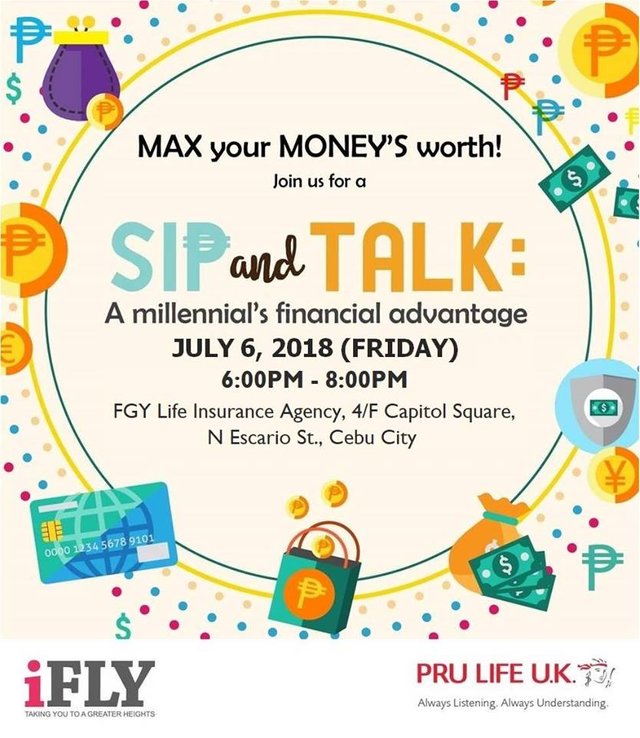

Ulog 007: Becoming #MONEYSMART! SIP AND TALK: A Millennial’s Financial Advantage

By the time I hit 25 years old, I realized I haven’t saved much money, wasted most of it and to my dismay, I didn’t have emergency funds at all. This was the time I started thinking about really wanting to save more and make my money grow for the future. So when my great friend Karla invited me to a financial awareness event, I didn’t hesitate in going.

SIP AND TALK: A Millennial’s Financial Advantage is a monthly financial wellness session hosted by Pru Life UK - FGY Life Insurance Agency. This seminar is for millennials like me who want to reach their financial goals and dreams. And last June 08, 2018, I had the privilege to attend one.

I was very excited and wore a business casual to the event. I arrived early at the venue together with my friend Karla. There were delicious snacks and overflowing coffee served which I indulged in before the session started. Other participants slowly arrived; there were teachers, students, employed and unemployed (me) people who attended. When almost everyone arrived, we got down to business.

#lit, #yolo, #blessed, #ootd, #travel

I won’t deny it. On the spot adventures and seeking new places to conquer – these are my addictions. This was where most of my cash goes to. I am the #yolo and #travel millennial. How about you?

With Johanna Yap as the speaker and host, there was never a dull moment during the entire time. In fact, it was a fun-filled activity with valuable knowledge and insights acquired. We started with an ice-breaker wherein we were group into three. My group’s name was Generation XYZ and introductions were made. That feeling when you are surrounded by college students.

The Money Ball Game then commenced. With a competitive nature, I voluntarily lead our group to victory (or so I thought). The Money Ball Game was fun. Every level of the game, there was a corresponding learning to it. The details I won’t spoil for future participants to enjoy as well. But overall, the game was all about learning where my current life stage is, financial planning and strategies to help me get to the place where I can finally call myself a FINANCIALLY HEALTHY INDIVIDUAL.

What I’ve learned:

- Saving money takes discipline. Savings should be your first expense. However, it is not enough to save but you have to make it grow. And that is when Investments come in. Investing is the smartest way to grow, protect and make your money work for you. Take advantage of compounding interest in the world of investments. The earlier you start, the longer your money grows.

- Most millennials are not clear with their financial goals. So here are 6 Steps to guide you through in defining them.

- Know WHAT you want.

- Understand WHY you want it.

- Know WHEN you want it.

- Know HOW much it cost.

- Strategize HOW you can achieve it.

- Be adequately protected.

All photos provided by Johanna Yap.

The first step to becoming #MoneySmart is AWARENESS.

You can join me on the next SIP AND TALK this coming July 6, 2018. RSVP here.

great article there dude.

Thank you for dropping by @sirwayneweezy!

Great write-up! Indeed we really have to save for our future and for the emergency expenses. It's one way of making ourselves ensured. Amazing company as well. It has this DNA test something from the ads that I have seen.

Thanks for reading @fycee! I havent heard about that DNA test! Will check it out soon!

You had me at:

Jaja, seriously now, this is a good move! Planning the future should be part of every Pinoy's goal.