$$ LESSON 2: Why Teach Financial Literacy

I've decided to write in a different way compared to $$ LESSON 1, because I want to engage more with myself and with you, rather than just me and the book.

From now on, my $$ Lessons series will focus on discussions and self-reflection. I will also provide a quick summary of the lesson so that you know what I'm talking about.

Summary of Lesson 2

In this age, the world changes faster and more frequent than 1929 stock crash and the Great Depression, what's more, important than money to ensure our survival is financial literacy.

It's not how much you make but it's how much you keep - and how many generations you keep it.

The number 1 rule is "You must understand the difference between asset and liability, and only buy assets". It's so simple but why people don't get it? It's because they have been educated by financial planners, bankers, and brokers so they must empty their cups first.

What defines the difference is not words but numbers.

An asset puts money into your pocket, whether you work or not. A liability takes money out of your pocket.

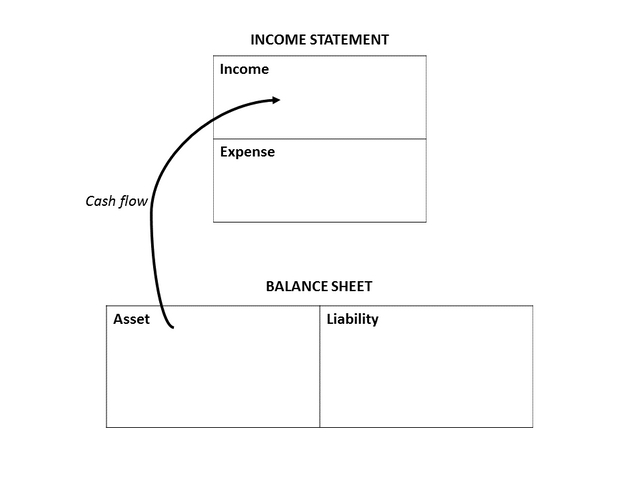

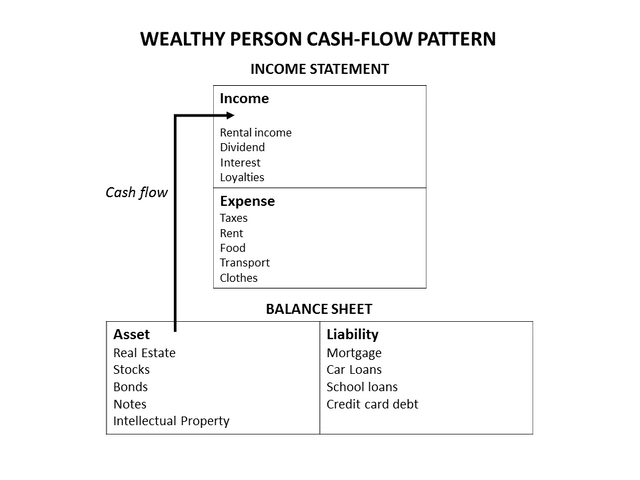

Cash flow of an asset:

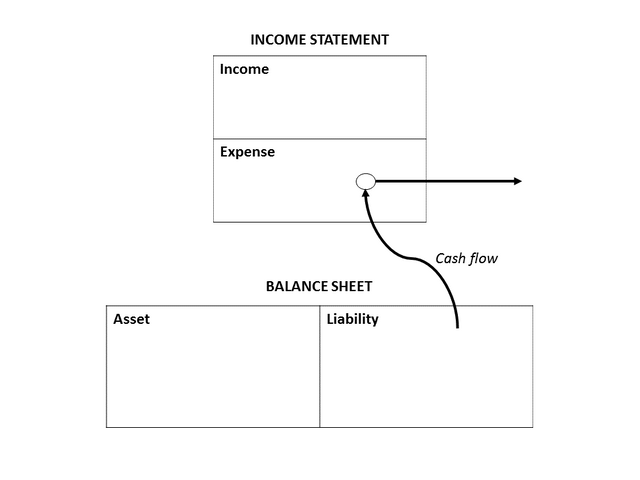

Cash flow from a liability:

So many people struggle because they buy liabilities, so in order to gain and maintain wealth, you must first build understanding of assets and liabilities.

