A Brief(ish) History of XRP

Like it or not, XRP has grown to become one of the success stories in crypto, with a large community of supporters behind it. Yet it remains one of the most controversial assets within the space. Whilst this is not a comprehensive analysis, by learning from it’s history perhaps we can present an overview of what has led to its key successes so far, and also why it is still the subject of so much hate.

Definitions

The terminology surrounding the XRP ecosystem has, rightly or wrongly, often been used interchangeably, so to help avoid confusion lets try to nail down the definitions from the start.

What is XRP?

XRP is a crypto currency, a digital asset that lives on a public ledger that can be transferred using digitally signed transactions.1 There is a max supply of 100 billion XRP, being divisible by 6 decimal places, meaning that the smallest unit (one drop) is 1 millionth of 1 XRP.

What is the XRP Ledger?

The XRP Ledger is built on open-source technology since 2013. It is the public distributed consensus ledger that XRP is native on (compared to blockchain technology that Bitcoin is based on). It supports a decentralised exchange for other assets, fast payments, and more. It can settle payments in just 4 seconds with negligible energy consumption. This compares with up to 2 minutes plus for Ethereum, up to 1 hour plus for Bitcoin and up to 3-5 days plus for traditional systems for example. It can handle 1,500 transactions per second and is scalable to that of Visa.2

What is Ripple and RippleNet?

Ripple is a company headquartered in California with over 200 full time employees that owns about 60% of all the XRP in existence. Ripple is utilising XRP as a settlement asset for international payments to go with its payment platform, RippleNet.

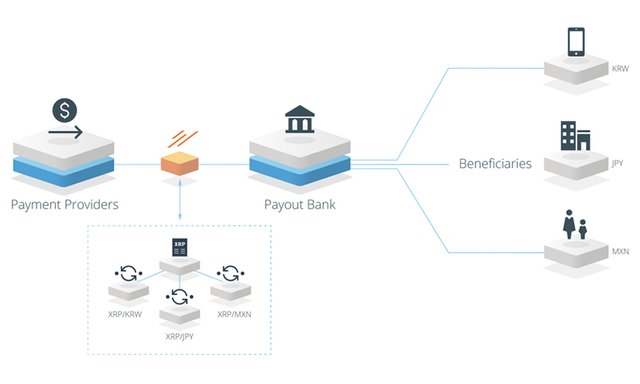

Ripple describes RippleNet as “a global network of banks and payment providers using Ripple’s distributed financial technology, which provides real-time messaging, clearing and settlement of financial transactions”.3 It is made up of the xCurrent (built around Interledger Protocol (ILP) - an open, neutral protocol, that enables interoperation between different ledgers and payment networks),4 xRapid and xVia product suite. These are not open source and have been built on top of rippled which is open source.

Confused?

XRP can be used as a settlement asset within RippleNet, but doesn’t have to be. RippleNet cannot exist without Ripple the company’s software. The XRP Ledger and native XRP asset are independent of Ripple and RippleNet and would continue to exist with or without Ripple and RippleNet.

Background

XRP was conceived by its founders, Chris Larsen, Jed McCaleb and Arthur Britto in 2012,5 however the events that led up to this started many years before and provide an important background to the digital asset.

Ripplepay

Ryan Fugger is a web and decentralised systems developer from Vancouver, Canada and the founder of The Ripple Project (Ripplepay.com), essentially the predecessor to what has now become the XRP Ledger. This was back in 2004, way before Satoshi Nakamoto penned the famous Bitcoin whitepaper on 31st October 2008. Ripplepay.com was launched by Fugger in 2005 and is described as “a financial service that allows you to extend credit lines to your friends, family, and associates and make secure payments in traditional and online currencies” by a version of the site that still exists.6

Even the Bitcoin founder is thought to have commented on this version of Ripple in a response to a query from Mike Hearn (former Bitcoin core developer, now at R3)7 in 2009, stating:

“Ripple is interesting in that it’s the only other system that does something with trust besides concentrate it into a central server.”

