Crypto Value Index: A better valuation metric

We are on a roller coaster; one day we are going up and the next it’s freefall with your stomach forcing its way through your hippocampus. It’s the wild west, which is great for the cowboys, but not great for the general utility of buying things at a stable price. If we are to realize bitcoin’s promise of a better currency we are going to need a better way to value it. The current bubble stems from lack of good information about the real value of a currency. If investors, traders and engineers used a better model, the volatility would reduce. Trying to value this rollercoaster, some argue, is impossible.

###But we are going to attempt the impossible. You with me?

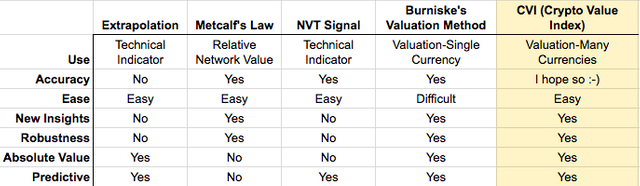

I’ve put together 4 models for valuing cryptocurrencies that I have found to be most effective: NPV Signal, Metcalf’s Law of network value, Burniske’s Discounted Quantity Theory of Money and Extrapolation. While useful in specific instances, none of the valuation methods for cryptocurrencies could say whether a currency was over or under valued in absolute terms. So to these three I add a fourth way, which for now is a work in progress: Crypto Value Index. CVI is based on Value Investing famously used by Warren Buffet amongst others. Does using CVI help?

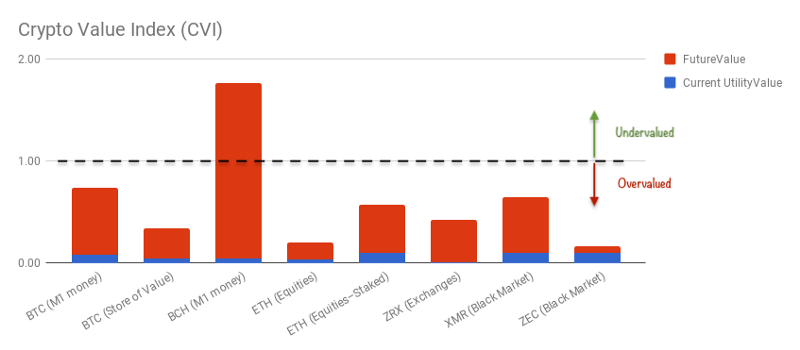

###CVI revealed that one Cryptocurrency is undervalued.

Why do we need a better valuation method?

To begin with it’s not clear why a non-trader would want better valuation models. Engineers and entrepreneurs don’t need to know if “Bitcoin Whatever” is going to “Moon” or has a Moving Average Crossover. But they do want to know whether a currency will be around and growing in 5 years. Additionally, better models would lead to a higher chance of success for currencies. Here’s why: more informed trading leads to less volatility, leads to more merchant adoption, leads to more usage. Merchants don’t want the headache of volatility—they just want to sell more widgets. The currency that manages volatility will be the first currency to get widespread usage and success.

###TL;DR Less Volatility -> Success

[As a side note, traders provide a important function to maintain the stability, providing liquidity to the market and make the market less volatile. If the market dips they buy, driving the price up, incrementally. If the market spikes, they sell, driving the price down incrementally. I hear some people disparaging Wall St types “why don’t they do something useful instead of being so money-hungry?” They make the dollar and the stock markets work so that the rest of us can go save the whales:-) ]

##Current Valuation Methods

Each valuation method has pros and cons.

