.

I disagree. Unless you are a nomad, having a home is a great investment. The thing is, most people buy a house already all pretty and whatnot. IE, at market value.

What I do is buy the undervalued house and live in it while I work on the projects that it needs. That is why my house went from $98K to $177 in just a short time, because my market is NOT a hot one. It was just picking the correct house with eyes towards profit.

Bleh, I'm actually working on an article about social security and I have zero intention, nor interest in living off social security and based on the numbers neither should anyone else! 😅

Wow, nearly a third think they'l be millionaires! That's a fun statistic.

That's practically delusional, given how low U.S. savings rates are for all but the top earners and how indebted people generally are. Nice work!

They can't say Americans aren't dreamers though...

Back in Africa, retirement has been a great issue. people don't care of what will happen tomorrow and blame the God will. I've actually asked my dad about his retirement and just said that until the government says so. i mean he has no plan yet on his late 60's.

Thanks again, you really contribute a lot in me

I appreciate the kind words, @jona12 Thank you

you are welcome. I'm actually working on a project of translating steemit in Swahili language from english and french. i'm still facing some challenges and need some guidance. i had a small problem with my steeem chat account but when it will be ready i will talk to you in detail.

i hope to hear more from you about the Kiva project. Thanks

I guess at steemit our social media is tied to our finances.

You are doing great! You could make a ton of money but if you are knee deep in debt what does it matter?

I find it hilarious that so many Americans think they’ll be millionaires. Although in 2018 may be their best shot!

Well, give it enough time and the dollar will inflate until it will be hard to NOT be a millionaire :D

Good luck on going to retirement at the age of 37.

How do you plan to achieve that?

Do you have a lot of money saved up?

No debt, no big wants, and a pension

You've got to understand that this sounds weird to me because my country's pension system is all messed up.

Young people are leaving country and going to Ireland, Germany, etc. and there's no body to support that pension system.

Thus, pensions are really small, and it's hard to live it if you don't have a lot money saved up.

pay cash for everything, avoid dept and invest more than whats comfortable, keys for financial success.