TRITTIUM.- THE FUTURE OF P2P LOANS.-

As they say: Trittium ($ Trtt) is developing a platform “that changes the loan issuing industry. For the future with possibility to easily take out a loan with Trittium coins.”

“We give an opportunity to leverage Trittium coins based on blockchain assets to secured loans to everybody worldwide. It transforms the industry.

That is the idea, develop a platform that allows you to obtain credits in exchange for your Crypto money. That is, you send them 1 BTC (or 1,000 TRTT) and they lend you 70% of the value at that time of those coins.

And they lend it to you in FIAT money and by bank transfer.

The idea is great!

HOW?

Trittium is developing a platform that will connect lenders and borrowers, so that individuals will make their money available to those who need it, in exchange for interest paid by the recipient of the loan.

What guarantees are there ?:

For the one who receives the loan:

- Reception of the money by bank transfer.

- Trittium acts as an intermediary, guaranteeing that the funds deposited as collateral for the loan will be there if it meets the conditions agreed in the contract.

- Avoid the payment of commissions to exchanges for the purchase sale of your cryptocurrencies.

- No bureaucracy or waiting, Instant.

- Anonymous.

For who lends the money:

- Trittium retains the guarantee in crypto demanded from the recipient of the money.

- If the cryptocurrency provided as collateral suffers a depreciation that prevents the % of the agreed loan being covered, he knows that the Trittium platform will demand greater guarantees from the borrower.

- No paperwork.

- No waiting.

- The money is there, locked, so in case of default of the borrower, it charges for sure.

- Guaranteed returns well above those obtained in traditional financial methods.

- Does not matter the credit history you have, only the coins that you can deposit as collateral.

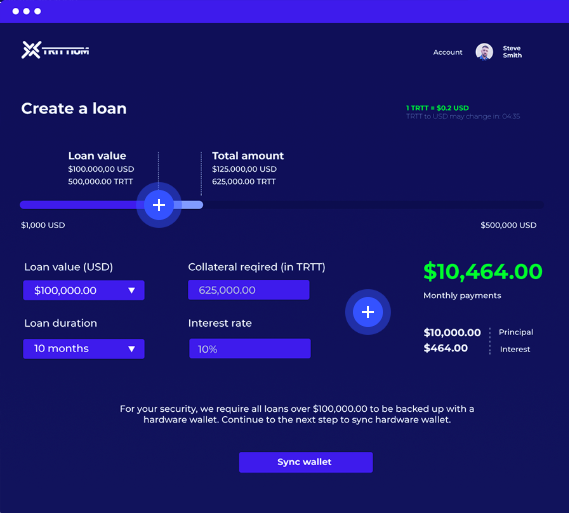

This is the image of the platform, still in the development phase:

Let's take an example:

Jak needs a loan of $ 5,500 for 4 months, he needs it urgently, and he does not want to go to 5 different banks and wait for days to be told if they give it or not. He has 1 Bitcoin in cryptocurrencies. (Of course he is sure BTC will moon in the next months, so he does not want to sell it).

He decide to use trittium services. The agreement he arrives at is the following:

- He sends Trittium the BTC he has available as collateral for his credit.

- At the time of the operation, imagine that the BTC price is $ 8,400, so what he is asking for is only 65% of the value of what he deposits as collateral.

- The credit is approved instantly.

- Jak receives the money by bank transfer in his account.

- After 4 months, Jack pays his loan and Trittium returns his Bitcoin. Jack will pay for this a small commissions in $ TRTT to the platform.

- If during these 4 months the $ BTC suffered a sudden value collapse, so that its value fell from a% previously agreed by all the parts, (70%) Jack would receive a notification telling him that he should increase the collateral that guarantees the loan.

- During this time Rob, who loaned him the money, was quiet all the time, since he knew that Jack's deposit was safe in Trittium.

As you can see, the system allows peace of mind for both, allowing them get benefit from the operation.

TYPES OF LOANS:

Trittium offers different types of loans and configurations:

- Free: Up to 10,000 dollars, terms between 3 and 10 months, only dollars.

- Plus: Up to $ 100,000: From one hour to 36 months, different currencies. Negotiation of special credit conditions. Credit & debit cards integration.

- Premium: More than $ 1,000,000. Individual negotiation

SECTOR: P2P LENDING

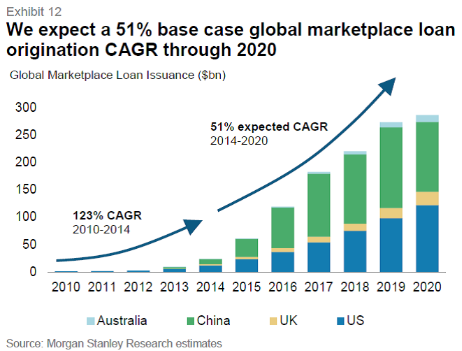

Since the appearance of Internet, the world of P2P loans has undergone a radical change, allowing millions of people to both borrow and receive loans quickly, easily and economically. Saving also slow bureaucratic processes.

This phenomenon has been possible thanks to the fact that people interact directly through the different platforms that exist in the network, opening the possibility of offering personal loans among them.

Thus, the person-to-person loans emerged, whose purpose is to offer a type of financing different from that currently existing in the market. Under the P2P format, people directly allocate their money to other people who need a loan with the intention of also making a profit.

We are inside a financial revolution that has been happening in recent years. There are many business models that opt for a collaborative economy, for the automation of processes or for the immediacy of the first screen, the smartphone.

P2P loans connect borrowers with lenders directly using technology platforms. This eliminates the dependence on large intermediaries such as banks and other financial institutions.

In short, the P2P lending does not stop being a decentralized way of obtaining money from people who are willing to lend it in exchange for some interests.

