Steemit Crypto Academy Contest / S15W2 - Stock to Flow Model

| INTRODUCTION |

|---|

When trading cryptocurrencies, enthusiasts and investors seek tools that can provide more information on the price dynamics of these digital assets. One such tool that has gained prominence is the Stock to Flow (S2F) model, a fascinating approach to predicting the price of Bitcoin.

Image edited with PixelLab

Image edited with PixelLab

| WHAT IS STOCK TO FLOW MODEL (S2F)? |

|---|

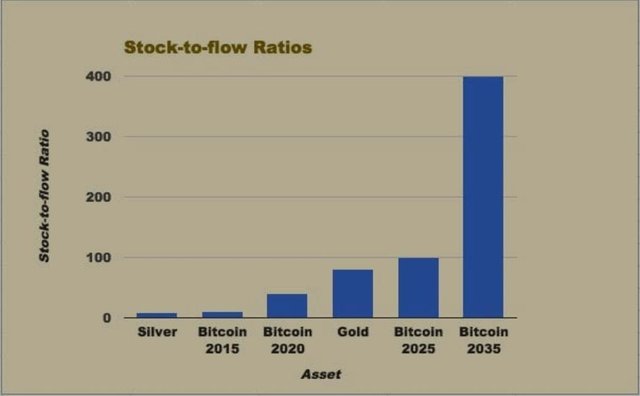

The Stock to Flow model is used to forecast the price of Bitcoin by examining the relationship between the existing supply of Bitcoin (stock) and the new supply created over time (flow). This model draws inspiration from commodities like gold, which are considered as valuable assets due to their inherent scarcity.

The S2F model establishes a ratio by dividing the existing supply of Bitcoin in circulation by the annual newly issued supply. This ratio provides credible insights into the scarcity of Bitcoin which is a key factor in predicting its potential price movements. The underlying prediction simple: the more scarcity of an asset, the more valuable it becomes.

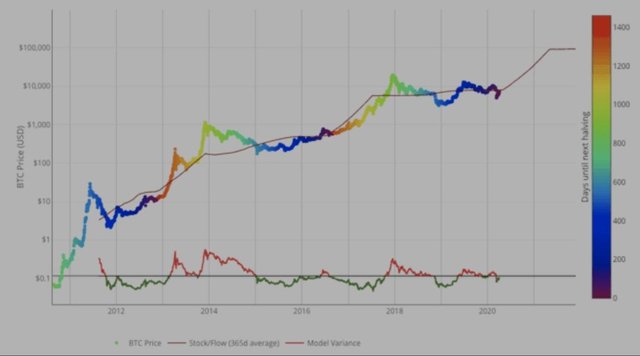

Creating a visual representation, the Stock to Flow model generates a graph that showcases the evolving scarcity of Bitcoin over time. The x-axis typically represents time intervals, while the y-axis represents the S2F ratio.

This graph serves as a roadmap, guiding analysts and enthusiasts in anticipating the future value of Bitcoin based on its scarcity trends.

| ADVANTAGES AND DISADVANTAGES OF STOCK TO FLOW MODEL(S2F) |

|---|

Advantages

Like any other tool used for analysis, the Stock to Flow model comes with its own advantages and disadvantages. On the advantages, the model provides a unique perspective on Bitcoin pricing, considering its scarcity as an important factor. It assists investors in making informed decisions by offering a forecast of potential future value.

Disadvantages

However, traders often criticize that the model oversimplifies the complex factors influencing the worth and value of an asset. By primarily focusing on scarcity, it might neglect market demands, advancements in technology, and other crucial variables that contribute to price movements.

Additionally, the reliance on historical data and assumptions about the relationship between scarcity and value raises concerns about the model's accuracy in predicting future prices.

| ANALYZING THE STOCK TO FLOW GRAPH |

|---|

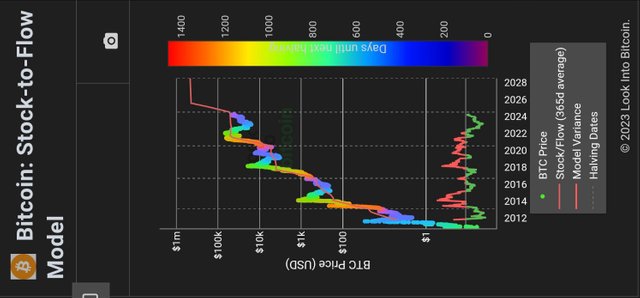

Taking a closer look at the Stock to Flow graph, available at this LINK and the below image, provides a fascinating visual representation of Bitcoin's scarcity evolution. The graph illustrates the dynamic interplay between the existing supply and the inflow of new Bitcoin, offering a glimpse into potential price movements.

