Because I Was Inverted – Who Really Knows

All great questions worth asking.

Considering that nearly every financial guru, reporter, trader, investor, economist, politician, and Twitter hack seems to be hyper-focused on these very topics, is it reasonable to assume that the indicators that matter are being missed?

Are we living in a purely narrative-driven world? To borrow a term from the wolf pack over at Epsilon Theory, are we living in a purely fiat world?

Good luck trying to predict anything within this mess. And at its core, investing is exactly that: attempts at predicting the future.

While there are countless frameworks, models, philosophies, and proprietary indicators people use to gain their edge, what appears more and more evident to me is that nobody knows what the future holds, nor will they ever.

Are all indicators created equal?

That said, making predictions in order to appear intelligent is en vogue. Undoubtedly, this dynamic has been created by the 2008-2009 GFC fallout that produced the stuff of legends in those who accurately predicted it.

We may as well call the movie, The Big Short, what it really is: every single person within the investment and financial industry's fantasy status.

This the reason why the current bull market run that spawned out of 2008-2009 is referred to as the "most hated bull market in history". Precisely because everyone wants to be the guys that call the “next big one” and end up in The Big Short 2: The Guys Who Are Smarter Than Those In The Prequel starring whomever women now adore more than Ryan Gosling and Brad Pitt.

This can be seen directly in the amount of interest people have in going short the market; whether it be in naked puts, bear-put spreads, or chief among the rest, shorting the VIX what is evident is that going short is the new long.

And more interestingly, it appears that many now believe that correctly timing a profitable short trade signals intelligence better than that of a profitable long trade.

Rather than going short be the new long, we’d be better off going long history. History has a funny way of repeating itself. A cliché , but true.

Software and the internet have allowed us many luxuries that we take for granted. Yet, it has also forever changed how financial markets operate.

Everyone now knows everything, it seems. But just as in physics, the fact that everyone is now observing the system much more intently is it possible that observing the world through outdated lenses is obfuscating the reality?

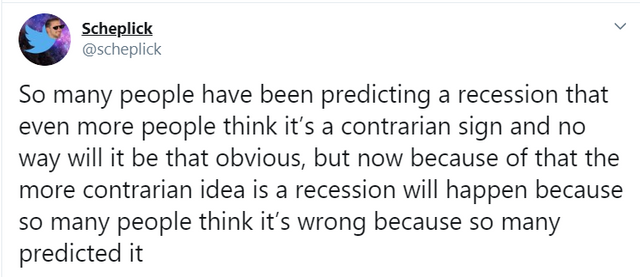

Are contrarians really contrarians nowadays? And if the majority identify as contrarian, does this mean an OG contrarian is one who goes contrary to the contrarians? Is this not a 360-degree rotation, placing us back at the start?

Rather, it seems the only thing we can do to maximize our odds of winning is leverage patience. With the market of naysayers and Big Shorters being so completely saturated, nearly everyone is looking to gain an edge by shortening their time frame. Nearly $47 Trillion are traded in high-frequency FX strategies DAILY.

The brightest minds of the last few generations have been sucked into Wall Street. Whereas former generations used to value engineering over finance, finance has become the most highly valued industry in our world-leading economy. People all want to make as much money as possible in the shortest amount of time. And who can blame them?

Yet, with so much human and financial capital being moved around in nanoseconds this capital has essentially made itself unavailable to the general economy. You know, the real economy where nearly 1 in 2 Americans have less than $400 in savings. I am sure they could use some of this $47 Trillion in FX that is traded daily with no net yield on human progress.

While I surely have no answers to any of these questions and consider myself a novice (on a good day) it sure seems clear that expanding your time horizons and trying to see beyond what is popular is a prudent place to begin.

"I am worried that the conditions under which I built the case for my strategy, whether the mental models and discretionary heuristics built over a long, successful career, or the systematic backtests I similarly produced, are a reflection of some state of the world that will not be the future state of the world." – Epsilon Theory

DISCLAIMER : This content is for informational, educational and research purposes only. This post is not to be taken as personalized investment advice.

Congratulations @maven360! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Vote for @Steemitboard as a witness to get one more award and increased upvotes!