Techniques for Shifting Stop Loss to Maximize Profit

@fadly 23 June 2021 15:23

Good evening everyone, trading Forex sabbath in the world of Steemit

On this occasion I will discuss the tecnique of Shifting Stop Loss to Maximize Profit

Trading forex is high risk. The responsibility for the outcome of any decisions rests with you.

Information is presented in the best possible way, but we do not guarantee 100% accuracy of all recommendations presented.

and does not guarantee the quality of promotional materials provided by third parties in the form of paid advertisements, banners, and so on.

Straight to

Changing the SL level often turns out to be able to have a positive impact if done correctly. Check out the technique for shifting the following stop loss so you don't get the wrong direction.

It is undeniable, stop loss (SL) is one of the crucial features that traders must master. Many traders lose hundreds of dollars just because they don't place a stop loss when trading. They are too confident to ignore the "safety" in the form of a stop loss. In fact, ignoring this feature is not a wise action. Trading is an activity that deals directly with the market, so the existence of a stop loss can actually be a savior from bigger losses when the market moves not according to projections.

Well, one way to use a stop loss that not only secures a position from losses but also increases profit opportunities is to move it. How is the technique of shifting the stop loss in question?

technique of shifting stop loss

Misperceptions About Techniques for Shifting Stop Loss

In fact, many traders misrepresent this technique. Some of them consider that shifting the stop loss is an action that is contrary to the principles of correct money management. Some even think that shifting the stop loss will only bring the trader closer to the Margin Call. Is that right?

To dissect it, maybe we can start with the question of what technique is wrong with shifting the stop loss? Why shifting stop loss can be fatal?

Whether or not shifting the stop loss actually depends on the situation and conditions at the time of doing it. In this case, there are two conditions that make this technique true or false, namely: when Floating Loss or Floating Profit. Most traders think this is the same, even though the two conditions are completely opposite.

Shifting Stop Loss When Floating Loss

Floating Loss is a condition where the trader is experiencing a loss but the position has not been closed. For example, a trader opens a Buy position on the GBP/USD pair in the hope that the position will go up. But in reality, the price is actually moving below the entry level. For more details, please see the following sample images.

shift stop loss when floating loss

This is the condition that traders should avoid. Usually, traders shift their stop loss in this condition because they believe that the price will soon reverse direction to the initial scenario. In fact, no one knows for sure where the market will move. It could be that the market is experiencing a trend reversal from Bullish to Bears or vice versa, so the price will continue to decline or strengthen. Worst case scenario, if the trader continues the trading account equity will be eroded if the position is not stopped immediately while the price continues to move against the projected direction.

Thus, shifting the stop loss at the time of Floating Loss is very risky and is not a wise move. Instead of continuing to shift the SL level and hoping the price will return according to the scenario, it would be much wiser to accept the "lose" at the initial stop loss level and return to improving trading analysis. Thus, the loss received will be much less.

Shifting Stop Loss When Floating Profit

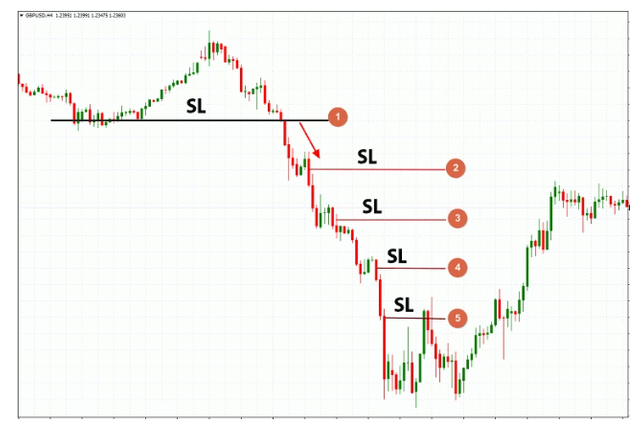

Floating Profit condition is when the trader is experiencing profit but the trading position has not been closed. For example, a trader opens a Buy EUR/USD position and the price moves higher according to the trading scenario. The technique of shifting the stop loss in this condition is reflected in the following chart:

slide stop loss when floating profit

Unlike before, shifting the stop loss at the time of Floating Profit like this is actually highly recommended. The main goal is to secure profit when the price is experiencing a strong bullish. So, when a reversal occurs later and the price touches the SL, the trader still gets a profit.

Types of Techniques for Shifting Stop Loss

Broadly speaking, the technique of shifting Stop Loss is divided into two, namely: The automatic method or commonly known as "Trailing Stop Loss" and the manual method.

Shifting Stop Loss Automatically

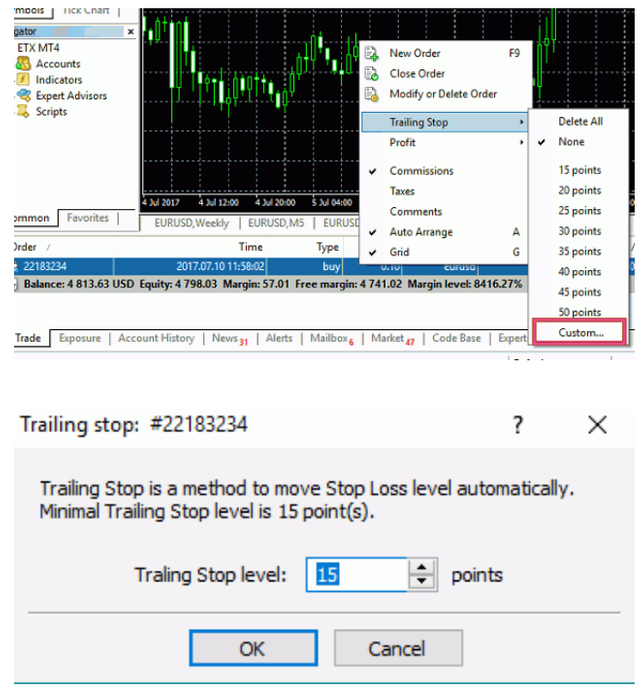

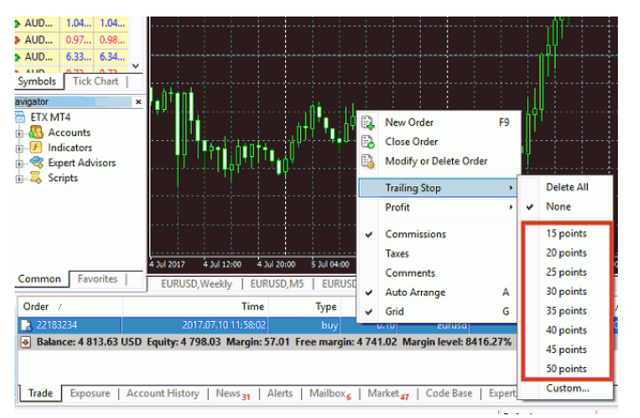

As the name suggests, this type of stop loss runs automatically. This technique is made possible by the use of the Trailing Stop feature. If using MetaTrader, Trailing Stops can be activated in the following way:Please open an order first.

Right-click on the order tab, then select "Trailing Stop".

Don't forget to set the Trailing Stop distance according to the available options.

For more details, please see the image below:

Trailing stop feature

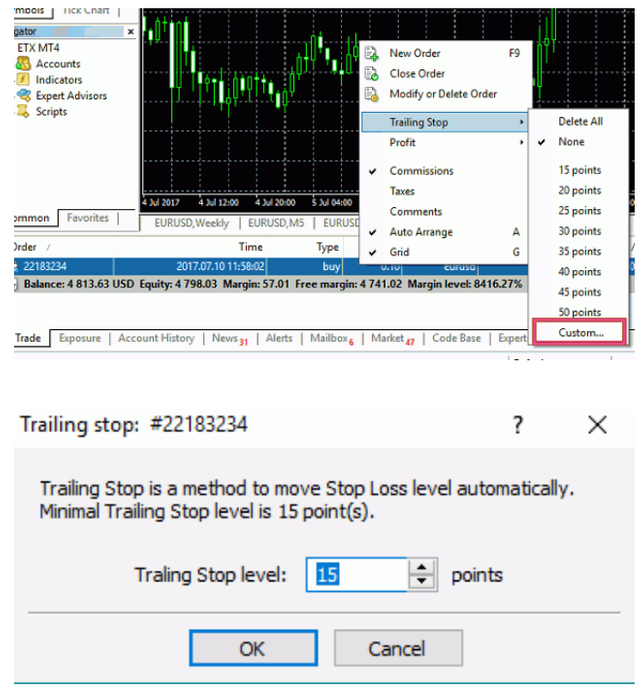

Trailing Stop distance can also be set as desired by clicking Custom.