Satoshi Nakamoto8

Meanwhile, Jed McCaleb (the former owner of Mt Gox, now Co-Founder and CTO at the Stellar Development Foundation) had been working on the eDonkey Network (a decentralised peer to peer file sharing network). In May 2011 however, his attention turned toward developing a digital currency system (the XRP Ledger) along with Arthur Britto and David Schwartz (now Chief Strategist and CTO respectively at Ripple) who joined him later that year, by which the members of a network validated the transactions in contrast to the proof of work system that was by then being used with Bitcoin.9 Chris Larsen (now Executive Chairman at Ripple) who had co-founded several Silicon Valley tech startups joined Jed in 2012 and together with Jessie Powell (Founder and CEO of Kraken) they reached out to Fugger to discuss their concept.10

Following negotiations with Fugger and members of the existing Ripplepay network, Fugger agreed to pass over control of Ripplepay to them.11 In September of 2012 they went on to also found OpenCoin, Inc, although less than a year later following an internal dispute, Jed McCaleb left the company.12

OpenCoin (to Ripple Labs to Ripple)

OpenCoin then began developing the protocol, building on the work done by Fugger, the founders and initial architects, seeking to enable the near instant, direct transfer of payments between two parties in any currency. This would dramatically improve upon the transaction fees and time delays within traditional systems that came before it. Amongst early investors in OpenCoin were Andressen Horowitz, Bitcoin Opportunity Fund (now Digital Currency Group),13 Roger Ver and Google Ventures, helping to provide an initial capital injection to OpenCoin and the projects it was working on.

A lot of the original XRP terminology was (and continues to be in places) “ripple” based - the “RP in “XRP” itself, the “rippled” server, the “ripples” nickname for the crypto currency, the smallest unit of XRP “drops”, etc. Had the main company utilising the XRP Ledger remained as OpenCoin, perhaps the distinction between the two would have been more obvious and less confusion developed down the line. As it was, OpenCoin rebranded to Ripple Labs in September 2013, then in October 2015 to just Ripple (though its legal name still being Ripple Labs, Inc).14 Since then, the interchangeability in terminology used to describe the company, the network, the XRP Ledger and XRP itself have caused confusion to those new and old in this space and has perhaps helped towards fuelling the centralisation argument of its detractors.

Recent events have sought to help make the distinction clear again however following the launch of a community-based project for an independent symbol for XRP that concluded in June. Subsequently, Ripple’s triskelion has started to be removed from exchanges, trackers, etc as it represents their company rather than the XRP crypto currency. The word “Ripple” has also been updated to “XRP” by some (much like EOS is just “EOS”), others however are refusing to do so.

Launch

XRP came into existence in 2012 with a 100 billion supply. Of which, 20 billion XRP were retained by the creators (Jed, Chris and Arthur - also founders of and shareholders in OpenCoin) and the remaining 80% were gifted to OpenCoin, Inc. According to a post to the old xrptalk.org forum by Jed McCaleb from May 2014 his personal share was 9 billion.15 It is thought that Chris Larson’s share was 7 billion XRP.16 Whilst criticism is made of the percentage of XRP that the founders gifted to the OpenCoin company, it was in the context of a very different funding era, where although OpenCoin had secured approximately $9 million in venture capital funding, that was a very small budget in Silicon Valley startup terms and certainly compared to more recent ICO fundraising. That funding would not last long-term therefore and the OpenCoin team knew they would need more resources to continue to develop both the public XRP Ledger and their own commercial product suites. Hence the founders gifted almost all of their XRP to OpenCoin, Inc.17 Most of this has now also been placed in a cryptographically-secured escrow account to create certainty of XRP supply at any given time and alleviate concerns that this could just be “dumped” on the market.

Long before there was any concept of an ICO, there were also public giveaways (or airdrops) of XRP on Bitcointalk forums. A least one of these receivers seemed to exchange them for Bitcoin fairly quickly however, something which in hindsight he may or may not regret.18 Other airdrops and charitable cause giveaways continued into late 2013 too, all designed as methods to promote XRP adoption in contrast to later fundraising methods used by other crypto projects.19

Post-Launch

The airdrops to forum participants created a great deal of interest and “buzz” around the digital asset, even the likes of Vitalik Buterin and Eric Voorhees can be seen posting their XRP addresses in the thread to claim the airdrop. However, it was not without its critics. According to posts in the Bitcointalk forum itself, early Bitcoin investors apparently concerned that this initial success was going to lead to XRP dominating the crypto currency space (therefore impacting their investments) began offering bribes of over $500 (5 BTC at the time) to say that XRP and Ripple were a scam.

