Universal Basic Income will fix the economy and tax system, even today

Universal Basic Income is a system that will give every citizen a paycheck from the government, just enough to put them over the poverty line. It's often argued that a UBI will be necessary when automation takes away all the jobs from people, making it very difficult to earn an income. But automation is not the only reason why a UBI should be implemented. There are many benefits a UBI will bring to the US, whether robots take over our jobs or not.

This UBI should be payed for with a 20% income tax. The UBI will be handed out equally to all US citizens aged 18 and over. It will also replace social security, welfare, minimum wage, and tax deductions.

Looking at data from 2016, this means that every citizen aged 18 and over would receive $12,834 from the government for that year. This is based off of $16.011 trillion total personal income, 249.48 million US population aged 18 and over, and a 20% income tax to pay for the UBI.

If the US taxed imports at the same rate as income, the total federal income tax would be 33% if the US spent 3.2 trillion on a UBI, 1.38 trillion on a Universal Health Care, 580 billion on military, and 1 trillion on everything else. I'm not supporting these exact numbers for the federal budget, but I will use 33% as an example for this blog.

Why 20 percent?:

- If it were 15% ($9,625 a year), then it wouldn't be enough to put someone over the poverty line for an individual and if it were at 25% ($16,043 a year) then it's pushing taxes too high when all other taxes are added on.

Why a flat income tax?:

