Using dynamic pricing as a critical path to vacation rental profitability

“You know you’re priced right when your customers complain—but buy anyway.”

(attributed to John Harrison, Clockmaker)

Because of the unique and personal nature of a home, vacation rentals pricing strategies by owner (sic) have generally had more to do with a poker game than with rocket science.

In fact most homeowners overestimate the value of their place, applying a subjective eye when comparing their home with similar properties in the vicinity.

The pattern is almost systematically the same:

The Illusion of an Expertise: “the average price for similar properties in the area is around US$…”

The Reality Distortion Field: “but my place is better than – let’s say this one – because of…”

Simplistic Assumptions: “so assuming that I can charge US$… per day, I should make…”

Yet, how to find the “right price” – that sweet spot where I charge the highest rate without loosing opportunities?

As surprising as it seems, this question makes little sense: what ultimately matters is the profit line at the end of the year, as well as the time you’re ready to spend to earn it.

Because there is a fixed amount of accommodation available for rent, and because different customers are willing to pay a different price for using the same amount of accommodation, yield management applied to VR should consist in repetitively forecasting supply and demand and constantly making rate adjustments. Rates are no longer driven by static “seasons” only; pricing is dynamic.

Location, size and maximum number of guests are universally recognized as the other primary static parameters by which the base price is determined. But a positive impact can be made on the bottom line by dynamically adjusting the daily rate according to two factors: time and occupancy:

Any period of time is available to rent as long as the starting date is still in the future; if not rented, this period is lost, just like perishable goods in a fridge;

The occupancy rate – the ratio of rented days compared to the total amount of available days, remains the ultimate metric both as a KPI and as driving force on market prices.

The input of other variables – such as local events, conference, or concerts…- can be relevant to a certain degree. But unless the property is nearby a Convention Center or a Stadium, they are tricky to integrate into a strategy because of their lack of consistency and unpredictability.

Rather, it’s critical to understand this first simple rule: fewer bookings at a higher daily rate can translate to better yield than more bookings at a competitive one.

Sounds obvious in theory. Let’s see this in practice.

Case Study

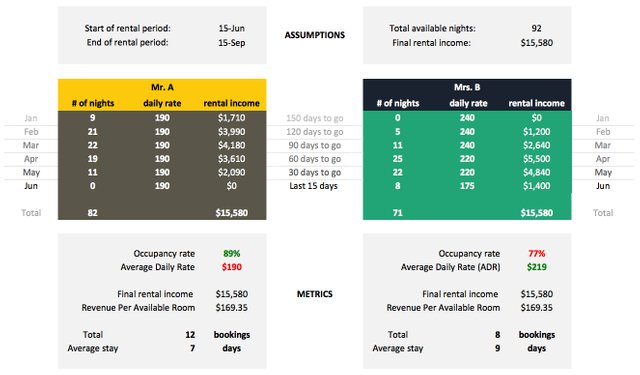

Let’s consider two vacation rental owners debating their pricing strategy:

• Mr. A wants as many renters as possible, so he has set a unique and competitive price for his home;

• Mrs. B wants to maximize profit, so she has built a pricing plan based on time & occupancy.

Let’s make simple assumptions.

First, let’s assume that both properties are located in the same vicinity, and are similar in size and arrangement;

To determine the overall best performance, we must assume that Mr. A and Mrs. B generate exactly the same rental income during the same period of time;

Regardless of their respective booking date, all reservations for stays taking place between June, 15th and September, 15th will be accounted for in the study;

Finally, for the sake of keeping things simple, let’s assume that all reservations are being confirmed during a period of 150 days preceding the rental period (note: in reality, bookings are expected to span over the entire period – through Sept. 15th)

As far as performance, one can predict with reasonable confidence that:

. Mr. A should outperform Mrs. B in terms of Occupancy Rate

. Mrs. B should outperform Mr. A in terms of Average Daily Rate

Since the assumption is that the rental income is identical for both properties for the same period of time, their respective Revenue Per Available Room (RevPAR) is the same, contrary to the Average Daily Rate (ADR) clearly reflecting 2 different pricing strategies.

By creating more traction, the competitive pricing used by Mr. A has generated more requests and – in the end – more reservations than the dynamic pricing system used by Mrs. B.

And it makes all the difference…

Take a look at what the 2 quarterly P&Ls could look like (try with your numbers!)

The bottom line shows a discrepancy of almost 20% between the two P&Ls.

Again the logic is simple to understand: since variable costs weigh on the profit line, a higher booking count translates into higher operational expenses (more greeting; more cleaning; more wear & tear… = more costs); we can see that the dynamic pricing model is an effective strategy to increase profit.

Discussion

In the Travel industry, the widespread idea is that airfares go up the closer you get to your flight; for vacation rentals, that’s the opposite: time plays in favor of the renter and against the owner.

Because a vacation rental is one of a kind – as opposed to the quasi-identical experience you get from a seat in coach from NYC to LA, the renter can always look for other options, and bargain until the last minute (by contrast, it might not be a great idea to wait until the last minute to bargain with Delta or Air France…)

Note: because each property is unique, every pricing curve should accurately adapt to the local market trends while reflecting a clear strategy (cover mortgage and tax; or make as much profit as possible; or need for cash flow…).

While no vacation rental market is the same (each location enjoys its own dynamic), it is reasonably safe to say that in most cases:

the ideal pricing curve should start at its highest point to seize profitable bookings as long as time does not require sequential corrections to adjust to the market;

as time is running out for the calendar to fill up at the other end of the curve, rates should go down before it’s too late.

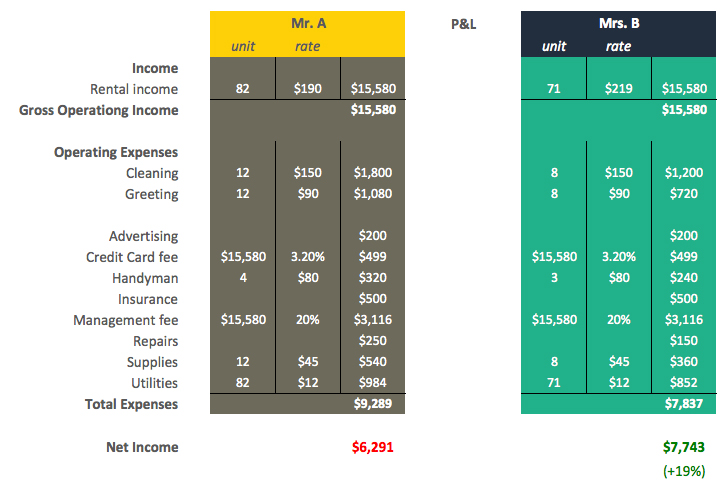

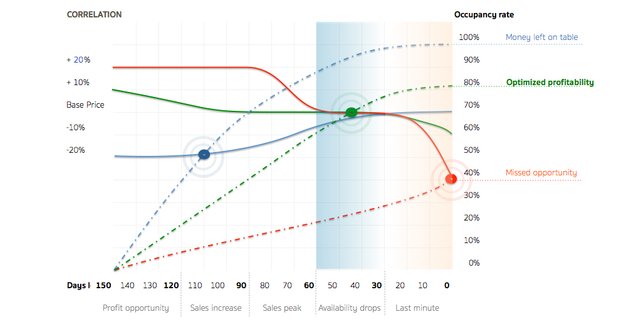

Below are visuals illustrating the mechanical impact on occupancy of 3 different pricing strategies:

• STRATEGY A: Pricing starts too high (out of the market) and – because of poor occupancy – undertakes severe corrections; the high volatility of pricing added to the poor occupancy a lot of confusion resulting in further

deterring renters;

• STRATEGY B: Pricing starts at its highest point (within the market), adjusts to the market trend as time goes by, and eventually drops to consolidate occupancy with last-minute bookings;

• STRATEGY C: Pricing starts and remains too low (below market) until availability becomes scarce and little room is left to increase profitability.

By superimposing both charts, we get something like this:

Here’s the take-away:

- There are 5 sequences to keep in mind as time passes relative to availability:

OPPORTUNITY – Before 120 days: time isn’t yet playing against the owner, prices can be at their highest point;

VALIDATION – Between 120 and 90 days: sales start to increase; it is time to validate pricing/traction;

ADJUSTMENT – Between 90 and 60 days: sales peak; prices need to be in line with the market;

FINE-TUNING – Between 60 and 30 days: as availability drops, tweaking can still make a difference;

CORRECTION – Less than 30 days: at this point “last minute” pricing is either designed to contain losses due to a poor occupancy performance, or to further maximize occupancy and earnings.

- Because a good pricing strategy should be about balancing pricing with occupancy, calendars filling either too quickly or too slowly expose unadjusted pricing; as shown on the charts above, the higher the curves

intersect, the more profitability is optimized.

- A unique and competitive rate tends to generate more bookings immediately – creating the illusion of performance, but as availability goes quickly, little room is left to increase prices later; the earlier the curves

intersect, the more money is left on the table;

- Overpricing only succeeds at keeping the occupancy unsatisfactorily scarce; the lower the curves intersect, the more opportunities are missed;

Conclusion

Dynamic pricing appears to be the latest pricing trend that the ecommerce industry is embracing quickly. While it is a fairly new concept in Vacation Rentals, it is safe direction to take in a more and more competitive environment.

Several cloud-based services have already taken the lead to bring Dynamic Pricing to the general public; each one offering its own set of features based on different tactics or approaches:

- BeyondPricing (the veteran of the pack) analyzes data daily in individual markets around the world, and makes price recommendations based off 3 variables: day of week, seasonality, and local events;

- PriceLabs’ experience in revenue management is about scanning local markets trends; offering predictive analytics and machine learning with some customization options;

- Wheelhouse leverages more than 10 billion data points, and offers a strategic approach using more than 240 unique rates per year, updated automatically every night;

- OutSwitch is a service tailored specifically for professional vacation rental managers who want be in full control over their pricing settings

Orbirental is well equipped to provide property managers with various dynamic pricing options actionable on a per property basis, as well as integrations with BeyondPricing, Wheelhouse, OutSwitch and PriceLabs.

Given the increasing price transparency in the industry – which in turn has increased the frequency of price changes, the good question might already no longer be “Is Dynamic Pricing for me?”, but “Which model is right for me? We welcome your comments and experience.

-Julien Vergely – Co-Founder & Advisory Board Member at Orbirental. Owner at PricingPerfect.com

Congratulations @orbirental! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @orbirental! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP