A very personal guide to altcoin-trading - part II

So in the first part I have explained why it is important to keep your coins safe as well as how to deal with disappointing events. In my second part I would like to jump to my main conclusion on how to earn money on altcoin trading.

First I want to point out that I am not really into day-trading. As I am not doing this for a living, I cannot spend that much time on watching charts and reacting on chart developments. Day-trading really is a hard job and especially as crypto markets are open 24/7, this would be very demanding.

Ok, so which altcoins did bring me the most $$$ so far? My portfolio consists of some more secure positions like bitcoin and altcoins like ETH and LTC. Those are nice, usually quite stable and as you have seen during the past months, they also have a constant uptrend and could even double up your stake. However the biggest potential have smaller altcoins that are about to becoming big, those which will be on the rise soon. They might bring you 10x or even 50x in short- or midterm. Of course this is also riskier than investing in the already well established cryptos, therefore some advice in advance:

- only invest money you can afford to lose

- crypto markets might be in a bubble. no one knows. money you are investing might be gone in seconds

- keep calm, make educated decisions and do not get hyped or panic

- diversify! Chose your portfolio wisely, investing everything into one or only into risky coins could burn your stack much faster than you might think.

- suggestions coming from my end are not trading advice. those are just my personal conclusions from what I have experienced in the crypto world

So how do I chose cryptos to see whether they might be on the rise? The answer is: doing lots of research. As there are so many altcoins out there, to find a new potential coin I start to narrow down the coins I will be looking at.

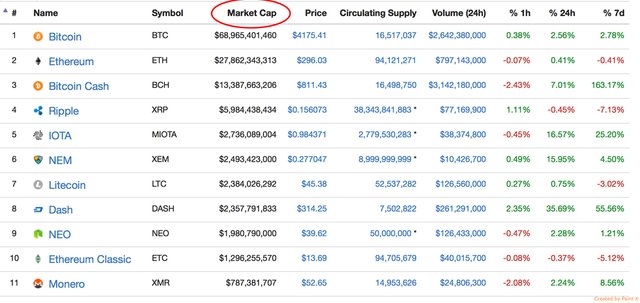

Using tools like coinmarketcap (www.coinmarketcap.com) helps you to filter coins for certain general criteria.

So the first and most important criteria is the market cap. The market cap is the indicator that defines the overall value of a coin, NOT the price of the coin itself. Many beginners only look at the price but at the same time do not realize, that a coin might only be worth $0.1 but if there are 16,000,000,000 of them out there, the single coin might never reach $100 as some other coins might do.

Source: coinmarketcap.com

I am therefore usually looking for a market cap in the range of $5,000,000 to $30,000,000 - those are the coins which usually already have gained some value and do not have a high risk of being a total failure, but at the same time might also have not reached their peak value yet. So how high could those coins go? Usually for a small coin it is difficult to get into the top 10 short- to mid term. Those have a marketcap of >1 billion, which is rather unrealistic to reach for most coins - although not impossible as recently proven by Neo.

So we are aiming for coins currently being at market cap top300 which are heading for the top 60, which would mean having a market cap of >$100 Million afterwards. Additionally I am usually looking for coins which have less than <200 Million coins distributed and would have a fixed amount of coins or a low inflation rate - I might discuss this topic in the future.

So this is the simple part, now the hard work begins - doing the research. A promising coin has to fulfill certain criteria in order to increase the likelihood for its success.

- A good concept

- being the best of its kind

- a great and dedicated team

- an active community

- value for the actual coin: what do you need the currency for?

- good marketing

- fixed amount of coins or low inflation rate

- potential for real world adaptability

- your feeling

Let me discuss each of those topics:

A good concept.

Go to their website, read the whitepaper and objectively reflect on the idea. What is the project about? Is the technical aspect sound? Do we really need this altcoin? Also a niche-product might have the potential to be a well established project in a couple of months, but might not have the same potential to grow as a project that might change our general way of doing business or our habits to communicate with each other - therefore topics which have a wide-scale adaptability but are also often more difficult to establish.

Source: ark.io

Also keep your eyes open, check what others are thinking about the project and whether they had the same thoughts as you had. But be careful! There are so many people out there just trying to build up a hype around their project or about the project they have invested in. Always be sceptical about what you read.

Being the best of its kind

So you have found an altcoin with a promising concept and good tech. Good start. But I am pretty sure there are other projects out there that might do similar things. Maybe even in the same way, maybe in an alternative way. Do some research here, compare those projects. Which one is at which stage, which project is supported by whom (any famous tech people behind it as advisors or doing promotion?). Think about whether competitors might push each other oder whether only one of them will make it. Very often, if one team comes up with a great idea, it might end up on top, but might also take some of the others with them for a part of their way so all of those coins go up in value. But be careful, in the end often only one project makes it to the top - the others might rise as well but could crash once it was decided by the public which project would be the top of the class.

**in my third part I will discuss the remaining factors of how I am selecting altcoins for an investment**

PS: unfortunately it looks like the main part of "Part I" was deleted. I am very sorry and might re-write it at some time.

This is great insight for everyone.

Market cap 💯📈📉

Nice post - well thought out and well written - following

Great post. Upvoted, followed you and resteemed.

Thanks for this guide. I was looking for the part 1 too ;(

What was part 1 roughly about?

This post is so awesome. I believe that follow this post, I can choose a really good altcoins, therefore lower risk for my portfolio. Thank you so much