Bitcoin TA - summary of analysts - 01. June 18

Regular daily update on BTC ta analysts opinions.

**My summary - short-term sentiment: bullish ** (last: neutral)

- Critical support 7'000 - 7'200 bounced us and seems to establish itself as swing low holding us for some time.

- We have Tone and @lordoftruth seeing this move up short lived and lower lows coming soon.

- Tone did switch short term (12hr chart) bullish while staying bearish on the weekly. He is seeing us going up to 8'000 - 8'600 max and than down.

- @haejin turned fully bullish seeing us going up in impulsive wave with potential huge run up.

- So it looks short term bullish.

- Still we need to break in this move 10'000. If not the likelihood of seeing new lows is increasing significantly. If we fall below 7'050 it will be very ugly.

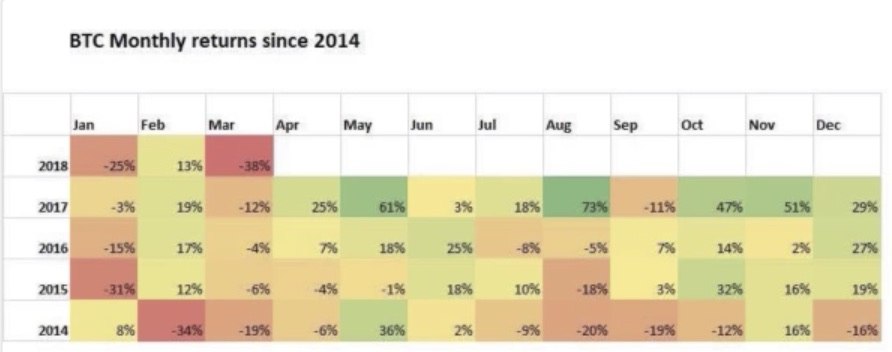

- May is usually a strong month. But not this year. We started at 9'240 and went all the way down to 7'485 (-19%). Lets see how June plays out -usually also a bullish month. Are we going to see a compensation of May with a huge rally up?

News about the blog

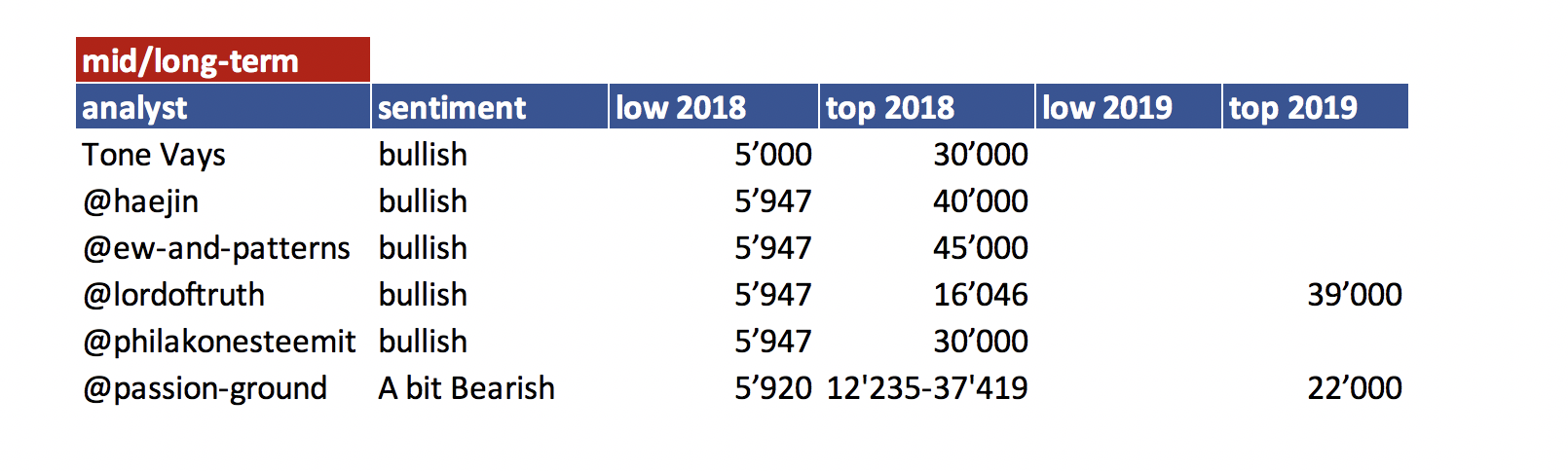

I need to revise my 2018 long term table. I need to add a 2018 and 2019 target an be more precise on the sentiment here. Will do that after I am back in Switzerland.

We lunched the bounty project beta. If you are interested and you like to create a bounty on your own have a look at this post

Analysts key statements:

Tone:

- Weekly:

Nothing has changed. Continues to compare this week to August 2014. We are below 50 week MA - Daily: We are green 3 of 9. He expects this bounce to not go higher than 8'000. CMF slowly moving to the downside. RSI got just to oversold and started to pick up

- 12hr: There is a chance that the price of bitcoin start to go up and hit the top of the triangle. Target of max. 8'600 here before going down again.

@haejin:

Bitcoin has completed the correction which was requisite from the first impulse sequence (white). It was a fractal of the first wedge (blue) as can be seen by the breakout style. The second impulse sequence is in progress and the fact that price is moving impulsively is a very good sign.

From a higher degree of trend perspective, the purple waves outline the bigger moves to come. In effect, the first white impulse sequence was subwaves to purple 1. The just finished abc are subwaves to purple 2. So, IF purple 3 is in progress; then the yellow waves are the subwaves....so, it's got much more to go up.

@ew-and-patterns:

We bounce of a trendline which established itself as new trend line.

@lordoftruth:

Bitcoin is trading around 7'475 and the chances is still valid to achieve more decline to extend losses to reach 6'519 - 5'878 - 4'300 as long as the price Below 7'910.

The 2 weekly bearish stop grabbers after breaking 7'614K, suggest drop below 6'519, to test 5'878 reaching 4'300 area, the same Destination point of the Butterfly "Buy".

Todays trend is bearish. Trading between 6'915 and 7'910.

@philakonesteemit:

A bounce at the 7'000 level was much expected due to hitting a major trend line support established since Nov 11, 2017.

Bullish View, if we break the 7'650 range, there's a chance to hit 7'850 to 8'000 range (0.5 to 0.618 fib retracement)

Bearish View, if we break 7'161 range, we'll most likely test 7'040, which I see as failing to hold and then testing 6'500.

@passion-ground:

At present, BTC can’t get out of its own way. So, where is the bottom? He sees 6'830 as a possible bottom.

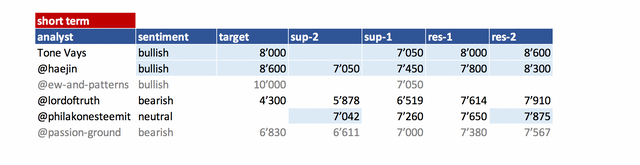

Summary of targets/support/resistance

Reference table

| analyst | latest content date | link to content for details |

|---|---|---|

| Tone Vays | 31. May | here |

| @haejin | 31. May | here |

| @ew-and-patterns | 29. May | here |

| @lordoftruth | 01. June | here |

| @philakonesteemit | 31. May | here |

| @passion-ground | 29. May | here |

Definition

- light blue highlighted = all content that changed since last update.

- sentiment = how in general the analysts see the current situation (bearish = lower prices more likely / bullish = higher prices more likely)

- target = the next (short term) price target an analysts mentions. This might be next day or in a few days. It might be that an analyst is bullish but sees a short term pull-back so giving nevertheless a lower (short term) target.

- support/res(istance) = Most significant support or resistances mentioned by the analysts. If those are breached a significant move to the upside or downside is expected.

- bottom = -> now renamed and moved to long term table. Low 2018

- low/top 2018 = what is the low or the top expected for 2018?

Further links for educational purposes:

- From @ToneVays: Learning trading

- From @philakonecrypto: Like in every post you find links to his amazing educational videos. For example here

- From @lordoftruth: Fibonacci Retracement

- From @haejin: Elliott Wave Counting Tutorial

*If you like me to add other analysts or add information please let me know in the comments.

to the moon baby

Looks to me like the current trend is downward. Only news or some kind of event is going to reverse the downward slide.

Averaging a bunch of BS, is likely to produce perfectly average BS.

Finally close to exiting this wedge we have found ourselves in! A few more weeks (maybe a couple months) and I think we will finally see that institutional money come in. I have been reading about many firms that are prepping to jump into the space and it is just a matter of time before they do.

I am thrilled that everything is still at a huge discount from the pervious highs in the beginning of the year and that we are finally seeing the everything flatten out! Great time to pick up some positions before the next alt cycle!

Cheers for the coming months! And hopefully all of this holding will be worth it in the end!

Thanks for the TA! Not sure how I haven't seen your page until now but have a new follower! :)

Come on Bulls!

Great post, I had no idea token holders will get stake in multiple blockchains. Good stuff! Anyway, was wondering, is there a way to verify if the private EOS key secured during registration via metamask is correct for the public key?

Wonderful technical summary for the end of the month @famunger, can't wait for next months analysis.

Yes, the technical analysis is awesome, and done my many people. Bitcoin price looks like in the bottom of support trend line. We may see a jump from here. I just followed you for further analysis.

best article thanks

Interesting content!

Good technical analysis and well detail Bitcoin market prediction , this your analysis is important for us traders to better make good trading decisions @famunger

This post is laudable.Really it is a good post.