[Financial Freedom] We have re-acquainted with "opportunities!

——Previous review——

Do you really have no chance?

Many people complain about "no chance" for the rest of their lives, but the truth is always full of irony:

In fact, there are always enough "big opportunities" to be "live in front of us", but the so-called "missing" is ultimately only the majority of people who turn a blind eye to this...

There are many such examples, but each one is likely to "didn't look like a good example" - Because the difficulty of this example is that the example to do is to "let the things that were originally turned a blind eye can be understood after the example"... You can imagine this difficulty.

Moreover, once we are discussing opportunities, we are all about "probability" everywhere, and every detail is not "determined", not "100%." Therefore, for those who are not familiar with "uncertainty reasoning", the process of proof is "completely full of loopholes", "have too many places to question", and even can't listen, can't stand, even can't keep up with it..."

But we must seriously discuss it anyway, because we have already "goed on the road", so "going on" is the only choice.

If you look back, you will find yourself missing many opportunities. You will feel sorry for this, also normal.

But what we have to remember is:

This is not the end.

Just like many people will regret it, they have not used the university for four years to fully polish a professional skill so that they can be good enough.

My situation is similar to everyone, and there is no good place to go. I haven't even worked in a career related to college majors.

But what about it? Even if I regret it anymore, nothing will change. Time is still passing fast, so since you are on the road, don't look back.

People always say that "when they lose, they know how to cherish", but they often cherish what they have lost. For the existing ones, they still adopt a disregarded attitude. Then they can only repeat the vicious circle of "lost" and "cherish".

Therefore, instead of regretting that they did not seize the opportunity at the time, it is better to let the future self not regret, and seize the opportunity now. This is what we can do.

Let me first give an example of "Bite the bullet". Please read it patiently - no matter what doubts (doubt and confusion) arise in this process, please put it aside, read it carefully, and then read it again and again. First try to absorb, then analyze the logic, and finally come to a conclusion - I mean, your own conclusion.

In my opinion, what happened in 2016 is actually very important, but most people may not have given enough attention to it:

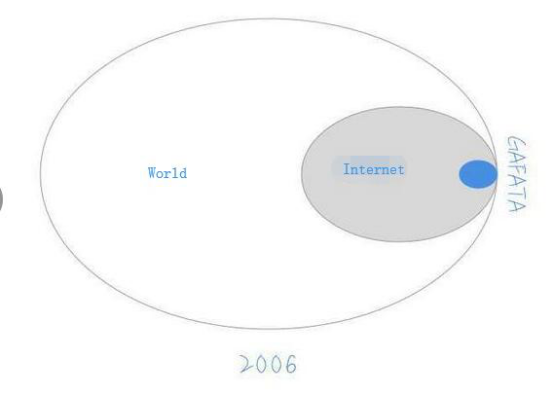

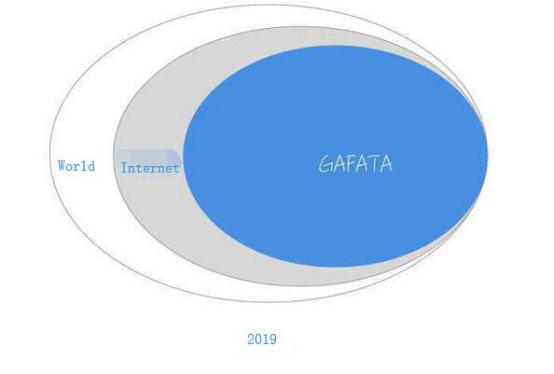

The Internet has really completely occupied the entire world. After more than two decades of rapid development, the Internet has completed its original mission of connecting everyone.

At the end of June 2016, Facebook reached 1.65 billion monthly users - almost one-fifth of the global population (as of July 2018, monthly users reached 2.2 billion, almost one third of the global population (2018 was 7.44 billion)). On the other end of the globe, WeChat, at the end of June 2016, the number of monthly users reached 803 million, which is close to 3/5 of the total population of China (as of the first quarter of 2018, monthly users reached 1 billion, China's population of 1.3 billion).

From another perspective, this became a fact:

All the people in the world who have the ability to consume are basically online...

For a long time before this, the so-called "Internet" was just a "minority group." In 1997, the total number of Internet users in China was only 620,000 - the proportion of the population is low. You can calculate. According to the China Internet Network Information Center (CNNIC) statistical survey report, as of June 30, 2006, the number of Chinese Internet users was 123 million (as of June 30, 2018, the number of Chinese netizens reached 802 million. Is it still a "minority group"?

