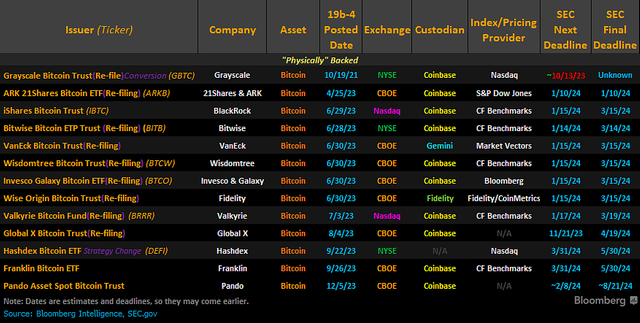

Take a look at the revised table about deadlines for spot BTC ETF applications!

Based on this recent revised table cooperating with the SEC(Securities Exchange and Commission), if spot BTC(Bitcoin) ETFs are approved Jan 2024, they will be listed on NASDAQ, CBOE and NYSE. Main custodian is Coinbase exchange which is listed on NASDAQ. A few weeks left until the decision of spot BTC ETF applications approvals.

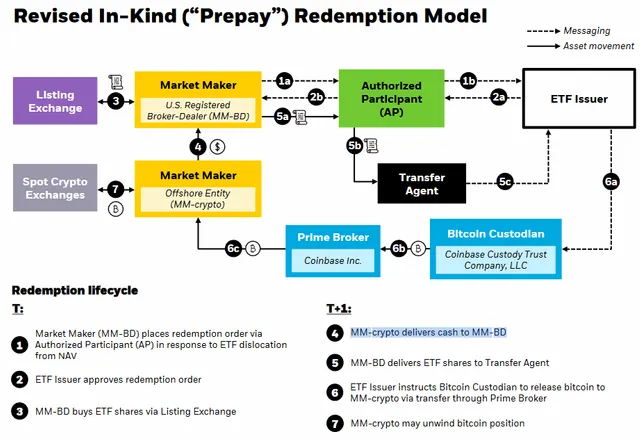

The SEC has emphasized the possibility of the BTC price manipulation. Through this revised model, AP(Authorized Participants, such as JP Morgan, Goldman Sachs) can issue spot BTC ETFs without directly holding spot BTC by means of MM(Market Makers) and Custodian.

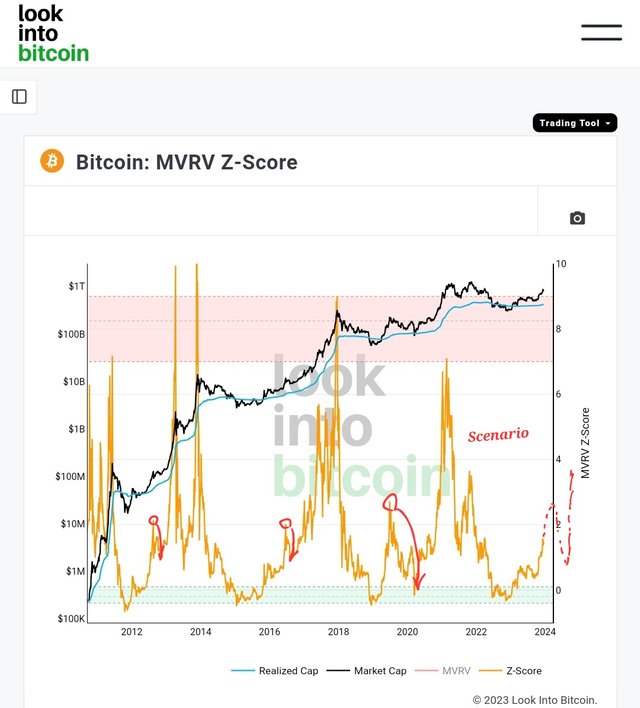

If spot BTC ETF applications are approved, it's gonna be possible to overshoot, which means the MVRV Z Score can reach 2.5~3.0. It's around $50k~65k. However, no one knows how much the market will be overshot.

When BTC surpassed 2.0 of MVRV Z Score during the last 3 bullish markets for 13 years, BTC has had corrections 3 times, and the MVRV Z Score collapsed to less than 1.5. So, be cautious about a next huge correction.

Next year, If spot BTC ETF applications are approved, and the crypto market is overshot, you need to secure more cash ratio from your investment portfolio. It's gonna be helpful for your long-term investment

This comment is for rewarding my analysis activities. Upvoting will be proceeded by @h4lab

BEST ARTICAL I EVEN READ ABOUT EFT