You Can Go Your Own Way! Churning And Other Credit Card Strategies - Part 2

First things first, I know what you're thinking. The graphics just keep getting better. Okay, I really had no intention of dodging the subject of churning in my first post. It's just what happened. Now it really is time. So what is churning? Let's look at the definition in the dictionary...okay, not really.

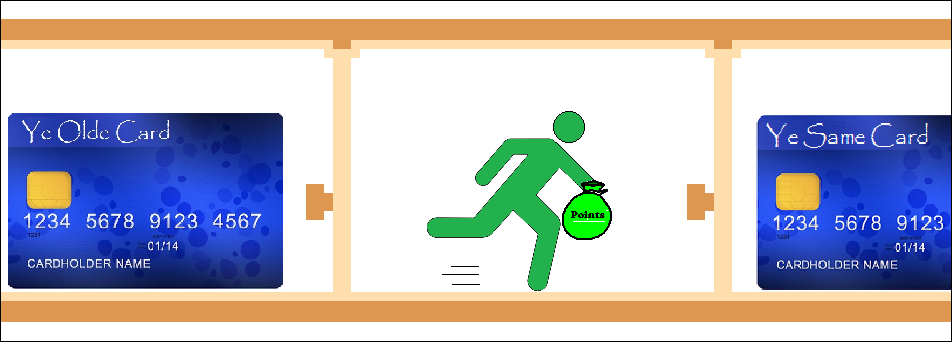

Let's talk about churning as it relates to credit cards. Churning is the idea of signing up for a credit card, then closing that card (stay with me), only to re-open the credit card at a later date to take advantage of that same bonus. It sounds wonderful in theory. I'll admit that I had every intention of doing this.

However, do you have something laying around the house that you really don't use any more? It's no longer new and exciting. Then a friend comes over and wants to take it off of your hands, but suddenly it becomes difficult to give up? That's what has happened to me with some of these credit cards. I'll give you an example. I signed up for the Hyatt card. It gave me 2 free nights at a category 1-5 resort. I used those last fall, and I had every intention of dropping the card like a bad habit. I mean my $75 annual fee will be coming up later this year. But do you know what I get for that $75? I get a night at a category 1-4 resort. Those can be over $200 a night. The jury is still out on this one. I'm not sure if I'm ready to give it away, but it really is all about where you find value.

Before you think you will be churning Amex cards, forget it. They typically have language in the terms and conditions that states you are only allowed the sign-up bonuses once per lifetime. Chase, some Citi, and maybe some others have what they call 24-month language. This means that if you have received the bonus in the past 24 months, no bonus for you. Make sure to read the fine print.

There have been a few cards that I have closed. I just didn't see the value in keeping them open. However, there have been plenty of people that were going to close their accounts due to the annual fee, and the customer service representative was able to do something for them. Sometimes they can waive the fee altogether, or at least possibly entice with some extra points to stay.

There are a few out there that apparently can still be "churned". I just haven't entered that realm yet. I mean I'm still technically new. I have a good amount of cards, but there are still so many out there.

Thanks for reading. Next article I'll talk about how getting your significant other, if you have one, into this can be beneficial. If you don't have a significant other, I will discuss interesting possibilities there as well.