TA: Is Bitcoin falling to 3000$?

There is a saying - you can't time a bubble. And Bitcoin, in fact, was in a major bubble. In the beginning of this FUD everyone just thought It was just an overdue correction. I've been proven wrong as many analysts did. As a trader, you are counting on historical data to interpret the future pathway of the price, and the data at the time being suggested it was a clear ABCDE correction.

But now we have new data to take into account. The descending wedge pattern is no longer at play because it was breached through the downside all the way to 6000$ where's no support.

As you can see the 6000$ level is now a wick kissing this vague trendline. And I say vague, because it only consists of two points and now a third in a form a wick. If you look at the momentum behind the moves it is clear that on the next run down that line will also be broken, so the next target would be around 4900$, but there is just nothing there to stop this massive momentum. Taking that into a account, and the fact that this isn't and abcde correction but just an ordinary 12345 move down, I've projected this scenario.

The next stong support that can contain this move downward is 0.236 Fibonacci level, which is in the terms of price 3000$. The other reason that leads me to believe that this is now a likely scenario is that historically this already happened.

If you zoom in a bit more you would see that after this move upwards was completed, the correction took place and ended at previous resistance.

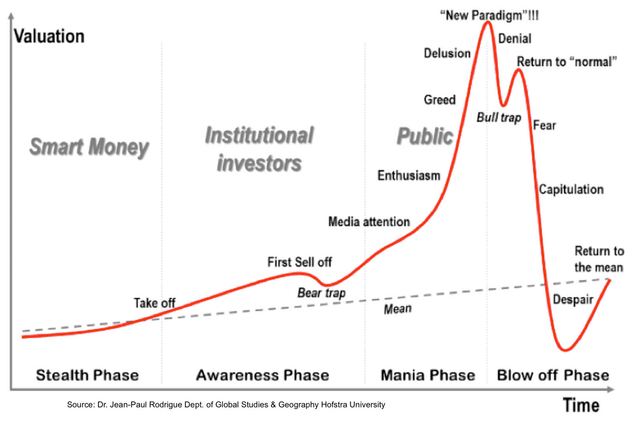

All of this will perfectly fit with the graf describing the phases of the bubble, and that graf fits perfectly with Bitcoin's price, including the bull trap that we've experienced.

Strange isn't it? How did we not see it coming? Cause we all wanted to believe. We were blinded by enthusiasm, potential profits and were just in denial. That's common human psychology and the reason why bubbles happen in the first place.

Now have in mind that am not saying that this will happen. But from a probability standpoint, this is the highest one.

The question that I have and would like to see how you are thinking in the comment section is how would this impact the entire market? We all know by now that when Bitcoin is going down everything is going down, and we've seen this repeatedly happen in the last month and a half. But this may be the chance for altcoin to blossom this year because if this scenario plays out I don't expect Bitcoin to recover anytime soon. It's the known hurry up and wait syndrome of the market participants expressed in every cryptocurrency - hurry up and buy while the price is going up, and wait till we are sure that we've reached the absolute low. On the other hand, if the most well known, most dominant and fiat gateway crypto goes down, maybe everything will go down in flames.

What do you think? Leave a comment below, I would like to spark a discussion.

P.s Congratulations you've survived a bubble popping, but this is nothing to what coming in the following years. Learn your lessons and be smart in the future.

Bok @drumsta pridruži nam se na novo podignutom Balkan Steemit Alliance discord serveru za balkanske Steemit korisnike detaljnije o ideji možeš pročitati u linku ispod

https://steemit.com/steemit/@ivan.atman/official-balkan-discord-server-is-up-and-balkan-steemit-alliance-is-up-steemit-balkan-savez-sbs

(server je tek podignut i možda budeš među prvima na praznom serveru, međutim svi su obaviješteni te će stići uskoro)

Very interesting analysis. Your point "from a probability standpoint, this is the highest one..." is spot on.

I know I might be going apples to oranges here, but it really reminded me of similar experiences in the commodities market - specifically silver. After huge spikes, it settled into a "new normal."

Guess it will depend on the Bitcoin concept itself. If it has staying power, then it just might settle into a "new normal" range instead of imploding.

Two big factors for me are a) silver has an actual physical component, Bitcoin is digital, and b) silver exists regardless of electricity...

source: www.kitco.com