What History Teaches About Interest Rates

“At no point in the history of the world has the interest on money been so low as it is now.”

Who can dispute the good Sen. Henry M. Teller of Colorado?

For lo eight years, the Federal Reserve has waged a ceaseless warfare upon interest rates.

Economic law, history, logic itself, stagger under the onslaughts.

We suspect that economic reality will one day prevail.

This fear haunts our days… and poisons our nights. But let us check the date on the senator’s declaration…

Kind heaven, can it be?

We are reliably informed that Sen. Teller’s comment entered the congressional minutes on Jan. 12… 1895.

1895 — some 19 years before the Federal Reserve drew its first ghastly breath!

Were interest rates 122 years ago the lowest in world history? And are low interest rates the historical norm… rather than the exception?

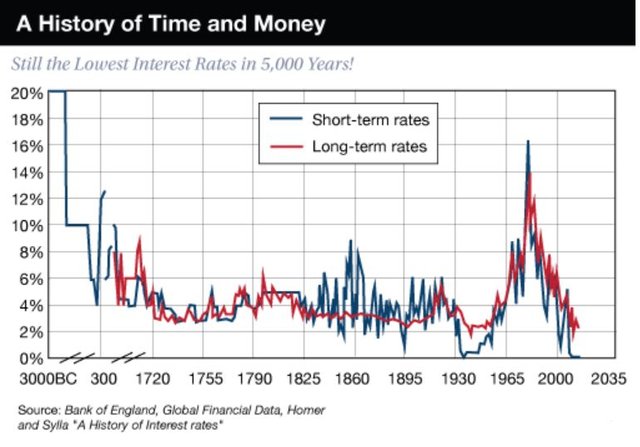

The chart below — giving 5,000 years of interest rate history — shows the justice in Teller’s argument.

Rates had never been lower in all of history.

They would only sink lower on two subsequent occasions — the dark, depressed days of the early 1930s — and the present day, dark and depressed in its own right.

A closer inspection of the chart reveals another capital fact…

Absent one instance at the beginning of the 20th century and a roaring exception during the mid-to-late 20th century, long-term interest rates have trended lower for the better part of 500 years.

Could the sharply steepening interest rates that began in the late 1940s be a historical one-off… a Mt. Everest set among the level plains?

Analyst Lance Roberts argues that periods of sharply rising interest rates like that period are history’s exceptions — lovely exceptions.

Why lovely?

Roberts:

Interest rates are a function of strong, organic, economic growth that leads to a rising demand for capital over time.

In this view, rates rose steeply at the dawn of the 20th century because rapid industrialization and dizzying technological advances had entered the scenery.

Likewise, Roberts argues the massive post-World War II economic expansion resulted in the second great spike in interest rates:

There have been two previous periods in history that have had the necessary ingredients to support rising interest rates. The first was during the turn of the previous century as the country became more accessible via railroads and automobiles, production ramped up for World War I and America began the shift from an agricultural to industrial economy.

The second period occurred post-World War II as America became the “last man standing”… It was here that America found its strongest run of economic growth in its history as the “boys of war” returned home to start rebuilding the countries that they had just destroyed.

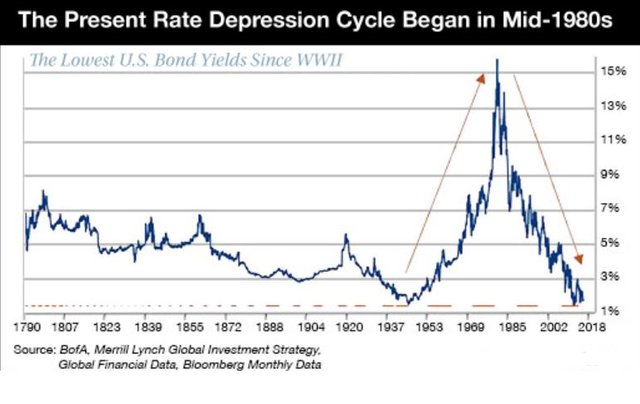

Let the record show that rates peaked in 1981… and have declined steadily ever since. If rising interest rates indicate a rising economy, does that mean our best days are in back of us?

And was this post-World War II period of dramatic and exceptional growth… itself the exception?

“Investors have often talked about the global economy since the crisis as reflecting a ‘new normal’ of slow growth and low inflation,” begins New York Times senior economic correspondent Neil Irwin.

“But just maybe,” he concludes, “we have really returned to the old normal.”

More:

Very low rates have often persisted for decades upon decades, pretty much whenever inflation is quiescent, as it is now… The real aberration looks like the 7.3% average experienced in the United States from 1970–2007.

“We’re returning to normal, and it’s just taken time for people to realize that,” adds Bryan Taylor, chief economist of Global Financial Data.

Today’s 10-year Treasury note yields a relatively slender 2.84%, for example.

But British consols — the world’s low-risk bonds of the day — yielded an even slimmer 2.48% in 1898.

This was, of course, shortly before the steep interest rate rise of the following three decades.

Granted, drawing meaningful comparisons between historical eras can be a snare, a chimera, the errand of a fool if done carelessly.

But maybe today’s low rates aren’t as outrageous as originally strikes the eye.

Paul Schmelzing professes economics at Harvard. He’s also a visiting scholar at the Bank of England, for whom he conducted a study of interest rates throughout history.

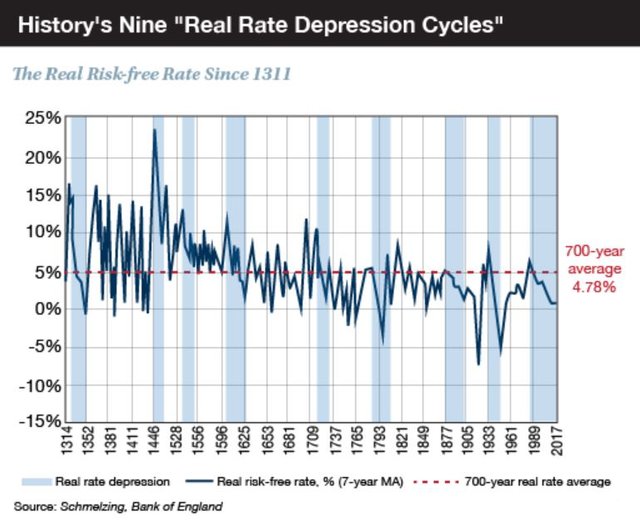

Over seven centuries, Schmelzing identifies nine “real rate depression cycles.”

These cycles feature a secular decline of real interest rates, followed by reversals. The first eight cycles tell fantastic tales…

These cycles often pivoted around such events as the Black Death of the mid-14th century… the Thirty Years’ War of the 17th century… World War II.

The world is currently immersed in history’s ninth rate depression cycle, which began in the mid-’80s.

It is here where our tale gathers pace…

Schmelzing’s research reveals that the present cycle is the second longest of the entire 700-year record… and the second most intense.

The only longer-lasting cycle came in the 15th century.

Only one previous cycle — also from the same epoch — exceeded the current cycle in intensity.

By almost any measure, today’s rate depression cycle is a thing of historic grandeur. The steep downward slope on the extreme right of the chart gives the flavor of its severity:

Schmelzing’s researches show that the real rate for the entire 700-year history is 4.78%.

Meantime, the real rate for the past 200 years averages 2.6%.

And so “relative to both historical benchmarks,” says Schmelzing, “the current market environment thus remains severely depressed.”

That is, real rates are well below historical norms.

And if the term “reversion to the mean” has any currency… rates could accelerate… quickly.

History shows that when rates do regain their bounce, they do so with malice.

We note that 10-year Treasury yields have gained roughly one full percentage point over the past year.

Could the cycle be ending?

It is premature to say.

But if the world is near the end of the current 34-year rate depression cycle, it could be in for a harsh lesson in mean reversion.

Schmelzing:

The evidence from eight previous “real rate depressions” is that turnarounds from such environments, when they occur, have typically been both quick and sizeable… Most reversals to “real rate stagnation” periods have been rapid, nonlinear and took place on average after 26 years.

More:

Within 24 months after hitting their troughs in the rate depression cycle, rates gained on average 315 basis points [3.15%], with two reversals showing real rate appreciations of more than 600 basis points [6%] within two years.

Yields on the 10-year Treasury bottomed at 1.37% in July 2016.

Nearly two years later, it has crossed above 3% before retreating slightly.

If the magnitude of the correction roughly equals the magnitude of the cycle it ends, we can likely expect one lulu of a reversal.

The current cycle is after all, the second longest on record… and the second most intense.

Since the stock market and economic “recovery” seem to hinge upon ultra-low interest rates, we shudder to think of what a “rapid, nonlinear” rate reversal would mean for either.

Its impact on America’s ability to finance its debt is another story altogether — but a story for a different day.

Of course, there is no reason in law or equity why the second-longest, second most intense rate depression cycle in history… can’t become the longest, most intense rate depression cycle in history.

The cycle could run years yet. Or it could end tomorrow.

But if history means anything… end it will…

Orignial article written by Brian Maher for The Daily Reckoning

https://dailyreckoning.com/history-teaches-interest-rates-2/

************** RTD NEWS UPDATE ****************

If you found this informative please upvote this post and share. For more commentary like this visit and subscribe to Rethinking the Dollar social media sites below:

RTD YouTube Channel: https://www.youtube.com/c/rethinkingthedollar

Twitter - https://twitter.com/RethinkinDollar

Facebook - https://www.facebook.com/rtdworldnews

The next recession is around the corner and a lot of people are unaware of why this time it will be a lot worse than the Great Recession of 2007-2013. In this new eBook, "5 Reasons To Hold Precious Metals Before the Next Recession ", I share my thoughts on how being prepared ahead of time will help those that hold tangible wealth in their hands through the next crisis.

Download a copy of the FREE eBook instantly here: http://bit.ly/5ReasonsEbook

#5Reasons #gold #silver #soundmoney

Good excilent information posted