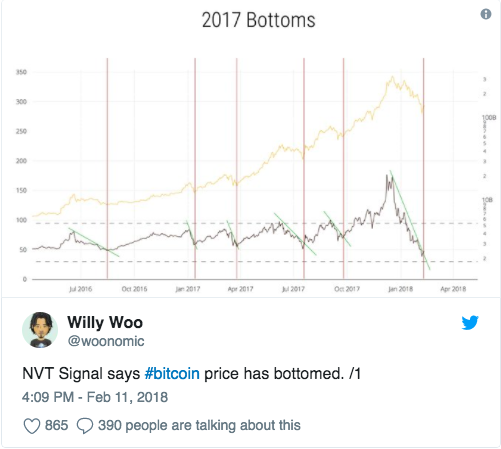

#1. NVT Signal

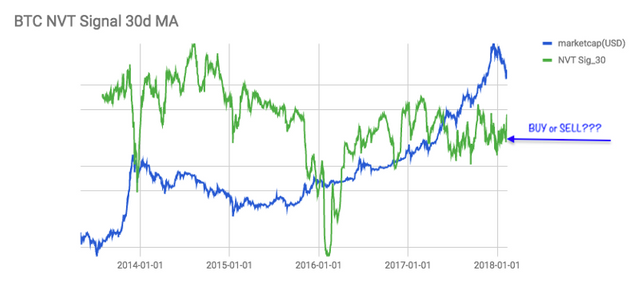

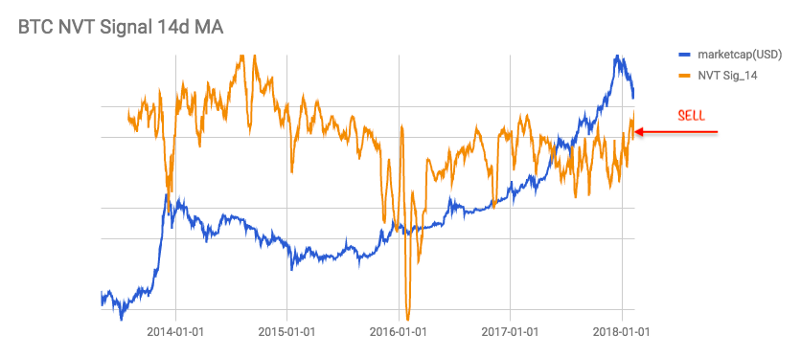

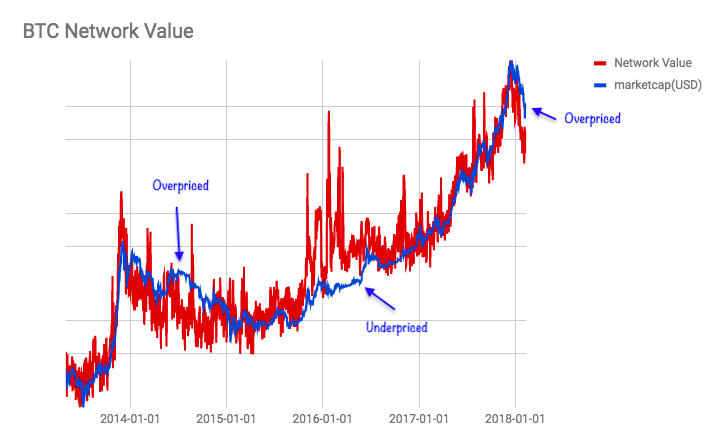

NVT Signal was developed by Willy Woo and Dmitry Kalichkin and seems to be the best crypto currency valuation method. Spikes indicate “BUY” and valleys indicate “SELL”

