FI/RE Series Part III: Just Take The Free Money Already!

Your boy @doggedfi is back. Let's cover Part III in the FI/RE series (Financial Independence / Retire Early). You ready?!

Just Take The Free Money Already!

I don't know about you, but I encounter VERY few opportunities to take advantage of free money. Why wouldn't you if you have the chance? Many do and never reach out to snag those free.99 dollars.

So some of you may be confused. When I say "free money", what do I mean? Well, for those of us that work for employers and have benefits from said employers, one such benefit may be a 401k/403b employer match.

This means that if you agree to fund your employee retirement account, your employer will also agree to match your contributions to a certain extent. HELLO FREE MONEY!

For example, if I elect to invest 6% of my yearly salary into my 403b account, my company will automatically invest 6% as well, dollar-for-dollar. If my salary is $50,000, that means I am sending $3,000 a year to my retirement account... and my employer is also sending $3,000 a year to my account.

But I Can't Afford To Contribute - No Wiggle Room!

It is important to note that when you contribute to your retirement account, it helps you in 2 ways:

- It is not a 1:1. If I elect to invest 100$ a paycheck, the amount of money I take home is not -$100, its a little less. This is because..

- Investing in your retirement account lowers your Adjusted Gross Income (AGI), meaning you are funding your retirement while simultaneously paying less overall income tax for the year.

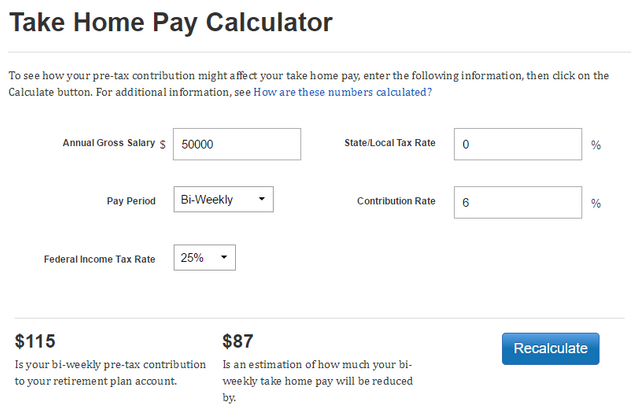

Check out this nifty calculator that will tell you how much it "costs" you to invest any given percentage in your retirement account each pay period:

Closing Thoughts

If it is available to you, ALWAYS take advantage of the free employer retirement match. Also, the annual contribution limit for your 401k/403b retirement account is currently $18,000. Your employer's contributions to your account do not count toward this limit.

As we continue through this series, we'll hopefully get you to a point where you can max out annual contributions to your retirement account to get you to retirement quicker than normal!

Cheers!

Just in case you missed any other parts of this FI/RE series:

Part I: What is Financial Independence and why should I care?

Part II: Preparing For Emergencies

Recommended reading:

The Simple Path to Wealth

Mr. Money Mustache

The Mad Fientist

Personal Finance subreddit

Financial Independence / Retire Early subreddit

@doggedfi

for the Minnow Support Project,

brought to you by rockstars such as

@aggroed, @acidyo, @ausbitbank, @canadian-coconut,

@teamsteem, @theprophet0, @Someguy123, and more.

.png)

Free money is everywhere here.

@cryptopie got you a $0.01 @minnowbooster upgoat, nice! (Image: pixabay.com)

Want a boost? Click here to read more!

Good post mate - not putting in into your 401k or equivalent means you are losing out on a lot of future potential.

Agreed! Compound interest is a powerful force!

Very well said, im still young yet but this crossed my mind few rinds in recent months. I need to start thinking about saving! Nice write up, thank you.

Thanks bud, appreciate you reading it and showing some big support on your own blog! Cheers mate.

No problem, glad I could help.

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by doggedfi from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, and someguy123. The goal is to help Steemit grow by supporting Minnows and creating a social network. Please find us in the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you like what we're doing please upvote this comment so we can continue to build the community account that's supporting all members.

This post has received a 2.59 % upvote from @booster thanks to: @doggedfi, @doggedfi.

I wish my employer had a match... :(

Good sound advice is like sticking with proper technique, you can't win 'em all but you will hedge the bet in your favor when sticking with the aforementioned. I now know another technique that I didn't previously. Good post @doggedfi. Thank you for the positive mention as well. I appreciate that.

Glad this post was beneficial for you! I'm glad you/I placed in that recognition contest. You deserve it for sure! Cheers bud.

Sigh. I notice financial advice is nearly always only applicable to folks who have more options than me. Of course I would contribute to a 401k if I had a job that offered matching contributions, but I don't :(

Definitely check out the full series. Solid financial habits can and should be applied to any income level!

@doggedfi yeah free money nice post dear upvote visit my wall when you free i hope you enjoy thanks alot have a nice day

You follow me I follow you