What It Feels Like to Be In Debt ( The Experience of Mr. Cooper. )

Purchaser obligation has quite recently hit a record-breaking high. It currently best more than $3.8 trillion. Not million. Not billion. Trillion. Being paying off debtors can influence you to feel as though you are totally alone.

Be that as it may, you aren't the only one. There are a great many individuals feeling precisely like you do well at this point. I say this since I used to be one of them.

When I was in my 20's, I piled on a great deal of unpaid liability. I was suffocating, and I thought there was no chance to get out for me however to default on some loans. Around then, it was everything I could find before me. It was all I knew, and I thought it was the existence preserver I required. Turns out, that it spared me from suffocating, however it didn't encourage me to swim.

In any case, that didn't settle anything. The reason was that I didn't set aside the opportunity to get to the foundation of my concern, which was what I looked like at cash. Thus, wouldn't you know it, quite a long while later, my significant other and I developed about $37,000 under water. Furthermore, by and by, I had a feeling that I was suffocating. However, this time, I didn't utilize the existence preserver. This time, I quit treading water and figured out how to swim.

My significant other and I cooperated and built up an arrangement and started the diligent work of paying off our obligation. We sold things. For some time, we didn't eat suppers out. We cut back our spending. For us, it worked. We could pay off that heap of obligation.

Despite everything I sat at the lounge area table that February night in 2010. We'd done it. We'd really done it! $37,000 gone in somewhat more than two years!! The moment I hit send to pay off the advance, I felt moment help. A weight that had been pushing me down these years was quickly lifted away. I could buoy and rest.

For me, it wasn't only the way that I paid off the obligation. I'd taken the simple street and done that previously. This time, it was on the grounds that I didn't do it similarly. I took in a ton about myself and rolled out improvements with the goal that I would not end up taking this way until kingdom come.

YOU AREN'T ALONE

In excess of 32 million purchasers have higher-intrigue obligation, a normal of $8,600 per U.S. family to be correct! What's more, an ongoing study directed by Mr. Cooper found that 68% of Americans are worried about their obligation.

In the event that you get yourself unfit to rest on account of your funds, you aren't the only one. I review numerous restless evenings agonizing over how I would pay the bills and feed our family. Truth be told, did you realize that 33% of individuals with obligation additionally lose rest? It's just plain obvious, you truly aren't the only one!

Amid our voyage, there were commonly we both concurred that we'd have done pretty much anything to escape obligation. Furthermore, a portion of our thoughts were quite extraordinary! At the point when YouGov asked those owing debtors what they would do to have their Visa obligation pardoned, 31% said they'd surrender online life for a year!! Be that as it may, of course, there are times I'd will surrender web-based social networking just not to need to manage web-based social networking. 😉

That influences me to ponder, what might you do on the off chance that you could never again need to stress over your charge card obligation? Perhaps you would complete one of these:

Would you surrender your most loved sweet or appetizing treat for a year? 32% of individuals studied said they would.

What about getting a tattoo of their most loved preteen artist? 14% would do this in the event that they could be sans obligation.

Perhaps migrate to Antarctica for a long time? On the off chance that you'd do this, you are among the 8% who'd do this.

Taking advantage of YOUR HOME'S EQUITY

There are alternatives, and one of the least complex ones might gaze you right in the face. While customer obligation has kept on ascending to more than $3.8 trillion, so has home value. Home value esteems proceed to climb and are up by 100% since 2000! Indeed, the normal mortgage holder has a normal of $90,000 in home value.

Before you ponder getting a home value credit, let me stop you in that spot. That is not what I am alluding to by any stretch of the imagination – there are different alternatives.

This is the place Mr. Cooper comes in. Mr. Cooper, the country's biggest non-bank contract servicer and a main home loan moneylender, is rethinking the homeownership experience to influence the home advance to process all the more fulfilling and less troubling. . A credit master can walk both existing and potential mortgage holders through their financing alternatives, alongside every one of the upsides and downsides of renegotiating so clients can settle on the correct choice for themselves, and the home advance process is additionally fulfilling and less troubling.

