BTC Death Spiral - Don't Buy The Fud

This is one of my many posts written to keep my thoughts easily link-able in response to a repeated question or post in the many crypto groups I'm in. Steemit is great for this purpose because I can easily find my own posts and link to them

The Article

For clarity's sake, I will be referring to Bitcoin Cash as "BCH" and Bitcoin as "BTC".

Recently an article was written by the blogger "Bitcoin and The Blockchain". In the article, the blogger wrote about their expectations for a BTC death spiral. The article was written on August 10th and goes over what is incorrectly framed as a weakness in the BTC chain but is actually a strength in the long run.

Difficulty Adjustment

BTC is designed with dynamic difficulty. A formula takes the last 2016 blocks and their timing and adjusts the difficulty for the following 2016 blocks to make block timing 1 block every 10 minutes, 144 blocks per day, and 2016 blocks per 2 weeks. This adjustment occurs on blocks that are a multiple of 2016. If the prior 2016 block period had more hash power than the current 2016 block period, the block timing will be off. This is framed as being a downward spiral, block times increase, miners leave, block times increase, miners leave.

BCH is designed with dynamic difficulty using a conditional Emergency Difficulty Adjustment (EDA). EDA allows adjustment for fluctuating hash power and non conforming block times. This is framed in the article as allowing a more responsive blockchain.

Downsides

BTC can indeed lose hash power as miners leave, increasing block times, and it CAN be ongoing for a few weeks maybe even as long as 6-8 weeks. BCH can indeed adjust for fluctuating hash power on a shorter term basis. This seems to validate the article referenced above, right? Wrong. There's a huge oversight here. There is not a huge cost to more frequent difficulty adjustments, so why would Satoshi have coded them to be the way they are? Because it makes BTC less susceptible to manipulation by miners. BCH is already facing this issue. The EDA is being manipulated. 92% of blocks have been mined by 2 miners. That's not decentralized at all. You'll note by looking into the blocks and hash power, they've been manipulating the BCH block timing and difficulty using the EDA. That's a HUGE weakness and was identified as one prior to the chain fork that created BCH when people were reviewing the Github. BCH's difficulty is susceptible to manipulation using the EDA and not only is it susceptible to manipulation using the EDA, it IS being manipulated using the EDA.

Manipulation of BCH

BCH adjusts for lower difficulty due to exiting hash power, makes the following blocks easier to mine and get the reward for even if the hashpower rejoins. Manipulations that would take months and many more miners to try to attempt on the BTC blockchain are happening in a matter of a few blocks on the BCH blockchain. This leads to 92% of BCH blocks being mined by 2 miners.

Manipulation of BTC

Because BTC is longer term to manipulate, equilibrium will be found. Yes, block times can be impacted in the short term. Yes, a small amount of hash power has left. Yes, there is currently a backlog and it will take a while to resolve. It may even worsen before being resolved. There's only so much hash power that will be removed. There's only so much manipulation that can be done since the difficulty adjustment is over such an extended period. The BCH people can enter and leave the BTC hashpower as many times as they'd like, but the difficulty adjustment on BTC is an average of the past 2016 blocks. Their entering and leaving will cause erratic block timing (9min - 11 min, instead of 10min) over 2016 block period. Eventually, the block timing will be corrected using an average. Then each subsequent difficulty adjustment will fine tune it even more.

BTC Hash Power and Difficulty

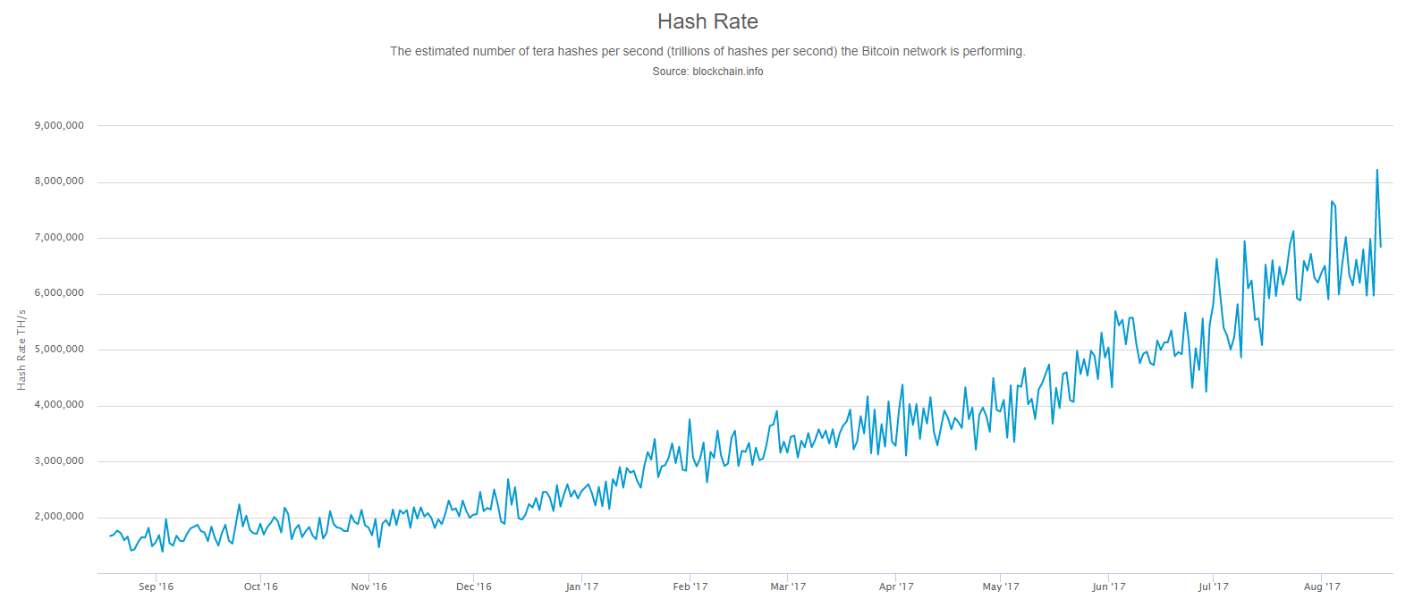

This image is a graph from blockchain.info showing hashpower on the 1 year time frame. Note that the recent hash power leaving isn't the crisis it's framed as.

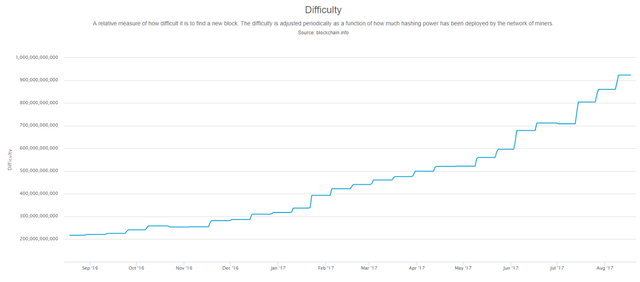

This image is a graph from blockchain.info showing difficulty on the 1 year time frame. Note that the difficulty wasn't significantly impacted by recent events.

