Financial Inclusion - An Unseen Problem

With one of my first posts on the Steemit community, i feel like addressing the issue of Financial Inclusion is a much needed topic to raise awareness and to further take steps that could help solve this growing and not foreseen issue. I feel like doing this through a series where i would start with what the problem is or defining the problem to drawbacks, results etc. and further try and provide a feasible solution. So following is my first episode in the series regarding financial Inclusion and i hope you people like it.

I would like to start by stating first what is Financial Inclusion, as this is a term misunderstood by a lot.

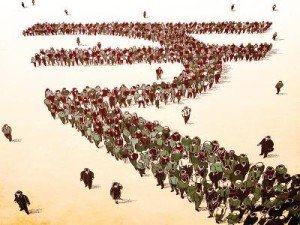

Making financial services and products available for all individuals and businesses, without discrimination is what financial inclusion precisely elucidates. According to The World Bank approx. These financial services include services like - transactions, payments, savings, insurance and credit, all of these provided in a sustainable and responsible approach. According to The World Bank, approx. 2 billion people around the globe don’t have a basic account. A basic bank account is the fist step in the long ladder of financial inclusion since it allows people to store their money, also send and receive payments and having approx 38% of the total adults without a bank account, is an alarming situation. The great challenge before us is to address the constraints that exclude people from full participation in the financial sector. Of these people 59% of the adults without an account describe the lack of money as a reason, leading us to the reality that financial services are not yet affordable or are designed to fit low income users. There are several other barriers to the same some of which include - lack of papers required for documentation, distance from a financial service provider, lack of trust etc. Digital financial technology or “fintech” comes as a savior along with the widespread use of mobile phones providing access of financial services to hard-to-reach population and small businesses. Some of the benefits of fintech include - Digital Id's enabling people to open an account and making it easier than ever. Digitization of cash payments, Mobile-based financial services, bring convenient access to remote areas. As counties worldwide increase efforts towards financial inclusion, there is still a long way to go for a financially included world.

Once we are clear with what Financial Inclusion is about here are some min blowing facts put forward by the UN which help further to realize how big or large the problem actually is. ( Source of facts : UN ) These facts all explain how large the problem is or what is the scle of the problem.

Some of the statistics from The World Bank that emphasize the need of financial inclusion are as follows : Out of those unbanked, the majority of people are from developing countries, where according to The World Bank 46% of adults are unbanked as compared to 6% in high-income OCED economies. South Asia, East Asia and the Pacific are home to more than half the world’s unbanked. In South Asia, about 625 million adults lack access to an account; in East Asia and the Pacific, about 490 million do. Indeed, just three Asian countries—India, China, and Indonesia—together account for almost 40 percent of unbanked adults globally. India is home to 21 percent of the world’s unbanked and about two-thirds of South Asia’s. China accounts for 12 percent of unbanked adults globally and Indonesia for 6 percent; together they are home to 7 of every 10 unbanked adults living in East Asia and the Pacific. Sub-Saharan Africa, with about 350 million unbanked adults, accounts for 17 percent of the global total. Further, there are differences in the basis of gender, 42% of the women are observed to be unbanked as compared to 35% for men, a difference of 7% based only on gender difference, the situation is even worse in developing countries where the gap reaches at 9%. Overall, women make up 55% of the world’s unabnked population. Difference also emerge by household income. The poorest 40 percent of households within economies account for about half the world’s unbanked—about 1 billion adults.

With this topic explained in my further episodes i would present some of the causes and how this effects an economy. Stay tuned for further episodes if you liked this. :-)