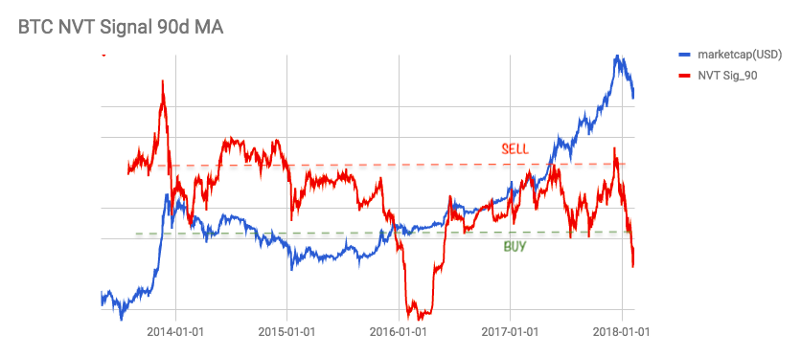

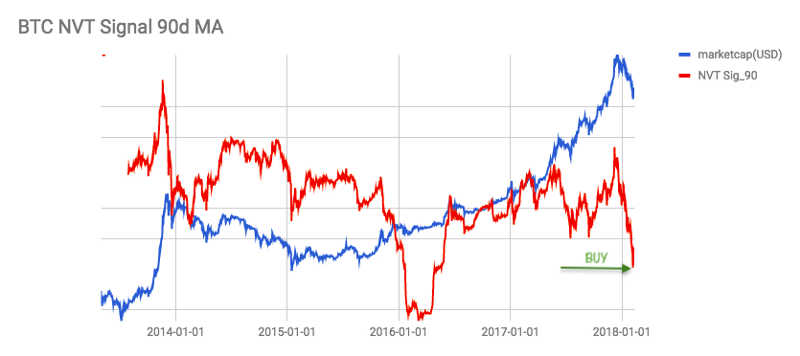

NVT Signal (an acronym for Network Value to Transaction ratio) equals the Network Value (Market Cap) divided by the 90 day moving average of the cryptocurrency transaction volume. To use it, graph the NVT Signal (one vertical axis) and the Market Cap (the other vertical axis) on the same graph. Then draw horizontal lines across the highs and lows of the NVT Signal—highs indicate SELL and lows indicate BUY. You’ll see that bubbles can often be predicted when NVT Signal goes too high.

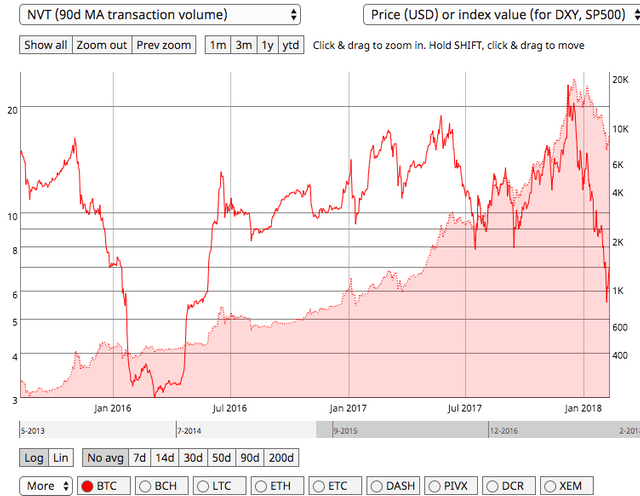

NVT Signals for popular cryptos like Litecoin point to strong “BUY” signals currently. You can mess around with the graphs of 14 crypto currencies here.

And if Excel is out of your comfort zone try Coinmetrics.io like the screenshot below. Coinmetrics can get addictively fun to play around with so you might lose a few hours there, FYI.

But NVT Signal has a problem. Changing the Moving Average from 90 days to 30d to 14d changed the BUY signal to SELL — thus, it’s not very robust. Why does 90 days seem to work for NVT Signal and 30 or 14 do not? NVT Signal works because Bitcoin is unlikely to keep doing the same thing for more than 90 days—that is, to say bitcoin is volatile and tends to have trends that last 90ish days.

90 day Moving Average suggests BUY

30 day Moving Average is not clear

14 day Moving Average suggests SELL

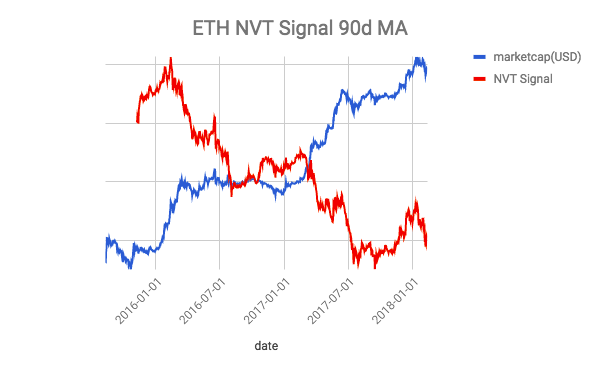

Further, NVT Signal doesn’t give a clear BUY/SELL signal for other currencies, like Ethereum (Data). NVT Signal isn’t a good signal for timing peaks and valleys of Ethereum and other currencies and thus has limited usefulness across currencies.

NVT Signal ends up being no better predictor than the second valuation method.

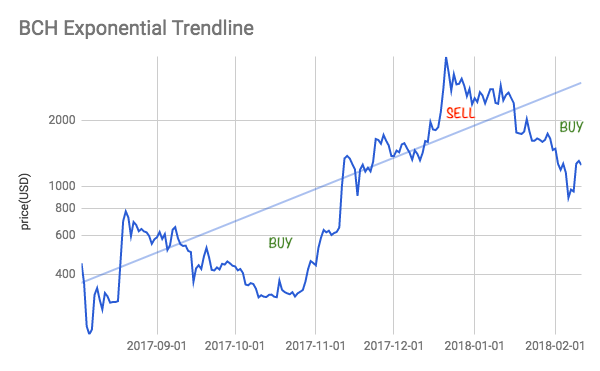

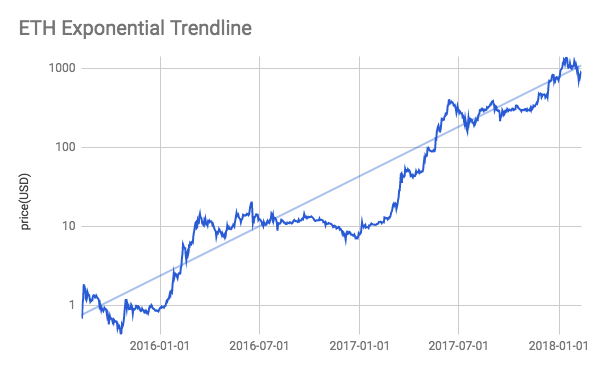

##2. Exponential Trendline

Just graph the price on a log graph, add an exponential trendline and you’ll see this works pretty well. If the price dips below the trendline, “BUY” and if it goes above “SELL.”

The Mental Model to think of here is “Regression to the Mean.” Things tend to go back towards the average value. For example, if a tall man and woman have a child, they don’t automatically have a VERY tall child. In fact, the child is more likely to be shorter than them. Prices tend to go back to their trendline.

