USDT / BITCOIN

Hi ,

I did some serious thinking about Bitfinex/USDT news.

And came to a possible scary conclusion.

Let's look to some news facts about this:

This news came out 04/25 and BTC prices dropped everywhere.

https://amycastor.com/2019/04/26/new-york-attorney-general-bitfinex-is-hiding-850-million-in-losses/

https://www.scribd.com/document/408259237/Stuart-Hoegner-Affidavit#from_embed

Only 74% of all USDT is actualy backed by US fiat $

It's getting complicated now:

https://iapps.courts.state.ny.us/fbem/DocumentDisplayServlet?documentId=vIexA1b0spKOnK_PLUS_ZUGTJ3A==&system=prod

each currency is covered by reserves, including traditional currencies,

cash equivalents, and, from time to time,

other assets and claims arising from Tether's loans to third parties

iFinex is the parent company of both Bitfinex and Tether.

In fact, Bitfinex has borrowed money from itself, and secured that loan with its own shares.

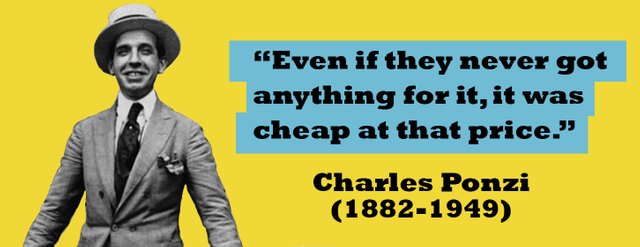

Do you know this man ?

Hohoho , where's the CEO ?

Now let's look what markets did (they never lie!!) :

Very quickly price recovered at Bitfinex , Binance , Huobi.

Comparing chart with USDT marketcap with BTC exchanges.

https://www.tradingview.com/x/uYIfR7Qr/

Hmm , interesting , all exchanges with USDT and Bitfinex recovered initialy

much quicker than exchanges with a fiat trading-pair , remarkable

Explanation : USDT is dump here is very strong , all into crypto.

Such trading action on every exchange is always the result of BIG BOYS,

assuming they now very well what they are doing otherwise they would be small.

My conclusion:

Logic says , the big worry ain't Bitfinex.

The big worry is Tether.

Big Boys are dumping Tether as quickly as possible , because the real value is not 1/1 anymore.

This investigation will lead to a downgrade of USDT to who knows maybe 0.75/1.

Similar to a credit fixing in fiat markets.

This is unprecedented in crypto land.

Getting a haircut on your fiat-crypto , means less buying power for crypto.

Supply/Demand rule : :-) Lower demand means ... lower prices

Usdt is used on so many exchanges...

This could be a crypto lookalike Lehman Brother's event

Tether became a ponzi-scheme , by this loans to itself with collateral of iFinex shares.

(And that's a very good reason to run away for Charles Ponzi's grandson)

By The Way :

iFinex-shares were funded with Special Purpose Vehicle's ,

investors in this were among others clients of Bitfinex

and any possible imaginary dark web mixing cartel , maybe next time

Thanks to

https://lekkercryptisch.nl/

who's articles I used as source of inspiration.

Disclaimer :

This post is the result of my thinking

and should not be taken as the truth.

They are not false accusations

nor advice to anyone .

It's a reflection of my mind , which I share.

Thanks for reading ,

do not follow me ,

walk beside me and

stay out of my aura or

or I'll run on your energy pathways. :-))

Have fun !!