Review Project UniDApp - Is a fully decentralized trading platform

1-What UniDApp???

UniDApp is a fully decentralized trading platform with a balanced feature set that simplifies the user experience to the maximum and

is based on Uniswap with an advanced set of tools that are only available for centralized exchanges to use on top of the DeFi ecosystem.

The platform will provide the user with an opportunity to access such tools as order aggregation, liquidity chart, planning of sales and purchases, analytics, scheduled automatic notifications.

Security and reliability of trading and asset transfers are in priority. For this task, UniDApp will provide a simplified interface that will connect to the Uniswap API.

UniDApp users are completely protected as they keep their private keys and only they have full control over their assets and transaction

Distinctive features of UniDApp are:

- the possibility of setting an unlimited number of pending orders for a decrease or increase in the price, which is an absolute necessity when a trader follows his strategy, be it using such instruments as Eliot waves or waiting for price fluctuations on the news. Orders will be triggered automatically regardless of whether you are sleeping, driving or just relaxing

-notification of reaching the specified price of the given tokens, which will help an experienced trader quickly navigate the market and, if necessary, change the strategy - the ability to monitor the required coin in real time, as well as, if necessary, view the price change graph since the coin listing on Uniswap

- a simplified and intuitively simple interface so that even an inexperienced person can figure out and study the functionality in a matter of minutes

- performance due to the optimization of all processes

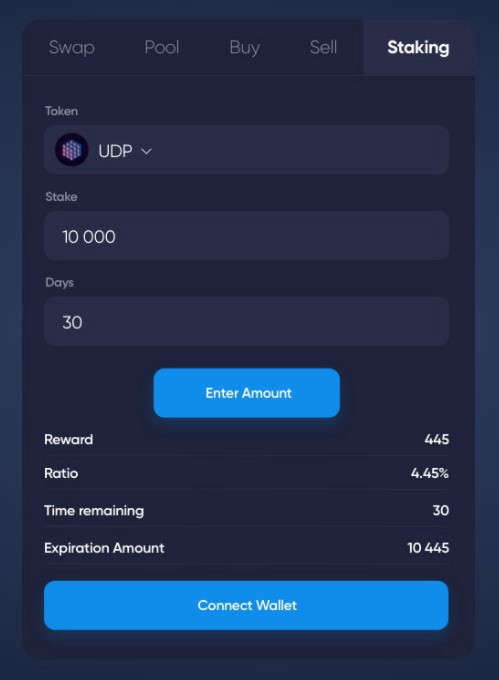

Staking:

The UDP token is a utility token.

On the UniDApp platform, in order to make transactions, the user must own a UDP token, which can be purchased on Uniswap after the 3rd round of OTC or any other exchange a few days later.

For each transaction, the commission will be 0.25% of the transaction amount and will be charged automatically in UDP tokens. 90% of the amount charged will go as a reward to the UDP token holders, the remaining 10% will go to the UniDApp fund. The ability of token holders to receive passive income will stimulate the liquidity of the token and the growth of its price.

With the advent of Uniswap, it has become one of the most important components of the entire DeFi industry, as it allows users to exchange tokens without trust, which means that all transactions are performed from smart contracts without the need for an intermediary or a trusted party.

An audit conducted by Consensys Diligence, publicly available on GitHub, confirmed the security of Uniswap smart contracts.

Uniswap has become the most popular decentralized marketplace. It connects traders, the transaction takes place directly between their wallets. The user does not need to create an account and leave funds on it, they are stored in a personal wallet.

Compared to other DEX competitors, Uniswap has a number of advantages for small traders. In particular, Uniswap does not pay for a listing, does not require its own tokens, and is one of the cheapest gas prices of all DEXs.

Uniswap’s unique architecture completely eliminates the order book. Oddly enough, market makers no longer quote a price when providing liquidity. Instead, they just supply the funds and Uniswap takes care of the rest. For this, UniDApp is being created to supplement the advantages of an already created decentralized product with convenient opportunities for all of us as on centralized exchanges, but without their flaws.

The new trend has revitalized the cryptocurrency industry, despite the fact that asset values remain 75% below their 2017 levels. It’s called DeFi, short for decentralized finance. At its core is the idea that crypto entrepreneurs can recreate traditional financial instruments in a decentralized architecture without falling under the control of companies and governments. DeFi apps don’t need intermediaries and courts.

