Distributed Credit Chain (DCC) – World’s First Distributed Credit Agency on The Blockchain

Hello Guys!!

I would like to ask you some questions.

Have you ever received debit alerts of some ridiculous bank charges that you know nothing about from your bank?

Have you ever been denied of loans from your bank after wasting the time and resources that you put into applying for such loans?

Or perhaps, are you even tired of the monopolistic nature of these banks that charges insanely high interest rates on loans while giving you peanuts as interest on your deposits with them?

If those questions sound familiar to you, then I’m here to tell you that a new era has dawned in the financial/credits sector and virtually most of these rip-offs by these centralized financial institutions will soon be a thing of the past with the introduction of decentralized financial services into the credits sector of the economy.

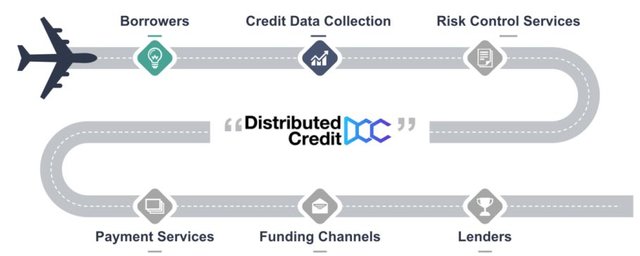

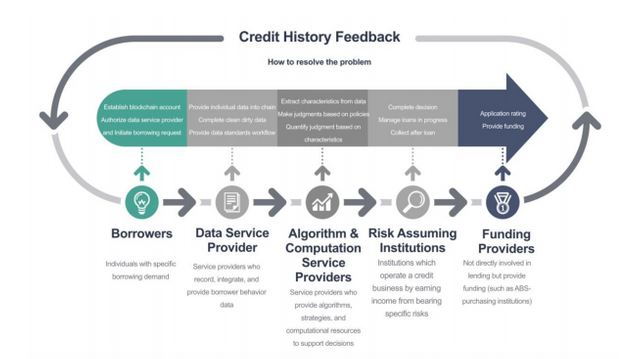

Today, I will be introducing you to a revolutionary decentralized credit platform called Distributed Credit Chain (DCC). Distributed Credit Chain (DCC) is an integrated ecosystem of distributed financial services which aims to break the monopoly of traditional centralized financial institutions. DCC is aimed at providing fair financial services to all the providers and users involved in a credit transaction, so that each participant in the transaction is remunerated adequately without scenarios where we have one party exploiting the other. This distributed credit services provided by DCC ensures inclusive finance.

It is an open-truth that centralized credit providers such as banks are highly exploitative in nature. Their centralized business structure gives them the ability to rip off users of their services in ways that are absolutely not economical to these users. Centralized credit services providers basically exploit the excessive premiums that result from information asymmetry that exist among participants in a credit transaction. I will be detailing some of the current issues that make centralized credit services by banks not appealing to users below:

- High Transaction Cost

- Decreased Efficiency

- Profiteering

High Transaction Cost

Basically, the modus operandi of centralized financial institutions is to share the cost of non interest-earning operations with the users. Bad debts which are irrecoverable debts are also shifted to the users of credit services by these credit services institutions. This represents additional to costs to borrowers who will still have to deal with high-interest rates from these highly exploitative financial institutions. But in a case where these financial institutions are monopolistic in nature, borrowers are forced to pay these high transaction costs due to lack of alternatives.

Decreased Efficiency

Borrowing from credit agencies involves bureaucratic processes of risk evaluation and creditworthiness evaluation of the prospective borrower. In carrying out these processes, a lot of time and other resources and expended. This represents waste of resources and decreased efficiency on the part of these credit agencies when verifying those that will not eventually meet the risk criteria. This also represents waste of precious time and resources on the part of the part of prospective borrowers who has expended time and other resources in applying for the credit.

Profiteering

Research has it that 80% of financial institutions profits come from the premium that they get between the interest rate and the lending rate. Credit agencies have deviated from their primary purpose of serving customers to making profits. They squeeze out lenders by giving them meager interests on their savings while charging exorbitant amount of interest on loans taken by these users. This widens the premium between interest rate and lending rates thereby making these financial institutions some insane profits at the expense of their users.