What individuals don't understand is that you might have the capacity to take advantage of your home's value and diminish those high-intrigue Mastercard installments.

Property holders make month to month contract installments and gradually pay down the adjust that is owed on their credits. In the meantime and as a rule, the estimation of the home keeps on expanding. The contrast between what a mortgage holder owes and the evaluated estimation of a house is home value.

For instance, in the event that you owe $150,000 on your home and it evaluates for $250,000, you would have $100,000 in value.

HOW DOES THIS WORK?

The thought is really basic. You will take out another credit on your home. Be that as it may, instead of doing as such for the sum you at present owe on your home loan, your new advance will incorporate the sum you owe on your home, in addition to money to take out to apply to other non-contract obligations.

When you take advantage of home value, you can utilize the extra finances to pay down your advances and charge cards. Envision: making only ONE installment every month! Utilizing home value through a money out renegotiate couldn't just lower your regularly scheduled installment, however could likewise dispose of the installments on high-premium Visa adjusts that never appear to diminish.

I'm one who cherishes illustrations, so let me demonstrate to you how this functions. Suppose your home loan adjust is $125,000 and your home evaluates for $200,000, which means you have $75,000 in value you would take out a home loan for $160,000, of which $125,000 is for the house and $35,000 is a value withdrawal (moneylenders more often than not enable you to acquire up 80% of the home's estimation). You at that point utilize that $35,000 to pay off your charge card adjusts. Smooth, huh?!

WILL IT REALLY IMPROVE YOUR CASH FLOW?

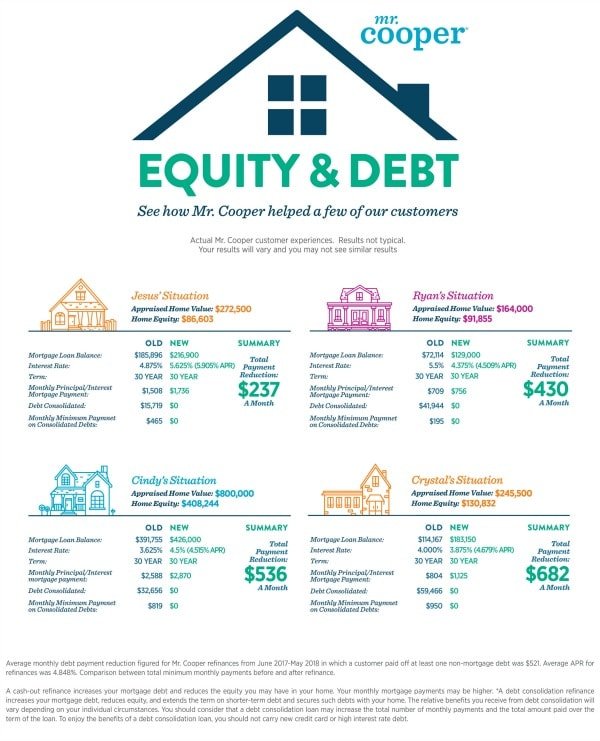

Many individuals will locate that experiencing a money out renegotiate with Mr. Cooper causes them diminish their month to month obligation installments. Look at a portion of these outcomes (real outcomes may change).

Consider what you could do with another $500 multi month. In the event that anything, envision what it would feel like not to worry about paying your bills lastly having the capacity to rest during the evening.

ARE THERE ASSOCIATED COSTS?

Similarly as with all advances, there are start expenses and closings costs for a money out renegotiate. Be that as it may, I have a one of a kind way you can spare $500! (Obviously, I have an approach to spare – that is the manner in which I get things done)!

There is no motivation to continue living this way. In the event that your obligation keeps you wakeful during the evening or you find that you're willing to surrender a kidney to dump it (yes, 7% of individuals would do this to escape obligation), there could be alternatives. You will most likely be unable to do it as I did, however utilizing your home may be an ideal method to help you at long last rest.