One Bitcointalk member recalls receiving a message saying that “a user going by the name of “TradeFortress” was paying forum members 5 BTC to edit their posts in this thread to say that, "Ripple is a scam." He went on to say that the message even provided the exact text TradeFortress wanted each user to post: “Ripple is a scam! Ripple is a get rich quick scheme for it's creators, a private for-profit company. It is NOT open source. It is CENTRALIZED, akin to PayPal rather than Bitcoin. For more info, visit RippleScam.org.”. The website referenced has since been closed.

Perhaps some genuinely did and still hold this opinion, as is their right. Perhaps the mantra just became embedded in some people’s minds and repeated to others over time. Some may have held genuine concerns that one company was the main driving force behind XRP development and may profit from it. To be fair however, at one point Satoshi was the only driving force behind Bitcoin, a central figure(s) and arguably now there is centralisation around certain players in the Bitcoin ecosystem. Would anyone begrudge him/her/them from profiting from that now, or anyone else who was holding for that matter? Given that this exact text is posted by multiple users, multiple times in the forum (predominantly in red), it does seem to suggest it was more about making a quick buck, at least at the time anyway. Some Bitcoin supporters who had defended accusations against BTC being a ponzi scheme and a scam prior to that were now using the same tactics against XRP.20 Unfortunately, this winner takes all mentality still remains a challenge in crypto today. “Maximalists” in any industry who had first mover advantage never thought anything else could/should surpass their company/platform/product/service either.

By mid-2013, an XRP community had begun developing, with the XRPTalk forum spinning off from Bitcointalk members that saw the potential XRP had to offer. Though eventually replaced by XRPChat, the forum was the catalyst behind the growth of the XRP community, which is now one of the largest in the crypto world and active across various social media platforms.

XRP then began to increase its trading volume, though initially dependent on a small number of exchanges, including Bitstamp and Gatehub. The volumes were small compared to today’s standards, but an important step in establishing XRP as one of the most widely exchanged crypto currencies post 2016.21

Strengths and Successes

The XRP Ledger is fast, settling payments in 4 seconds and aiming to improve on that. That’s hard for anyone to beat. It can handle 1,500 transactions per second 24/7 and can scale to handle the same throughput as Visa. It has a minimum transaction fee of just 10 drops (0.00001 XRP or approximately $0.0000044 as current rates). This is not paid to any party however and is irrevocably destroyed as an anti-spam feature (along with the XRP account reserve balance) designed to make it prohibitively expensive to DDoS the XRP Ledger network. Whilst the transaction cost is pretty non-existent, there are others like IOTA for example that offer a zero transaction fee.

It is versatile and acts as a bridge between currencies. It’s also distributed - using open-source technology, built on the principles of blockchain with a growing set of validators.22 Decentralisation is also increasing as one Ripple operated validator is removed for every 2 independent validators added to the recommended Unique Node List. Bitcoin and Ethereum for example are both seen as being more decentralised, however the XRP Ledger is aiming at being more decentralised than these both by the end of 2018 according to Ethan MacBrough (former Ripple researcher, now Lead Scientist at Coil) who said “By end of 2018 we will have a diverse array of trusted validators more decentralized than Bitcoin or Ethereum”.23

The XRP Ledger has proven security and stability being the only public blockchain that has experienced no reversed transactions, no censorship and no major operational issues for over five years, making it ready for institutional and enterprise use. All of the over 40 million ledgers have been closed without issue since inception.24