So, the question now is can we have distributed credit agencies that offer fair financial and credit services to users? Credit agencies that are not monopolistic in nature, and that can ensure inclusive finance to all the participants to a credit transaction.

During the course of my research, I found a distributed credit platform which aims to pioneer the decentralization of financial/credit services in the financial sector.

Introducing Distributed Credit Chain (DCC) – World’s First Distributed Credit Agency on The Blockchain

Distributed Credit Chain (DCC) is a decentralized credit ecosystem built on the blockchain to provide fair and efficient credit services to users. Traditional centralized financial institutions are fraught with many problems e.g. high bank charges, high-interest rates on loans, dishonest operations, abysmally low savings rate just to mention a few. We believe that this rip-off by banks is made possible due to the centralized nature of the mode of operation of these financial institutions. DCC exist aims to break this monopoly by creating a distributed credit agency that is secured by blockchain technology while adequately rewarding all the participants in a credit transaction. DCC was birthed to create lasting solutions to the problems that current financial institutions have created. DCC aims to revolutionize the financial industry in the following ways:

Blockchain-based Competitive Lending Rate

Secured and Speedy Credit Transactions

Massive Reduction in Transaction Cost

Non-Cooperative Game Between Participants

Blockchain-based Competitive Lending Rate

One of the major reasons why Distributed Credit Chain (DCC) was birthed is to return power to the people. Up until now centralized credit agencies like banks holds the monopolistic power of setting the lending rate they wish to charge borrowers with borrowers having no choice but to accept. DCC creates a decentralized credit platform whereby borrowers have access to view lending rates from every part of the world thereby choosing an interest rate that best suits them. This totally removes the monopolistic powers of these financial institutions as they begin to compete with themselves which will definitely bring about a much more lower interest rate. The asymmetry of information about the lending rates in other part of the world has been removed with the introduction of a distributed credit system that gives power to the people to choose the lowest interest rate that suits their needs. Interest rates conditions are different from country to country. For example, a Chinese credit agency might be willing to charge an interest rate that is much lower than what a UK credit agency will charge for the same amount of loan. DCC therefore makes it possible for a UK residence to take a loan from a Chinese credit agency thereby taking advantage of the perfect knowledge of the market that DCC provides. This is such a groundbreaking achievement by DCC which will definitely return the power of negotiation to the people.

Secured and Speedy Credit Transactions

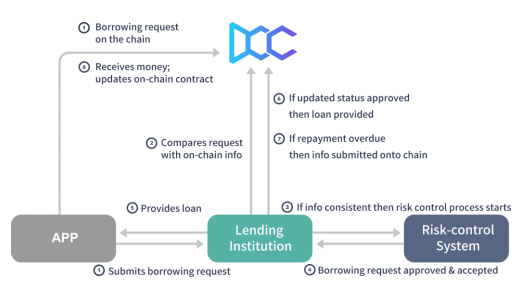

Distributed Credit Chain is a novel credit platform built on the blockchain. What this offers is that transactions are encrypted on a distributed ledger which means they are highly secured and tamper-proof. All the credit transactions are carried out on the blockchain, with credit history of borrowers made available to credit agencies in seconds. This facilitates the process of loan applications. What obtains in the traditional financial sector is a bureaucratic process of applying for loans which can take between several days to several months depending on the amount of time spent on risk evaluation of the loan application. DCC removes this delay and in turn replaced it with a super-fast and secured credit transaction.

Massive Reduction in Transaction Cost

Centralized financial institutions are in the habit of passing the costs of their non interest-earning operations to users. What these exploitative institutions are about is milking customers of their funds while dumping on them various banking charges that has nothing to do with them. DCC provides a decentralized credit platform which totally removes all these costs and ridiculous banking charges to users. This represent another attractive feature of a distributed credit agency and one more reason why distributed credit agencies will soon displace centralized financial institutions.

Non-Cooperative Game Between Participants

Distributed Credit Chain (DCC) provides a decentralized credit ecosystem in which all participants are treated equally. DCC makes use of smart contracts to initiate transactions thereby giving participants equal access to data. The openness of this platform ensures that lenders and borrowers can cooperate on equal basis thus creating a non-cooperative game between participants.

From all the above advantages that DCC provides over tradition financial institutions, it is evident that distributed credit structure is the way forward. This decentralized credit ecosystem gives power to the people in terms of choosing the best interest rate that suit their needs while also providing a fair and secured credit platform. This project is handled by a team of highly professionals and the ico was sold out in minutes which is a testament to how important people see this project. This is a rare gem in the crypto space and one we must fully support if we want to see the monopoly that banks holds in terms of credit transactions end. The power is now in our hands to overthrow the exploitative traditional financial services for a more liberal and fair credit services on the blockchain.

The Use of The DCC Token

DCC is a standard erc20 token that will be utilized on the Distributed Credit Chain platform. All transactions on the chain will be carried out with the use of DCC. DCC balance is managed through DCC token contract to maintain a fixed total amount of DCC. As the credit service system in the DCC continues to expand, we expect that more and more distributed services are carried out on the platform which greatly increases the liquidity. The DCC will also be used to redistribute credit benefits in the ecosystem. DCC tokens will also be used to incentivize good credit behaviors by rewarding those who pay their loans before time with DCC tokens.

Token Information:

Name: Distributed Credit Chain

Total supply: 10,000,000,000 DCC

Type: ERC-20

Ticker: DCC

ICO Token Price: 1 DCC = 0.0388 USD

Sold on pre-sale: 26,400,000 USD

Fundraising Goal: 49,000,000 USD

Token Allocation:

- Foundation - 28%

- Management Team - 20%

- Private Round - 18%

- ECO Reward - 17%

- Market & Cooperation Agency & Consultants - 15%

- ICO – 2%

Use of Funds Raised During ICO:

