How smart contracts works?

Smart contracts may greatly improve the process of post-trade settlement, by reducing disputes and errors. Smart contracts will ensure that final settlement will happen when the execution of a trade occurs. With smart contract technology, a legal agreement can automatically execute clauses within it.

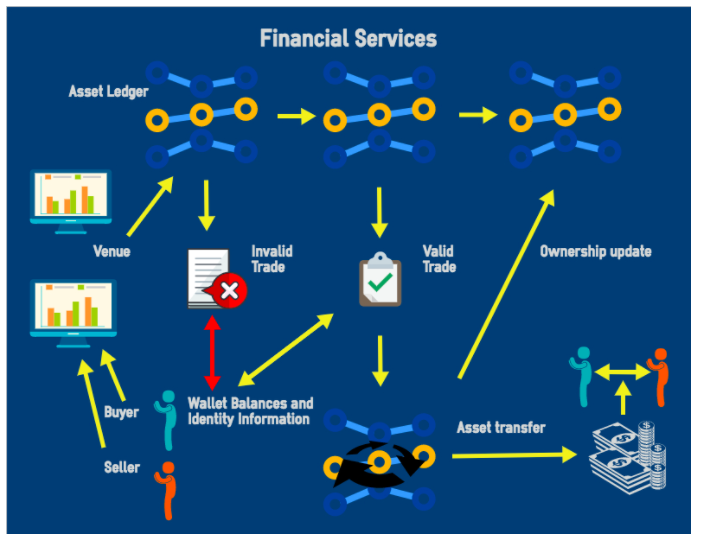

The image above shows the automation of back-office processes involved in trade confirmation and post-trade settlement via DLT. An asset ledger stores ownership and transactions. Smart contracts allow the asset ledger to handle collateral management and initiate payments per contract terms. Venues (e.g. exchanges, MTFs, bilateral voice conversations) still match trade requests with a counterparty, and provide price discovery. Querying information on the asset ledger may assist with price discovery. The asset ledger verifies the parties and asset ownership. It will then either accept, or reject the trade. If, for example, the seller does not own the asset in question, or the new trade would result in an illegal overexposure on the buyer side, the trade would be rejected. When a trade is valid and accepted onto the blockchain, the blockchain automates an immediate change in ownership, or a delayed, or contingent asset transfer. The changes in asset ownership or contract terms are securely recorded onto the asset ledger. The contract is programmed to execute automatically, exchanging payments and other assets per the terms agreed to by the parties.

It is still unclear whether courts will enforce blockchain contracts in the same way that they enforce traditional written contracts, with inked paper signatures. Therefore, the current best practice is to record trades on blockchain, alongside traditional legal documentation. The operative clauses in the traditional written contract are converted into smart contract templates to be placed on blockchain once a trade is confirmed. For example, a full ISDA master agreement document would be stored on blockchain, and tied to the smart contract governing the underlying swap or derivative trade. This leverages the predictable outcomes of a legal contract with the efficiencies that can be gained from distributed ledger technologies .

Steemit:

https://steemit.com/@g1984

Twitter:

https://twitter.com/Crypto_Gui

YouTube:

bit.ly/2wL6Yxx

☁️Cloud Mining:

Get a 3% discount on you cloud mining contract using this code “Q4AkJD”

Genesis Mining - www.genesis-mining.com

💲Buy Bitcoin:

http://bit.ly/2uswcEf

💰 Secure your Crypto with Hardware Wallets:

Hardware:

Ledger Wallet

http://bit.ly/2urYVcd

Trezor Wallet

http://bit.ly/2wLBtDw

💵For donations:

Bitcoin:

1PzdfEmjp4a15mhba9Wak2vHyWBQ3wnCG

Ethereum:

0xE7c74E54DDA62FDf10Aaa5D1f40b2Bc30d115C62

Dash:

Xx38gtynz9tUHscwCSvTq5EA88qe4j6UfN

Litecoin:

LPMGUoBs68MnoJANgfmvZp31h88xvhkPiz

Coins mentioned in post: