[Financial Freedom] Do you really have no chance?

Many people complain about "no chance" for the rest of their lives, but the truth is always full of irony:

In fact, there are always enough "big opportunities" to be "live in front of us", but the so-called "missing" is ultimately only the majority of people who turn a blind eye to this...

There are many such examples, but each one is likely to "didn't look like a good example" - Because the difficulty of this example is that the example to do is to "let the things that were originally turned a blind eye can be understood after the example"... You can imagine this difficulty.

Moreover, once we are discussing opportunities, we are all about "probability" everywhere, and every detail is not "determined", not "100%." Therefore, for those who are not familiar with "uncertainty reasoning", the process of proof is "completely full of loopholes", "have too many places to question", and even can't listen, can't stand, even can't keep up with it..."

But we must seriously discuss it anyway, because we have already "goed on the road", so "going on" is the only choice.

Let me first give an example of "Bite the bullet". Please read it patiently - no matter what doubts (doubt and confusion) arise in this process, please put it aside, read it carefully, and then read it again and again. First try to absorb, then analyze the logic, and finally come to a conclusion - I mean, your own conclusion.

In my opinion, what happened in 2016 is actually very important, but most people may not have given enough attention to it:

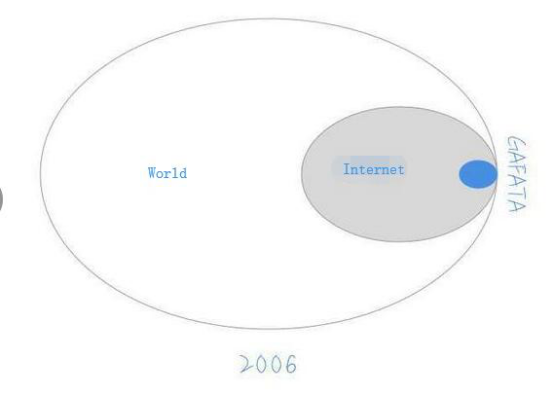

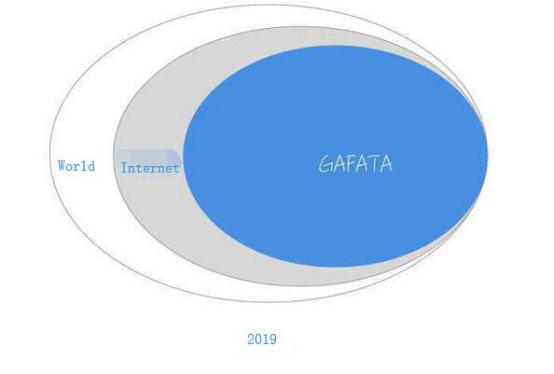

The Internet has really completely occupied the entire world. After more than two decades of rapid development, the Internet has completed its original mission of connecting everyone.

At the end of June 2016, Facebook reached 1.65 billion monthly users - almost one-fifth of the global population (as of July 2018, monthly users reached 2.2 billion, almost one third of the global population (2018 was 7.44 billion)). On the other end of the globe, WeChat, at the end of June 2016, the number of monthly users reached 803 million, which is close to 3/5 of the total population of China (as of the first quarter of 2018, monthly users reached 1 billion, China's population of 1.3 billion).

From another perspective, this became a fact:

All the people in the world who have the ability to consume are basically online...

For a long time before this, the so-called "Internet" was just a "minority group." In 1997, the total number of Internet users in China was only 620,000 - the proportion of the population is low. You can calculate. According to the China Internet Network Information Center (CNNIC) statistical survey report, as of June 30, 2006, the number of Chinese Internet users was 123 million (as of June 30, 2018, the number of Chinese netizens reached 802 million. Is it still a "minority group"?

In the years of rapid Internet development, several companies have become giants. I have just created an abbreviation for them - GAFATA (searching on the Internet, Google has a font called "Gafata"...):

Google Amazon Facebook Apple Tencent Alibaba

For example, if the Internet is a "new world that has finally been built", then GAFATA is the "real estate giants" in this "new world", which provides all the infrastructure and services for business operations on the Internet, including data, cloud, computing, payment, trading, social... So, each of them has completely occupied the "monopoly advantage." So, for a long time, their ability to make money is the strongest, maybe getting stronger and stronger in the future...

The most terrible thing is that they are also making investments!

All the new technologies and services that may appear on the Internet, they are "naturally" and "swallow them" – making many "early investors" engage in a macroscopic view, "at most, divide a small portion" (even the well-known VC in the industry, it is the same fate).

Then, what is the relationship between this fact and the "opportunity", especially the "wealth opportunity"?

First of all, the stocks of these companies have been publicly traded in the financial market, that is, no matter who you are, you can directly buy (invest) the stocks of these companies; secondly, the stocks of these companies are "large-cap stocks", very fluid, if you buy their stock, you can be sold at any time; more importantly, they are likely to grow very strong for a long time in the future - for reasons Well, the above has been explained as completely as possible.

Note that the two words "very likely" in the above wording are not "certain", and in the process of passage of time, the probability of this "very likely" is also constantly fluctuating, possibly amplitude, very quite big...

In my opinion, GAFATA is likely to be opportunity that everyone has the ability to grasp - note that it is only "very likely", not "certain".

However, the low relative risk of investing in GAFATA is indeed a clear conclusion - and the longer the holding period, the lower the system risk may be.

But I am almost certain about the "everyone" in the above sentence - But I believe that most people, even if someone tells him this way, they will still think for one reason or another, even afterwards have the reason they don't understand themselves. Turned a blind eye to this "opportunity" to it. When they reacted, they had to sigh: "Oh, it’s all fate!"

... I think that in 2026, this text still exist on the Internet - this is one of the benefits of the Internet.

The example is finished.

Note that this example is here, not as a "conclusive evidence", because I know the fact - although I have tried my best to make it clear, actually:

1.It is possible that what I said still have inaccuracies; 2. It is possible that what I said still have incomplete places; 3. Even if I say it is complete, there are still many people who can't understand or understand wrong; 4. For other people whose values are different from me, the above examples are likely to be "can not stand the scrutiny" in their view, or even "all are loopholes"...

So, this example is just used to prove a reason in there:

You see, there are some (big) opportunities, so standing there so clearly, but many people just can't see...

But don't worry, because the following content is really important.

What about "see it"? Do you think that "see the opportunity, is the opportunity yours?" Obviously not, seeing it, just seeing it, grasping the opportunity is another matter.

The greater the chance, the more people will see a strange tendency:

Face the bigger the opportunity, the worse the people's action.

Regarding GAFATA, I have told privately to many people. I don't think this is something worthy of "confidentiality". Even its value lies in: although it's value very huge, it is so obvious, it is a typical kind of " because it seems too simple to be ignored and despised.

Most importantly, the value of this conclusion can be approximated by the following formula:

The return is equal to the principal multiplied by (1 + compound annualized rate of return) squared per year.

In other words, if you actually act, then your income must first look at that base, that is, how much the principal amount is, and secondly, how long your investment period is, and finally look at the compound annualized rate of return. How high is it, is it 10%, or 20%, or 30%? Serious investor knows, long-term compound rate of return over 25%, is particularly high - the inexperienced investor wants are "at least several times the" rate of return.

Among the people I have told when I have rest, there are not many people who actually do it. I am not surprised about this, because I have encountered more aggressive investment types before, and I have seen more "anyone who is not acting anyway". Of course, I have seen a larger proportion "later sighed that if they had to think more about it then will better" person.

Over the past year or so, when I understand the logic of investing in GAFATA (in fact, just the little bit above), I started to act, and I continued to buy GAFATA on a regular basis, and set the proportions and positions that I thought were reasonable. Formulate the principle of adjusting positions, and then observe, summarize and adjust these principles - I feel that this is not boring at all, I feel that this thing is interesting, and I am not tired. In the last quarter of 2016, I even signed up a fund in Hong Kong to prepare myself and help my friends in the community to invest in GAFATA.

So, never complain about "no chance", that is what other group of people do, anyway, not us.

The problem is that even if you see the opportunity, it does not mean that you can "automatically grasp the opportunity", or you should add continuous thinking and action based on your own thinking, and you will be able to truly grasp the opportunity - it is "possible". It is not necessarily "inevitable" because there is always a factor of luck.

The thing you have to do is to use your own knowledge, think with your own, and then invest with your own capital "responsiblely". What responsibility is it? It's calm when you're lose money, and leisurely when you're make money, which is easier said than done - because most people don't have the knowledge and judgment to support behind the money make a decision.

Don't ask someone this question:

Then, how do I buy US stocks in China? (GAFATA also has stocks that can only be bought in the Hong Kong stock market)

Why not ask this question? Because this kind of problem is a problem that you should solve by yourself. If you can't solve this problem, you will not only score is failing, or even "score is negative". No one has any reason to help you.

I have a friend, Dai Mi (戴汨), the founding partner of JOY CAPITAL (愉悦资本). Last year, I helped him forward a job advertisement:

JOY CAPITAL: JOY CAPITAL is ready to recruit two investment analysts. Welcome to forward recommended candidate. The minimum requirements in history are as follows: 1. Work experience: the less the better; 2. Investment or business experience: preferably not; 3. Key universities, difficult professional (such as mathematics and physics); 4. Love sports, do not like to sleep; Resume address: Think about it yourself.

This is their job advertisement. At that time, I was very happy when I saw it. After seeing this advertisement, I completely understood that people who didn’t understand where the resume should be delivered were directly “unqualified” and even filtered, because For those people, even the resumes can’t be delivered...

Think again, what is the position that JOY CAPITAL is recruiting? It is investment analysts. If you are recruiting the front desk, this request is a bit too much, but if you want to apply for an analyst, even if the "CV delivery address" is didn't analyzed (study) clear, you should be directly filtered out, isn't it? The world is as simple as that.

A lot of so-called "problems" about investment are not only unworthy to answer, but even should not be asked by others - ask Google at the most, and then ponder over it. This is the basic quality.

Also, please remember:

In the investment field, you don't need to be eager to act.

The most difficult part of the grasp of investment knowledge is that it is "very counterintuitive". Therefore, image description, if you don't put your own operating system "overturned", there is no way to do it correctly. Have been patient for almost half a year, and are afraid that the remaining half a year is not fast enough?

Thinking and action

1 Have you ever reached any conclusions in your eyes, and then you grasped them, but the people you told were not grasp it?

2 Has anyone told you what opportunity, and later proved that it is indeed an opportunity? Why did you miss it at the time? If there is a lesson, what is it?

3 Regarding the “example” (GAFATA) in the article, what is your opinion if you have different opinions?

【The Better chapters】

Respect the difference in the magnitude of capital

The rigid demand for investment is to hedge!

How to recognize, choose, and cultivate the right rigid demand?

Congratulations @lilijing! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @steemitboard: