With Bitcoin, Remittance isn't an Expense, but a means of Profit.

Thanks to mass media headlines about Crypto prices, a vast portion of the world is now aware of Bitcoin. However, assuming that Bitcoin serves little value besides trading is a grave mistake. Due to its decentralized state, Bitcoin can be quickly moved across borders for a small fee. This makes Bitcoin an extremely effective medium for remittances.

When an expatriate (expat), which is a person working in a foreign country, sends money to his or her country of origin, the funds are called a remittance.

Every year, over $600 billion are transferred in remittances; India, China, Philippines, Mexico, and Nigeria are the top 5 remittance destinations. Some expat workers from these countries have realized the unique opportunity Bitcoin has provided. They are not only able to save money on remittance fees, but actually, make large sums of money by simply being a remittance provider.

How Remittance Works

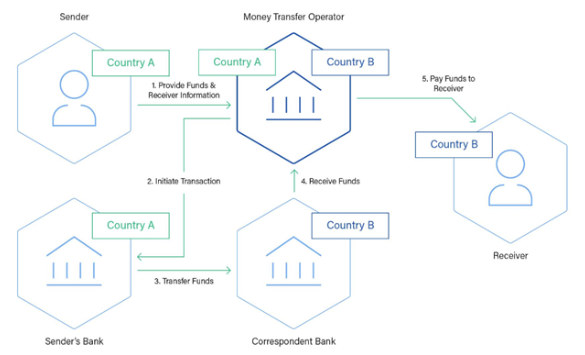

Suppose you are an expatriate who’s working in the United States and want to send money to your family in Asia. The first thing you would do is go to the nearest Money Transfer Operator (MTO), hand over the cash at the available exchange rate, and then the MTO begins the process of sending the money.

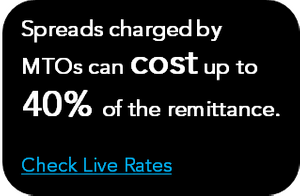

The MTO will charge you a fee for using their service, but it’s important to recognize MTOs as mere shops that link people to Remittance Software Providers (RSPs), like Western Union or Moneygram. RSPs charge MTOs for set-up and subscription, which are fees that are passed on to expatriates. The MTO receives a small fraction of the remittance fee as most of it goes to the RSP; thus, MTOs rely on a business model that integrates incredibly high spreads on fiat conversions.

Once the funds reach your family, there’s a significant deduction due to the remittance fees consumed by RSPs, and the conversion spreads consumed by the MTO.

Several middlemen are involved in a fiat remittance.

How Bitcoin Remittance Works

Bitcoin remittances rely on cloud-hosted MTOs, which integrate Decentralized Finance. Such MTOs are tailored to be easy to use by the underbanked. These MTOs are able to transfer money with just an internet connection. As Bitcoin remittance does not need RSPs, cloud-hosted MTOs, unlike traditional MTOs, do not pay any subscription or software setup fees.

Due to the peer-to-peer nature of Bitcoin transactions, remittances that utilize cryptocurrency are able to dodge the convoluted network of middlemen involved in a fiat remittance (as displayed in the graph above) and can be fulfilled at great speed. Despite the nascent stage of blockchain technology, many expatriates have seen the benefits of Bitcoin remittances; according to a report on Clovr, a blockchain research company, 15.8% of the world’s remittances are done with cryptocurrency.

Cryptocurrencies have already become the 4th major cross-border payment medium. Falling behind only PayPal, Money Transfers Services (like Western Union), and wire transfers (via banks or credit unions).

How Expats are Making Money off Bitcoin Remittances

While fiat remittances are an expense, some expatriates have figured out that Bitcoin remittances can actually be highly profitable. The process isn’t even difficult.

Suppose, that you are working in the United States and want to send money to your family in India, a country that has banned Bitcoin exchanges. Considering the high fees associated with fiat remittances, you stand to benefit by using alternative means of remittance, such as Bitcoin. A unique surprise catches you off-guard: Bitcoin sells at a great premium in India. Because it is difficult to buy Bitcoin in India, BTC sells at a great premium there—as much as 10%. By having access to an American and Indian bank account, you gain access to an incredible arbitrage opportunity. Not only could you remit money to India and provide your family potentially 10% more than you had expected, but you can even stock up extra BTC and then sell BTC for Indian rupees to make a profit.

