Buffett Shmuffet and Crypto Demise

Information and disinformation are of the most powerful weapons on Earth today.

Since the implementation of systems of communication which allow people all over the planet to receive information, almost of their choosing, within hours, minutes or even seconds after dissemination begins, the power to manipulate world markets and make or break millions of people in an instant has become a reality as so much is reliant on sentiment, which relies on information and hence disinformation.

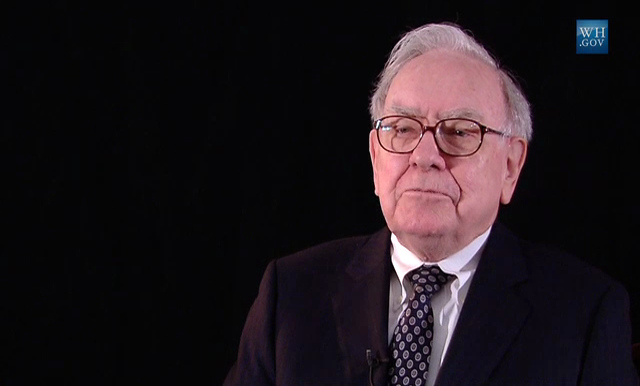

Warren Buffett told CNBC recently

"In terms of cryptocurrencies, generally, I can say with almost certainty that they will come to a bad ending," ... "When it happens or how or anything else, I don't know,"

He also said

"I get into enough trouble with things I think I know something about," ... "Why in the world should I take a long or short position in something I don't know anything about."

Warren Buffet is a highly successful man who is idolized for his wealth generation and has incredible influence in the investment world.

My problem is the stark contrast between the quoted statements.

If he says

"I don't know anything about." referring to cryptocurrency,

then how can he be making statements like

"I can say with almost certainty that they will come to a bad ending,"

when he knows the impact such statements will have on investors.

I have observed Buffet in interviews, carefully avoiding statements which would influence people to buy or sell individual stocks or in specific industries about which he has knowledge, despite relentless aggressive questioning, because he knows the impact his words have and yet he makes a sweeping statement on that which he admits he knows nothing.

One is inclined to ask : Is this a disruptive statement, designed to destroy the global wonder which this new technology has given us. The concepts emerging as Blockchain technology develops have the potential to change finance, money supply, macro and micro economics, politics and the prosperity of Man on this planet.

It is no wonder the moguls would wish to protect the systems they do know, which provide their inordinate wealth while most struggle for survival due to the vial maxim : " all for us and nothing for anyone else" which seems born of the truth - "power corrupts"

Other ridiculous statements have been made by such as the head of Germany's largest bank, claiming a while ago that bitcoin has no real value, like the FIAT currencies have, while the truth is quite the contrary. FIAT currency has a built in program for the destruction of humanity while Bitcoin has a built in protection against the very same thing. Many other supposedly brilliant men have also made similar statements.

The real problem is that these men may well make these statements true if the sheep keep feeding on their disinformation.

History is replete with examples of men who have wielded great power and enjoyed great wealth despite a very real lack of real intelligence. Real intelligence abides in those who truly have the best interests of all at heart.

We should be very careful of believing things just because a rich man says them, especially when his interests are at stake. That is not to say that Buffet is wrong about the future of cryptocurrency but that such statements should be backed by sound economic principles.

Cryptocurrency may well come to a bitter end but it is a cause for truth while FIAT is a system which exposes the gullibility of man and the malicious intent of those controlling it, to those prepared to question the integrity of its origins.

This Fiat Currency Exploitation Is Robbing Generations Of Americans

A US president faced with the fundamentals of FIAT economics in his time warned that the US would face destruction if the system was ever implemented again as it was terminated in the 19th century after its implementation in the interest of resolving national financial difficulties consequent to the civil war.

President Jackson's Veto Message Regarding the Bank of the United States; July 10, 1832

Two important truths to consider are :

Cryptocurrency is not backed by anything more than FIAT currency is, except the absence of inflation and

While Bitcoin and other cryptocurrencies have inflation preclusion built in, most cryptocurrencies do not and we should not fool ourselves into believing that cryptocurrency itself has magically eliminated the law of the harvest or indeed the need to consider its implications.

It may well be that Buffet is right, that what is happening in the cryptocurrency markets will ultimately result in a bigger bubble than almost anything we have ever seen, aside from the world's FIAT and the burst would be truly catastrophic.

The future lies in benevolence and the absence thereof and we are all responsible for our attitude and efforts in that regard.

Images from Google images - reuse rights and Pixabay. Other attribution within the post.

good news

Buffet Schmuffet indeed.

The thing that is missing from most discussions about cryptocurrency is what it enables, DAOs, decentralised governance, transfer of value digitally to name a few. The last one I mentioned is partly discussed but only in the context of fiat currency. Take steem as an example, this has enabled digitising influence (sp) and you can transfer this influence digitally. This is a new phenomenon that is never discussed when crypto comes up. Let's shift the conversation on from bitcoin.

It is simple in fact guys - do not think WB is in financial 'need' to manipulate market investors, we all know he is not. Need he HAS is of ego nature to maintain his position and influence and yes, he is very well aware of how serious impacts this sort of statement.

It is having a flavour a buygone ages