Yes, Centralized vs Decentralized - We all Agree, but Where are We Now?

We are at the very beginning!

When something so fundamentally ground shaking comes along once every 500 years, it doesn't get implemented overnight. Those down in the weeds, those having heard about Bitcoin in 2010 and watched every painful paint chip story like Mt Gox, we sometimes need to be reminded of where we really are in this New Experiment (or new paradigm, or new World Order?). A lot of folks will read @falkvinge's post and ask, well, I agree with the premise, but why and how does this work for me and what do I need to do? The answer is take a deep breath, because we are at the beginning, and there's a lot of greenwater in front of us:

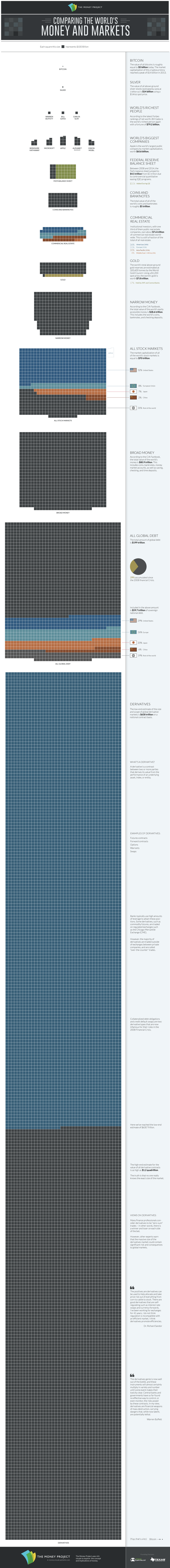

So you might be looking at this and thinking, um, gee whiz @kewpiedoll, I have to wait until 2023 in your prediction model to kick this into high gear? But no, look at the scale, which is in trillions of dollars. Here, "$5,000" = five quadrillion dollars. If you're drinking the decentralized crypto kool-aid (like I am), these are the kinds of upside numbers that you're looking at. That's what @falkvinge's post meant to me.

But let me show you what that graph looks on a log scale:

This shows you more clearly where we are really at, about $12B in total market cap (bitcoin + alts), or $0.012T. We are at the very beginning of this little decentralized experiment we call BlockChain Technology. Steem is part of that new paradigm. If you're new to this, welcome. If you're not, be patient. And just look at that curve to date. you can even see the "mania" price run-up in the end of 2013 that nearly flattens out to the rest of the log curve (these will happen, along with dips, it's just the nature of the beast).

Let me explain

At the beginning of 2011, Bitcoin was really the only game in town, the first cryptocurrency that showed us what it was all about (and that it worked, and worked well). In January it was worth $1.5M. By 2013, alts like Litecoin and Ripple began to appear. In the end of 2015 we saw Ethereum and very recently Steem make a charge. Bitcoin showed us what was possible, but the Blockchain revolution will be many different projects. If you read about that guy somewhere that bought 5000 bitcoins in 2009 for $27 and forgot about them (now worth $3M) and say to yourself, well good for him but too bad for me, the shows over. I don't think that assessment could be any further from the truth.

I'm not saying you're going to be rich, but I might be able to say to you:

You're going to be rich

Why? Because I don't really give a shit. You can have your opinions and I can have mine. But I believe in this decentralized paradigm, that's it's real, it's coming to a theater near you, and it's currently the size of pinhead and it'll eventually be the size of the moon. Granted these are just my opinions and anything could happen in the future, including the relatively low probability that cryptos go absolutely nowhere. But with 4,5, maybe even 6 orders of magnitude on the table, is it really worth not paying attention? I mean, even just a little. Five orders of magnitude means $10 becomes a million. Steemit gives you $10 just for signing up. you don't even risk anything.

There's a fair amount written on different investment strategies and blockchain projects. Probably more to the imperative now is being aware of what's out there than trying to get large amounts into each project. I have previously written my two cents on crypto investing here. albensilverberg's recent post suggested Synero, Vericoin, Steem, and Factom. I appreciate these types of suggestions and each person's decisions to get involved with any coin / project is their own (hence the decentralized nature -- coming full circle on this aren't we!!). I'd add Rubycoin and Solarcoin for now. There's a lot of others, and they'll keep popping up out of the ether as we move forward (no pun intended?). Happy hunting, and keep quenching that thirst with copious amounts of Kool-aid. You need a lot of it in Crypto Land.

Cheers, QP doll

QP, just a note.

Users are no longer given $10 to sign up. That amount has dropped to $7 now.

I'll take my Kool-Aid in grape. :)

oh really? thx for the info. You only have a future $70k instead of $100k. I'm so sorry! ;)

Haha! Either way, I'll welcome it.

Just didn't want you to have incorrect info in your article and have it come back to bite you.

"QP is telling people they get $10 for signing up and all I got was $7! He's scamming people"

You know how they get. :)

https://steemit.com/liberty/@marco555/the-imminent-tax-on-crypto-thoughts-evidence-and-opinions

All of my crypto-kool-aid tastes like rubbing alcohol.

Is this bad?

ha! Just add more sugar....

That's not gonna happen, obviously, because it exceeds the money supply by quite a margin. I think the global M3 is near 80 trillion usd.

The global broad money supply is ~$80T, yes. That assumes crypto only takes over the role of fiat currencies, so you can stop my graph at the $100T line (about 2024 or so). We are at $0.01T, so that's only a pathetic return of $100 per dime invested (or $1M on a hundy thrown in now). I'll give you that point. But the "obviously" part of your comment I won't.

What's is money? Does it include a central bank debt component? That's at $200T. The value of all derivatives is estimated at >$600T. The high-end valuation for all derivative contracts is $1.2 quadrillion dollars. But no one really knows, it could actually be much higher. My sensibility it is much higher.

We are also coming into a middle class explosion - one where capitalism lifts some 100,000 to 200,000 people out of poverty per day. Even if this rate slows, by the time we get out to 2030 to 2035, the total money/debt/collateralized obligation aggregate total will be 10x the ~$1Q+ it is now.

If Blockchain tech via fintech took over all of this space, that would be it's aggregate value. Maybe I even low-balled it.

Here's a good graphic on it:

But even if all these assets add up to, say, 1-2-3 quadrillion, you can't have another 1-2-3-5 on top of that because it's a zero-sum game where something must be spent to buy the crypto so that its price goes up.

(What's spendable is typically the money - in other words, best case scenario is the total replacement of money with crypto, so, say around 100 trillion).

But I think crypto will be in the triple-digit billion or low/single digit trillion range. Which is 100-1000x compared to current valuation...

ok. I like this number too.

as my stock friend would say, a hundred-bagger ;D

Yeah, we'll be alright for a few lifetimes I guess.

I MENTIONED "$27" IN MY POST AND NO BERNIE SANDERS UPVOTE??

pissed....