Uma Chit Fund - Revolutionized Savings cum Borrowing

Uma Chit Funds (India) Limited is a chit fund company which manages, conducts or supervises, as foremen, agent or in any other capacity, chits as defined in Section 2 of the Chit Funds Act, 1982.

Uma Chit Fund token (UCF) is an ERC20 compliant token issued on the Ethereum platform. It is a utility token on the Uma Chit Fund platform.

The perfect blending of Uma Chit Fund with Blockchain Technology

The thing that makes Uma Chit Funds stand out from the other chit fund projects in the market is the fact that the platform is backed by the highly trending blockchain technology along with enabled smart contracts. By engaging our platform with blockchain technology, we would be able to serve the chit holders with unmatched transparency, scalability and some additional member benefits (which will be made available at the maturity of every successful chit term period). Smart contracts are lines of code that are stored on a blockchain and automatically execute when predetermined terms and conditions are met.

The benefits of smart contracts are most apparent in business collaborations, in which they are typically used to enforce some type of agreement so that all participants can be certain of the outcome without an intermediary’s involvement. So, this will ensure full transparency and assure the users/members that our end of the deal will be met without an intermediary’s involvement. All the records and history will be digitally stored and linked together on the distributed ledger (blockchain). Each record is also encrypted to provide an extra layer of security. Blockchain is said to be “immutable” because the records cannot be changed and transparent because all participants to a trade have access to the same version of the truth.

Therefore, Uma Chit funds will make it possible for you to save and borrow funds easily without having to look at the financial documentation. Also, we look forward to providing various other opportunities which will make it convenient and beneficial for our users/members to pay the weekly/monthly/yearly EMI’s with our utility token (UCF) which will indeed help increase the demand and use cases for our coin on the platform.

Customer satisfaction

We strive to provide the most advanced user interface to the users of our chit groups. Each user would have a real time update regarding their chit purchase, upcoming or pending EMI’s, actual benefits in the form of dividends (excluding the foreman charges), borrower’s limit for each month, etc. We will try to keep our participants/chit holders as close as possible by keeping complete transparency and attending personally to any chit holder having problem/issue with the platform.

A survey form will be sent to each chit holders on their dashboard after the end of every successful chit round to get genuine reviews about the chit schemes, platform and if any updates are needed. This will enable us to meet the demands of the chit holders by implying necessary changes onto the platform for ease of access and convenience.

Regulation of Chit Funds

Union of India has Act 40 of 1982, an establishment by the Central Government, which is controlled by the particular State Government with the assistance of State Rules. The State can likewise look for exhortation and help from Reserve Bank of India on strategy matters.

There is an office of “Registrar of Chit Funds” in each State that screens activity of the chit organization minutely including the base capital prerequisite before the initiation of business, acknowledgement of security rising to the chit sum for the sake of Registrar before the beginning of every chit, limitation on the total volume of turnover corresponding to the net possessed assets, limitation in the usage and appointment of the subscribers’ assets in the possession of the chit advertiser, and so on.

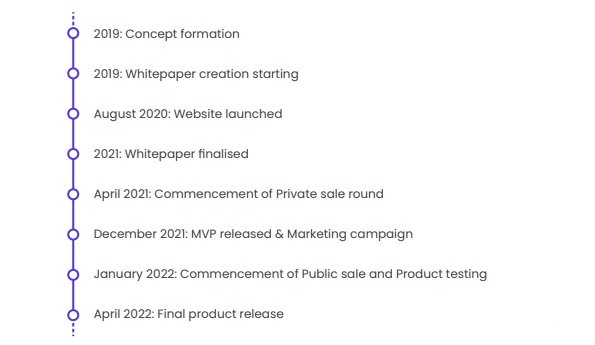

ROAD MAP

TEAM

Statistics and future of Chit Funds

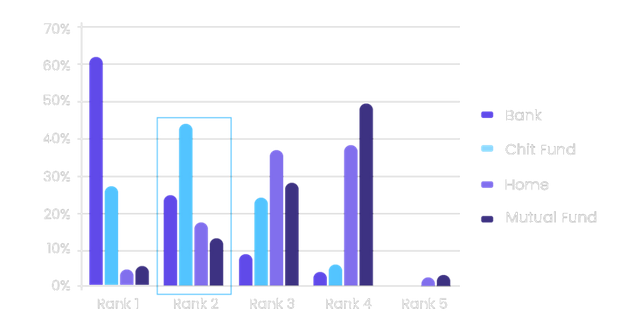

A study conducted by Institute of Financial Management and Research under the direction of Dr.Mudit Kapoor, Indian School of Business, Hyderabad and Dr.Antoinette Schoar, MIT. Sloan School of Management, USA recommends that Chit Funds are innovative access to back for low-income families.

The estimated size of the Chit Fund industry is INR 35,000 crore (nearly 5 billion dollars) and is growing. The overall ranking of the preferred mode of savings according to the study:

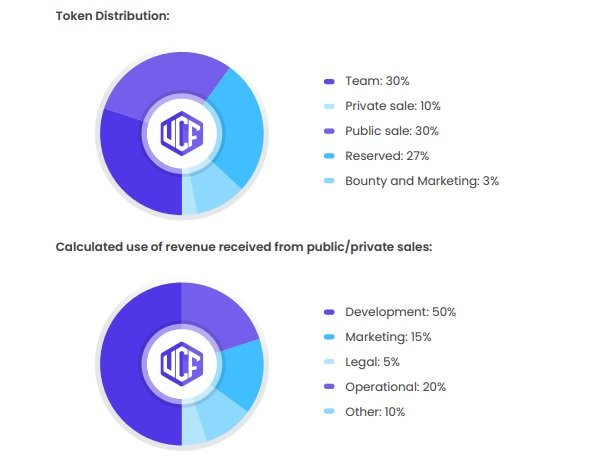

Tokenomics

- Token Name: UCF

- Platform: Ethereum (ERC-20)

- Total amount: 1,000,000,000

- Private sale soft cap: $50,000

- Private sale hard cap: $500,000

- Public sale soft cap: $100,000

- Public sale hard cap: $1,000,000

- Token price: $0.1

Links

Website | Whitepaper | Twitter | Facebook | Telegram | Instagram | Steemit | RedditMy Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=423449

ETH Address: 0x459BfBFaeF4b36a09CBb220804195A45d40b3ce3

Hashtags: #umachitfund #startup #blockchain #ethereum #chitfunds

- Private sale soft cap: $50,000