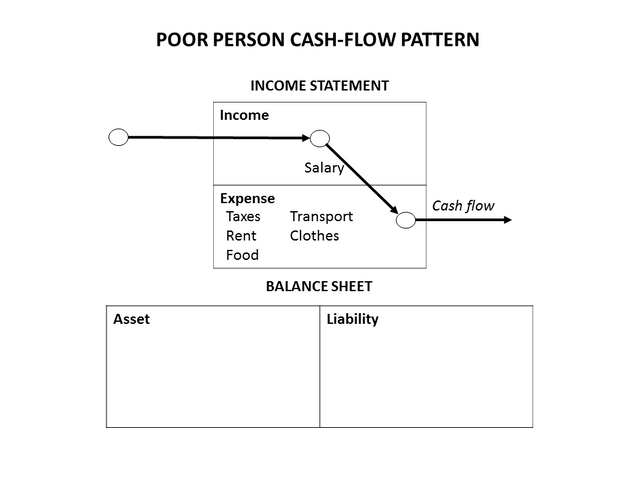

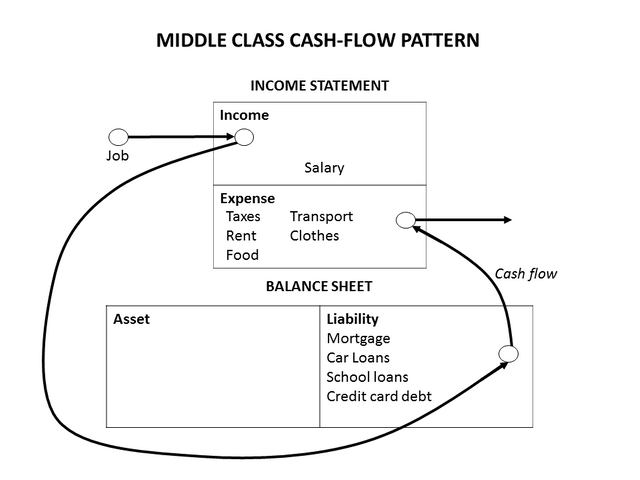

Follow how the cash flows and it'll tell you a story of how a person uses the money.

These diagrams are obviously simplified because imagine Rich Dad teaching to two 9 years old kids.

More money doesn't solve problems because higher income means higher expense. What is missing from the majority is financial education. That's why you can be professionally successful but financially illiterate.

The story of a typical young couple.

A couple gets married

Their income increases (because they combined) and so do their expenses

The no.1 expense is tax (income, property, road, etc.)

Buy a new house, spends more on furniture, renovation, and appliances.

Buy a new car, spends more on fuel and maintenance.

Suddenly liabilities increases, filling with mortgages and credit card debts.

A baby added to the mix, the young couple works harder for promotion or raise. But higher salary means higher tax.

Continue to get more debts, eventually rolling into debt consolidation plan

This is a Rat Race. This young couple's true problem is not knowing how to handle their money. So many people don't stop and think "Does this makes sense?" but instead they follow the crowd like,

Diversify your money

Your home is an asset

Play safe

Get a safe job

Buy the shares now

Robert teaches your home is a liability. Why? Because it takes money out of your pocket - taxes, expenses, loss of opportunities when all your money is tied up in your house. And that causes you to lose experience in other investments. That doesn't mean you can't buy a house, but first secure assets that can generate income to pay for the house.

Assets first, liabilities later

When assets are big enough to cover your expenses and liabilities, the balance is reinvested back into your assets, growing your income. This is what the wealthy do.

What the middle-class does is work hard for promotion resulting in higher taxes. They also treat their home as an asset and do not invest in income-producing assets.

According to Robert's definition, wealthy means when your assets are enough to cover your expenses, you're not rich but you're wealthy.

End of summary

I have omitted a lot of details but these are the super important ones. Now is the real deal of the post, Discussion, and Self-Reflection.

What was Robert saying?

Take the time and understand each quote. You don't need to agree or disagree, just try to understand. This is a discussion.

It's not how much money you make, it's how much money you keep.

Tifa: I should aim to save more money rather than generating more money. Those savings can be used to buy income-generating assets. It's useless to buy a lot of assets and at the same time my spending increases. In the end, I don't have much money left. Also, the more money I keep, I can pass it on to the next generations, and I don't pass only money but I also pass down assets that I have.

Intelligence produces money and solves problems. Money without financial intelligence is money soon gone.

Tifa: When it comes to money, I need to think logically and ask myself "Does this makes sense or not?", "How to use this money wisely?" and separate me from desire. Even though I have a lot of things I want to buy, but my focus should be spending that money wisely and focus on buying assets, not expenses. Else, if you give me 1 million dollars, I'll spend it all on traveling and I'll be back to square one in a year's time.

