WeTrust Analysis ($TRST)

The following is not financial advice.

Welcome to back The Scoop!

This is the next post at a place where we share analysis and opinions for interesting coins, tokens and pure gems in the vast landscape of the blockchain world. There's so many coins out there, but not a lot of free information (looking at you, paid groups) and analysis on them. The Scoop aims to change that by sharing and improving the data available for a given coin by focusing on evaluating instead of predicting.

Wow, look at that fire sale out there. It's sort of skewing the data on these coins, but still, half price is quite the entry.

What is WeTrust?

It's a collaborative saving and insurance platform that allows you to leverage social trust and reputation to participate in various lending and borrowing programs. Outside of this, future projects include credit identities and even mutual insurance. They want to build up social capital and use it to make p2p lending easier and more beneficial to all participants. The TRST token is used for rewarding folks facilitating trust and is paid by those using the Trust Network.

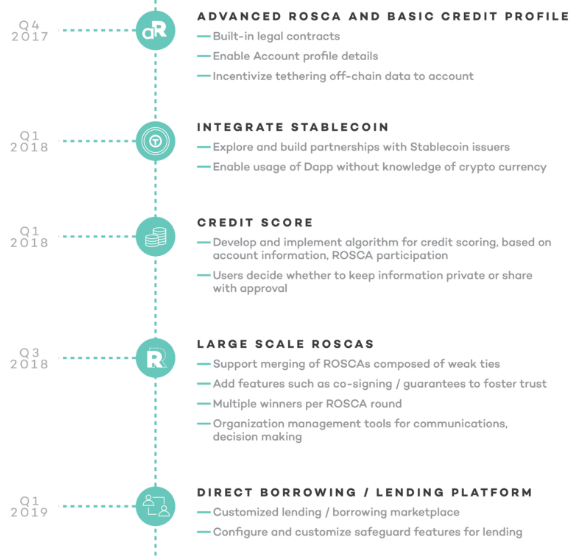

Snip of their roadmap.

Try out the beta TLC product:

https://tlc.wetrust.io

Check out their video.

Where's the wallet?

It's an ETH token, so you can store it in an Ethereum wallet.

Nice whitepaper:

https://github.com/WeTrustPlatform/documents/blob/master/WeTrustWhitePaper.pdf

How many of them are they?

CMC says ~92m circulating with a total supply of 100m.

Who's the team?

Founded by some ex-Googlers and is loaded with developers, marketing and academia folks. Also, Vitalik is an advisor, along with a bunch of other ones whose goal to provide the guidance necessary to make sure the product is successful.

More details:

https://bitcointalk.org/index.php?topic=1773367

What motivates them?

18% pre-allocation for team, marketing and future expenses. A little smaller than usual, which is a good sign.

Marketcap and Competitors?

~55m today with < 1m volume. Clearly an opportunity as it's listed on the high-volume exchange Bittrex.

We're sure there are some, in various sub-industries or with slightly different goals, but none immediately come to mind.

How is TRST different?

The team is actually full of people who have both the business and technical acumen to get stuff done.

Pros

- focus on delivering a product

- low cap

- vision

- great set of advisors

Cons

- competition

- volume

Also, @SecretsofCrypto seems to be a fan:

https://twitter.com/SecretsOfCrypto/status/901120402704834560

Any constructive criticism?

Must get some more partnerships and perhaps enterprise agreements. Adoption is key.

Also, getting listed on higher volume exchanges could help things there.

Where is it traded?

Bittrex claims most of it's volume.

https://bittrex.com/Market/Index?MarketName=BTC-TRST

The Final

Based on the FA, TRST looks like a low to medium risk with high reward potential if they continue to deliver and catch on. Picking it up under 6k sats would be bargain or around $1 - $2 would be an upper entry while still expecting solid, crypto-style gains.

And that's your scoop!