For now, a few expat workers have caught on, but those who have this knowledge have already begun profiting from this opportunity enabled by peer-to-peer finance. While the example above focuses on the arbitrage available in the Indian market, similar arbitrage opportunities are available across the world, and all you need is to compare market prices with the prices on a price on a peer-to-peer finance platform.

Real-Life Uses of Peer-to-Peer Finance

Bitcoin, which is a peer-to-peer value transfer and wealth preservation medium, is only one part of peer-to-peer finance. The web has enabled the launch of peer-to-peer capital raise, debt/equity issuance, payments, and more. Services that once required the integration of governments, financial corporations, and countless other middlemen can now be executed on a peer-to-peer basis.

The full potential of peer-to-peer finance is yet to be explored, but here are some benefits that are already being well-enjoyed by people across the world:

Earning an Income

Bitcoin has been a critical catalyst to the evolution of peer-to-peer finance, and it, therefore, remains a key part of many p2p financial activities.

Peer-to-peer finance has critically changed the way Bitcoin is bought and sold. P2p finance platforms enable limitless personalization of any trade; both buyers and sellers are able to set their trade preferences and easily filter through trade partners. With hundreds of payment methods now available on peer-to-peer marketplaces, it has become incredibly easy to buy and sell bitcoins. Despite the price dip seen throughout 2018, volume has been largely sustained and, in fact, the number of trades has gone up. Meanwhile, the market makers on peer-to-peer platforms have found a great opportunity to build a significant income.

Wealth Preservation

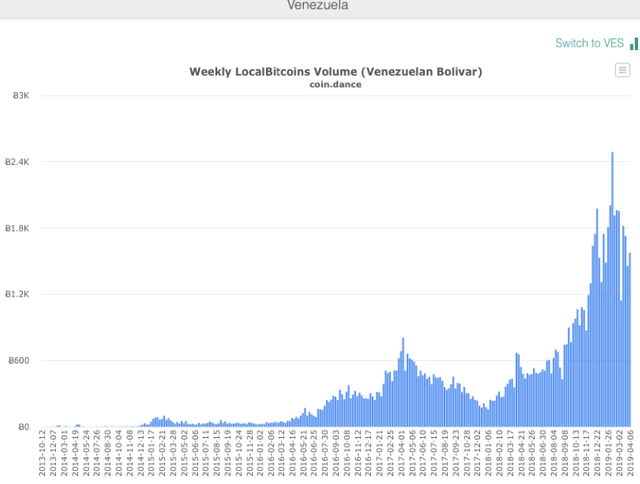

Peer-to-peer finance has been the greatest boon to those living in the world’s weakest economies. Currencies like the Venezuelan Bolivar have lost an incredible amount of value in a matter of months. According to Trading Economics, the annual rate of Venezuelan bolivar jumped up to 2.69 million percent in January 2019 (coming from 1.70 million percent in December 2018). The Bolivar is not a lone case; other currencies, like the Turkish Lira and the Argentinian Peso, lost as much as half of their value in 2018.

The purchase of Bitcoin is a growing trend in all countries that are witnessing or have witnessed inflation of extreme proportions.

Bitcoin has given people across the world an opportunity to preserve wealth, and peer-to-peer finance platforms, which enable the purchase of bitcoins through hundreds of payment methods, have bridged the supply of BTC with the demand of BTC—for even the unbanked.

Remittance

A soon-to-be trillion-dollar industry, remittance has been cheaper, quicker, and more efficient through Bitcoin and peer-to-peer finance. Peer-to-peer allows people to send money across the globe and some have seen that there’s an opportunity to even profit from this.

E-Commerce

Few things are as representative of the digital age as the explosive e-commerce market. Given the vast potential and ease of scalability available to merchants who create a digital footprint, this is an increasingly competitive space. While there are limited growth fronts that remain untapped, merchants who open up to Bitcoin payments are able to target a growing niche community.