In the years of rapid Internet development, several companies have become giants. I have just created an abbreviation for them - GAFATA (searching on the Internet, Google has a font called "Gafata"...):

Google Amazon Facebook Apple Tencent Alibaba

For example, if the Internet is a "new world that has finally been built", then GAFATA is the "real estate giants" in this "new world", which provides all the infrastructure and services for business operations on the Internet, including data, cloud, computing, payment, trading, social... So, each of them has completely occupied the "monopoly advantage." So, for a long time, their ability to make money is the strongest, maybe getting stronger and stronger in the future...

The most terrible thing is that they are also making investments!

All the new technologies and services that may appear on the Internet, they are "naturally" and "swallow them" – making many "early investors" engage in a macroscopic view, "at most, divide a small portion" (even the well-known VC in the industry, it is the same fate).

Then, what is the relationship between this fact and the "opportunity", especially the "wealth opportunity"?

First of all, the stocks of these companies have been publicly traded in the financial market, that is, no matter who you are, you can directly buy (invest) the stocks of these companies; secondly, the stocks of these companies are "large-cap stocks", very fluid, if you buy their stock, you can be sold at any time; more importantly, they are likely to grow very strong for a long time in the future - for reasons Well, the above has been explained as completely as possible.

Note that the two words "very likely" in the above wording are not "certain", and in the process of passage of time, the probability of this "very likely" is also constantly fluctuating, possibly amplitude, very quite big...

In my opinion, GAFATA is likely to be opportunity that everyone has the ability to grasp - note that it is only "very likely", not "certain".

However, the low relative risk of investing in GAFATA is indeed a clear conclusion - and the longer the holding period, the lower the system risk may be.

But I am almost certain about the "everyone" in the above sentence - But I believe that most people, even if someone tells him this way, they will still think for one reason or another, even afterwards have the reason they don't understand themselves. Turned a blind eye to this "opportunity" to it. When they reacted, they had to sigh: "Oh, it’s all fate!"

Every year, new black swan takes off and old swan continues to take off.

Whenever we hear these news, we are always excited, but there are very few people who really grasp these opportunities. The key is that after we know it, we have to ask ourselves a question:

what should I do?

As Luo Zhenyu said in the New Year's speech, whether it is a white swan or a black swan, it’s a success if you eat it into your stomach.

Saw a trend, watching it slip away from the side, and finally regret it over there. Such things are repeated year after year, and we should learn more from it.

You may wish to take a look at Luo’s speech and carefully consider the plan for this year compared the previous question.

... I think that in 2026, this text still exist on the Internet - this is one of the benefits of the Internet.

The example is finished.

Note that this example is here, not as a "conclusive evidence", because I know the fact - although I have tried my best to make it clear, actually:

1.It is possible that what I said still have inaccuracies; 2. It is possible that what I said still have incomplete places; 3. Even if I say it is complete, there are still many people who can't understand or understand wrong; 4. For other people whose values are different from me, the above examples are likely to be "can not stand the scrutiny" in their view, or even "all are loopholes"...

So, this example is just used to prove a reason in there:

You see, there are some (big) opportunities, so standing there so clearly, but many people just can't see...

This is a phenomenon that is “invisible”. I have used a more succinct word:

Totallyilliterate.

This is a very vivid word. A pair of good eyes open very big, but nothing can be seen.

It’s not that only illiterate people are blind. Literacy but can't read the article, also blindness. Can understand the article, but can't thinking the truth, also blindness...

At different times, the concept of “eyes” is different, but one thing is the same, that is, without serious thinking.

This is why we need to polish our own cognitive systems.

May be your vision or hearing is innate. But your reading ability and thinking method are not born by nature. The exercise of this part of the ability is precisely the effective way we put an end to the "totallyilliterate".

But don't worry, because the following content is really important.

What about "see it"? Do you think that "see the opportunity, is the opportunity yours?" Obviously not, seeing it, just seeing it, grasping the opportunity is another matter.

The greater the chance, the more people will see a strange tendency:

Face the bigger the opportunity, the worse the people's action.

Regarding GAFATA, I have told privately to many people. I don't think this is something worthy of "confidentiality". Even its value lies in: although it's value very huge, it is so obvious, it is a typical kind of " because it seems too simple to be ignored and despised.

Most importantly, the value of this conclusion can be approximated by the following formula:

The return is equal to the principal multiplied by (1 + compound annualized rate of return) squared per year.

In other words, if you actually act, then your income must first look at that base, that is, how much the principal amount is, and secondly, how long your investment period is, and finally look at the compound annualized rate of return. How high is it, is it 10%, or 20%, or 30%? Serious investor knows, long-term compound rate of return over 25%, is particularly high - the inexperienced investor wants are "at least several times the" rate of return.

Among the people I have told when I have rest, there are not many people who actually do it. I am not surprised about this, because I have encountered more aggressive investment types before, and I have seen more "anyone who is not acting anyway". Of course, I have seen a larger proportion "later sighed that if they had to think more about it then will better" person.

Most people will not take your recommendation seriously.

This is not unusual, because most people are as "totallyilliterate" as I said.

If a thing he really feels good, you don't recommend him to go back to find it; instead, if he doesn't feel that way in his heart, today you have made great efforts to recommend it to him, and he still turns a blind eye.

For example, every year at the beginning of the new year, many people are busy losing weight.

I personally have a wealth of fitness experience, so when someone ask me, I will actively give them advice. But in the end, the people who really listened to it are still few and far between.

So don't be obsessed with seeking other people's opinions. Even if you get really good advice, the most important thing is that you have to practice.

Over the past year or so, when I understand the logic of investing in GAFATA (in fact, just the little bit above), I started to act, and I continued to buy GAFATA on a regular basis, and set the proportions and positions that I thought were reasonable. Formulate the principle of adjusting positions, and then observe, summarize and adjust these principles - I feel that this is not boring at all, I feel that this thing is interesting, and I am not tired. In the last quarter of 2016, I even signed up a fund in Hong Kong to prepare myself and help my friends in the community to invest in GAFATA.

So, never complain about "no chance", that is what other group of people do, anyway, not us.

The problem is that even if you see the opportunity, it does not mean that you can "automatically grasp the opportunity", or you should add continuous thinking and action based on your own thinking, and you will be able to truly grasp the opportunity - it is "possible". It is not necessarily "inevitable" because there is always a factor of luck.

The thing you have to do is to use your own knowledge, think with your own, and then invest with your own capital "responsiblely". What responsibility is it? It's calm when you're lose money, and leisurely when you're make money, which is easier said than done - because most people don't have the knowledge and judgment to support behind the money make a decision.

Don't ask someone this question:

Then, how do I buy US stocks in China? (GAFATA also has stocks that can only be bought in the Hong Kong stock market)

Why not ask this question? Because this kind of problem is a problem that you should solve by yourself. If you can't solve this problem, you will not only score is failing, or even "score is negative". No one has any reason to help you.

I have a friend, Dai Mi (戴汨), the founding partner of JOY CAPITAL (愉悦资本). Last year, I helped him forward a job advertisement:

JOY CAPITAL: JOY CAPITAL is ready to recruit two investment analysts. Welcome to forward recommended candidate. The minimum requirements in history are as follows: 1. Work experience: the less the better; 2. Investment or business experience: preferably not; 3. Key universities, difficult professional (such as mathematics and physics); 4. Love sports, do not like to sleep; Resume address: Think about it yourself.

This is their job advertisement. At that time, I was very happy when I saw it. After seeing this advertisement, I completely understood that people who didn’t understand where the resume should be delivered were directly “unqualified” and even filtered, because For those people, even the resumes can’t be delivered...

Think again, what is the position that JOY CAPITAL is recruiting? It is investment analysts. If you are recruiting the front desk, this request is a bit too much, but if you want to apply for an analyst, even if the "CV delivery address" is didn't analyzed (study) clear, you should be directly filtered out, isn't it? The world is as simple as that.

A person's analytical ability ultimately determines how much wealth he can have. Especially in this era of fragmentation of information, whether we can grasp the main information and see the true logic behind the incident is one of the important criteria for a person to seize the opportunity.

The polishing of analytical skills is a long-term homework, and it is impossible to make a huge change in one day.

How to get started? There is an easy way:

Don't rely on others to provide thinking.

To put it more simply, if you can solve problems by search engines, don't ask for questions.

Once you start single thinking, you will find that your analytical skills have improved a lot.

This is the equivalent of suddenly discarding your crutches. Although you are faltering at the beginning, you will be able to adapt to the days of abandonment and be able to get better and better.

So starting today, don't rely on others to provide thinking and start to hone your analytical skills.

A lot of so-called "problems" about investment are not only unworthy to answer, but even should not be asked by others - ask Google at the most, and then ponder over it. This is the basic quality.

Also, please remember:

In the investment field, you don't need to be eager to act.

The most difficult part of the grasp of investment knowledge is that it is "very counterintuitive". Therefore, image description, if you don't put your own operating system "overturned", there is no way to do it correctly. Have been patient for almost half a year, and are afraid that the remaining half a year is not fast enough?