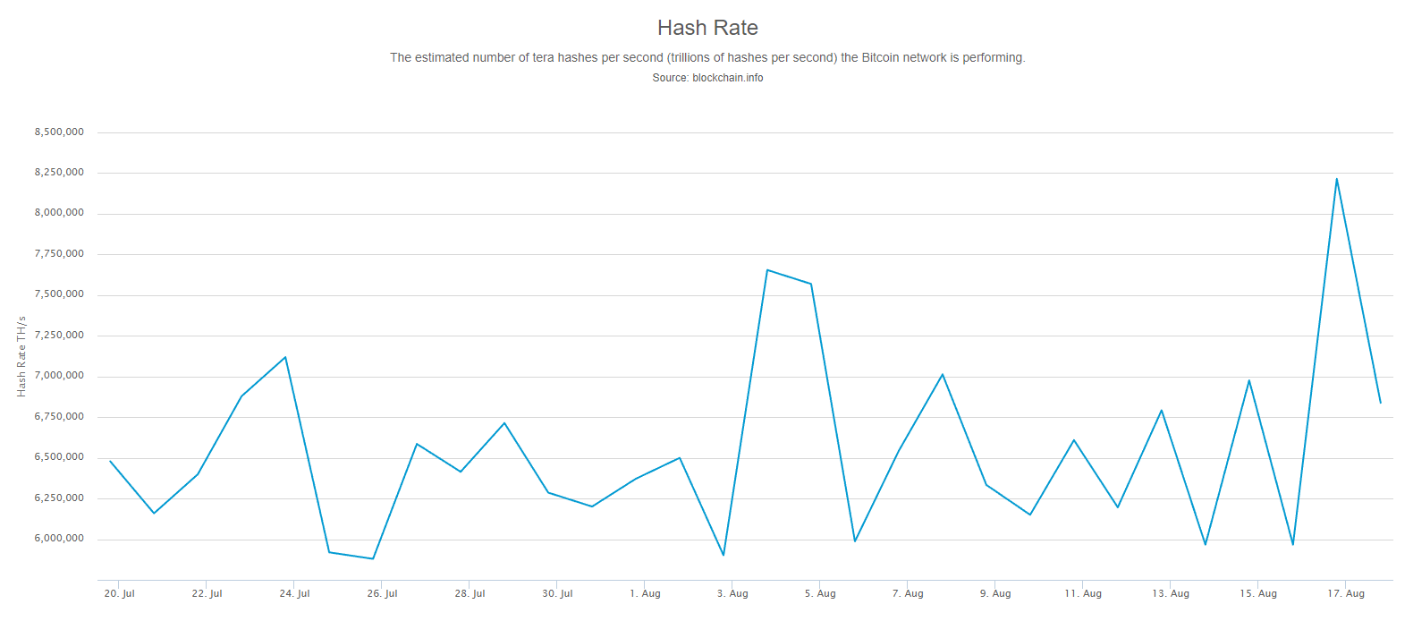

Want a closer look? This image is a graph from blockchain.info showing hashpower on the 30 day time frame. It's almost as if hash power was added, just to be removed precisely for the fud potential. That would be crazy though, right? Who could possibly benefit from this fud besides people with bch, because they're ones getting 92% of block rewards, they, of course would never manipulate anything to increase BCH price. (sarcasm)

Oh and here's the 30 day difficulty chart, also from blockchain.info.

Final Thoughts

Manipulation of both is occurring in the short term. BTC's manipulation is far less critical than the BCH manipulation. Erratic block timing in the short and midterm on BTC is far less of an issue than the centralization and manipulation apparent in the BCH blockchain. While BCH mining parity has allegedly been reached, that is a creation of the manipulation that has occurred - parity has been reached, but only for the 2 miners that have mined 92% of the blocks. They will continue manipulating the EDA to ensure they receive a majority of the blocks. When calculations are run comparing the rewards of the other miners of BCH to BTC, a far different picture is shown. The only way to make this a nonissue is to increase BCH hash power to the point that isn't as easily manipulated. Unfortunately, that will likely require 20-50x the current hash power added miners other than the 2 manipulating the EDA. It is much more likely that BTC will begin to adjust for the fluctuations over time and the blocktiming will get finer tuned over the coming weeks. In terms of BCH, I expect to continue seeing efforts to raise BCH price for the miners to capitalize on their 92% of BCH block rewards.

I'd like to know if the miners are keeping it in BCH or selling their BCH for bitcoin. I'd imagine they are stocking up on BTC whenever possible, which would say it all if true.

You can check that with the wallet addresses. ;)

There is something going on here and we likely won't have all the answers until November but this post gives me a lot to think about and keep an eye on. Thanks. Upvoted and resteemed.

Thanks @kunschj :) This is, of course, a developing situation. Just providing some clarity in terms of the actual situation.

Thank you for your take on it. I've read several different perspectives on the situation today.

What do you think @zadowlan?

I don't know what to make of all of it. BitCoin Cash caught me totally off gaurd. Not what I was planning for at all. Lately I've been reading in to MTL and LTC.

My view on it is simple. This is an alt coin. BUT an alt coin that didn't even have interest, at least coins that ICO we know have interest based on their raise. This one didn't even have that. People were excited because BCH used a chain fork instead of a code fork, resulting in the ability to spend their balance on both chains. Free money. The miners are fudding BTC and there are impacts on BTC but they're minimal and will correct in the near future.

Yea I claimed my free BCH and got out. I don't really want anything to do with bitcoin cash. I read that people that stored their BTC on coinbase will get to claim their bitcoin cash, but they won't have access to it until the 1st of next year.

Yea, which is another example of why you should store your crypto in places where you hold your private keys. :)

Isn't it the case that BCH can lose many times, but has to win only once for this to occur? Thus it will always be a risk?

Not at all. See BCH maximalists ( I can't believe I'm typing that) want BCH to be THE Bitcoin. The issue is that it isn't. They can manipulate over and over just like any other shitcoin, but it's just price manipulation to get an advantageous price for miners to sell and dump on those who bought to join the pump. BCH is likely the largest pump and dump ever.

When I read in different crypto-related websites I see that there is also a lot of people claiming BCH is the real Satoshi coin because BTC was never meant to be what it became after segwit. It's another point of view worth considerating..

I guess you don't know me. I did consider it. I watched all their little hype youtube videos and all. The issue is that I'm a software engineer and I know what limitations could've been put in the code initially. They weren't put in and the code was made to be able to be adapted to what was needed. Bitcoin as released in 2009 is not what was intended to be forever. The way BCH devs and backers approached this was beneficial to the backers. BCH is and will always be able to be manipulated through the EDA. That's not good for anyone but those gaining by manipulating it.

Hey sorry for the late reply, I'm still finding out about Steemit and quick ways to get back at posts. You are right I don't know you, and I'm not claiming you are wrong. As I'm sure many of us I am just trying to keep an open view and not taking the first thing I read for truth. I thank you for your comment and will surely use it to finally make my own decision about what to do with my BCH. Have a good day!