2019 Tax Year Information These effect This coming up tax season

This article gives you the tax rates and related numbers that you will need to prepare your 2018 income tax return. In general, 2018 personal income tax returns are due by Monday, April 15, 2019.

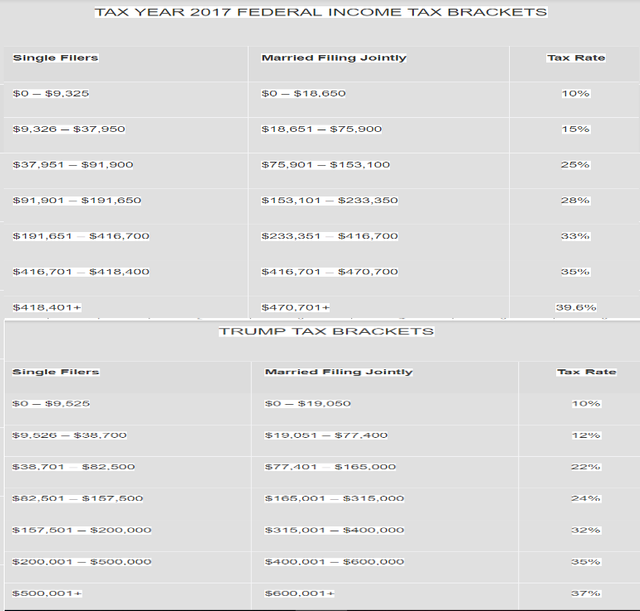

The Federal income tax has 7 rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. The amount of tax you owe depends on your income level and filing status.

These tax rates are new and come from the Tax Jobs and Cuts Act of 2017, which was signed into law by President Trump on December 22, 2017. These tax changes are effective as of January 1, 2018.

While there are still 7 tax brackets, the rates have decreased overall. (These lower tax rates will expire in 2025, unless Congress votes to extend them.) The top rate is reduced from 39.6% to 37%. The bottom rate is still 10%, but it now covers more income.

Remember that moving into a higher tax bracket does not mean that all of your income will be taxed at a higher rate. Instead, only the money that you earn within a particular bracket is subject to that particular tax rate.

Here are the 2018 tax rates and brackets organized by filing status:

.png)

.png)

NOTE: There are no personal exemption amounts for 2018.

2018 Standard Deduction Amounts

There are 2 main types of tax deductions: the standard deduction and itemized deductions. You are allowed to claim one type of deduction on your tax return, but not both.

For instance, if you claim the standard deduction, you cannot itemize deductions – and vice versa (if you itemized deductions, you cannot claim the standard deduction). You can use whichever type of deduction results in the lowest tax.

The standard deduction is subtracted from your Adjusted Gross Income (AGI), which means it reduces your taxable income.

.png)

Note that there is an additional standard deduction for elderly and blind taxpayers, which is $1,300 for tax year 2018. This amount increases to $1,600 if the taxpayer is also unmarried.

On December 22, President Trump signed the GOP’s sweeping tax bill into law. Under the new tax code, the child tax credit will increase from $1,000 to $2,000. This begins for tax year 2018 (when you file taxes in April 2019). Additionally, the plan adds a $300 credit for each non-child dependent or parent for five years.

Trump’s tax plan originally called for cutting the number of tax brackets in the federal income tax system from seven to four, but the final version of the bill maintains the seven brackets. It does, however, change them. The new Trump tax brackets have rates of 12%, 25%, 35% and 37%.

This is how Trump’s tax plan stacks up against current federal income tax brackets:

Trump Tax Plan Calls for Increasing the Standard Deduction

There are deductions to consider as well. Changes are coming for taxpayers who take the standard deduction and for those who itemize. The Trump tax plan increases the standard deduction to $12,000 (for individuals) and $24,000 (for married couples filing jointly).

Under the old tax plan, the individual standard deduction is $6,350 for individuals and $12,700 for married couples. In other words the standard deduction nearly doubles under the Trump tax plan.

Trump Tax Plan Increases the Child Care Tax Credit

The child tax credit for tax year 2017 (impacting the taxes you filed by April 2018) was up to $1,000 per child. It’s a credit as opposed to a deduction. This means that it reduces your tax bill on a dollar-to-dollar basis by up to $1,000 per child. Say for example, you owe the IRS $4,000 and are eligible for the full $1,000 credit, you would now owe $3,000.

The Trump tax plan increases this credit to $2,000 for children under 17. The bill also changes who is eligible for the credit. Filers may claim the full credit if they have income up to $200,000 for single filers (up from $75,000 currently) and up to $400,000 for married couples (up from $110,000 currently).

On November 9, the House tax-writing committee amended Trump’s tax bill to keep the adoption credit. The adoption credit continues to be worth up to $13,750 per child.

Trump Tax Plan Lowers Corporate Tax Rate

The old corporate tax rate was 35%. Trump originally went on the record saying he hoped it would be slashed to 15%.

However the final tax plan reduces the corporate tax rate to 21% (down from 35%).

Earned Income and AGI Limits

.png)

Investment Income Limit

Investment income must be $3,500 or less for the year.

Maximum Credit Amounts

The maximum amount of credit for Tax Year 2018 is:

$6,431 with three or more qualifying children

$5,716 with two qualifying children

$3,461 with one qualifying child

$519 with no qualifying children

These amounts are slightly higher than last year.

Time to cite sources

ALL of this information was taken straight from these pages and was not edited for content. This is real tax information for this coming year. And as such can not be made personal.

I simply put them all together to form this report, so all the information will be in one place. And some information was used to show a comparison from last year.

https://www.irs.com/articles/2018-federal-tax-rates-personal-exemptions-and-standard-deductions