MSTR has rather a healthy financial structure than I thought 😮

Several months ago, I started wondering how many debts MSTR(MicroStrategy) holds, compared to total assets 🤔

Because, if they have a high debt-to-total asset ratio, they might suffer a death ☠️ spiral 🌀 next bear 🐻 market.

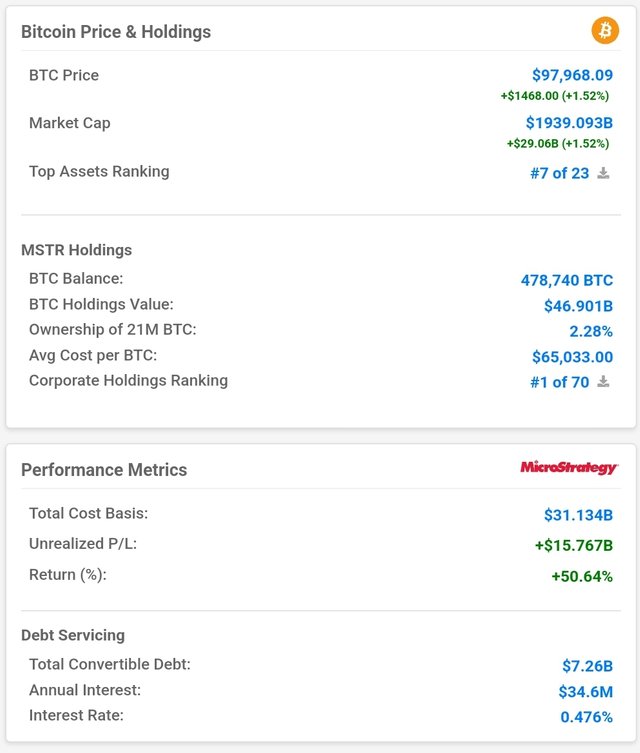

So, I checked how many BTC(Bitcoin) they are holding. They are holding 479k BTC. It's around $46b.

And in this table, they have $7.26b convertible bonds. I wondered whether it is the total debts of MSTR 🧐

So, I checked the balance sheet of them. Dec 31, 2024, their total liabilities were $7.6b. It's similar to the current convertible bond size. Therefore, we realized their most debt type is the convertible bond.

Alright, let's calculate the debt-to-total asset ratio.

Their current BTC holdings value is $46.9b. You can check the data in Figure 1 again. And their current convertible bond size is $7.26b.

= $7.26b ÷ $46.9b × 100%

= 15.48%

It seems that their financial structure is rather healthy than I thought 😮 As far as I know, average debt-to-total asset ratio of global corporations is about 30%.

MSTR price surged 2,365% for the past 5 years Amazing

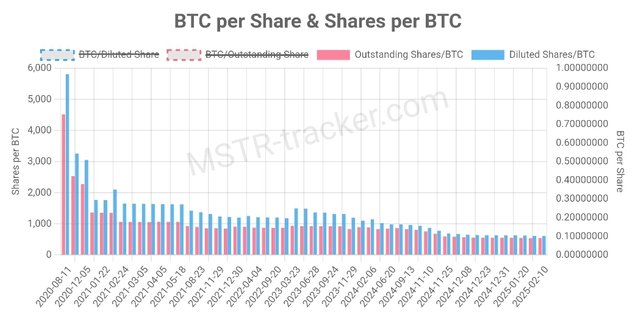

BTC per share has been decreasing. Since I realized their debt-to-total asset ratio is low, I don't think MSTR is overrated.