Trading Using Fibonacci Retracement Levels

| INTRODUCTION |

|---|

Fibonacci retracement levels allow traders to forecast potential price reactions, which is helpful when making trading decisions.

Designed with PixelLab

| The Idea of Fibonacci Retracement and Its Application as a Technical Analysis Tool in Crypto Markets |

|---|

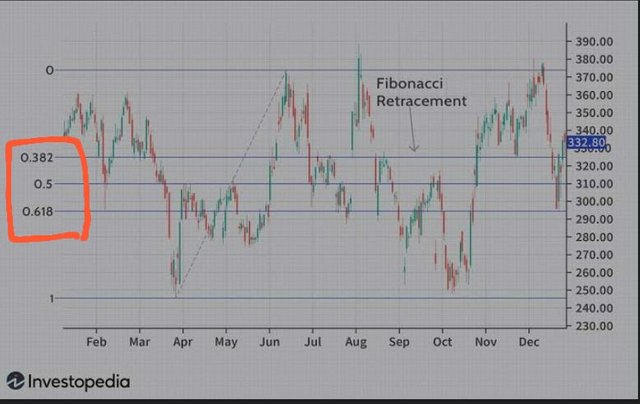

In financial markets, including the Bitcoin market, technical analysts use the Fibonacci retracement to predict likely levels of support and resistance. The Fibonacci sequence forms its basis and is symbolized on a price chart by significant ratios such as 23.6%, 38.2%, 50%, 61.8%, and 100%. These levels show possible places during a trend where the price of an asset can retrace or reverse.

| The Fibonacci Retracement Levels for Cryptocurrency Pairs such as BTC/USDT, ETH/USDT, and STEEM/USDT |

|---|

One of the various technical analysis tools on TradingView is the finbonacci retracement. With the this tool, prudent traders can find some degree of support and guidance for the above mentioned cryptocurrency pairs. These levels help traders find potential entry and exit points as well as locations.

A screenshot from this source

A screenshot from this source

A screenshot from this source

A screenshot from this source

A screenshot from this source

A screenshot from this source

| Breakdown of Key Fibonacci Levels |

|---|

During technical analysis, it is important to monitor the Fibonacci levels. The 0.500 level is thought to be a neutral point that is between the high and low points of a trend. This level is watched by traders for possible reversals or continuation patterns.

Known by many as the golden ratio, the 0.618 level is a crucial Fibonacci level. expressing a lot of support or opposition. At this point, traders frequently search for price reactions since they indicate a strong likelihood of trend continuation or reversal. In order to make wise trading decisions, traders can find possible regions of support and resistance by understanding these important Fibonacci levels.

| The Fibonacci Retracement Plus Additional Technical Indicators |

|---|

When the RSI coincides with Fibonacci retracement levels, it offers more proof that circumstances are either overbought or oversold. Including a variety of indicators improves the accuracy of trade signals since it gives traders a better understanding of the dynamics of the market.

For example, when Fibonacci retracement levels coincide with RSI divergence or Moving Average support, they strengthen the likelihood of potential reversal zones or trend continuation areas.

| The Recent Fibonacci Retracement Price Behavior of STEEM/USDT |

|---|

A Fibonacci retracement study of the current behavior of the STEEM/USDT market offers fascinating insights into possible levels of support and resistance. Traders can find key retracement levels and predict market movements by applying Fibonacci retracement to analyze recent price changes. For instance, traders can identify Fibonacci retracement levels from the swing low to the swing high if STEEM/USDT shows a notable climb.

However, Fibonacci retracement levels that are determined by taking the swing high and swing low can suggest possible resistance levels during downtrends when selling pressure might get stronger. Fibonacci retracement is used in STEEM/USDT analysis, which enables traders to adjust their trading strategies and come to wiser conclusions.

| CONCLUSION |

|---|

In summary, technical analysis can be enhanced in the context of bitcoin trading by utilizing the flexible Fibonacci retracement method. Fibonacci retracement levels and important ratio analysis help traders identify possible support and resistance levels more precisely. The Fibonacci retracement can offer a more thorough analysis that can enhance traders' trading tactics when paired with other technical indicators.

I wish to invite friends to participate in the challenge, @sahmie, @josepha and @yancar

Hello dear, greetings to you. I hope you are enjoying the sweet moments of your life.

You said in all financial markets Fibonacci works. The same it works for Bitcoin and other Cryptocurrencies too. Yes that's very true. In Crypto market alot of traders are using the Fibonacci retracement to predict key levels of support and resistance. You have mentioned all the best levels of Fibonacci. I think the most important of them are 0.38, 0.5 and 0.61. Most of the time the price respect these levels.

When Fibonacci retracement levels coincide with RSI divergence or Moving Average support, they strengthen the likelihood of potential reversal zones or trend continuation areas. That's perfect too. I use Fibonacci with other trading tools. It's the best thing which gives more accuracy to your trade.

You have given a beautiful analysis of ETH, BTC and STEEM. All the levels of Fibonacci retracement are very well explained through the screenshots.

Wish you best of luck in the contest, keep blessing.

I'm glad you appreciated the analysis of ETH, BTC, and STEEM using Fibonacci retracement levels.

Best of luck to you as well!

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

@jaytime5 Your detailed explanation of Fibonacci retracement and its practical application in crypto markets is impressive. The inclusion of screenshots illustrating the concept with BTC/USDT ETH/USDT and STEEM/USDT adds valuable visual context. The breakdown of key Fibonacci levels especially 0.500 and 0.618 makes it easier for traders to interpret potential reversals or continuations. Additionally highlighting the synergy of Fibonacci retracement with other indicators like RSI and Moving Averages enhances the overall analysis. Your insights into STEEM/USDT's recent price behavior through Fibonacci retracement provide practical applications for traders. Well-done!

Thanks so much for your kind words. It's an advantage for traders to leverage on this useful tool for prudent judgment and efficient trading practices

You have explained clearly what Fibonacci retracement is which everyone would understand better. Good post from you and success to you.

Thank you, and success to you too

TEAM 5

Congratulations! Your post has been upvoted through steemcurator08.Your post is very well explained about trading using fibonacci retracement levels. Its a great oppertunity for many people. best of luck to you in future.

Thank you for the wishes!

Hello @jaytime5, you’ve written well on this topic.

Your detailed theoretical explanation of Fibonacci Retracement as a technical tool, how it is applied in the crypto market, the breakdown of Fibonacci levels, its technical indicators and the recent Fibonacci Retracement price behavior of STEEM/USDT are easy to understand by various traders. Many success in the contest!

Wow, I must say, your detailed explanation of Fibonacci retracement and its practical application in crypto markets is truly impressive. I'm really impressed with how your illustrations of the concept using BTC/USDT, ETH/USDT, and STEEM/USDT. It adds such valuable visual context to your explanation.

The way you broke down the various key Fibonacci levels makes it so much easier for traders to interpret potential reversals or continuations. It's fantastic that you also highlighted the synergy of Fibonacci retracement with other indicators like RSI and Moving Averages, it enhances the overall analysis.

Your insights into STEEM/USDT's recent price behavior through the use of the Fibonacci retracement are incredibly practical and provide traders with actionable applications. Well-done! Your expertise in this area is truly impressive.

Dear friend

I really appreciate you effort in writing this topic. You have explained what Fib ratio is based on your understanding .

You also took time out to search for the charts and showed us how it is applied in both uptrend and downtrend.

Thank you for also telling us how other indicators (RSI) can be used to make the Fib tool more effective in printing out signals.

Wishing you the best in this contest.

Thanks for your kind words and success to you too!