Custom trailing stop image

Custom trailing stop level Gambar image

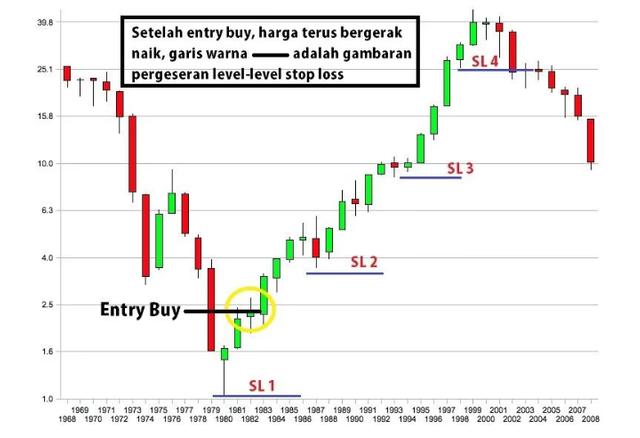

Once this feature is enabled, the stop loss level will move automatically based on the configuration. To understand how Trailing Stops work in trading, please see the image below.

A picture of how a trailing stop works

When a Sell order has been opened and the price continues to decline, the stop loss level will automatically go down to numbers, 2, 3, 4,5, etc. So in essence, the more price drops, the more profit a Trailing Stop can lock in.

This technique will work optimally when applied to trending markets, where there is a very clear long rally, so that the profit that can be locked will be even greater.

However, the technique of shifting SL with the Trailing Stop method is not completely perfect. Users must also be aware of their weaknesses. One of them is when the market is sideways. This technique will not work optimally because there is a possibility that the price will bounce (up and down) so that the stop loss level is easily touched.

So, it is highly recommended to confirm the strength of the trend first before using the Trailing Stop. In addition, try to set the trailing distance wisely (not too tight or too loose).

- Shifting Stop Loss Manually

Broadly speaking, the working principle of manual stop loss is not much different from the method above. What makes the difference is that traders need to shift the stop loss level themselves, so traders need to be diligent in monitoring price movements so that they can adjust their stop loss at the planned level. In this case, trending market is still a more recommended market condition.

Manual stop loss Gambar image

In the example above, the market is bullish so that the open Buy position is done around SL1. If the price continues to increase, please shift SL1 to SL2, SL3 and so on. Remember, the SL position will not change automatically because Trailing Stop is not used here.

The technique of shifting the stop loss manually really requires regular chart monitoring, so this method is also not recommended for beginners who do not understand the concept of setting a stop loss correctly. But the advantage, manual stop loss allows traders to have more freedom in setting the desired level distance.

Which Is Best For Traders?

When compared, of course the answer will be very relative and depend on the needs of each trader. For traders who don't want to be complicated and don't have much time in front of the monitor, automatic stop losses will be more suitable. However, for full-time traders who have a lot of time and want to be able to freely manage risk management according to market conditions, manually shifting the stop loss will be the more appropriate choice.

What needs to be underlined, the two methods of shifting the stop loss above have their respective advantages and disadvantages. Do not use one of the methods above and then neglect the risks it poses. If you are confused about choosing one of the two methods above, please do a test on a demo account first, and feel which one best suits your needs.

Although considered crucial, it turns out that not a few traders are reluctant to use stop losses for various reasons. One of the factors that underlie their doubts is the existence of a stop loss hunter. What is a stop loss hunter and why does its appearance make many traders think twice about using a stop loss? Learn the ins and outs in the Stop Loss Hunter Special Edition Podcast.

That's what friends I can convey and inform about the technique of Shifting Stop Loss to Maximize Profits, hopefully you understand about trading.. the Forex

Follow Me

@fadly

start success go! go! go!

good post