Compared to traditional loan options, loans at Tritium have a number of advantages over traditional banking. · A higher level of access to financing for borrowers.

- Greater transparency for all.

- Greater profitability for the investor, especially if we compare what would be obtained with fixed-term deposits, government bonds and similar.

- Security: In the case of Trtt, the security of the charge is 100%, since we have the deposit in cryptocurrencies of the person who received the loan.

- Liquidity: The secondary market allows us to quickly get rid of the investment and recover the money.

- It is not necessary to have advanced financial knowledge or experience.

This is the future that the sector of P2P loans is expected to have.

THE PROJECT: DEVELOPMENT AND CURRENT SITUATION.

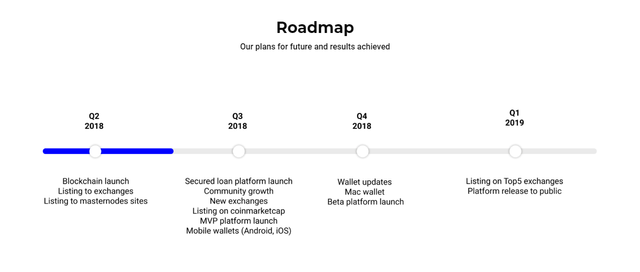

Currently the Trtt developers are working on:

- Web wallet.

- Mobile wallet.

- Development of the platform.

Recently 2 new developers have been added to the team.

At the same time, work is being done on the following phases of the project:

- Creation of Limited Responsibility Company in Estonia (Mid July)

- Contact with banks to obtain an IBAN and send money to banks or credit cards directly.

- Obtaining a license to operate as a cryptocurrency company (Mid August).

ROADMAP

At the moment they are fulfilling it perfectly, it makes sense and it is feasible, so we should see the platform release as real product in the first quarter of 2019.

The ROI by then will be around 10-12% and the currency price is expected to be around $ 1.

BUDGET AND ACCOUNTING.

I would like that 10% of the current projects in Crypto should be clear about the ethical commitments on which they must build in order to successfully develop a company like this.

The main key: TOTAL TRANSPARENCY.

- Each dollar spent or invested is related to a pre-established budget.

- Expenses are public, including supporting documents of them.

- Extra income or expenses, in addition to public, are shown and justified, reasonably explaining the reason for doing so.

- In the $TRTT Discord (https://discord.gg/7PDearP ) there is a channel only for the budget, where everything is justified and explained.

PROJECT PRICE BEHAVIOR:

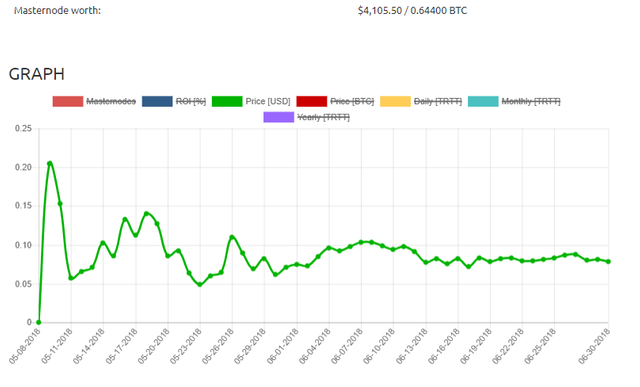

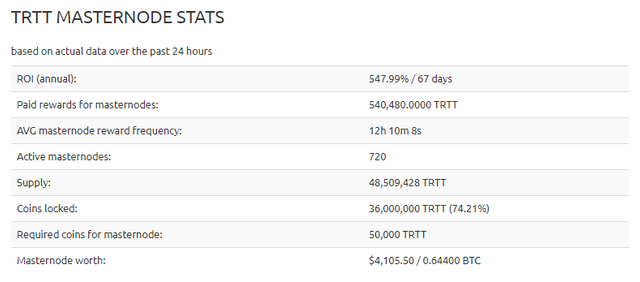

I think that we can rarely find a currency that currently has an ROI of 547% with this price stability after 56 days of follow-up.

It seems obvious that the rewards will have to descend soon, since the ROI is too high IMHO for a project of these characteristics.

PROS AND CONS:

PROS:

- Professional and dedicated team.

- Innovative.

- Transparency.

- Fast and efficient system for all the parts.

- Real, profitable and sustainable Project.

- Sector P2P loans in clear growth.

- Advantages in speed and procedure with respect to traditional banking and even on other P2P lenders thanks to the collateral in Crypto currencies.

- Licenses, permits and operations on the way, 100% reliable project.

- No risks for the lender, since it has the collateral.

- The borrower receives the loan without depending on his previous credit score.

- TRTT has a privacy function to send transfers anonymously.

CONS:

- Difficult solution to a rapid decline in the price of the currency that the borrower put as collateral.

- Different legal situations in each part of the world can affect the project in the long term.

- Scarce white paper of information (I know that the intention is to renew it soon).

- The implementation of the crypto world in the real world may take some time more, and with it the time of massive implementation of the platform.

About the currency:

74% of the coins are locked by investors, which reveals the belief in the long term of the project.

Conclusion:

In my opinion we are facing one of the very few projects within the world masternodes that results: viable, real, sustainable, profitable and future-oriented.

It is a rara avis, with an original and reachable real use.

More info:

Web: https://trittium.cc/

Twitter: http://twitter.com/trittium_cc

Facebook: https://www.facebook.com/Trittium-Project-234382600446330

Reddit: https://www.reddit.com/user/trittium_cc/

Discord: https://discordapp.com/invite/5rURZyR

Medium: https://medium.com/@trittiumcoin

If you liked the article, you can follow me on Twitter

upvote for me please? https://steemit.com/news/@bible.com/6h36cq

Good article on $TRTT, a must read.