[Weekly Roundup] 2018/08/24 SEC officially rejects 9 bitcoin ETFs. The winter is coming.

We provide the weekly roundup report in both English and Chinese version. MICA focuses on Asia's cryptocurrency advisory services. We provide integrated solutions for ICO projects, which covers from technical evaluation, token model design, coin listings, private investment roadshow and press release.

Ifyou are interested in our service, please contact us via [email protected]

Our press platform: https://blockcast.it/

The rejection of bitcoin ETFs will make investors re-focus ICO markets and real potentials of projects will be the key for fundraising.

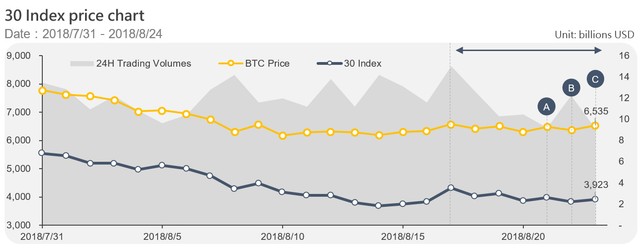

The most popular topic in August is the approval of bitcoin ETFs by SEC, pushing the bitcoin dominance continuing to grow. However, crypto investors’ expectation is beat by SEC’s official rejection of 9 bitcoin ETFs on August 23. Besides, China’s regulation is intensifying. This week the government not only blocks blockchain media’s accounts on WeChat but also prohibits any forms of meeting or conference related to cryptocurrencies in any public space of Beijing. This bad news didn’t scare the market confidence badly. The bitcoin price only dropped 4%, stable standing at $6400 and the top 30 market index is stable, weighed at 3,876. The above data and facts indicate the winter of cryptocurrencies is coming and the market will stay in range-bound. In a short time, the market variation will be low. That is, it’s the time for the investors to calm down and examine the intrinsic value of ICO projects instead of speculation. We believe the winter is good for the market and blockchain industry to develop positively. In the past, ICO teams only need to invest a lot in marketing and promotion to raise millions of dollars instead of focusing on technical developments. In the experience, when the market variation is low, capital tends to move to small-cap cryptocurrency with high potentials to gain extra profits or directly invest in those top ICO project for long-term investments. Therefore, we expect ICO market will regain its popularity in the next few weeks.

A. August 21, China blocked all blockchain media public accounts on WeChat.

China blocked numbers of blockchain media public accounts on WeChat such as Deepchain, Huobi News, Node Capital-backed Jinse, and CoinDaily. However, these media’s website is still operating normally, and other relatively small press stays unaffected. This policy hurt China’s blockchain media badly because most of the Chinese users access the contents through the WeChat news platform, accounting for more than 40% to even 90% of their total traffic.

B. August 22, SEC rejects nine bitcoin ETFs.

SEC announced its rejection of 9 bitcoin funds from ProShares, GraniteShares, and Direxion. The ETFs proposed by ProShares and Direxion don’t possess real bitcoins but derivatives such as bitcoin future issued by CBOE and CME.

C. August 23, China banned cryptocurrency roadshows, meetings, and conferences

The Beijing city government announced its new policy to ban any forms of physical activities related to cryptocurrencies in public spaces. Many events such as meetups, conferences, and forums are all canceled and suspended due to this new policy.

In the short term, we expect a low price variation in large-cap coins. Investors will re-focus on ICO markets.

The regulatory risk of cryptocurrency market has been erased because of SEC rejection of bitcoin ETFs and the following market price revision. Fortunately, the BTC price is stable thanks to the previous restructuring of bitcoin holders. Based on our observation, the whole market won’t expect the price to rise in a short time, and the price variation will be low. We assume, in the next few weeks, the capitals will adopt two strategies for profits:

The first strategy is to target small-cap coins with high potentials. The money will flow in and boost the price up for returns. Small-cap coins will be more profitable than large-cap coins. The second strategy is to re-focus on ICO market. Investors will seek for high potential ICO projects and only invest in those projects with real business values. The reasons behind this strategy are simple. The market has been calmed down. Most retail investors are not as speculative as before. It’s no longer easy for ICO teams to harvest those retail investors by using marketing and sales techniques. Investors will set higher standards for their investment, including technical evaluation, team member due diligence and third-party rating competitions. The ICO team members will also put efforts on the development of blockchain technology instead of road-shows and marketing. The market is not dying. Instead, we believe this is the right time for the blockchain industry to develop positively. And we are excited about it.

Congratulations @micafund! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!