Labor Costs - 30%

Marketing - 25%

Reserve Fund - 25%

Business Cooperation - 10%

Consultancy - 5%

Ecosystem Operations – 2%

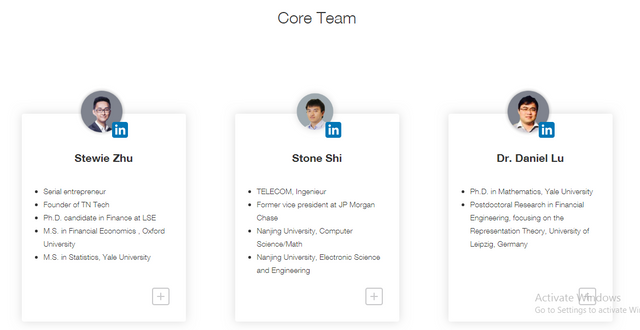

The DCC Team

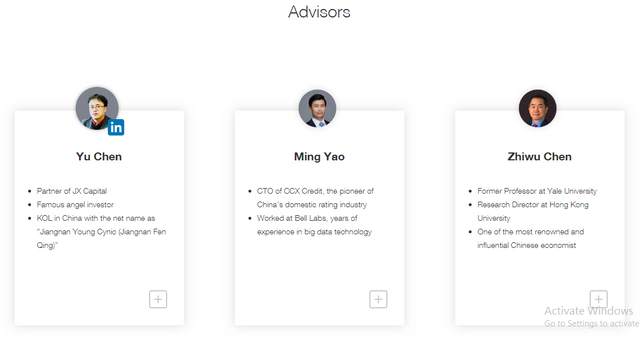

Advisors

Partners

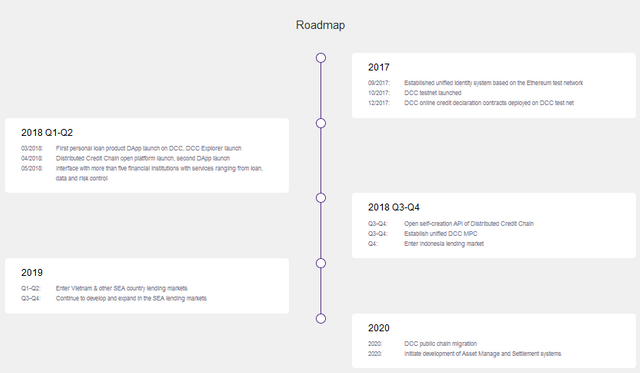

Roadmap

I have provided links to the website and whitepaper of DCC below

• Website: https://dcc.finance/

• Whitepaper: https://dcc.finance/file/DCCwhitepaper.pdf

The following provides the link to their social media sites:

• Facebook:https://www.facebook.com/DccOfficial2018

• Twitter:https://twitter.com/DccOfficial2018

• Youtube: https://www.youtube.com/channel/UCX0Y5MQwTLGPtIP1jAJm9Ng

• Medium: https://medium.com/@dcc.finance2018

• Reddit:https://www.reddit.com/r/dccofficial

• Github: https://github.com/DistributedBanking/DCC

Authours Profile: https://bitcointalk.org/index.php?action=profile;u=2077261

Authours's Telegram: https://t.me/foley15

Really informative article mate. I could read from your post that the project is about building a distributed credit platform on the blockchain which will solve most of the problems of traditional banks like high interest rate on lending, bureaucracy etc.

Thumbs up

Thank you for stopping by. Hope you have been wowed by the awesome features of the DCC platform

This actually did clear my thoughts on the Distributed credit chain network and I'm particularly glad on how this is geared at tackling the problems of monopolistic influence on lending rates brought about by the centralized credit agencies. I think this is a notable development for the financial credits system and do look forward to the launch of the working platform

Yes you're right. DCC totally removes the monopolistic tendencies of traditional banks in setting lending rate and give power back to the people because they have perfect knowledge of the market and can get loans anywhere in the world at a reduced lending rate. Thanks for stopping by

I have truly never had time to thoroughly look into this project until now and I must truly commend your effort on this article as you have given an in depth knowledge on this work. I'd love to ask, what are the plans in place to achieve this? I ask because this write up has sparked a predilection in me and I'd love to invest in this. So what plans are in plans to make this feasible?? By the way, the authenticity of this project is one I must truly commend. Great job.

The plans are already set in motion. The funds needed to build the dcc platform has been raised during the ico. $49m was raised in less than an hour despite the negative investment atmosphere in the crypto space. This shows the belief that people have in this project. And the team has begun work on building the first truly decentralized credit platform that offers fair and secure credits to prospective users. Thanks for stopping by

Information they say, is key.... Thanks for this mate...

You're welcome sir. DCC is such a brilliant project.

Good post and good token. Look also my post on airdrop

https://steemit.com/cryptocurrency/@advisor77/100-million-vtho-airdrop-for-vet-holders-on-binance

Thanks for stopping by. I'll definitely take a look at your post

Excellent innovation! It's about time we had something like this. I believe DCC program will help a lot of disgruntled people who have been cheated through unnecessary transaction charges.

You're very right about that brother. DCC puts smile on the faces of customers who has in one way or the other been ripped off by these centralized credit institutions with their innovative decentralized credit platform. Thanks for stopping by

Even in this era of ICOs failing Dcc has proving an outstanding measures. This is something really huge we should look into.

very informative article. take a look if you like my content @nitindafda

Definitely I'll do that bro. Thanks for reading

DCC is definitely a breakthrough in the finance sector using the blockchain technology. While you take the whole money lending system on a decentralized scale, you end up breaking the monopoly of the current existing bureaucrats. For a developing countries like India, South Africa etc. raising capital for a common man is a burdening task. After implementing the DCC system in such countries, a massive boom can be created in the banking sector and hence throwing light on blockchain which many people are not aware of. Good luck mate :)

I couldn't have said it better brother. DCC is such a groundbreaking project with lot of potentials particularly for developing countries where the activities of these monopolistic centralized lending institutions is largely unchecked. Thanks for your input

really good post :)

Thank you