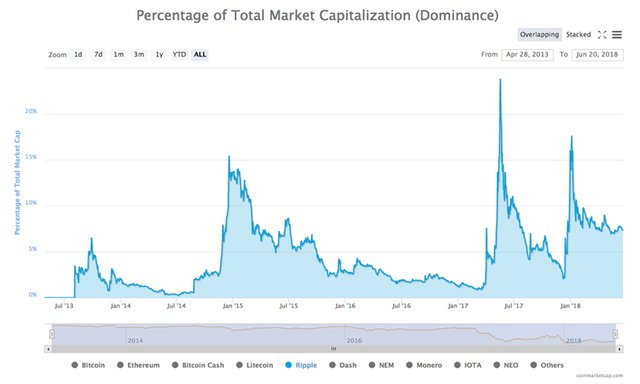

Despite the inevitable peaks and troughs of any asset, XRP has seen increased market share, or dominance as a percentage of the total crypto market capitalisation over time, from 3.46% in August 2013 to around 7.33% at the time of writing and over 20% in peak periods. It has held the 2nd or 3rd market position for most of its history. As a comparison, Bitcoin has gone from 94.24% to 40.02% in the same time period, peaking at 96.18%. The explosion of Ethereum saw that crypto move from 3.14% to 18.63% in a smaller time period from August 2015 to present however and other crypto currencies have outperformed XRP in smaller time frames.

On the exchange front, it has gone from being available on just a handful of exchanges in the early years to over 60 today and boasts a typical current daily volume of over $230 million.25 Also, in an era of growing excitement towards the advent of decentralised exchanges, a little known fact is that the XRP Ledger has had a decentralised exchange built into it from the beginning, something that savvy players in the ecosystem have already been leveraging for years. Forthcoming decentralised exchanges from the likes of Binance will be a strong competitor to that however.

As Ripple’s xCurrent clients begin migration through to xRapid, where significant further cost savings can be achieved, XRP would then increasingly be used as a universal settlement asset. xRapid is currently being used or trialled by Cuallix, MoneyGram, MercuryFX, Cambridge Global Payments, IDT, Western Union, Viamericas, and Currencies Direct (those that have announced anyway), with Ripple CEO Brad Garlinghouse being quoted saying at the recent Money 20/20 event that “By the end of this year, major banks will use xRapid as a liquidity tool. By the end of next year, I would certainly hope that we will see…in the order of magnitude…of dozens. But we also need to continue to grow that ecosystem…grow the liquidity”.26 Critics however would point to the fact that Ripple’s xCurrent customers do not require XRP and that those using it have mainly done so on a trial/pilot basis with no evidence of permanent adoption of xRapid (although Cuallix, MercuryFX and Viamericas are already entering production usage of xRapid).27 The proof will ultimately be in the pudding, but it’s hard to believe that banks and FI’s aren’t interested in saving more money, and when some of them do, it makes it harder for their competitors to ignore. XRP also only needs to be used for a few seconds at a time (if that’s preferred), therefore, despite concerns about having exposure to a volatile asset, given the maximum timeframes involved the risks are minimal.

Third party initiatives from the likes of the new Coil startup, including the rebirth of the Codius smart contracts solution that complements the XRP Ledger (though offers interoperability with other ledgers through ILP) and competes with the likes of Ethereum will provide additional applications and adoption of XRP as different players in the ecosystem begin to develop new use cases. Ripple’s Xpring initiative will also seek to promote new projects within the ecosystem and there are community efforts too as the XRP Ledger continues to be leveraged in developing exchanges, payment platforms and more.

Problems and Controversy

From the outset and as mentioned, XRP has long faced the accusation of it being a “centralised scam”. We have already discussed the history behind this, but as a general observation genuine scams tend to disappear, not keep going from strength to strength for over 5 years.

Linked to the centralisation label is the view of many that XRP can never be decentralised as even if there are many independent validators, they all use Ripple’s “default list” therefore creating a centralised system. It is correct that Ripple currently has a recommended Unique Node List (UNL). However, according to the company, Ripple intends to remove itself from this process entirely by having network participants select their own lists based on publicly available data about validator quality. This process is also opt-in and each validator directly or indirectly chooses its own UNL. If Ripple ceased operating or acted maliciously, validators could change their UNLs to continue using the network.28 This means that:

• Everyone gets to choose who they trust.

• No one can be forced to trust anyone.