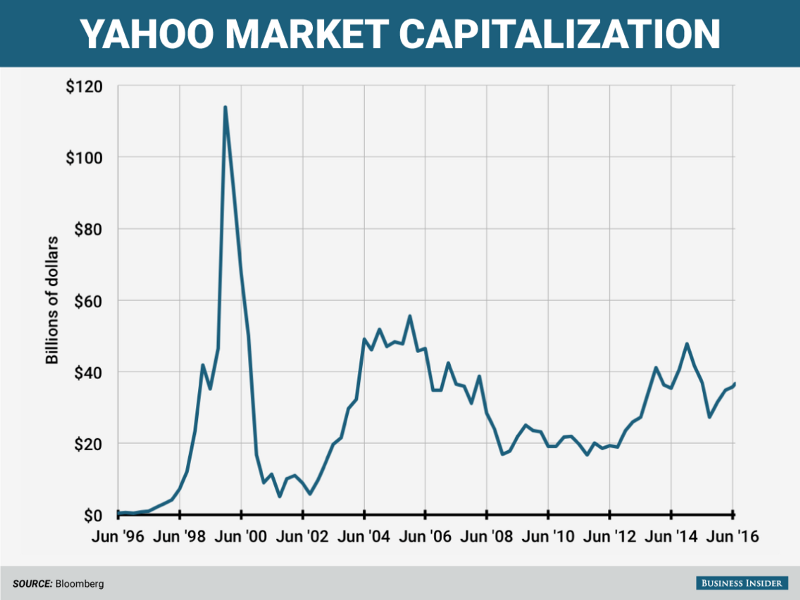

But they don’t always go back to the mean. There is no rhyme or reason why a currency should follow one trendline or another. Yahoo’s growth was exponential…until it wasn’t. Trends are misleading. If the trendline was right the last 4 times it will probably be right this time, however, at the point when you are “totally confident” that you’ve “figured it out” and “trust your metrics” so you remortgage your house to buy Yahoo stock, inevitably the bottom will drop out of the market and you get free fall like the tech bubble. Whoops.

Nothing is exponential forever. So using a trendline is misleading.

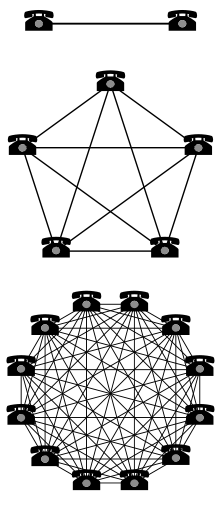

##3. Metcalf’s Law

Valuing Network effects is another way to value cryptocurrencies. Whereas the value of a broadcast network like TV increases in value in proportion to the number of homes connected, the value of a telephone network scales with the square of the phones, Metcalf’s Law.

NetworkValue ∝ NumberOfPhones²

Take a moment to think about that. For TV, when you join, there’s just one new connection—Broadcaster and you. For Telephone, the number of connections increases by the number of people in the network already—you and Alice, you and Bob, you and Carol, etc… Social Media follows Metcalf’s Law as well so it’s easy to see why a YouTube-like service will eventually beat HBO, NBC and CNN.

In practice not every new user is equally valuable to all other users in a network so in practice Metcalf’s law is described by

NetworkValue ∝ Nodes * Log (Nodes)

For currencies, Metcalf’s Law is

NetworkValue ∝ TotalTransactionValue * Log (NumberOfTransactions)

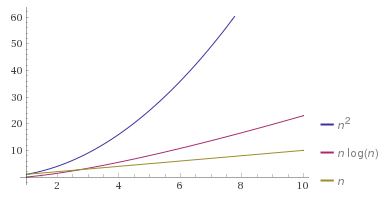

[Don’t get scared away by big words like logarithm, it just means that it doesn’t increase as fast as NumberofTransactions², see below.]

Graph: Network Value Growth: n is broadcast TV, n log(n) is Metcalf’s Law in practice, n² is Metcalf’s Law in theory

Metcalf’s Law describes the value very well. It’s astonishingly impressive, actually. And I hope someone can shed more light on why this works so well considering most traders aren’t looking at the number of transactions.

The blue line is higher than the red line suggests the currency might be more overpriced than before, and vice versa.Even for Ethereum the model is surprisingly accurate.

But Metcalf’s Law only shows relative value, not absolute value. And it’s not predictive, it’s descriptive. (If you could predict both the number of transactions and transaction size you could predict price, but we can’t know either of those in advance without a flux capacitor and a time machine.)

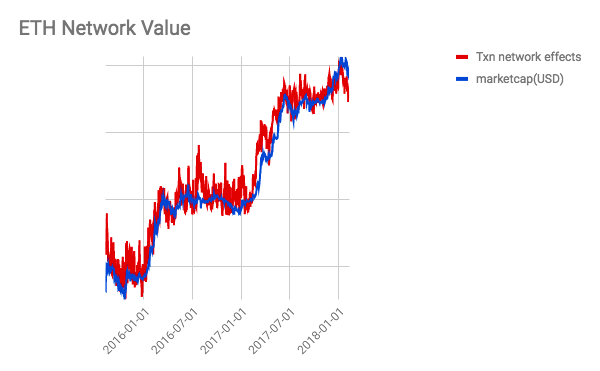

##4. Burniske’s Valuation Model

Unfortunately Chris didn’t name is method so we’ll just call it BVM. It takes many factors into account: the quantity theory of money, discount rate, Total Addressable Market, Market Saturation Rate, Holders, etc

Unfortunately, the model becomes unwieldy, with many assumptions and doesn’t offer a good way to compare investment opportunities. Here is just one sheet of the BVM for only one currency—it’s hard to do this for 100 currencies and pick the best 3.

#Building something better

Value investing says BUY if the market values the currency at less than it’s fundamental value and SELL if the market values the currency at more than the fundamental value. All that’s left is to determine the fundamental value, which is where the magic begins.

There are two parts to this: the theory and trying to find these numbers in the real world.

##Theory

The RealValue is the current utility plus value in the future discounted back to the present

RealValue = UtilityValue + NPV(FutureMarketCap)

where the UtilityValue is how much of the currency we need for real transactions today, NPV is the Net Present Value and the FutureMarketCap can be described as

FutureMarketCap = TotalAddressableMarket/Velocity x MarketShare

where the TotalAddressableMarket is the per year value of transactions in the future, Velocity is the number of times an average unit of currency changes hands and MarketShare is the percent of the market the new currency is responsible for.

To clarify that, let’s take the example of the Black Market. The Black Market is estimated at $15B per year. Money changes hands typically 5 times per year and let’s say Bitcoin will be used for 10% of the Black Market in 10 years.

TotalAddressableMarket = $15B

Velocity = 5

MarketShare = 10%

So the FutureMarketCap in 10 years is $300M. That’s the amount of Bitcoin that would need to be in circulation to power 10% of the Black Market. Clearly, the Black Market is not enough to justify the current $200B Market Capitalization of Bitcoin. But if Bitcoin was used for 10% of all payments (not just the Black Market) in 10 years, would that justify the current price? Let’s find out…

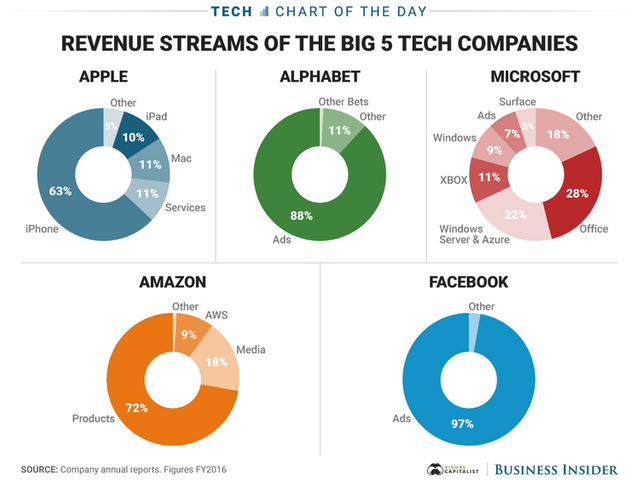

To determine if a cryptocurrency is over or undervalued, divide the RealValue by the Supply (about 17m bitcoins currently) and by the MarketPrice ($11,000 per BTC, for example) so the

CryptoValueIndex = RealValue / Supply / MarketPrice

or

CryptoValueIndex = (UtilityValue/CurrentSupply+ NPV(FutureMarketCap)/FutureSupply)/ MarketPrice

where

NPV(FutureMarketCap) = FutureMarketCap/(1+DiscountRate^FutureValuationDate)

This formula is so simple compared to other formulas.

“But wait!” you say. “There’s too many assumptions.”

Back to the Real World

You‘ve got a point—there are a lot of assumptions, but!… I’ve gotten many such objections and, in the end, we are able to work through the assumptions and come up with a very decent indicator.

Before we go further I want to give you a tool to calculate your own CVI. Use your proprietary information to develop your own Index. Here’s the template with Cryptocurrency MarketPrice, marketcaps and CurrentSupply updated automatically. Make a copy of the spreadsheet and add your favorite Altcoin to the Valuation tab to see if you should buy or not. Go ahead, open this sheet… I’ll still be here…

https://docs.google.com/spreadsheets/d/1Zq3ptg0qnazHicARtMDHEi6j9Hl-22TOMCBYhIQOw5w/

Make a copy of the spreadsheet so that you can edit (keep both open so that you can post comments in the Original Template with any questions or update requests). Check out the Valuations tab of your new CVI template and follow along…

UtilityValue

The UtilityValue is how much of the currency is currently being used. Let’s take Bitcoin as an example:

BitPay says they are processing $1B per year, with a Currency velocity of 5 (that is, one bitcoin changes hands 5 times per year, typical for daily use currencies) then they are processing $200M bitcoins. BitPay processes about 1/100th of all useful Bitcoin Transactions so $200M * 100 = $20B are needed to run Bitcoin. That’s the current UtilityValue from the Bottom-Up Analysis.

To check our work, let’s calculate the UtilityValue with a Top-Down Analysis. I’d guess, based on the information I hear, that only 5% of the value of transactions are being used for non-speculative purposes. 5% of the current MarketCap of roughly $200B is $10B, roughly in line with our bottom up analysis of $20B.

Discounted FutureMarketCap

Most of the value of Cryptocurrencies, I found, lies in discounted FutureMarketCap…hardly surprising, I suppose. To determine the discounted FutureMarketCap, here are the quantities we need to find:

-FutureValuationDate

-DiscountRate

-TotalAddressableMarket

-MarketShare

-FutureSupply

-Velocity

The good thing is that we are dealing with only a few variables.

FutureValuationDate should be a time that is far enough away that micro events don’t affect the price much, but close enough that we can still have a rough view of what the world will look like. 1 year away is too close as there could be short term bull/bear market. 50 years is too far as we don’t know if we will be controlled by one-eyed, AI overlords by then . 5 to 15 years is a good time frame. I picked 10 years.

DiscountRate is some percent between 0% and 100% indicating how risky the investment is. 12% is the market rate so we know the discount rate has to be higher than that. VC investments are around 40%. BTC is somewhat less risky (commonly 30%) and ZRX is riskier. I used the Lindy Effect to estimate risk. This is a good place to use your insider information about the relative risk of projects to adjust the model.

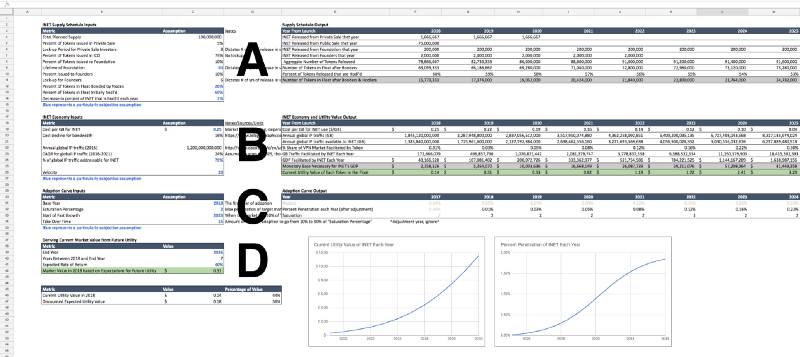

TotalAddressableMarket is the primary market the currency is going after, such as being digital cash in the case of Bitcoin Cash or the Equities market in the case of Ethereum. Google around to find an accurate estimate. This model only focuses on ONE target market for a few reasons. 1. to keep things simple because when you increase the amount of data you look at you increase the noise to signal ratio, 2. because optimizing to be the best at one thing necessarily makes the currency NOT the best at everything else (or, in reverse, a currency that tries to be the best at many things will likely be the best at none of them) and 3. by the Pareto Principle 80% of the value will accrue to 20% of the use cases. Take the example of the top tech companies—the vast majority of revenue comes from just 1 product (except Microsoft).

MarketShare is an opportunity for you to enter your insider info again. One service rarely takes 90% of the market and we expect that the currencies we are assessing will be higher than 1% otherwise we wouldn’t be interested in them.

FutureSupply can affect the Crypto Value Index substantially and we have pretty good knowledge on the supply of a coin at ANY date in the future. BTC caps at 21M and ETH is adding about 18M per year and, as we will see, staking a Proof of Stake currency dramatically affects the benefits of investing.

Velocity is typically around 5 for M1 money supply so we can reasonably expect BTC to have similar Velocity in that use case, whereas the Velocity of gold is much lower so as a store of value BTC will have a lower Velocity, but also a lower TotalAddressableMarket.

That was pretty easy, right?

The only variables you need to give more thought to are TotalAddressableMarket, Velocity, MarketShare and DiscountRate.

Using this method several currencies were assessed, where an index >1 indicates Undervalued (“BUY”) and <1 indicates Overvalued (“SELL”). Here are the results for a few popular currencies:

##What does it mean?

You now have a long term basis to assess which currencies are worth your time and money. If you are an entrepreneur and product developer you can go to your team with facts instead of opinions about which currencies to support. If you are a developer, you can decide which market opportunities are the most interesting to go after. If you are a trader, starting with an undervalued currency will give you a leg up on everyone else

This article uses my assumptions. I advise adding your assumptions to the model. Modifying the variables can be insightful. What if a currency went after a bigger market? For example, adding BTC’s use cases of M1 Money and Store of Value) yields an Undervalued situation. ETH seems to be Overvalued mostly because the supply inflates by 18m per year. However, if you Stake your Ethereum it’s worth about 3 times as much, all things being equal, showing how important it is to stake PoS coins.

One caveat you’ll note is that the model only looks at coins purported to have the best developers. Marketing and network effects are helpful, but ultimately only the best technology will win. An example is Yahoo. Paul Graham recently wrote an article that Yahoo thought of itself as a media company, not a technology company. All of the best engineers went to Google and other companies that valued them. By Price’s Law, 50% of the value is created by the square root of the number of creators in a domain. Assuming there are 10,000 crypto teams, 50% of the value will be created by the top 100 teams or top 1%, so the model depends on first picking currencies with excellent technology and engineers.

Another caveat is that when outcomes are uncertain a portfolio is needed. But that is covered elsewhere.

There you have it. A way to value cryptocurrencies over the longterm and add you own information to customize.

At this point, I would wager than my valuations are more incorrect than the simple Exponential Extrapolation. (I am sure bias runs through my estimations.) But Value Investing is a stronger foundation to build an accurate valuation system.

The end goal is to create an open-source repository for valuation information to reduce volatility, reduce Information Asymmetry thereby increasing Merchant adoption and cryptocurrency success. The analysis should be as simple as possible, but no simpler.

If you want to add proprietary data then fork the sheet, but if you want to improve the model please comment so we can improve the method in a wiki-like style. Here’s the data you can comment on/download+edit:

https://docs.google.com/spreadsheets/d/1Zq3ptg0qnazHicARtMDHEi6j9Hl-22TOMCBYhIQOw5w/

Please Comment with what you think works, doesn’t work or any confusion you have. Follow me on twitter @kyleschutter

Congratulations @kyleschutter! You received a personal award!

Click here to view your Board of Honor

Congratulations @kyleschutter! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!