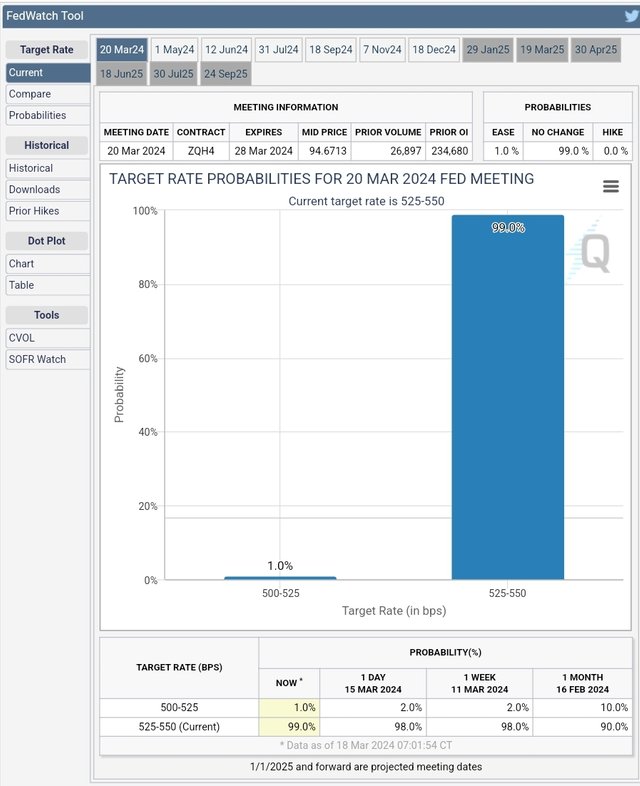

The next FOMC meeting is in 32 hours.

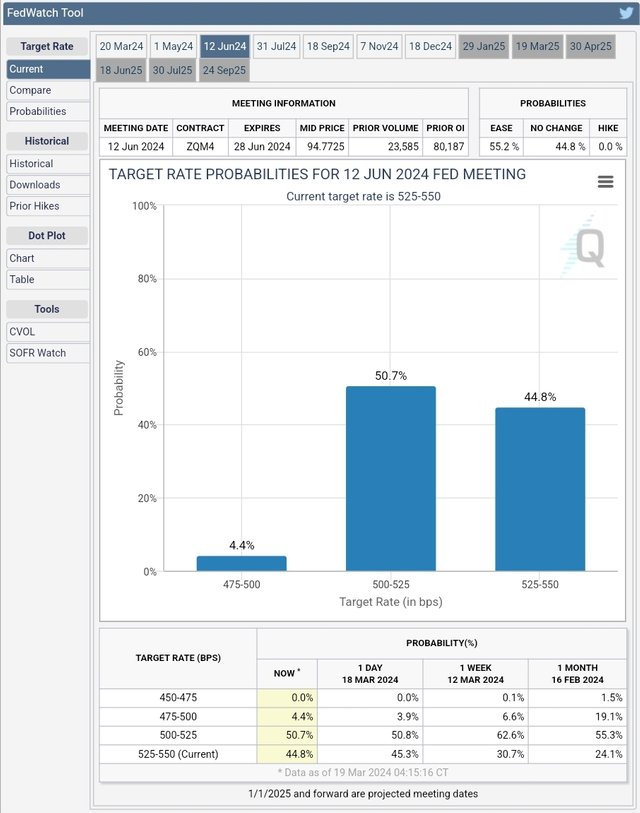

The market participants anticipate that the federal funds rate will be continuously paused, and it will cut in June.

Not only crypto investors, but also stock investors have been waiting for the end of the quantitative tightening.

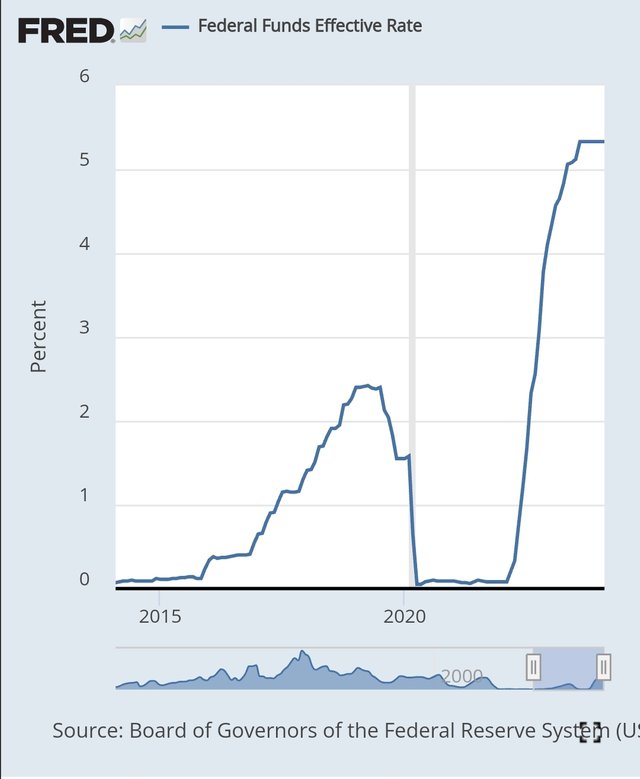

If the interest rate cut starts this year, it will be the 2nd experience for the crypto investors, since the BTC(Bitcoin) was listed on 2010. The 1st experience of the rate cut was 2019. It's before the COVID-19. At that time, the BTC had been bearish.

However, I think the current is different to 2019. The macroeconomy of the 🇺🇸 looks robust with respect to the GDP and unemployment rate. As well as, the existing business model of AI(Artificial Intelligence) boom of big-tech companies.

So, I think this federal funds rate cut won't be with the recession together. If so, this rate cut will be positive for the crypto market. That's the reason why we're on the beginning of the bullish market.

This comment is for rewarding my analysis activities. Upvoting will be proceeded by @h4lab

Congratulations, your post has been upvoted by @upex with a 100.00% upvote. We invite you to continue producing quality content and join our Discord community here. Keep up the good work! #upex

Welcome to the winning season🥂