• Validators can't force others to trust them.

Anyone can run a node and/or validator and introduce transactions. If the transaction is valid (signed, etc.) it's guaranteed to be included.29 People will also argue that validators just don’t/won’t change from the recommended UNL. That seems unlikely however. Imagine ordering an Antminer from Bitmain. It will automatically point to the Antpool mining pool run by their company by default. Does that mean everyone will just leave that setting too? Of course not, they will decide what is best for them and whom they want to trust and cannot (rightly) be forced to do anything differently.

“Ripple can freeze XRP” is something that is often repeated amongst detractors. The freeze feature that does exist only applies to non-native assets on the XRP Ledger however and not XRP itself.

There are also criticisms about the initial distribution which we have already covered, but at one point the potential for former founder Jed McCaleb’s large volume selling of XRP was a big concern (he pointed this out in the same XRPTalk forum post we already discussed). This led to a lawsuit that was finally settled in 2016 with an agreement on future resale terms however.

Aside from this, there have also been other lawsuits over the years, perhaps one of the most notable in September 2017 when R3 sued Ripple for specific performance of an option agreement in which Ripple agreed to sell up to 5 billion XRP for a certain price. Ripple countersued claiming that R3 reneged on a number of contractual promises, and was acting in a spirit of opportunism after prices had subsequently increased more than 30 times. A Delaware judge ruled in favour of Ripple, however the case is still continuing in California and New York.30

Others will also say that XRP is a “bankers coin” and banks will die. Yes, banks and pretty much any company in the payments world will likely have to adapt or face being displaced, but broadly speaking, in the real world banks aren’t going anywhere anytime soon. Power and control over your own money has changed forever. If you want to be your own bank, now you can. Not everyone will have the same view.

“XRP was all pre-mined” is another accusation thrown its way. The terminology is strange however as the concept of mining relates to proof of work crypto currencies only. So, if people mean XRP is not a PoW crypto by saying this, then yes they would be correct. It is also a strange negative however as once all BTC is mined for example at that point it will technically be “pre-mined” too, so it’s unclear why that is particularly bad?

There is also perceived regulatory uncertainty surrounding XRP with many in the crypto community wishing to define it as a security. Whilst there has been no definitive ruling, others who have practiced in corporate and securities law suggest this is unlikely.31 Furthermore, supporters have pointed out that following the FinCEN (Financial Crimes Enforcement Network) case against Ripple Labs and its XRP II subsidiary in 2015, FinCEN declared XRP a currency, not a security. As FinCEN have already signed an agreement with Ripple, allowing them to continue their XRP sales, if XRP is an unlicensed security then FinCEN now has to explain why they signed an agreement allowing the sale of said unlicensed securities.32 Perhaps we will see further clarity once the current pending lawsuits surrounding this matter have been heard. Perhaps they were simply delaying tactics to an inevitable announcement too?

Conclusion

Whilst many take a different viewpoint and are right to continue to ask questions of Ripple the company, evidence suggests that XRP should be considered a crypto currency like any other (or digital asset if you prefer). Decentralisation concerns are understood, however I believe the transparency provided by Ripple regarding their involvement and holdings, the solutions they have put forward and the growth in independent validators all over the world answer those sufficiently. The perception of many won’t change, as it’s easier to believe and regurgitate sound bites from popular forum members or activists from one coin community or another, than to conduct your own research. And that happens both ways too. It’s also partly a symptom of “The Highlander Syndrome” that seems to have built up in this industry that there can be only one and so others are disregarded or mocked. As a person (albeit perhaps a rare one) who is involved in and finds a use case for Bitcoin and XRP amongst other crypto currencies, I am most impressed in Ripple’s stance that building bridges and interoperability are more important than building walls. Mainstream adoption won’t come to an industry of in-fighters. It will come to an interoperable system with a history of delivery where assets compete on a level playing field to provide a realistic option to move away from the traditional systems of the past. But that’s just my 2 XRP.

Disclaimer: I am a user of Bitcoin, Ethereum, XRP, IOTA, BNB and other crypto currencies.

![]() By James Hunt (@humanjets)

By James Hunt (@humanjets)