A screenshot from here A screenshot from here |

|---|

Analyzing this graph involves studying patterns and trends to make informed predictions about Bitcoin's future value.

| APPLICATION OF THE STOCK TO FLOW MODEL TO STEEM |

|---|

While cryptocurrencies like Bitcoin and STEEM share some common indicators, including limited supply, the differences in utility, consumption dynamics, and community factors might limit the direct application of the Stock to Flow model to STEEM.

Bitcoin, often considered a "digital gold," aligns well with the model's proposition of scarcity leading to value appreciation. However, STEEM, designed for social media and content creation, operates in a distinct ecosystem.

The utility and consumption dynamics of STEEM differ significantly, causing challenges in directly moving the Stock to Flow model.

| CONCLUSION |

|---|

The Stock to Flow model stands as a compelling tool for understanding and predicting Bitcoin pricing based on scarcity. Its application to STEEM, may face challenges due to the unique characteristics of our native cryptocurrency. As the cryptocurrency space continues to evolve, new models tailored to specific assets may emerge which may provide clearer insights in the future.

I will invite @yancar, @steemdoctor1 and @sahmie to participate in the contest.

Your post has been successfully curated by @𝐢𝐫𝐚𝐰𝐚𝐧𝐝𝐞𝐝𝐲 at 35%.

Thanks for setting your post to 25% for @null.

We invite you to continue publishing quality content. In this way you could have the option of being selected in the weekly Top of our curation team.

Thank you for the support @irawandedy

Great entry broo.... Keeep on working.

Thank you for the support!!

My pleasure brother 💗

@jaytime5

You explained it very well in the world of cryptocurrency, people look for something and find tools that can determine the price. I mentioned that it can determine the price of Bitcoin and tell about its volatility. It is predicted about others if you talk you have clearly explained the title of the post your post is appreciable good wishes for the competition God bless you.

Thank you so much for your kind words! I'm delighted to hear that you found the explanation clear and appreciable.

Greetings @jaytime5.

Indeed, the Stock-to-Flow model is a really useful tool for understanding and predicting Bitcoin prices based on its scarcity. However, when it comes to applying it to STEEM, our native cryptocurrency, there might be some challenges due to its unique characteristics. As the cryptocurrency space keeps evolving, we might see new models specifically designed for different assets that could provide even clearer insights in the future. Thank you for this clear explanations and I wish you good luck in the contest.

Your good wishes mean a lot, and I thank you for your encouraging words. Good luck to you as well!

Saludos cordiales gran amigo jaytime5, un gusto para mi saludarte y leer tu participación.

Es un método nuevo, tiene amantes y tiene muchos detractores, pues una de sus desventajas es que es altamente manipulable y eso causa malestar.

Te deseo muchos éxitos, que tengas un feliz y bbendecido día.

Greetings, my friend @jaytime5! Your breakdown of the Stock-to-Flow model is osm. Explaining its advantages, disadvantages, and challenges with applying it to STEEM shows a comprehensive understanding. All the best in the contest, success for you! 👍

Great exploration of the Stock to Flow (S2F) model ! Your explanation of how it predicts Bitcoin prices based on scarcity is clear and insightful. Its interesting to see How the model simplifies certain aspects while possibly overlooking other crucial factors in the complex crypto market. The visual representation of the Stock to Flow graph adds a nice touch making it easier to grasp the dynamics of Bitcoins scarcity evolution. Exploring the challenges in directly applying the model to STEEM shows a good understanding of the unique characteristics of different cryptocurrencies. Well done!

Thank you for your thoughtful feedback! I'm glad you found the exploration of the Stock to Flow (S2F) model insightful.

This indeed well detailed.

The S2F model have incredible soar through many investors mind recently.

It qualities when applied on knowing a scarcity movement of commodity,

Determination of the existing and new product involves help well in the possible price Prediction.

Though it good strategy to use, it's also good to consider proper investigation as it doesn't give complete accurate determination of rate or data involve but it's undoubtedly one of the best strategy and tools to crypto lovers.

I love your presentation.

Kudos 👍

Hello dear friend greetings to you, Hope you are having good days there.

You said that the Stock to Flow model is used to forecast the price of Bitcoin by examining the relationship between the existing supply of Bitcoin (stock) and the new supply created over time (flow). Yes that's true. We look if the flow of supply is less, it's good time for entry. It raises the price of BTC.

At every halving events the prices go up, it's just because of scarcity. The minging get slow by 50%. You have defined the advantages and disadvantages very well. Linkage is Stock to flow model also defined well.

The best post dear, best wishes for the contest.