Forget The P/E Ratio - This Is The New Ratio To Look At...

The price-to-earnings ratio is probably the most well known way to value a company.

This ratio, known as the P/E ratio, makes sense even if you're not a financial whiz. It's the price of a company in relation to its annual earnings.

That makes sense, right?

The lower a company's earnings, the lower it should be valued. If a company is making a lot of money, then it should be valued much higher.

However, sometimes the P/E of a company can go sky high. This usually happens when the market is valuing the company based off of future expectations.

Most tech companies have higher P/E valuations than, say, a toothpaste manufacturer.

That's because investors expect the tech company to have much higher future earnings. Meanwhile, the toothpaste company will probably have relatively consistent earnings.

We can see this in today's market with companies like Tesla, Amazon, or Netflix.

Netflix currently has a P/E of just under 200. In simple terms, that would mean it would take 200 years of current earnings to match its price. That's nuts.

But, investors are saying, 'Hey, Netflix is going to be MUCH more profitable in the future, so I am willing to pay a higher price now, because in the future, earnings will be so high that the stock price will go even higher. So, if I buy now, I'm actually getting a deal.'

This same thinking goes for Tesla, Amazon, and all other companies that have very high P/E ratios.

But... at what point does the P/E ratio get completely unrealistic?

In addition to individual companies having a P/E ratio, we can also determine the P/E of an index.

For example, we can look at the Shiller P/E ratio of the S&P 500. The Shiller P/E ratio is defined as price divided by the average of ten years of earnings, adjusted for inflation. This gives us a much better look at the P/E of a market when you consider historical trends and inflation.

Source: Multpl

As you can see, we are currently at the second highest level ever for the S&P 500. That means that investors are valuing stocks very high.

They are expecting companies to be making A LOT more money in the future, and they are paying a hefty premium for the right to own those stocks right now.

The only other time in history that this ratio has reached such highs, was during the dotcom bubble. That's when investors thought that the internet was going to change the world.

To be fair, the internet did change the world. But, the prices that investors paid on that expectation was WAY more than what the internet companies could return.

And that is what is happening again today.

Investors are valuing companies based off of a 'price-to-fantasy' ratio.

Source: Bloomberg

So, investors are expecting that stock prices will go up, according to the price-to-fantasy ratio.

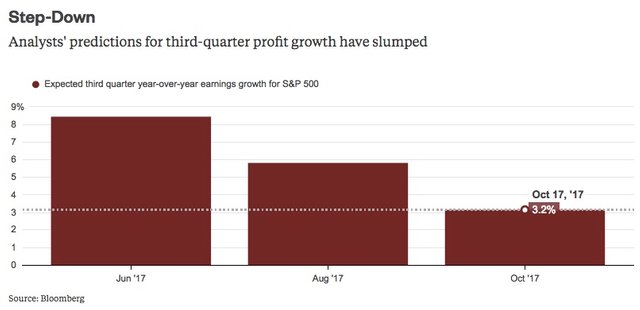

Meanwhile, analysts continue to predict LOWER profit margins for the S&P 500.

Source: Bloomberg

Kind of makes you scratch your head, right?

Investors are paying more for stocks that are going to be making less profit.

These are the types of things that indicate a market is getting overheated.

Will the market crash tomorrow? Who knows...

But, investing your hard earned money in a market that is following the EXACT game plan of previous market corrections seems like a very risky move.

That said, there is a strong chance that things could get even crazier. Investors could get even more irrational.

And I want nothing to do with that game.

And don't forget... it's also just fine to do nothing. Sit on your hands and be patient. There is always another opportunity coming around every corner, so don't get sucked into the irrationality of others.

this was a fine article I hope you wrote it yourself!

The one thing that in my opinion is missing in such ana anlysis is the fact that interest rates are very low right now. As a result assets should be valued a little higher since a) you cannot just put your money in the bank and make interest and b) the fact that money is cheap will also inflate asset prices.

i dont know exactly how strong this effect is going to be however.

Yet overall i feel that you analysis is spot on and i also dont want to be involved with stocks at this time.

I agree that interest rates play a role but I think it's also for an additional reason. Lower interest means the cost of debt is cheaper for a corporation thus future projected earnings are higher (due to expected lower WACC). Therefore historic PE ratio could be higher on average because of higher expected future earnings. So therefore, as you pointed out there is increased demand for Stocks(instead of bonds/bank interest) to generate a return on the investor side, plus on the corporation side there is higher expected earnings thus higher valuations.

Very true.

That's why rising interest rates can be a disaster for these companies. Their debt will continue to grow as their payments on interest alone start to balloon. If their business doesn't actually start making real profits, they just keep digging a deeper hole as their cost of borrowing increases.

Of course I wrote it.

I agree with you about assets inflating in value... However, the companies that are the most inflated in value have almost zero tangible assets. And the intellectual or technological assets that they do own are often just a dream or idea.

The companies with the highest P/E multiples (think Netflix, Tesla, etc.) are the ones that have the 'biggest dreams.' If they can't execute on those dreams, then there is nothing left to back up their proposed value.

Interesting article.

I am curious how the PE ratio is now vs. historic for mid cap and small-cap indexes. The S&P is the "large caps."

Congratulations @codyshirk! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP