Is Tether a real safety net for the crytocurrency world?

Today I just wanted to finish what I started yesterday. I would like to talk about how Tether (USDT) is perceived. What people think it is and what I think is useful to.

So as (almost) everyone of you know by now, USDT is an USD backed crytocurrency available in some of the biggest exchanges in the world to serve as a surrogate for the actual United States of America's issued currency.

It gives this exchanges the possibility to offer it's users the chance to trade their crypto for "real money" without the legal obligations that this would bring to them.

For some people, this gives them the confidence they need to invest their hard earned money into cryptocurrencies in one of these exchanges. They feel that in case of a strong pullback or even a crash, USDT offers them the opportunity to keep their money safe while the prices recover.

And this is truth... in a way.

Let's take as an example the current situation. In the last month and a half we've seen a strong pullback in value of most of the cryptocurrencies currently being traded in the market. Bitcoin, most notably of all.

In this situation, anyone that sold their BTC (or any other coin wich price went down this month) for USDT at a higher price than it is today and decides to buy again, will earn some BTC to their portfolio. This wolud earn them even bigger gains once the BTC price recovers to it's original value.

So we have to say that in this particular situation, USDT works pretty fine for what it's supposed to be good for. A value refuge in a volatility environment. Negative volatility that is. Someone could lose money if he/she goes in and out of USDT at the wrong time. But that's not a problem, just part of the known risks of trading.

But what would happen if instead of pullback (as big as this can be) we have a crash? A real crash. A Bitconnect kind of crash.

I know, this seems unlikely and far fetched to me as I am sure that it seems to you. If we weren't confindent in the future of cryptocurrencies we wouldn't be writing and reading each other in this platform, but the truth is we've had crashes in the past so we know that it could happen again.

And USDT is supposed to be a way of keepeing our investments safe on that situation. But it is not. And that's OK.

In case of a real crash, a huge amount of investors would seek to sell their "not USD backed" crypto for USDT. All at the same time. This, even when USDT value is supposed to be pegged to a 1 USD value, would bring USDT value up causing people who fled out of other crypto into USDT to actually lose money while doing it. Then all of these people would sell their USDT, all at the same time, bringing it's value down again and making them lose money. Again.

So, why if USDT can't save our savings and investments in case of a crash people seem to think otherwise? I know, you are going to tell me that this isn't truth. But why then was the market hitted so hard by the news of US regulators investigating Tether and Bitfinex?

In conclusion, Tether is useful. Tether can't save your money from a crash. And it doesn't matter

Invest in crypto only if you're confident on it. On it's technology and it's future. And of course, invest only what you can afford to lose.

Share your thoughts

Its nice to have a stable coin to jump in and out of during these up and down cycles .

It is, but like @Johanalejo explained, the entire logic of the crypto market kind of renders this "stable" state of a coin useless when the average user uses it that way. You'd need a variety of "stable" coins, that wouldn't really increase like others.. I think...

It has been an useful tool this last month. I haven't used it because I rather just hold those coins I'm confident, but many people actually gained some BTC (ETH, LTC, etc) buying and selling USDT

There is a tremendous opportunity for central banks in every country to create their own electronic currencies with their own set of KYC/AML parameters, and letting that currency be used on the local crypto exchanges within the country or in countries with which they have agreements with.

This would avoid any possible future issues with non-governmental pegged cryptocurrencies.

You are Right..👌

I like this.. your comment..carry on dear @ebargains

I can't put too much trust on governments. But anyway, I think you're right and when we have some central banks putting out their own (more stable) currencies, that could propel a new rise in the market because of people more confident in investing and having a way out in case of a pullback

Your post was resteem by Whale ResteemService @booster007 & @boostupvote

Resteem over 9000+ followers

Keep it up!

All the best!

First Follow for 3 hours | Send a minimum transaction 0.100 steem/SBD with post URL in memo | Your post gets resteemed | A post can only be resteemed once!

I read that there are real worries that the price of Bitcoin is being propped up by #Bitfinex and #Tether

Tether was sketchy from the start. One alternative might be gold backed cryptos, like Xaurum or the soon to be project of the Perth Mint.

I don't think that the problem in this case is what do you use to back its value. For example, the venezuelan government will issue an oil backed crypto. I think that it's a matter of trust in who is behind it

Yes that is absolutely true. Gold is just one example of a trusted commodity. There can be many others.

its sad to say but if we really want a refuge crypto then we need one backed by a government. picture a crypto us dollar where the new dollars can be mined by citizens and the old one can be traded in. they could also be burned when used to maintain stable value. it is inevitable for governments to get into crypto and once their fiat systems can be blockchained they will convert. i think that coupled with atomic swaps will be the future of crypto.

Agree. I don't think I would use it unless it becomes the everyday use currency, but the inclusion of those government backed coins will boost up trust in the system

I agree with you on USDT. I think it is the rumor, scandal and panic that in the media that shake things up and its a real shame.

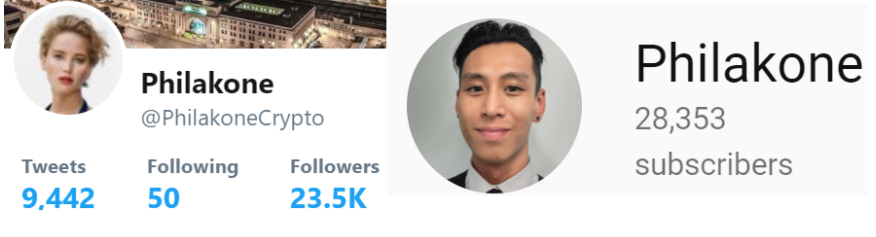

Just started following you. Great post. Community, please consider my blog. I currently have 70,000+

followers on Youtube, Twitter, and here combined where my goal is to help improve the crypto community.

I provide free TA on request, make high accuracy calls, and focus on improving YOUR trading game in a concise and educational manner.

https://steemit.com/bitcoin/@philakonecrypto/bitcoin-btc-feb-1-in-depth-fundamental-and-technical-analysis

I agree with what you said about Tether. My concern is that we have to trust Tether and its bank to hold the USD. Every other cryptocurrency is designed to be trustless.

It seems Maker is trying to solve a lot of the problems of Tether and become more sustainable in the long run with their second coin, the name escapes me right now