Moreover, accepting Bitcoin as payment cuts loss by removing the charge-back expenses pushed by payment card providers. In fact, many small e-commerce businesses account for charge-backs as a third of their expense. With the growth of peer-to-peer finance platforms, accepting Bitcoin is easier than ever and chargebacks could soon be mitigated.

The borderless aspect of Bitcoin also eases the means to reach any market. Entrepreneurial minds in, say, Africa, can tap into the North American market by easily accepting Bitcoin payments. While the customers pay in Bitcoin, peer-to-peer platforms enable easy and quick conversion to fiat.

E-commerce merchants, as competitive as they are, have yet to fully take advantage of the opportunities provided by peer-to-peer finance. Those who take the early step will stand to sweep the benefits.

Payments

This one’s a given since Bitcoin is innately a currency. While many countries in Europe are adopting a cashless lifestyle enabled by payment cards, point-of-sale systems aren’t as widely accessible in other parts of the world, especially in South American, Africa, and Southeast Asia. And when PoS systems are available, payment cards tend to put stringent limitations in these regions.

Take for example Nigeria. The limit on most debit cards if $100; few people who can prove a high source of wealth can acquire cards with limits of $1,000. These limitations make otherwise common purchases, like a new iPhone, nearly impossible unless paid for in cash. Peer-to-peer finance platforms can be a great convenience in such scenarios as they can tap into online payment gateways like AliPay. Your Bitcoin holding can be sold on a p2p platform and then a smartphone can be paid for via AliPay.

Bitcoin and Peer-to-Peer Finance are Changing the World

Blockchain technology has revolutionized the global monetary system. Soon after the creation of Bitcoin, early adopters rushed to figure out a means to use the currency. It was only a matter of time before people began to search for the best Bitcoin affiliate programs, best bitcoin trading strategies, or even just looking for the best cryptocurrency to invest in. With the emergence of peer-to-peer finance, people have managed to not only make money from Bitcoin but also gain control of their finances.

Bitcoin is more than just a speculative asset. With peer-to-peer finance, it’s a real-life medium of exchange (currency), a convenient—even profitable—means to remit, a means to preserve wealth, and much more. Bitcoin may still be in its early years, but it has already had a great impact on the lives of many. Now, even businesses are integrating p2p finance to ensure they are able to take advantage of the doors opened by Bitcoin.

But Bitcoin isn’t all about money. While Bitcoin and peer-to-peer finance have changed the way financial operations are run, it has also inspired big charity events that help less fortunate communities. An example of this would be ZamZamWater’s and Paxful’s #BuiltWithBitcoin initiative. With the power of peer-to-peer finance, the two companies were able to join forces to not only build 2 schools (so far) but also provide scholarships to female Afghan refugees.

Bitcoin and peer-to-peer finance have finally made it possible for people to fight against the unjust yet uncontrollable lottery of birth. Societal and geographical limitations can limit fiat currencies but not a decentralized currency that can be pushed through peer-to-peer financial platforms. The peer-to-peer revolution is here and it’s time to figure to take full advantage of it.

Connect with me:

Cryptocurrency News Cryptocurrency Airdrops Best ICO List Ripple XRP News Ethereum News Crypto Bounties Blockchain News Blockchain Lawyers

Remittances are the perfect use case for crypto. Besides the crappy exchange rate spread you get, the fees can get quite high. You can see for yourself at: https://www.westernunion.com/us/en/send-money/app/price-estimator With some random searches I found a $30 fee for sending $1000.

That's not even taking into account censorship, limits, sanctions, forfeiture, etc.

Thanks for looking into it with such depth. The WU fees can be more painful on small transfers, which is often the case with foreign labor.

dude, nice seeing this on the front page of reddit.com/r/bitcoin

and i didnt even notice I was on busy.org for a while

Topics addressing real use of p2p finance and Bitcoin should be there.

Yes. I've sent money abroad via Western Union and the fees were incredible and had to deal with a bank at one end. Many people use this service (or so i'm aware) so yes, its a perfect use case.

Through decentralized cryptography, Bitcoin eliminates the need for banking intermediaries, significantly lowering transaction costs, and could liberate poverty-stricken economies around the globe by providing access to capital to the one-third of humanity that is excluded from the financial world.