The code determines the resolution of each possible dispute, and users, in turn, keep all their funds under control. This reduces the cost of providing and using products, and allows for a more reliable financial system.

Another significant advantage of such an open ecosystem is the ease of access to financial services for people who, for some reason, do not have such an opportunity. The traditional financial system is based on profit, usually not providing services in low-income communities. However, thanks to DeFi, downsizing operating systems are shrinking.

The new paradigm in the world of decentralized financial services has already given the world many successful crypto projects based on Ethereum, such as Dai, which accounts for two percent of the total circulation of Ether, worth approximately $ 339 million, and many others. UnidApp will soon become an integral part of our lives.

2-How the new DeFi project UniDApp is ready to solve the problems of Uniswap.

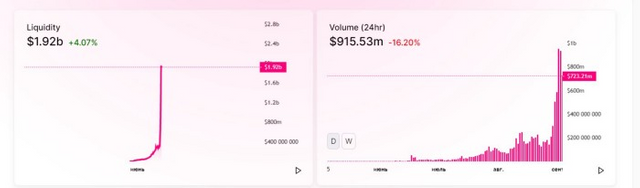

Decentralized finance activity continues to push related services to new records. This time, Uniswap became the first decentralized exchange protocol to exceed the 1 billion mark in 24 hours.

According to the tracking portal CoinGecko, Uniswap is the third largest platform in terms of adjusted trading volume, including centralized ones, second only to Binance and OKEx.Trading volumes are surging on Uniswap and other so-called decentralized cryptocurrency exchanges, challenging established venues like Coinbase while driving up fees and congestion on the Ethereum blockchain.

But is all that good with Uniswap?

Uniswap has been helping us to make trading on the basis of Ethereum for quite a long time, but still many people are in no hurry to move here from the usual centralized exchanges. Stuck transactions, huge Gas fees, and last but not least, manual trading.

How to build your strategy? How to monitor the pool price and liquidity? How not to miss the right price? And many other questions continue to discourage users from switching from centralized exchanges to DEX exchanges.

Thanks to Ethereum’s Uniswap protocol, UniDApp will help get rid of some of these problems. UniDApp platform will provide the user with an opportunity to access such tools as order aggregation, liquidity chart, planning of sales and purchases, analytics, scheduled automatic notifications. For this task, UniDApp will provide a simplified interface that will connect to the Uniswap API.

The popularity and importance of Uniswap are growing every month, which is also facilitated by the simplification of the process of connecting websites and mobile applications to the protocol and interacting with it using the JavaScript SDK. The SDK is regularly maintained with its source code fully transparent and accessible via GitHub, this allows outside observers to validate the code and this best shows the open policy of Uniswap.

The growth and spread of Uniswap will directly affect the demand and development of the UniDApp project, since with it users will be able to on-chain state for liquidity, token values and exchange rates, and initiates real-time feeds to the dashboard where automated trading can then take place.

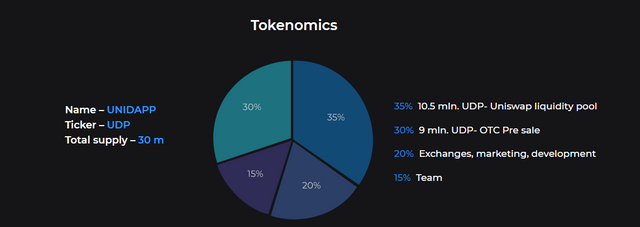

3-Tokenomics

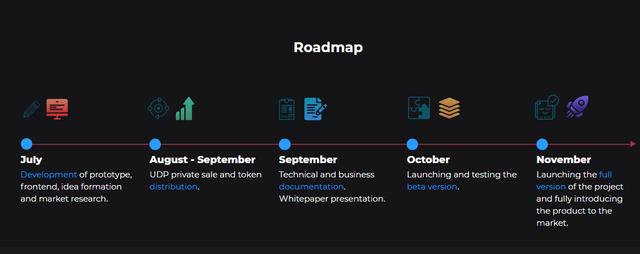

4-Roadmap

More information:

Website: https://unidapp.app

Twitter: https://twitter.com/UniDApp

Telegram: https://t.me/unidapp

Medium: https://medium.com/@unidapp.project

Author:

https://bitcointalk.org/index.php?action=profile;u=2578600

ETH: 0xc19A0C710c1f57b930C82350d5A200a1C48f62de