Africa talking

Business APIs in Africa are getting a boost from global venture capital thanks to a new $8.6 million round for Africa’s Talking—a Kenyan based enterprise software company.

The new financing was led by IFC Venture Capital, with participation from Orange Digital Ventures and the investor that’s upending most Silicon Valley mores, Social Capital, led by former Facebook exec Chamath Palihapitiya.

Capital from the round will be used to hire and build capacity at the company’s Nairobi headquarters; expand its presence in other geographies around Africa; and invest in research and development in IoT, analytics, payments, and cloud offerings, according to chief executive Samuel Gikandi.

The company will open a tech studio for “engineers and developers to collocate with Africa’s Talking for 12-18 months…to build new products and companies,” Gikandi said.

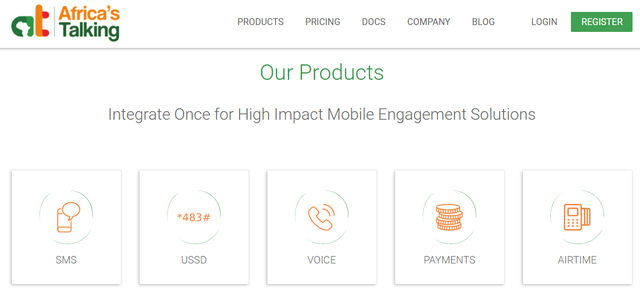

Africa’s Talking operates in Kenya, Uganda, Rwanda, Malawi, Nigeria, Ethiopia, and Tanzania and maintains a private cloud space in London through Rackspace. The company works with developers to create solution focused APIs across SMS, voice, payment, and airtime services.

Africa’s Talking operates in Kenya, Uganda, Rwanda, Malawi, Nigeria, Ethiopia, and Tanzania and maintains a private cloud space in London through Rackspace. The company works with developers to create solution focused APIs across SMS, voice, payment, and airtime services.

“We’re helping software developers in Africa connect to local infrastructure,” said Gikandi. “We find companies that have local infrastructure, whether its mobile operators, banks, or data-centers, then we partner with them and build a platform that simplifies access to that local infrastructure and open it up to software developers.”

Africa’s Talking has a network of 20,000 software developers and 1000 clients including fintech lending startup Tala; solar power financier and retailer M-Kopa; and financial services giant Ecobank, according to Gikandi.

The company gets paid through mobile wallets, earning fees on a portion of the transactional business its solutions generate.

Founded in 2010, the Series A round represents the company’s first significant venture capital investment. “We’ve primarily bootstrapped the business and became profitable in 2012,” said Gikandi.

The private company does not release financials or confirm net revenues, but Gikandi said that the company’s profitability was a stipulation for investment from its new backers (unlike the requirements for startups coming from Silicon Valley).

As the company looks to expand geographically in the African continent, observers can likely expect Africa’s Talking services to begin cropping up in francophone countries, otherwise, why else would Orange Digital Ventures’ invest in the round, since Orange has a presence in over 20 French speaking African nations.

IFC Ventures will be an active investor, with Africa Regional Head Wale Ayeni joining the board.

“The caliber of the tech team was a reason [to invest],” says Ayeni. “They’ve been able to build a cloud based digital platform and produce a product that people are willing to pay for. It’s rare to see that kind of high caliber tech talent create something that can scale that rapidly…and we’re looking forward to what they’ll build in the future.”