Interesting about the profiteering country by country due to Bitcoin prices, I had no idea. On another note, do you think this potential Facebook 'stable coin' will try to corner this diaspora remittance market? It has the users.

The details of FB's native coin are so vague that I cannot say much about its use.

What I can say is that it will definitely be limited use as even FB's payment system only works in the US. Moreover, it'll have to abide by all forms of regulatory oversight that BTC needn't follow.

There is no second Bitcoin.

The problem with Facebook coin is that it will absolutely be permissioned and censorship prone.

Totally, there is no second bitcoin and the FB coin will of course have so many strings attached to not lessen the 'integrity' of FB. Thing is though the sheer number of users on FB and how often they use them. It's probably the perfect platform for the perfect remittance solution (in a perfect world, but still not in my world).

Here in the Philippines, still the idea of bitcoin as a remittance vehicle is still never heard of.

I live in a community of expats family, still all of then have no idea.

Posted using Partiko iOS

Be a hero and educate them about this subject so that they may save an incredible sum on fees.

Been doing it @hatu little by little, my aim is to prevent people from being scammed when they are asked to invest in certain coins.

And since fb is so prevalent in my country, my strategy is to lure them first to @Partiko as an alternative platform, and as a soft entry into the blockchain.

I also build a small community of steemians composed of mostly my senior high students, and few friends. Supporting them with upvotes and tiny sp delegation.

My pacing is very slow, since their understanding to this type of technology is from zero to little understanding.

I keep on posting relevant bitcoin and steem news in fb, and have been very enthusiastic in answering a few queries.

So far that is where i am heading at the moment.

I'd say introduce your school friends to airdrops. Things with a direct monetary incentive are easier to spark interest.

As for your neighbors who are from expat families, showing them how p2p finance platforms like Paxful can save them so much in fees should be a winning strategy. They needn't lose all that money to WU or MG.

Yah Western Union is the usual center we used here.

Thanks for that wonderful advice.

Good morning to you, from steemians of the Philippines.

Posted using Partiko iOS

How long do you think the Curry Premium will last though? Others that have existed in the past, most famously the Kimchi Premium (which was as high as 40% at one point) only really lasted for a couple of months. Such is the nature of free markets, I guess.

Posted using Partiko iOS

It will last as long as the Indian government is limiting and controlling the amount of rupees going outside of the country. That is how the arbitrage is created. Easy to get Bitcoin in, difficult to get rupees out.

Also it's not 10%, more like a few percents right now. Although during the bull run it was 20 to 30%

It does vary; the arbitrage at this very second is ~6%.

There is no exchange in India. I see 3% comparing best price on localbitcoins to Google Bitcoin price. How do you get yours?

Posted using Partiko Android

Premium or not, the 20%, 30%, or even 40% fees charged by MTOs via spreads will be an ever-present saving. The current premium is just a nice cherry on top.

Also, I wouldn't term the premium that way; it could offend some people.

Really? Don’t Indians eat curry like Koreans eat kimchi, though?

Posted using Partiko iOS

In this article, you’ve stated that the fact that fiat remittances are expensive and that bitcoin sells at a high premium in India, as a basis for why we should use blockchain remittances: through MTOs. Wouldn’t it be the same if we just directly sent them the Bitcoin? Just curious

Posted using Partiko iOS

The MTOs in the p2p space are just the connecting grounds for people. Your BTC is directly sent to other people; consider the cloud-based MTO, in this context, as a means to find the right match.

I do think that Bitcoin is a good remittance option but volatility makes it a bit risky.

Target a slightly high miner fee and you'll get the transaction through pretty quick. It will almost always be better than the MTO spreads.

BTC to INR

Nice post @hatu sir, it clearly defines advantages of using bitcoin remittance vs traditional remittance, it cuts all intermediatory person fees, it is a peer to peer,fast plus you can earn through this method by arbitrage trading.

Great coverage on this. When this thing really sets in, I mean like really really sets in, the change in the way the world does so many things will be breathtaking no doubt. Boom we are literally already in the history books. Hello future readers!

Learning is the beginning of wealth. I´m learning with your posts.