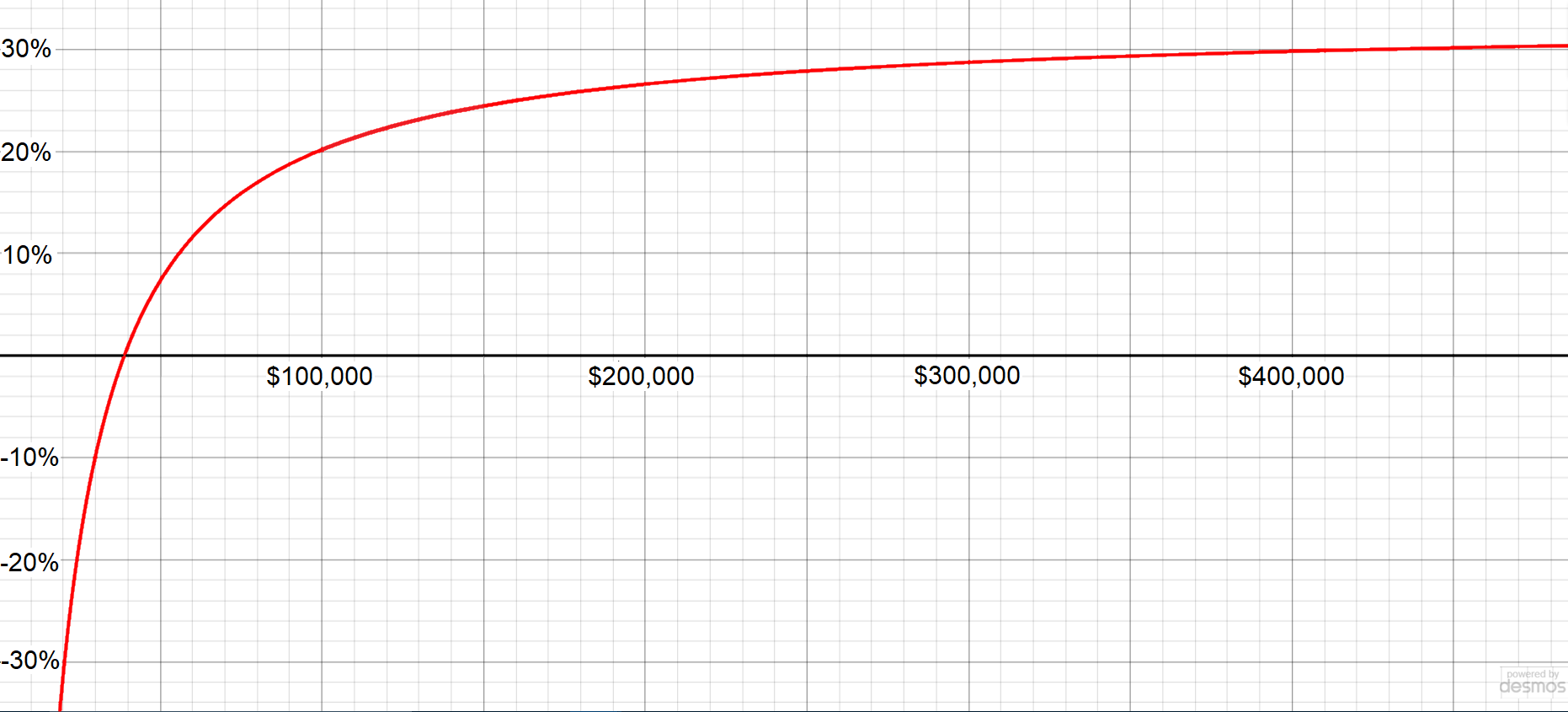

- A flat income tax combined with a UBI creates a very progressive net tax rate (shown in the graph below). If the total income tax is 33% and the UBI is $12,834 per year, then anyone with an income below $38,890 will have a negative net tax rate and anyone making more than that will have a positive net tax rate. The net tax rate is calculated with the formula (0.33 * income - 12834) * 100 / income.

- If it wasn't a flat income tax then people would receive money from the government at a higher income than $38,890, which is already more than the median individual income in the US.

- With a flat tax, people who work twice as much or contribute to the economy twice as much will make twice as much income. If the government lowers incentives to make higher incomes then there will be less income to tax for a UBI

- Extreme simplification. There will be no tax returns. The government will keep track of total income, imports, and the population receiving the UBI. Whenever money goes into your account, the government will take 33% of it. Then at the end of each month, the government gives everyone the same UBI. You will no longer have to file for taxes.

Why tax imports?:

More tax revenue without increasing income tax.

The US needs to become financially independent of China. What if the economy of China plummets or they end up in a war? The US doesn't want to be effected by that.

This would bring manufacturing back to the US. If companies manufacture in the US and automate their factories then it will cost less than making products in China, will dramatically lower shipping costs, and dramatically lower shipping time. All of this will make products cost way less.

People who decide to outsource jobs to other countries should have to pay the same amount in taxes as those who decide to put jobs in the US.

Why age 18 and up?:

If the UBI age is too low then it has to be distributed to more people making it cost more. If it is too high then it won't be given to people who really need it. People who are 18 need the money to pay for college or to start saving up for a home. 18 is the age when people typically become financially independent from their parents. If the UBI is at age 18+ then it will replace financial aid and pay $12,834 a year for a student's education. Using UBI to help pay for college while getting government involvement out of college in every other way will cause colleges to be more innovative and efficient.

There are problems with giving the UBI to children even if it is a smaller amount. The money would go into the parent's account because minors aren't able to have their own bank account. Some parents would only use the extra money for themselves. Some people would take advantage of that system by having more kids just for extra income, and then abandoning those children. Couples who have kids will not need extra UBI because they are both receiving UBI, making it so the couple is getting a total of $25,668 from UBI.

A better way to reduce child poverty is to provide shelter and food to any child that wants it. I will make a post about this later.

Why should the government get rid of the minimum wage?:

There won't be a need for a minimum wage with a UBI. Wages will be higher than they are today because if they aren't, people will decide to not work and live off the UBI. Businesses will increase wages until all positions are filled.

Even with higher wages, a UBI will decrease costs for small businesses because the UBI will cover some of the worker's wages.

How would a UBI improve the economy?:

A UBI creates more circulation of wealth. When the lower class has more wealth, they consume more, giving money back to the businesses, which creates more income to tax and give back to the people.

Cheap labor will benefit small businesses, helping them grow.

What other benefits does a UBI have?:

A UBI will eliminate poverty.

It will lower crime rates.

It will give more power back to the workers because they can quit their job without going into poverty. Businesses will have to make sure they are paying workers enough and treating them well enough that their employees don't quit.

It will get rid of social security and welfare.

What will UBI not do?:

It will not cause everyone to quit their job. As explained before, if people do try to quit their job, businesses will raise wages and improve work situations until they decide to come back.

It will not increase prices on necessities such as groceries. More people will be buying groceries, but businesses will increase the supply of groceries to keep the prices down. If anything, demand will increase on products such as a better tv or car. That's human nature. It is not a problem if those products increase in price.

Rental prices might increase, but only until more apartments are made to keep up with increased demand.