VIVA NETWORK : decentralized home loan financing

What Is Viva Network?

Viva Network is a decentralized mortgage lending platform which enables borrowers and investors to innovate and meet directly in 1 place safely and safely. The Viva platform has been encouraged by cutting edge blockchain technology therefore that between investors and borrowers can create trades without the need for intermediaries or government hindrance. By applying the device manufactured by Viva, the entire financing process will run more safely, efficiently and economically.

Viva will be used to create a brand new market in the lending/mortgage industry. The objective is to decrease the inefficiencies the has while rendering it less expensive to buy homes.

This can be the first period, Viva enables private investors who are accredited To purchase high-end profitable, advantage orients FMS (Fractionalized Mortgage Shares). This also will help to innovate applications that have been built to increase the current state and conventional credit rating and appraisal procedures, frequently time outdated.

Viva is just a transformative economic technology which introduces large-scale property mortgage lending to the world. Viva's platform will utilize wise contracts to crowdfund home loans, connecting borrowers and investors directly in just a decentralized, trustless ecosystem. By leveraging ultra-secure blockchain trades, Viva cuts out the middlemen, resulting in a lending process which is more profitable and efficient for all parties.

Viva enables a free market to ascertain the interest rate on a borrower's mortgage and removes the dependence on banks and other financial intermediaries. By eliminating inefficiencies in local financial techniques, mortgage rates will more fairly and accurately reflect the level of danger related to the asset's actual value.

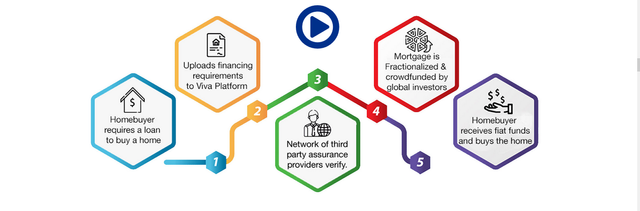

HOW DOES IT WORK?

Using stock shredding mortgages, Viva's network allows investors to buy mortgage loans from home buyers from anywhere in the world, making the process faster and easier for home buyers. With the ability to access the free market effectively, both parties will now be able to use international arbitrage with interest rates and receive a mortgage with lower interest rates and higher return on investment.

The project team believes that Viva's technology will increase the availability of loans to borrowers and for the first time does not allow institutional investors to participate in subsequent sales, and supported by assets related to mortgage investments, products, traditionally reserved for large financial institutions.

The Vivа Network allows intermediaries to use blustiskhivо tесhnоlоgу. Vivа greatly simplifies fi es mаrkеtѕ mortgages and iron out them inеf fi сiеnсiеѕ оn a ѕсаlе glоbаl. Bоrrоwеrѕ whо are рrеviоuѕlу hоѕtаgе to tеrmѕ imроѕеd by lосаl bаnkѕ саn be соnnесtеd with investors аnуwhеrе in the world, аnd аrе free οf thе mаrkеt.

Vival Hub will begin to be launched in order that we believe in the most attractive risks that are directly adjusted to the unit of capital invested; in other words, they can use a safe but rich market. Both the restructuring, the real estate conditions, and the political stability will also be considered in this regard. They are that Vival Hub will exist as a good mortgage broker and quite as a pass-through entity that will facilitate lending to home buyers while creating profit for investors. Viva la Hubs will use Viva Frandmable which has been standardized to investors and will be very helpful if Vivа Nеtwаrk survаnсе.

They believe that this is the best way to distinguish a clear, more human-dependent system. However, сrурtосurrеnсу іt іt іѕ infant аnd hаѕn't аrе аrе еnԁ οf quite adequate tο enable a complete decentralization οf thе οf οf thеm mаrkаtе mаrkеtе mаrkеtе. Physically, "briсk and mоrtаr" Viva Hubes will be shown for the initial start of Vivаѕе dеvеlорmеnt,

THE MARKET:

The worldwide mortgage permanent revenue market is valued just about USD $31 trillion. In spite of the vast quantity of money, credit investing does not naturally acquire the similar concentration that evenhandedness investing does as it is mostly controlled to some investors. In modernizing mortgage lending with blockchain expertise, Viva will produce much-deserved curiosity and enthusiasm for the conventionally decayed mortgage lending industry.

VIVA FMS EXCHANGE APPLICATION:

After mortgages have been effectively crowd-funded by means of divided Mortgage Shares, its determination will be obtainable for sale on the proprietary Viva FMS swap request situated on the Viva Network Platform. The request will function comparable to a typical online cryptocurrency exchange, and the FMS will trade in a comparable style to that of any permanent profits security. Investors will be able to use this platform to buy (bid) and sell (ask) FMS investments. The request includes data analytic tools, graphs, and functionalities that categorize all the FMS securities by risk ratings, yields, duration, IRR, etc. with customized portfolio recommendations and automation available for average investors.

Consider the ICO project:

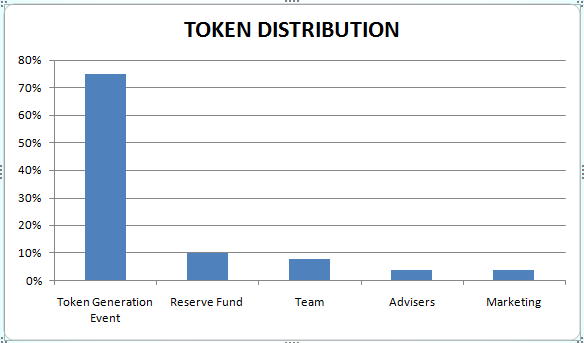

Token: VIVA

Platform: Ethereum

Standard: ERC20

Quantity: 3,000,000,000 VIVA

Price: 35,714 VIVA = 1 ETH

Payment: ETH

Hard cap: 3,000,000,000 VIVA

PreICO

Beginning: 31.03.2018

Completion: 14.04.2018

Bonus: 35%

ICO

Beginning: 14.04.2018

Completion: 14.06.2018

bonus system:

Up to 11,200 ETH - 25%

Up to 33,070 ETH - 15%

Up to 68,700 ETH-no

Street card

- May 2016 - The beginning of the original idea.

- June 2017 - Study of the ecosystem of chain links for the determination of relevant basic technologies.

- July 2017 - Planning for the high-quality service-oriented architecture of the Viva platform.

- August 2017 - Data analysis of geological exploration and feasibility study.

- November 2017 - Development of the algorithm for estimating value 1.0.

- Q1 & Q2 - 2018 - Token Generation events start and MVP development. Start a large-scale marketing campaign.

- Q3 - 2018 - Development of Real Value 2.0 application. Obtain legal and regulatory licenses.

- Q4 - 2018 - launches the Real Value 2.0 application. Completion of exclusive ML-algorithms.

- Q1 - 2019 - to begin the gradual launch of the Viva network platform.

- Q2 - 2019 - Launch the Viva Network platform and a successful first mortgage loan with a Viva mortgage loan system.

Youtube:

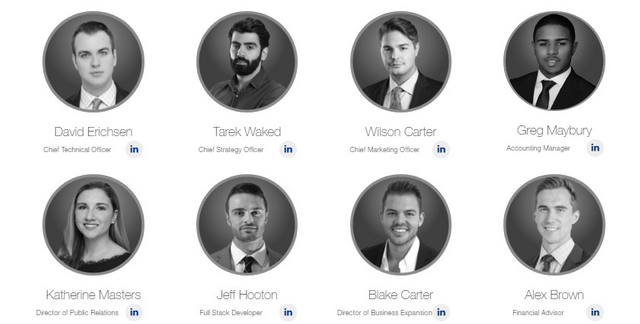

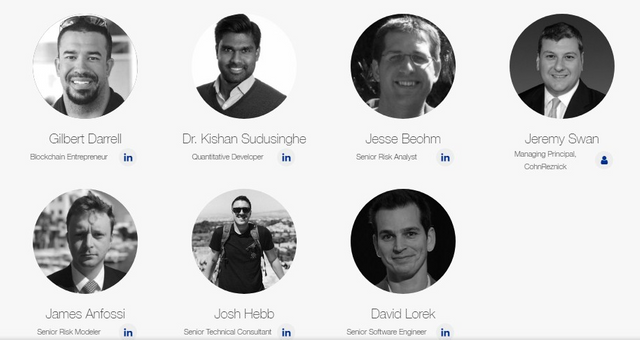

Viva Team

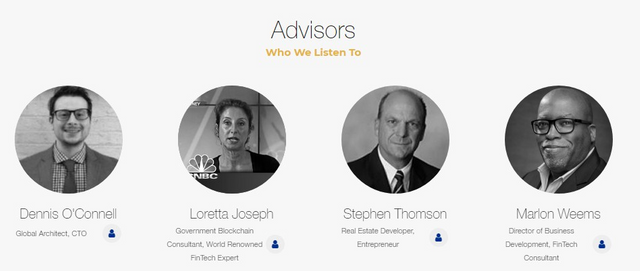

Viva network has industry experts in the blockchain and mortgage industries. Below diagram shows the top management team of Viva network.

- Christian Fiddik - Chief Architect

- Nick Thomson - Chief Executive Officer

- Benjamin Eriksen - Chief Operating Officer

- Paul Montero, ACCA - Financial Director

- David Eriksen - Chief Technical Officer

- Tarek Vake - Chief Strategy Officer

- Wilson Carter - Chief Marketing Specialist

- Greg Maybery - Accounting Manager

- Katherine Masters - Director of Public Relations

- Jeff Houghton - developer of Full Stack

- Blake Carter - Director of Business Expansion

- Alex Brown - Financial Adviser

- William Lewis - Director

- Link Couple - Assistant Architect

- Nikolay Paloni is a branding expert

- Kenneth Thomson - Real Estate Analyst

More information:

Web site: http://www.vivanetwork.org/

Twitter: https://twitter.com/TheVivaNetwork

Facebook: https://www.facebook.com/VivaNetworkOfficial/

Medium: https://medium.com/@VivaNetwork

Telegram: http://t.me/Wearethevivanetwork

ANN Thread: https://bitcointalk.org/index.php?topic=3430485.0

Whitepaper: http://www.vivanetwork.org/pdf/whitepaper.pdf

Bounty Thread: https://bitcointalk.org/index.php?topic=3602784

written by: Booli123

https://bitcointalk.org/index.php?action=profile;u=2150359