On buying your own house

There is a great British tradition to investing in bricks and mortar. Your home is your castle.

I had a friend who rented in a nice neighbourhood. When I first got on the proverbial ‘property ladder’ I asked him when he was planning to buy and he said that really liked where he rented and he couldn’t afford to buy in that area. I responded that maybe he needed to move to a slightly crummier area or downgrade the type of property so he could afford. His was not so much a question of deposit at the time (as the banks were offering practically 95% mortgages) but a question of lifestyle and rent v mortgage per month for a comparable house. Years later he lamented that he could not get onto his property ladder and would never own his own home.

My view is clear that buying your first home is not ‘investing’ in property. I would agree if you plan to invest as a buy to let landlord there are numerous considerations to take into account. You need to consider tax planning, interest rates, risk versus reward, and suitability of both area and specific property for renting. However buying your own house that you will live in is just a substitution of rent for mortgage payments, but the difference being that the one is lost forever and the other is a forced saving.

So my advice to you is to buy a house as young as you can possibly afford it. It is astonishing how my wife and I felt slightly under pressure when first buying a house in London in 2006 and later when upgrading in 2011, but this soon dissipates after a year or so. At this stage you are comfortable as you have probably fixed your mortgage (if the conditions are right) but become comfortable with that level of expense in your budget. Your friends who are renting continue to see escalation in rentals, whilst you have merely ‘fixed’ your rent and know that every month, although most is probably going to interest, there is some capital saving there.

Ok so I will admit that we lived in crazy times in the UK between 2000 and 2016, where house prices rose at incredible rates and equally I have never lived in a major property correction where prices crash 30-40% down. Nevertheless I would argue that if you are talking about your primary residence – you shouldn’t really care about property prices. Or at any rate are in the market for a long period. What you do care about though is fixing your rent and at a level you are comfortable with.

There is also the emotional joy of ‘owning’ one’s own property and a roof over one’s head. It is a universal need. With burgeoning population and a fixed land mass area – you can never go wrong having ownership of some land and a house to call your own! You will have great joy doing up your own property and improving it and later when it comes to retirement you should be striving to have your house fully paid off. Then you can downsize, move out to the country and even get some capital back for your retirement.

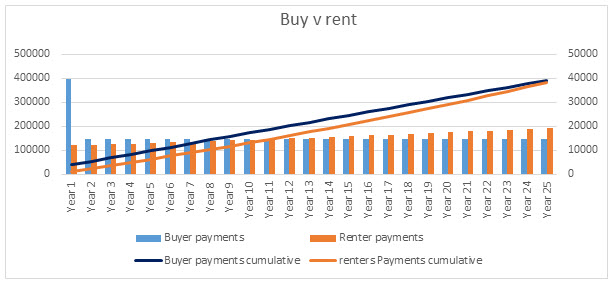

So barring the free option of capital growth on a burgeoning property market, even the forced saving can be useful. Let’s assume 2 people and an identical house in the same neighbourhood for say £225k. The one pays a 10% deposit (£40k) and (ok simplistically) fixes their mortgage over the full 25years at £14.7k per year (£1,225 per month) and pays interest at 4%. The other rents for say £12k per year (£1k per month) but at a slower escalating 2% per year.

By the end of 25 years they would have paid off approx. the same amount being a cumulative £385k ish. The prime difference though is that Buyer now owns their own house, conservatively valued at GBP250k, the renter is still renting, except rents are now (inflation adjusted 2%) at GBP19.3k per month.

By the time of retirement one is sitting on an asset with zero rental cost to live there, the other is enslaved to a rental market that has moved since they first entered. Note I have been conservative on interest rates and were rates much higher, the likelihood is that rents would have equally risen much higher.

So I understand and appreciate there are a number of problems people will need to overcome:

(a) Difficulty in getting the deposit together

(b) Understanding of the complexity of mortgages and the whole buying process

(c) Gazundering and gazumping

But at the end of the day there is a whole financial industry supporting property buying. You do need to do your homework and will have to become a little of an expert on the process. But at the end of the days it’s just paperwork. Owning your own home in the long run will give you much greater security and converts over time into an asset that has value.

Property ownership (as primary residence) is purely converting rent costs (which you have no control over) into mortgage payments (over which you have some degree of control). I agree it’s not so simplistic and mortgages can be variable, trackers, fixed, offsetting etc.…but at the end of the day you still have control over how payments are made. In good times you can overpay your mortgage and build up a buffer. During difficult times you can always engage with your bank to push the payments out over a longer lifetime. Remember it is generally not in the interests of the bank to push you out of your home. They will try and come up with a solution as at the end of the day that are in the business of making loans and would rather be receiving mortgage payments (albeit on a smaller scale) than making fire sale auction sales of property.

i have to side with your friend as rent prices are so high its crippling our income and my credit score is so low that a broker would just laugh and show us the door. i know we need to buy (its a must) but the light at the end of tunnel does not exist. So pleased for you though, you have done the right thing. just wish i had started my adult life with home buying being a top 3 priority.

I do sympathise. I mean house prices have completely bludgeoned salary increases from a ratio of maybe 3or 4 * annual salary, houses are now placed at 8 - 10 times at least. So I guess a sense of timing and dumb luck is involved! Also I know (especially young people) really battle even to get a deposit together with crippling rents and for a long while there were really poor mortgages on the market requiring significant deposits. Good luck to you though and I hope you do see some light...

Thanks for your comment.

Buying a house is clearly more intelligent then ranting one..it means saving..

I agree! The key point is so many people look for house appreciation as the main driver to saving. I think even in a flat market the fact that a large percentage of your monthly 'accommodation' payment is going into saving (capital repayments) plus of course interest is far better in the long run than renting. The only way I could see this equation working for a renter is if you rented a house cheaper than what you would have had to pay mortgage on and then pay the difference into a saving vehicle (shares/interest bearing bank etc).

This post has received a 3.06 % upvote from @drotto thanks to: @genxlifelessons.

This post was upvoted and resteemed by @resteemr!

Thank you for using @resteemr.

@resteemr is a low price resteem service.

Check what @resteemr can do for you. Introduction of resteemr.

Wise words. We gave up on dream of country UK and moved to Australia, bought land and a house anf have 90K AU to go and looking like retiring by 50. Gawd wish we had bought when we were young... with the way house prices skyrocketed we would be minted now. But we are doing okay given the grand scheme.