Rich people acquire assets. The poor and middle class acquire liabilities that they think are assets

Tifa: This is tricky. I don't really have much understanding before this, so I don't know what are the liabilities that I think are assets. After you have seen Robert's teaching on assets and liabilities, what do you say about this quote?

If your pattern is spend everything you get, most likely an increase in cash will result in an increase in spending

Tifa: I cannot agree more to this! I used to have a higher salary but I spend a lot more on clothes, computer gadgets, games, game cash and make-up stuff. But now my salary is lower, I need to change my lifestyle and manage my money better. Thus, I get to save even more than before!

By not fully understanding money, the vast majority of people allows its awesome powers to control them

Tifa: I don't understand stock markets, intellectual properties, shares, bonds so I don't dare to take risks to invest in them. I know they're assets but I'm scared because I don't know how they work, you see. You guessed it right, fear is controlling me right now :(

At least now I know fear is controlling me :)

Additional Questions

Be honest with yourself. If you do not like some of the answers, ask yourself if you're willing to change and accept the challenge to change your thoughts. Don't worry, I'm doing this with you :)

1. When did your financial education begin? Was it with this series or from another source?

My first proper financial education begin when I started to read Rich Dad Poor Dad by Robert Kiyosaki. I've heard a lot of rumours about investments, assets, and liabilities before but nothing as proper as this book.

2. How did you react when you first read Robert's definition of assets and liabilities?

Is it really that simple? Really? Why didn't I realize it earlier?? All these while, my money has been going into liabilities and expenses.

3. How did you react when Robert stated that your home is not an asset? Did you change your mind after his argument?

My home belongs to my father's so I don't have any opinion on this. But I think houses that you don't stay in and you rent it out or sell it at a higher price is an asset. That's why property investment is booming right now.

4. Which cash-flow situation looks most like your life?

Middle class :(

All of my salaries go into liabilities like my car loan, insurance, taxes, and expenses like food, petrol, internet, and etc. I didn't buy a single asset!!!

5. Other than your home, is there something that you thought was an asset but it turns out to be a liability?

Hmmm, nope.

6. Would you agree with this statement: "What's missing from most people's education is not how to make money, but how to manage money"? Why or why not?

I agree because, in school, we learn biology, chemistry, physics, mathematics, history, and language so that we can use those skills in our future career. Basically, the school is teaching us how to work for companies, industries. Ultimately, this means school is teaching us to make money by working. If we get good grades, we get a good job and money will come eventually. How I wish this is true! But in reality, a lot of people still trapped in a rat race (including me) and don't realize it.

7. Rich dad told the boys it's not numbers that matter in accounting, it's the story told by the numbers. What story do the numbers in your life tell?

My financial statement obviously tells me a few things.

- I don't have a single asset

- I have only a single source of income. Without my job, I can't survive a single month.

- All of my income is poured into liabilities and expenses

- My liabilities is more than my assets, same goes for my expenses is more than my income.

The conclusion is I am still not managing my money wisely.

8. When was a time in your life that a positive accomplishment such as promotion or raise, didn't lead to the financial statement you've anticipated?

I get a little bit of increment (around RM100-150) every year, but I am still struggling with money. I don't have enough savings and I keep spending. It's like the increments never existed. I spend whatever I have. I now realized I have a really, really bad financial aptitude. The quote "higher salary, higher spending" fits the "old me" perfectly. I'm getting better now because I have a very diligent accountability partner that kinda "monitors" my expense and tracking.

9. How many days forward could you survive if you stopped working today? Does that number surprise or frighten you?

0.5 months... OMG!! Given my current financial state, I cannot stop working! If I stop, I'll only be able to survive for 2 weeks... This is bad... THIS IS BAD!!! It's a wake-up call for me to start buying income-generating assets and review my financial statement.

Share your opinions on the summary, quotes or questions. I love it when you participate in the activity with me 😍 😍

@tifaong writes simple and positive practices and ideas that you can learn (or re-learn) and apply in your life immediately. She covers life lessons, self-help, relationships, and motivational contents. Her mission is to spread positivity so that we can live a happier, fulfilling life.

Click the banner to check out her profile 😁

#Newbieresteemday

#Greetersguild

Follow @greetersguild and join us on discord to learn more (newbies and non-newbies welcome). We are always looking for more Greeters to join our team! https://discord.gg/3jYNPUx

You've been upvoted by TeamMalaysia Community :-

To support the growth of TeamMalaysia Follow our upvotes by using steemauto.com and follow trail of @myach

Vote TeamMalaysia witness bitrocker2020 using this link vote for witness